Why Does Xiaomi's Car Keep Making Waves?

![]() 03/07 2025

03/07 2025

![]() 528

528

From black T-shirts and jeans to suits and then to leather jackets, Lei Jun is arguably the only tech figure who has sparked heated discussions solely through his fashion choices.

Prior to Xiaomi's Dual Ultra new product launch event on February 27th, no one would have predicted that the topic of "Lei Jun wearing leather jackets" would overshadow the buzz around Xiaomi 15 Ultra and SU7 Ultra, trending on Weibo.

Moreover, Lei Jun solidified his status as the "ultimate sales promoter." Not only did the Xiaomi SU7 Ultra surpass 10,000 pre-orders within two hours of its launch, but the same brown leather jacket he wore sold out across the internet.

Returning to the launch event, from the price, gold emblem, to its luxury car positioning, every aspect of the Xiaomi SU7 Ultra sparked intense discussions online, with topic engagement levels that even the simultaneously launched Xiaomi 15 Ultra couldn't compete with.

Since the release of its first model, the SU7, in March 2024, Xiaomi Car has consistently been at the forefront of industry focus, with every move under the spotlight.

Behind the hustle and bustle, what is Xiaomi Car's real performance? Can it truly spearhead China's automotive industry?

| Best-Sellers Reign |

At the beginning of the launch event, Lei Jun first introduced Xiaomi SU7's performance over the past year. In just nine months, it amassed 248,000 pre-orders and delivered 135,000 vehicles.

Subsequently, the Xiaomi SU7 Ultra was officially launched with a final pricing of 529,900 yuan, a nearly 300,000 yuan drop from the previous pre-sale price of 814,900 yuan.

At the event, every time Lei Jun made a major announcement, thunderous applause and cheers erupted from the audience; related topics immediately dominated Weibo's trending list, with a popularity akin to Xiaomi SU7's grand launch a year ago, once again igniting an internet carnival.

As Xiaomi's inaugural foray into the automotive industry, the Xiaomi SU7 garnered significant attention from the market, government, peers, Mi Fans, ordinary consumers, and onlookers. It seemed natural that the SU7 would become a best-seller.

However, a year later, Xiaomi's second car appears to have repeated its success, with over 10,000 pre-orders within two hours of its launch. While this is significantly lower than the Xiaomi SU7's 10,000 pre-orders within four minutes of its launch last year, in the industry, only AITO's M9 has achieved similar results.

This is likely rooted in Xiaomi's culture of best-sellers, the outcome of Lei Jun transferring the best-seller philosophy from the mobile phone industry to the automotive industry.

No one knows more about creating a best-seller than Lei Jun.

In his book "Xiaomi Entrepreneurial Thoughts," Lei Jun mentioned that best-sellers are crafted, not marketed. Producing one or two best-sellers sometimes hinges on luck, but consistently doing so must rely on a comprehensive model and system.

To enable enterprises to continuously produce best-sellers, Lei Jun summarized four aspects: identifying user needs, exceeding expectations in products, surprising pricing, and efficiency.

Over the past few years, Xiaomi has adhered to this methodology, seeking user needs and listening to user suggestions through Xiaomi forums, enhancing configurations, designs, and other aspects; offering surprising price reductions at launch events to provide users with ultimate cost-effectiveness; and relying on a robust supply chain system to improve efficiency. Through this process, Xiaomi has consistently launched best-selling mobile phones.

Now, Xiaomi is transferring this philosophy to the automotive industry. The first electric vehicle, the SU7, addressed the issue of range; the Ultra, positioned as high-end, elevated its performance to directly compete with luxury cars and sports cars such as Porsche and Tesla. By setting a high pre-sale price of 814,900 yuan before the launch event and pricing it at 529,900 yuan at the event, it created a shock for consumers with a nearly 300,000 yuan drop. Finally, it relies on its more than 20 core suppliers to improve production efficiency.

If Xiaomi can successfully transfer this best-seller philosophy to the automotive industry, it will undoubtedly disrupt the entire sector.

| Beneath the Surface of Best-Sellers |

Best-sellers are the tip of the iceberg, but hidden beneath is Xiaomi's ability to create them.

Behind the emergence of best-sellers, there must be a mature supply chain. Without a mature supply chain, it's impossible to achieve high cost-effectiveness and large-scale supply. Supply chain capabilities determine an enterprise's cost structure, product advantages, and delivery capabilities.

When it comes to supply chains, no one knows more than Xiaomi. Xiaomi mobile phones are renowned for their powerful supply chain ecosystem, and Xiaomi Car has continued this tradition, with over 20 core suppliers, ranging from the three-electric system, intelligent connectivity, intelligent cockpits, to various components of electronics, chassis, body, interior, and exterior decorations.

