Trump's Tariff Lever: A Double-Edged Sword

![]() 03/10 2025

03/10 2025

![]() 629

629

Introduction

Trump's tariff policy has far-reaching implications, affecting not only foreign nations but also the United States itself.

On the matter of tariffs, Trump remains unyielding in his stance, refusing to negotiate. Recently, during his address to Congress, Trump accused India of imposing tariffs exceeding 100% on American cars and announced that, starting April 2, the United States would reciprocate with similar tariffs against India. Trump reiterated his commitment to impose reciprocal tariffs on India, a stance he has maintained since taking office.

Barely a month into his reign, the new king finds the White House's tariff policy targeting not only the European Union but also regions such as Mexico, Canada, China, and India. Trump stands at the center, wielding his tariff lever with impunity. Wherever this lever swings, no nation remains untouched.

Those on the receiving end of Trump's tariff lever face dire consequences.

From a broader perspective, Japanese and Korean automakers export significant volumes to the United States, particularly Korean Hyundai and Kia, along with Japanese Toyota, Honda, and Nissan. The tariff policy increases their export costs, directly impacting their competitiveness in the American market. Notably, the United States serves as a lucrative market for many of these automakers, underscoring its importance.

On a closer look, Mexico and Canada bear the brunt of the tariffs, and the American auto industry finds itself in a precarious position amidst these tariff actions. Under the guise of "protecting local manufacturing," these policies aim to create barriers for other countries but impose cost pressures and disrupt supply chains for American automakers.

01 American Cars Also Suffer

Investors caution that Trump's 25% tariff on imported cars from Canada and Mexico may prompt Detroit's traditional Big Three to reduce production in these countries, potentially erasing billions of dollars in profits at the corporate level.

Even Tesla, which manufactures most of its models in the United States, is not immune, as some of its components are sourced from abroad. Mexico alone accounts for 20% to 25% of Tesla's parts production.

According to S&P Global Mobility, between 2020 and 2024, approximately 3.6 million cars were imported from Canada and Mexico to the United States, including many of the best-selling models in the country. In the first two months of 2025, about a quarter of new car sales in the United States originated from these two countries.

General Motors is particularly vulnerable.

The company produces approximately 840,000 cars annually in Mexico and 150,000 in Canada. Cars assembled by GM in Mexico accounted for about 25% of its sales in the United States in 2024, compared to 18% for Ford. Cars imported from Canada constituted 5% of GM's sales in the United States and about 3% for Ford.

Ford CEO Jim Farley previously warned that imposing a 25% tariff on Mexico and Canada would create an unprecedented loophole in American manufacturing.

"President Trump has frequently spoken about strengthening the American auto industry, increasing local car production, and fostering more innovation here. If the White House can achieve this goal, it will be a landmark achievement. However, so far, what we have witnessed is cost pressure and chaos."

An email from Stellantis, the parent company of Fiat Chrysler, this week revealed that the group had informed American dealers that once the Trump administration's tariffs on Mexico and Canada are implemented, the group would be at a competitive disadvantage compared to Asian and European peers.

"These tariffs will weaken the competitiveness of our core brands Chrysler, Dodge, and Jeep, putting us at a disadvantage in competition with importers from Korea, Japan, and Europe, as manufacturers in these countries currently do not face similar challenges," the email stated.

Currently, Ford operates three factories in Mexico, and most of the cars GM sells in the United States are manufactured there, including the Chevrolet Silverado, GMC Sierra full-size pickup trucks, and several new electric vehicles.

S&P Global Mobility estimates that if tariffs persist, North American car sales will decline by about 10%. Specifically, sales in Mexico will fall by 8%, the United States by 10%, and Canada will be the most affected, potentially declining by 15%.

More concerningly, if the tariff policy is implemented for more than six months, 57% of suppliers will cut or delay related investments, and 47% of suppliers indicate they will be forced to lay off employees. Regardless of how long this tariff war lasts in the future, the entire North American auto industry will face exceptional challenges in 2025, the year Trump returns to the White House.

02 Is Volkswagen the Most Vulnerable?

According to Bloomberg Intelligence data, tariffs could cost European automakers $6.2 billion in revenue this year, with Volkswagen being the hardest hit.

On one hand, Volkswagen heavily relies on vehicle production in Mexico, and the increase in tariffs will directly push up production costs. Volkswagen's Puebla plant in Mexico is one of its largest worldwide. This facility produced nearly 350,000 cars in 2023, including popular models like the Jetta and Tiguan, all of which were exported to the United States.

Volkswagen's premium brand Audi will also be affected by the tariff policy. Volkswagen's Audi plant in San José Chiapa, Mexico, primarily produces the Audi Q5. In 2023, it manufactured nearly 176,000 cars, most of which were exported to the United States.

On the other hand, Volkswagen also imports a substantial amount of auto parts from Mexico and Canada. The adjustment in tariffs means that supply chain costs will rise, further compressing profit margins. In Canada, Volkswagen is constructing a battery gigafactory in Ontario, expected to commence production in 2027.

In fact, Volkswagen has already anticipated the risk. The group plans to invest over $10 billion in the United States, including expanding the capacity of its Chattanooga plant in Tennessee and a joint venture project with electric vehicle manufacturer Rivian. These investments aim to enhance its production capacity in the United States to mitigate the negative impact of tariffs.

