Domestic Auto Brands Intensify Sales Battle, Joint Ventures Counter with Strategic Maneuvers

![]() 03/10 2025

03/10 2025

![]() 476

476

Introduction

Independent brands are fiercely competing, and joint venture brands are not idle.

Recent years have witnessed a paradigm shift in the automotive market as independent brands steadily erode the market share of joint ventures. The landscape established in the previous era is now being dramatically altered.

Data reveals that in 2024, sales of Chinese brand passenger vehicles reached 17.97 million units, capturing a market share of 65.2%, a 9.2 percentage point increase from 2023. Conversely, joint venture brand passenger vehicle sales stood at 9.592 million units, with their market share dwindling to 34.8%. This trend is poised to continue in 2025 with the burgeoning new energy sector.

While some are achieving breakthroughs, others are facing significant challenges.

Amidst this wave of electrification, new energy vehicle makers like NIO, Xpeng, and Li Auto, along with independent brands such as BYD, Changan, and Geely, are solidifying their positions with stable performance. Notably, BYD set a new industry benchmark with monthly sales of 500,000 units, emerging as a formidable force in both domestic and global new energy markets.

In contrast, traditional joint venture giants like Volkswagen and Toyota have collectively experienced sales deceleration, with second-tier joint ventures struggling to maintain their presence in the Chinese market. The fuel vehicle market, traditionally dominated by joint ventures, is continuously eroded, and they find it challenging to compete with Chinese brands in the transforming electric vehicle sector. This predicament forces multinational automakers to reassess the rules of engagement in the Chinese market.

01 Encirclement and Counterattack

At the 2024 Chengdu Auto Show, SAIC Volkswagen pioneered the "one-price" model with the launch of the Tharu New Trend.

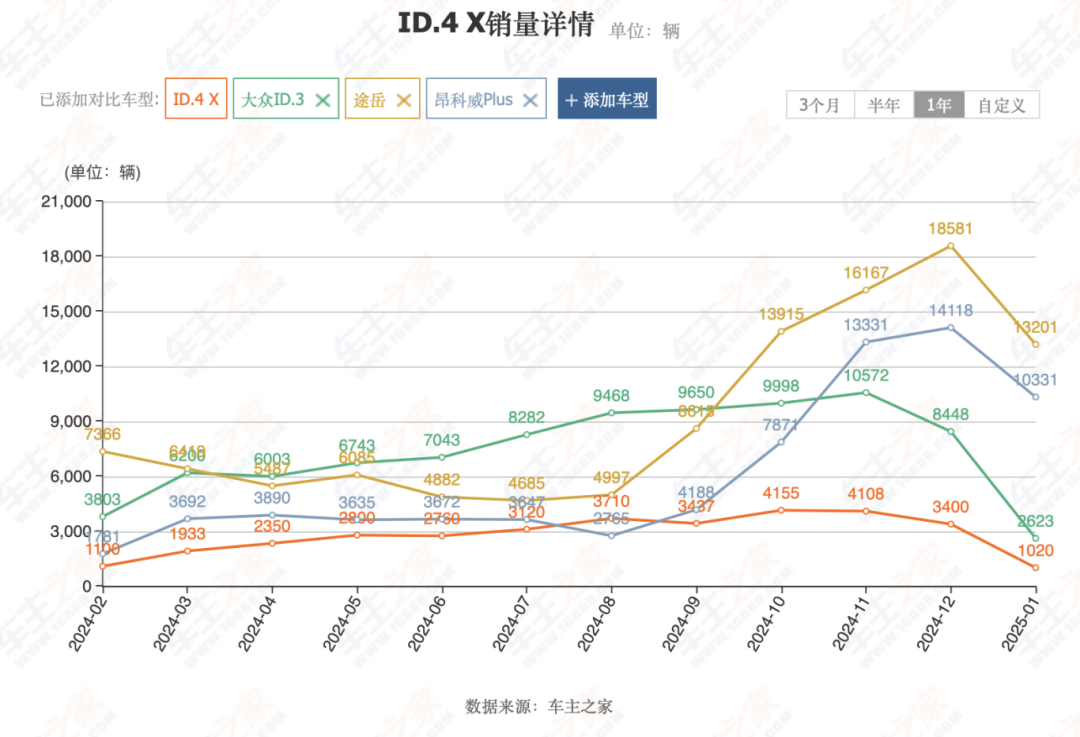

This strategy significantly boosted the previously sluggish sales of the Tharu New Trend. Initially averaging less than 5,000 units per month, the Tharu family surpassed 20,000 orders in the first month after the "one-price" model's introduction, with monthly sales exceeding 10,000 units, peaking at 12,000 in November and closing the year with 18,581 units in December.

In September of the following year, SAIC-GM, a subsidiary of SAIC Motor Corporation, followed suit with a "limited-time one-price" marketing strategy, successively launching models like the Envision PLUS and the all-new Cadillac XT5.

The "one-price" model has yielded remarkable results, driving a recovery in SAIC-GM's performance. For instance, sales of the Envision PLUS surged 110.5% year-on-year after adopting the "one-price" strategy. Additionally, sales of other Buick models also increased, with the new energy vehicle Buick E5 recording 3,039 units sold and the plug-in hybrid version of the Buick GL8 exceeding 10,000 units.

The introduction of the "one-price" model eliminates the problem of opaque terminal prices, enabling consumers to complete transactions directly based on the listed price without negotiation, thereby enhancing the transparency and convenience of car purchases. The success of this model has prompted other automakers, including GAC Toyota and Beijing Hyundai, to adopt similar strategies.

