BYD Raises HK$43.5 Billion in Share Placement: A Cash Crunch or Capital Opportunity?

![]() 03/05 2025

03/05 2025

![]() 536

536

On March 4, Beijing time, BYD (01211.HK) announced that it had entered into a share placement agreement with the placing agent on March 3. Assuming full subscription, the total proceeds from this placement will amount to approximately HK$43.51 billion. After deducting commissions and estimated expenses, the net proceeds are expected to reach HK$43.38 billion.

According to the announcement, these net proceeds will be utilized for the group's R&D investments, overseas business development, replenishment of operating funds, and general corporate purposes.

Specifically, the mention of overseas business development aligns with BYD's aggressive expansion into overseas markets over the past two years. This share placement also presents an opportunity for capital to participate in the equity appreciation resulting from BYD's rapid growth.

Here are the key details of this share placement:

1. Placement Price: HK$335.2 per share, representing a discount of approximately 11.8% compared to the ten-day average closing price of HK$380.1 prior to March 3, 12.3% off the five-day average of HK$382.2, and 7.8% lower than the March 3 closing price of HK$363.6.

2. 90-Day Lock-Up Commitment: From the placement agreement date to 90 days after the closing date, the company or any representative will not sell, transfer, dispose of, issue, or grant any equity, rights, or warrants without the placing agent's prior written approval, except for the placed shares.

3. Minimum Number of Placees: The placing agent will place shares with at least six placees on a best efforts basis.

4. Number of Placed Shares: 129.8 million shares (currently, there are 1.098 billion tradable shares in Hong Kong).

5. Status of Placed Shares: Upon completion, they will enjoy the same status as issued H shares.

6. General Mandate for Issuance: The board of directors has the authority to issue up to 219.6 million H shares under the general mandate. If all 219.6 million shares are placed at HK$335.2, the maximum placement proceeds could reach HK$73.61 billion.

Why is BYD conducting this share placement? Is it a sign of a cash crunch, or is it a strategic capital opportunity?

In late January 2025, GMT Research, a Hong Kong institution that previously highlighted fraud at Evergrande, released a 52-page short-selling report on BYD. The report claimed that BYD's actual net debt was as high as RMB 323 billion, more than ten times the officially announced RMB 27.7 billion.

This report caused significant uproar, primarily focusing on the automotive industry's common payment terms between automakers and suppliers. GMT accused BYD of hiding significant debt by extending its payment cycle to suppliers. According to the report, BYD's average payment cycle to suppliers is 275 days, significantly longer than the international automaker standard of 45 to 60 days.

