Selling Cars at a Loss: Leapmotor's Dilemma and the Limits of the "Half-Price Ideal"

![]() 03/12 2025

03/12 2025

![]() 543

543

By Li Yue

Produced by Jieche Technology

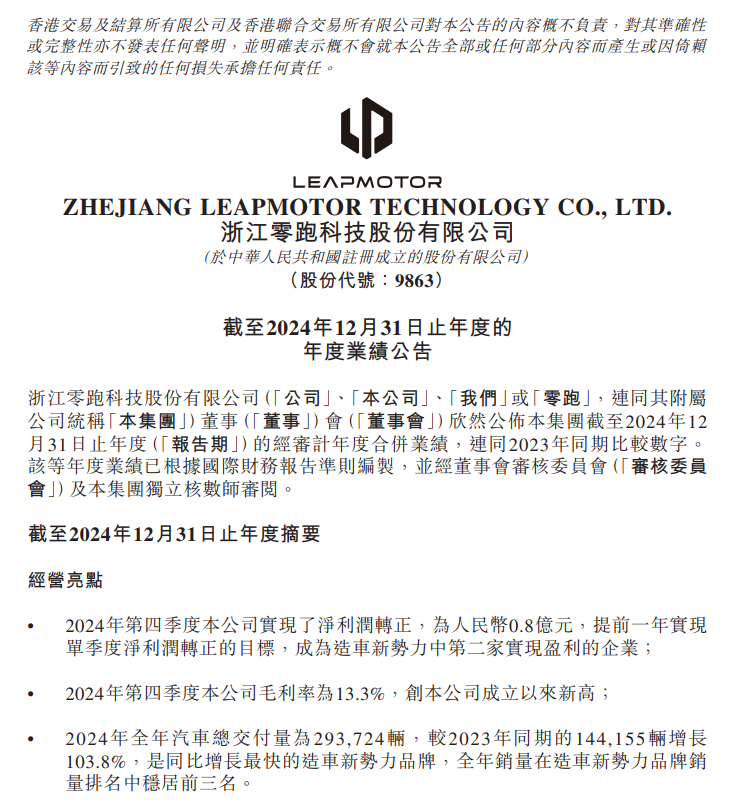

Leapmotor's 2024 financial report, released on March 10, paints a mixed picture: "Annual deliveries reached 293,700 units, a 103.8% increase year-on-year; gross margin rose from 0.5% in 2023 to 8.4%, with the fourth quarter hitting a record high of 13.3%; net operating cash flow hit 8.47 billion yuan, and free cash flow turned positive at 6.32 billion yuan." These figures seem to confirm Leapmotor's emergence as a profitable player in the industry.

However, a glaring figure in the report exposes a fundamental issue: the company's net profit attributable to shareholders in 2024 was a loss of 2.82 billion yuan, equating to a loss of roughly 9,600 yuan per car sold. Even though the fourth quarter recorded a profit of 80 million yuan, it is a mere drop in the ocean.

This business model of "losing money on every car sold" is essentially the result of an imbalance between Leapmotor's low-price strategy and cost control. The C series, Leapmotor's mainstay models, accounted for 76.6% of sales. Notably, the C10 and C16 models, which can be compared to Li Auto's L7 and L8, are priced roughly half of Li Auto's models, earning Leapmotor the moniker "half-price ideal".

While low prices undoubtedly boost sales, they also hinder brand premiumization. Leapmotor's gross margin falls significantly below industry leaders (such as Tesla's nearly 18% and BYD's approximately 20%). Though Leapmotor appears to have improved its gross margin through economies of scale, its profit margin per vehicle remains critically compressed. Any slowdown in sales growth or increase in costs could widen the loss gap.

Every enterprise and brand must be unique; otherwise, they lose their value. Earlier, when Leapmotor was labeled a "mini Li Auto," Cao Li, Senior Vice President of Leapmotor, responded that the company neither rejects nor embraces this label, insisting that Leapmotor remains Leapmotor.