These include CATL (batteries), Bosch (braking systems), GoerTek (intelligent cockpits), among others. With such a robust supply chain ecosystem, Xiaomi Car has the foundation to become a best-seller.

As crucial as the supply chain is the distribution channel. Unlike mobile phones, cars require a substantial number of sales channels and after-sales services. Over the past year, as of the end of February, Xiaomi has opened 220 stores in 65 cities nationwide, with plans to add 16 new stores in March. Meanwhile, 33 Xiaomi Car service centers and authorized service centers have been established.

With over 200 stores opened within a year of launch, this store expansion speed surpasses almost all new force brands. Moreover, Xiaomi Home surpassed 10,000 stores in 2021 and plans to open 20,000 in China by 2026. Assuming Xiaomi opens its channels to AITO like Huawei, there is still immense potential for the scale of Xiaomi Car's future channels.

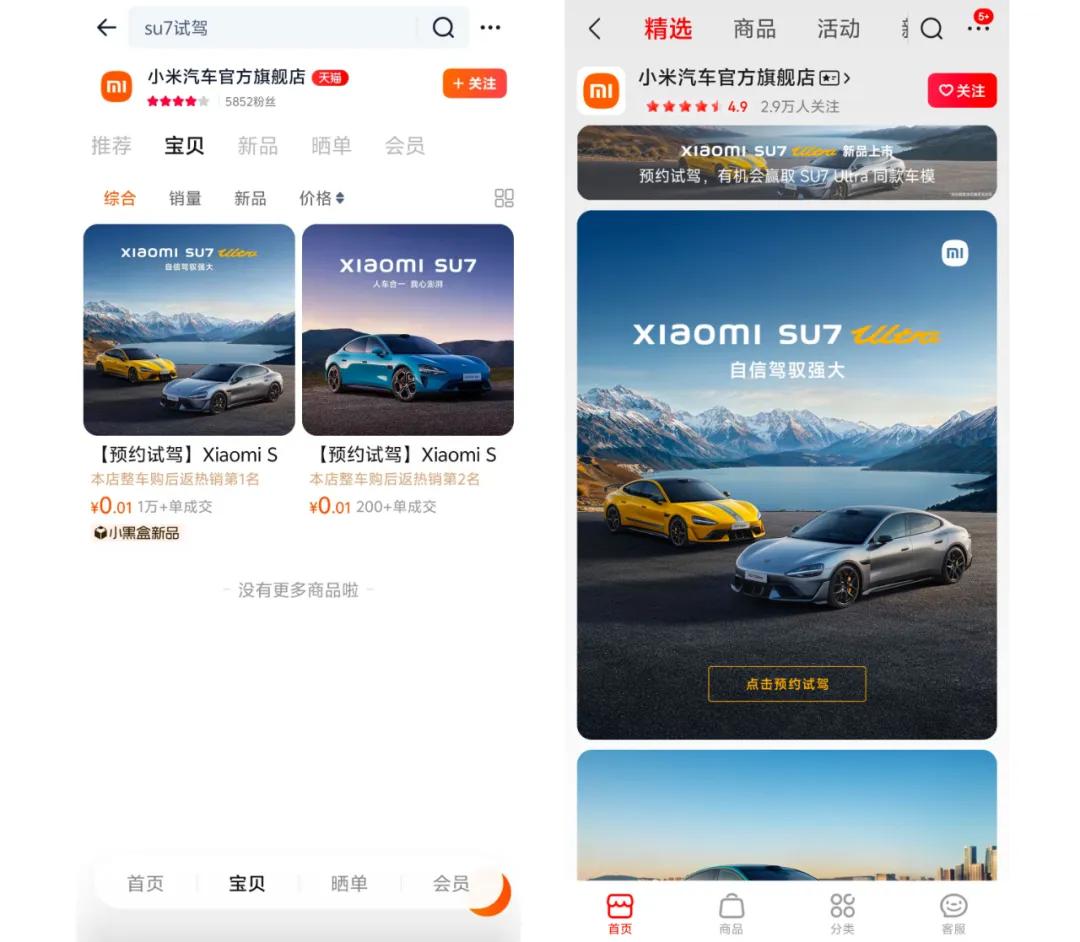

Unlike other automakers that focus on offline sales, Xiaomi Car also places great importance on online channels. At the end of February, Xiaomi Car's official flagship stores simultaneously entered JD.com and Tmall, two mainstream e-commerce platforms. While they currently only provide appointment test drive services, it's anticipated that they will pioneer a new trend of online car ordering in the future.