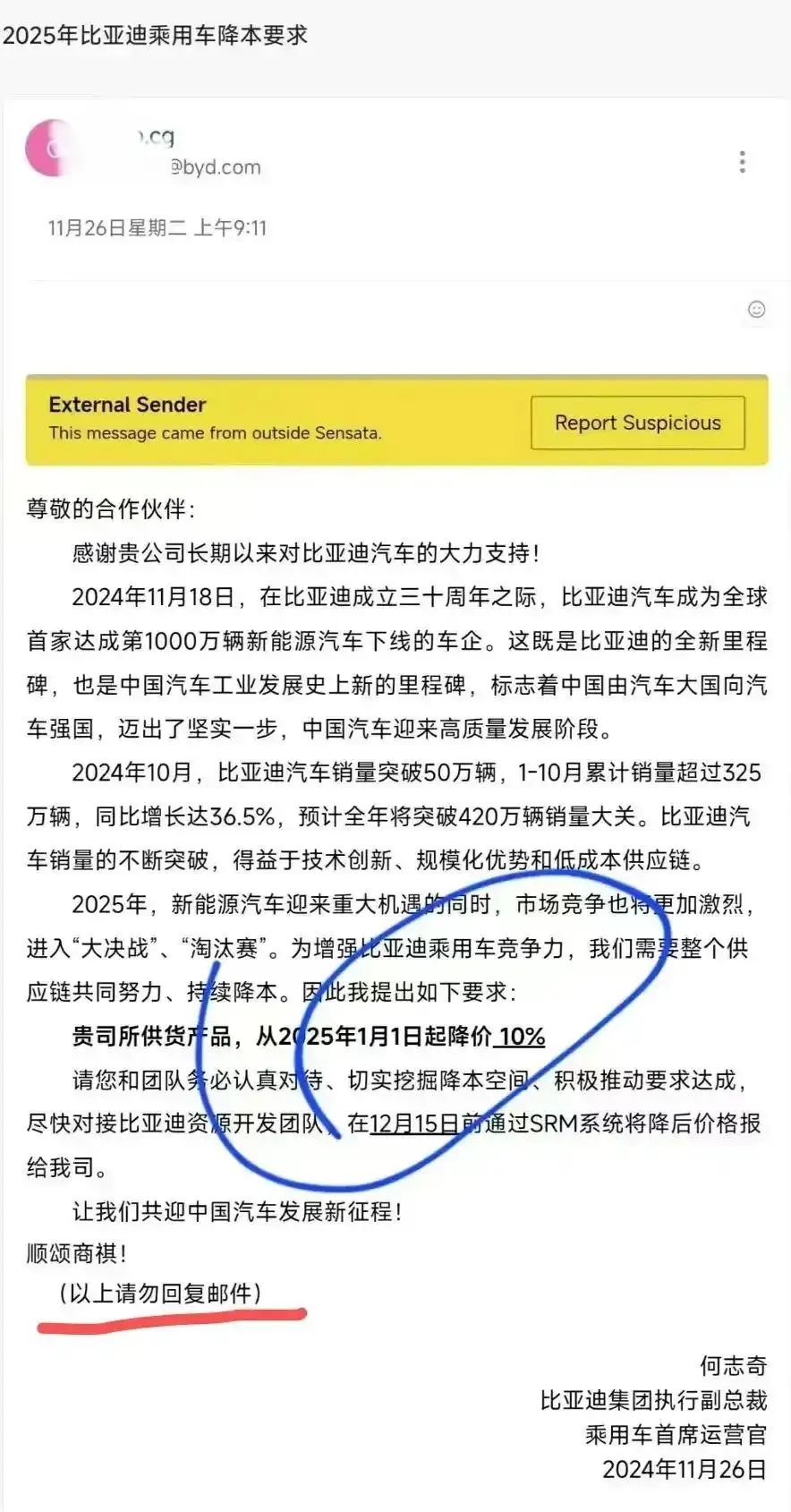

Besides the controversy over BYD's hidden debt related to payment terms in January 2025, in November 2024, BYD also faced public scrutiny due to an email requesting suppliers to reduce prices by 10% from January 1, 2025. In response, Li Yunfei, general manager of BYD's brand and public relations department, stated that annual price negotiations with suppliers are standard practice in the automotive industry.

Returning to the question, whether BYD is facing a cash crunch depends on its financial statements. As BYD has not yet released its full-year 2024 financial report, only the Q3 2024 financial report is available for reference.

According to the Q3 2024 financial report, BYD's net profit for the first three quarters was RMB 25.24 billion, up 18.12% year-on-year, with total operating revenue of RMB 502.3 billion, up 18.94% year-on-year, and operating profit of RMB 31.75 billion, up 19.18% year-on-year. All three core indicators showed growth of nearly 20%, which is still impressive for a company of this size.

In terms of the balance sheet, total assets amounted to RMB 764.3 billion, total liabilities to RMB 595.5 billion, total owner's equity to RMB 168.8 billion, monetary funds to RMB 66.32 billion, and inventory to RMB 124.4 billion.

From the cash flow statement, net operating cash flow was RMB 56.27 billion, net investing cash flow was RMB -86.65 billion, and net financing cash flow was RMB -11.96 billion.

Considering BYD's monetary funds of RMB 66.32 billion, the net proceeds of this share placement of RMB 43.38 billion will significantly bolster the company's cash reserves. Notably, BYD's monetary funds exceeded RMB 100 billion at the end of 2023.

Revisiting the first use of placement proceeds mentioned in the announcement, which is R&D expenditure, BYD's R&D expenditure in 2023 reached RMB 39.575 billion, up 112% year-on-year. In the first three quarters of 2024, R&D investment amounted to RMB 33.319 billion, up 33.61% year-on-year.

From this perspective, the net proceeds of RMB 43.38 billion from the share placement are roughly sufficient to cover BYD's R&D investment for a little over a year.

However, it is anticipated that BYD will aggressively expand overseas in 2025, aiming to increase its overseas sales share, thereby achieving its 2025 sales target of 5 million vehicles or higher.

After the successful launch of the "Tian Shen Zhi Yan" strategy, which gained consumer recognition, BYD's orders continued to surge, with a cumulative delivery of 615,000 vehicles from January to February 2025, up 90.44% year-on-year. Additionally, 67,000 new energy passenger vehicles were sold overseas in February. This aligns with the second use of proceeds mentioned in BYD's placement announcement - overseas business development.

Simultaneously, BYD's share price, benefiting from the "Tian Shen Zhi Yan" strategy, has continued to climb, with H shares once reaching a historic high of HK$408.8 from HK$279 at the beginning of February. Notably, this share price performance was achieved post the GMT short-selling report.

An Opportunity for Capital?

Following BYD's share placement announcement on March 4, BYD's H shares briefly fell by more than 8%. The opening price of HK$336.2 was slightly above the placement price of HK$335.2, but the intraday low was HK$334, and the closing price was HK$339, with a turnover reaching a recent high of HK$17.33 billion.

This means that besides the placees participating at the placement price, all funds eligible to trade Hong Kong stocks can participate by directly purchasing in the secondary market.

Apart from replenishing funds, BYD's share placement also offers large capital the opportunity to participate in BYD's development dividends. A net purchase of RMB 43.5 billion worth of shares in the secondary market may propel BYD's share price to new highs, potentially providing a capital arbitrage opportunity.

If BYD's share price continues to rise after this correction, this share placement presents a significant capital opportunity.

Regarding BYD's development prospects, in addition to the expectation of vehicle sales growth, there are also expectations for advancements in intelligence and robotics.

Worth mentioning, in the humanoid robot race popularized by Tesla, besides investing in Zhiyuan Robotics, BYD established an embodied intelligence research team as early as 2022. This team primarily focuses on the customized development of various robot bodies and systems by deeply exploring the company's large-scale application scenario requirements. Currently, the team has developed products such as process robots, intelligent collaborative robots, intelligent mobile robots, and humanoid robots.

The valuation of this segment has yet to be reflected in BYD's share price. It is noteworthy that although Tesla's market value has fallen below the trillion-dollar mark, a significant portion of its valuation is still attributed to its intelligent driving FSD, Robotaxi's Cybercab, and humanoid robot Optimus. BYD may also deserve a valuation expectation for its intelligence and robotics initiatives.