This response was ambiguous. During a media interview after the B10 pre-sale launch event on March 10, Zhu Jiangming, CEO of Leapmotor, candidly addressed the "half-price ideal" label: "(This represents) recognition of Leapmotor's product strength. Design and comfort can be 'comparable to Li Auto,' which is a plus for our product. However, Leapmotor also has 'more innovations,' and many aspects are entirely different from Li Auto."

Zhu Jiangming's half-acceptance and half-rejection of the "half-price ideal" label reveals a significant strategic shortcoming. According to brand management expert David Aaker, brand equity hinges on uniqueness, relevance, and authority. Leapmotor, however, contradicts these principles:

First, the loss of brand uniqueness: Being associated with Li Auto positions Leapmotor as a "cheap substitute" rather than an independent brand. Consumers perceive Leapmotor solely through the "low-price" label, leading to a fragile brand association.

Second, insufficient brand authority: Li Auto has established a high-end image through precise family user positioning and extended-range technology. In contrast, Leapmotor lacks a unique technological identity and has yet to formulate a differentiated user value proposition.

Third, brand extension risk: Leapmotor plans to launch the B series (compact SUV B10, mid-size sedan B01) in 2025 to cover the mainstream market. However, the "half-price ideal" label may hinder the premiumization efforts of this new series.

Zhu Jiangming's failure to unequivocally reject the "half-price ideal" label essentially sacrifices brand value for short-term sales growth. This strategy might attract price-sensitive consumers initially but will eventually trap the brand in the low-end market, making it difficult to breach the price ceiling. As David Aaker notes, "Once a brand is labeled as low-price, it will cost ten times as much to tear off that label."

Leapmotor once claimed to have achieved full in-house research and development in six areas: electronics and electrical systems, batteries, electric drives, intelligent cockpits, intelligent driving, and vehicle architecture. However, the latest financial report and product performance reveal technological inadequacies:

First, intelligent driving relies on external assistance: The "super integrated central domain controller" of the LEAP 3.5 architecture relies on the Qualcomm 8650 chip and lidar, and the algorithm level still requires assistance from third-party large models like Alibaba Cloud and DeepSeek. The end-to-end intelligent driving model is also built on the QNX Safety operating system.

Second, the three-electric system lacks barriers: Although CTC battery technology and oil-cooled electric drives have been mass-produced, giants like CATL and BYD have achieved more mature solutions. Leapmotor's "golden powertrain" has yet to form an absolute advantage in performance or cost.

Third, R&D investment is inadequate: In 2024, R&D expenditure was 2.9 billion yuan, just one-third of Li Auto's (about 10 billion yuan), and most of it was allocated to the iteration of existing technologies rather than forward-looking innovations.

The so-called "full in-house research and development" appears more like a marketing ploy. Leapmotor still relies on international top-tier suppliers for core technologies. Its claimed "cost advantage" may stem from using domestic substitutes to reduce procurement prices rather than structural cost reductions from technological breakthroughs. As competition in intelligence intensifies, Leapmotor's technological shortcomings will hinder its competitiveness in the high-end market.

Leapmotor should have recognized the urgency of brand upgrade, but strategic execution remains lackluster. Currently, product premiumization is stymied: Though the C16 won the "2024 Automotive Industry Peak Award" from the International Automobile Quality Standardization Association (IAQSA), its design, materials, and luxury feel still lag behind Li Auto and NIO. The B series targets the mainstream market, but the "half-price ideal" brand perception may make consumers question its product strength.

In the overseas market, Leapmotor has also encountered challenges. Despite collaborating with Stellantis Group, which is predominantly locally dominant with sales in markets like Europe and the United States, these markets impose high tariffs on Chinese-made new energy vehicles. Leapmotor, which relies on cost-effectiveness, may be more adversely affected by tariff barriers.

David Aaker emphasizes that brand premiumization necessitates "consistent experience" and "emotional resonance." Leapmotor's problem lies in lacking both leading technological strength to support high-end products and a brand story that resonates with users. It can only rely on price wars to sustain growth, a model doomed to be unsustainable in a competitive market.

Leapmotor's 2024 financial report reveals a harsh reality: low prices can win the market but not the future. If it continues to be ambiguous about the "half-price ideal" label, its brand value will continue to erode. What awaits Leapmotor may not be the vast sea and stars but the end of price wars.