Furthermore, Lei Jun once summarized four key abilities for creating best-sellers, with users being a term repeatedly mentioned, and user engagement being Xiaomi's invisible weapon.

In "Engagement: Xiaomi's Internal Handbook on Word-of-Mouth Marketing," Lei Jun mentioned that he views user engagement as Xiaomi's core concept, making friends with users. First, interact with users in product research and development; second, leverage users' word-of-mouth for promotion and marketing.

Xiaomi mobile phones collect user suggestions through platforms such as Xiaomi communities, giving users a sense of participation in research and development. The same applies to Xiaomi Car. User participation is a pivotal part of Xiaomi Car SU7's marketing process. By collecting online feedback, discussing hot topics, and conducting activities like "Xiaomi Car Answers 100 Questions from Netizens" and "Lei Jun Answers Netizens' Questions," it absorbs user opinions.

On this basis, Xiaomi Car touches users through small details such as mobile phone holders, physical buttons everywhere, storage for umbrellas, and sun-protective glass.

For the Xiaomi SU7, Lei Jun called it "the best-looking, best-driving, and smartest sedan under 500,000 yuan." For the SU7 Ultra, Lei Jun said it "rivals Porsche in performance, pursues Tesla in technology, and matches BBA in luxury," directly appealing to users' hearts. This is Xiaomi Car's profound user insight and the key to its success.

| Can Xiaomi Car Lead the Charge? |

The abilities beneath the surface manifest above the water, evident in Xiaomi Car's continuously improving sales. In February 2025, Xiaomi SU7 delivered over 20,000 vehicles, with deliveries exceeding 20,000 for five consecutive months and cumulative deliveries surpassing 180,000.

Among the new wave of automotive forces, Xiaomi Car's position is rapidly ascending. In China's weekly sales rankings for new force brands, XPeng, Xiaomi Car, and Lixiang Automobile have consistently been the top three finishers, with the leadership of the new forces shifting from "NIO, XPeng, Lixiang" to "XPeng, Xiaomi, Lixiang."

Although Xiaomi Car is gaining momentum, the development of other companies cannot be overlooked. XPeng and Lixiang have "snapped out of it" to occupy the top two positions, while NIO, Zeekr, and AITO are hot on their heels. Whether Xiaomi Car can truly spearhead the new forces may not become clear for a few more years.

Currently, the more pressing issue facing Xiaomi Car is consumer complaints and doubts about it. Especially quality issues, which almost all automakers face. Even the world's most established brands, such as Mercedes-Benz, BMW, and Tesla, have repeatedly recalled vehicles due to quality issues.

The same applies to Xiaomi. In January of this year, Xiaomi Car announced the recall of approximately 31,000 SU7 standard electric vehicles. The reason given by Xiaomi Car was that some vehicles within the recall range may have issues with the software strategy, which could lead to abnormal time synchronization, affecting the detection of static obstacles by the intelligent parking assistance function, increasing the risk of scratches or collisions, and posing a safety hazard.

Although Xiaomi Car responded promptly and provided timely solutions, this incident also exposed that Xiaomi Car still faces quality challenges. Some netizens questioned, "As long as there are safety hazards, it's a major defect accident, not a small matter." "It's been recalled just one year after launch; quality control is a problem."

More importantly, in cutting-edge fields, being able to lead does not solely rely on high sales. The key lies in self-developed technology, which requires Chinese automakers to stand on their own feet rather than rely on foreign technology.

In this regard, Lei Jun has stated that all of Xiaomi's intelligent driving technologies are self-developed. To this end, Xiaomi invests over 2 billion yuan annually. Before this year's launch event, Xiaomi Car officially announced the full rollout of XiaomiHAD end-to-end full-scenario intelligent driving, once again upgrading its intelligent driving capabilities.

Of course, although Xiaomi's intelligent driving technology is fully self-developed, it still relies on a robust supply chain system for the bottleneck of chips. For instance, the cockpit chips come from Qualcomm, and the intelligent driving chips come from NVIDIA.

If Xiaomi Car can realize self-developed chips in the future, like Huawei's mobile phones, breaking through the blockade, it will mark a new turning point for both Xiaomi Car and domestic cars.

For now, Xiaomi Car has ignited the market with its internet genes and best-seller strategy, but whether it can transform from a "traffic carnival" to an "industry disruptor" still requires overcoming the dual challenges of quality and self-developed technology to truly reshape the future of China's automotive industry and spearhead this charge.

Images sourced from the official, infringing content will be deleted.