Judging from the series of signals released by the White House, the implementation of the new tariff policy may force Volkswagen to accelerate these investment plans and optimize its global supply chain.

In our article "Trump's Steel Sword Hanging Over European Cars," we analyzed the impact of tariff policies on European automakers. Once high tariffs are finalized, the situation for European automakers will become even more dire.

Taking Germany as an example, approximately three-quarters of the cars manufactured in the country are shipped abroad, making the auto industry highly susceptible to trade barriers. Trump's decision to impose high tariffs on steel and aluminum imports has even threatened to impose high tariffs on Canada and Mexico (where Volkswagen, BMW, and Mercedes have manufacturing plants), significantly impacting the auto supply chain.

Although some German automakers/suppliers have localized production in the United States and will not be directly negatively impacted by tariffs, high tariffs will still affect prices due to the multiple transportation of auto parts across the Mexico and Canada borders, effectively pushing up prices. Many people's fears may soon become a reality as Trump's series of measures may exacerbate inflation. When prices of American goods rise, related companies may choose to pass on some or all tariff costs to consumers.

The direction of tariffs also affects Japanese and Korean automakers.

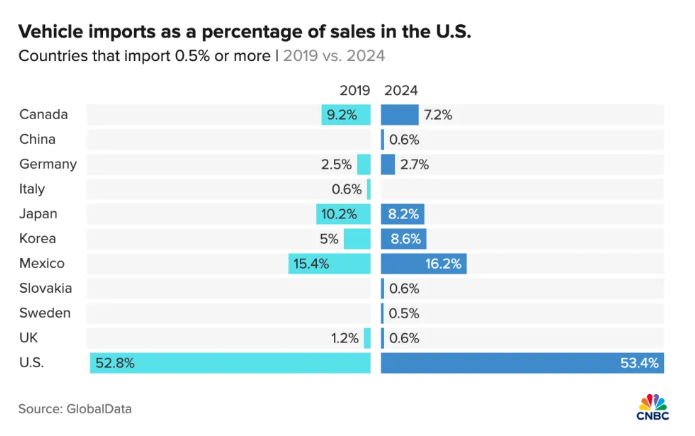

CNBC in the United States cited data from GlobalData indicating that last year, about 53% of new cars in the United States were produced locally, with the rest relying on imports. Among them, Mexico is the largest importer to the United States, accounting for 16.2% of the total imported cars, followed by Korea and Japan, both accounting for over 8% of the total, and Canada in fourth place at 7.2%.

Just this week, Trump specifically "criticized" South Korea, stating that many countries impose higher tariffs on the United States than the United States imposes on them, which he deemed unfair. Taking South Korea as an example, South Korea's average tariff on the United States is approximately four times that of the United States on South Korea.

03 Invisible Supply Chain Pressure

Trump's round of tariff "bombardment" could disrupt the North American integrated supply chain that has existed for over 25 years. The automobile manufacturing industry is a complex global system engineering that relies on the stability of the supply chain. Before the final assembly of a complete vehicle, some auto parts may have to cross the border six times or more.

Taking the Ford F-150 as an example, even for models fully assembled in the United States, there are approximately 2,700 major billable components, sourced from at least 24 different countries. Industry research shows that virtually no American car is made entirely of American parts.

According to Global Data, about one-third of the pickup trucks sold in the United States are manufactured in Mexico and Canada. Pickup truck products are the backbone of the American auto industry, generating long-term high profits for the Detroit Big Three.

Many American auto executives believe that, besides the supply chain crisis brought about by the COVID-19 pandemic, the upcoming tariff war will become one of the most unstable situations for American cars. Almost all automakers will be affected, and the impact will be almost immediate.

The nature of the automobile manufacturing industry determines that any changes made by enterprises to their manufacturing footprint will take several years. No automaker can relocate production and supply chains overnight.

Moreover, Mexico and Canada are also significant production bases for many auto parts companies.

Sweden's Autoliv, the world's largest manufacturer of airbags and seat belts, employs about 15,000 people in Mexico; tire manufacturer Michelin has two factories in Mexico and three in Canada; and China's Yanfeng supplies automakers such as GM and Toyota from its Mexican factories.

In recent years, more and more parts companies have relied on North American production. Tesla has been encouraging its Chinese suppliers to set up factories in Mexico to supply its Shanghai plant, but this plan has yet to materialize.

The transfer of auto production and supply chains cannot happen overnight, posing the biggest challenge and dilemma at present. Industry insiders analyze that North American auto tariffs will ultimately increase consumer costs and bring intangible pressure to enterprises before so-called job opportunities return to the United States.

Ford CEO Jim Farley has warned that long-term tariffs will "erase" automakers' profits and force management to make "significant decision-making changes," including relocating manufacturing plants to the United States. However, building new facilities is a lengthy process, and companies remain vulnerable to costs.

Automakers have no choice but to pass on these costs.

North American analysts estimate that Mexico provides up to 40% of auto parts to the United States, and Canada provides over 20%. Suppliers will have to bear some of the tariff costs. If rising car prices lead to weakened consumer demand, they may suffer additional blows, potentially resulting in production cuts and layoffs.

Responsible Editor: Li Sijia

Editor: Chen Xinnan