Some industry insiders have even dubbed the "one-price" model as the "lifesaver" for joint venture brands.

Six months later, SAIC Volkswagen, the pioneer of this model, relaunched a limited-time one-price offer for its new energy vehicle model, the SAIC Volkswagen ID.4 X Smart Edition. This offer covers three models: the Pure Smart Edition at a limited-time price of 139,900 yuan, the Pure Long-Range Edition at 175,900 yuan, and the Extreme Smart Long-Range Edition at 191,900 yuan. Notably, after the price reduction, the prices of SAIC Volkswagen ID.4 X and FAW-Volkswagen ID.4 CROZZ are now aligned.

Under the strategy of limited-time one-price, SAIC Volkswagen ID.4 X is anticipated to experience a sales recovery.

This follows the success of Volkswagen ID.3 in breaking through the price barrier, with an official price reduction of 40,000 yuan leading to a surge in sales, prompting adjustments in production capacity. Additionally, many other joint ventures have utilized price adjustments, with Toyota bZ4X offering terminal discounts of up to 60,000 yuan and Buick E5 achieving good results after implementing the "same price for oil and electricity" strategy.

Beyond implementing China-specific pricing to secure a future, thereby breaking the global pricing system, the joint venture camp is also attempting a localized technological counterattack aimed at breaking the encirclement of independent brands.

For instance, Honda has established a China electric vehicle R&D center; Nissan has introduced e-POWER hybrid technology; and Hyundai Kia has brought hydrogen fuel cell vehicles to China. Joint venture brands are increasingly investing their core technologies in the Chinese market.

Furthermore, luxury brands represented by BBA have even initiated channel revolutions to break free from constraints. The Mercedes-Benz EQ series has entered shopping mall experience stores, Audi has formed a dedicated new energy sales team, and BMW is piloting a new "online ordering + delivery center" model. In this digital reconstruction of the traditional 4S store system, the participation of joint venture and foreign brands is growing stronger.

From pricing strategies to technological counterattacks to channel revolutions, the continuous countermeasures emerging from the joint venture camp are seeking new opportunities for them. As the market becomes increasingly unpredictable, what independent brands aspire to, joint venture brands are reluctant to concede.

02 Intense Competition is Inevitable

Despite joint ventures exhausting their strategies, independent brands still hold numerous aces up their sleeves. With both sides fiercely competing, the battle is destined to be intense.

On the evening of February 10, BYD held its intelligent strategy conference in Shenzhen. Wang Chuanfu, Chairman and President of BYD, announced at the conference that BYD would equip its entire lineup with the "Divine Eye" advanced intelligent driving system, ushering in the "era of intelligent driving for all".

The "Divine Eye" comes in three versions: "Divine Eye" A, the triple-laser version, primarily used in NIO models; "Divine Eye" B, the laser version, mainly featured in Denza and BYD brands; and "Divine Eye" C, the triple-camera version, predominantly used in the BYD brand. BYD's entire lineup equipped with the "Divine Eye" will lower the price of intelligent driving to a starting point of 69,800 yuan.

BYD is not alone; Huawei's ADS 2.0 has achieved nationwide mapless intelligent driving; Xpeng's XNGP has expanded its city coverage to over 243 cities; and NIO's NOP+ has accumulated over 1 billion kilometers traveled. The iteration speed of autonomous driving algorithms by independent brands far surpasses that of multinational automakers, resulting in a generational technological gap. Even when compared to Tesla's FSD, which has entered the Chinese market, they hold their own.

While it is well-known that the joint venture camp is attempting to break through the price "iron curtain," what is less known is that this "iron curtain" was woven by independent brands.

In 2023, BYD's Qin PLUS strategy of "same price for oil and electricity" pushed plug-in hybrid models into the 100,000 yuan range. Subsequently, models like Wuling Bingguo and Changan Qiyuan A07 lowered the threshold for pure electric vehicles to 50,000-80,000 yuan, while new forces vertically integrated the supply chain, bringing high-end configurations such as 800V high-voltage platforms and silicon carbide electronic controls to the 200,000 yuan market, achieving both price and configuration competitiveness.

In this arms race involving price reductions and configuration upgrades, many brands have made lidar a standard feature rather than an option, and the iteration cycle of intelligent cockpits has been shortened to less than 12 months. For example, the Xpeng G6 is equipped with 31 sensing hardware, the Lixiang L9 pioneered five-screen three-dimensional interaction, and the Zeekr 001FR has joined the 2-second club for 0-100 km/h acceleration...

The independent army is fortifying its position through the three major battles of price wars, intelligent driving wars, and configuration wars.

With market changes, the global automotive industry landscape is being restructured, and the automotive market battle presents three major trends: technological competition shifting from the three-electric system to AI large models; market competition extending to county-level regions; and the battlefield expanding from the Chinese market to overseas markets (Southeast Asia, Europe).

On one side, independent brands occupy the commanding heights with their first-mover advantage, while on the other, the joint venture camp still holds the two trump cards of the global supply chain and brand recognition. Consequently, in this confrontation between old and new forces, we witness the collision of two industrial logics - the competition between internet thinking and manufacturing traditions, and the clash between local innovation and global system strength.

In this fierce battle destined to be intense, the true winners will be those automakers that can seamlessly integrate technological innovation with systemic capabilities, possessing both local insight and global vision.