Audi Struggles with "Elephant Turn": Sluggish Electric Car Sales, Profits Plunge

![]() 03/14 2025

03/14 2025

![]() 676

676

As the European automotive industry grapples with mounting challenges, Audi's Brussels plant, once a beacon of its electric transformation, officially shuttered on February 28. The substantial sunk costs highlight the formidable obstacles Audi faces in its transition to electric vehicles.

Securities Star observed that due to a widespread decline in sales across major markets, Audi's global sales plummeted 11.8% year-on-year in 2024, marking the steepest drop among the BBA trio and being surpassed by Tesla for the first time. With its roots firmly planted in internal combustion engine vehicles, Audi saw an 8% decline in electric car sales last year, accounting for less than 10% of its total sales. In China, its largest single market, Audi's market share is increasingly eroded by local new energy vehicle brands. Surviving the new energy wave has become a pressing issue, and accelerating localization has emerged as Audi's core strategy. Additionally, under the dual pressure of a 50% profit decline in the first three quarters of 2024 and a stalled electric transformation, Audi is seeking self-rescue through extensive cost reductions and strategic adjustments.

01. Closure of 70-Year-Old Plant Reflects Electric Transition Challenges

According to media reports, Audi's Brussels plant, with a rich history spanning over 70 years, officially closed on February 28, resulting in the loss of over 3,000 direct and indirect jobs. The plant transitioned to electric vehicle production in 2018.

China Auto News reported that Audi's first all-electric SUV, the e-tron, began mass production at this plant in 2018. In 2022, the Q8 e-tron, a mid-cycle refresh of the e-tron, rolled off the assembly line alongside the Q4 e-tron.

Audi cited a decline in global demand for high-end electric SUVs as the primary reason for the sharp drop in demand for the Audi Q8 e-tron produced at this plant. The company also mentioned long-standing structural issues at the plant, including high logistics and production costs. It is reported that Audi has decided to relocate production of the Q8 e-tron's successor to its Mexican plant.

The Q8 e-tron, the Brussels plant's flagship model, sold only 49,000 units globally in 2023, marking a year-on-year decrease of 4.3%. Sales further deteriorated by 27% in 2024. With an annual production capacity of 120,000 units, the Brussels plant has consistently operated at a low capacity utilization rate for years.

Once seen as the linchpin of Audi's electric transformation, the Brussels plant's closure underscores the company's unfavorable progress in transitioning to new energy vehicles. In 2023, Audi's global electric car sales surged 51% year-on-year to 178,400 units. The Brussels plant contributed 53,600 electric vehicles, accounting for 30% of electric vehicle deliveries that year.

In 2024, Audi's electric vehicle sales dipped 8% to approximately 164,000 units, representing just 9.81% of total sales. Notably, sales in Germany plummeted 33% year-on-year to 22,000 units, partly due to the elimination of electric vehicle purchase subsidies at the end of 2023.

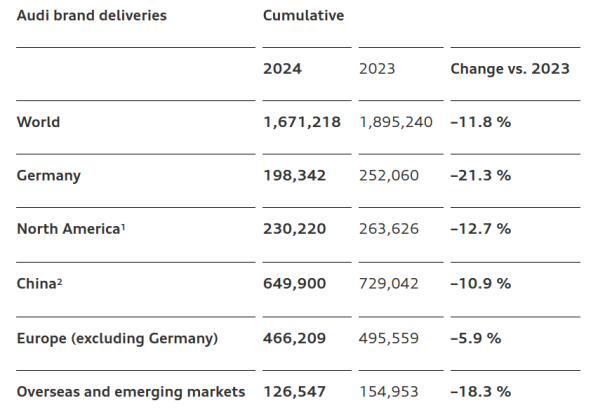

Regarding overall sales, Audi's global sales in 2024 stood at 1,671,200 units, marking a year-on-year decline of 11.8% across all major markets. Sales in Germany, North America, and Europe (excluding Germany) fell by 21.3%, 12.7%, and 5.9%, respectively. In China, Audi's core market, the company delivered over 649,900 vehicles to customers, a year-on-year decrease of 10.9%.

Securities Star notes that Audi still failed to shake off its "third place" position among the BBA trio. In 2024, Mercedes-Benz sold 2,389,000 units globally, a year-on-year decline of 4%; BMW sold 2,450,800 units, a year-on-year drop of 4%. In contrast, Audi's global situation is more dire, not only experiencing the largest decline last year but also continuing to "lag behind" in sales, with a significant gap. Tesla also surpassed Audi for the first time with nearly 1.8 million units sold in the same year.

02. Chinese Market Relies Heavily on Internal Combustion Engine Vehicles

Despite a notable decline in sales in China, the market remains Audi's largest globally. However, with the rise of high-end electric vehicle brands such as NIO, Li Auto, and Wenjie, Audi's market share has been severely squeezed, and the market share of Chinese brand (domestic) passenger vehicles has surpassed 70%.

Audi operates in China through a partnership with two major players: FAW Group and SAIC Motor (600104.SH). FAW-Volkswagen Audi, as the earliest joint venture with Audi, holds the majority of advantageous product resources. In 2024, FAW-Volkswagen Audi sold 611,100 vehicles, a decline of over 12% from 698,200 vehicles in 2023; over the same period, SAIC Audi's cumulative deliveries surged 70% to 43,200 vehicles. Clearly, FAW-Volkswagen Audi is the primary sales force in the Chinese market.

When announcing its 2024 sales, FAW-Volkswagen Audi claimed the title of "No. 1 market share in locally produced luxury fuel vehicles," with sales of 550,100 locally produced fuel vehicles. This achievement was driven by significant price reductions. In 2024, FAW-Volkswagen Audi implemented substantial price cuts for multiple models, ranging from 32,000 to 100,000 yuan.

Since the beginning of this year, FAW-Volkswagen Audi has continued its price-competitive strategy. The self-media account Chili Auto observed that in the retail market, the lowest quoted price for a new Audi A4L has dropped to over 170,000 yuan, lower than domestic new energy vehicle brands such as ZEEKR 007 and over 100,000 yuan cheaper than the NIO ET5.

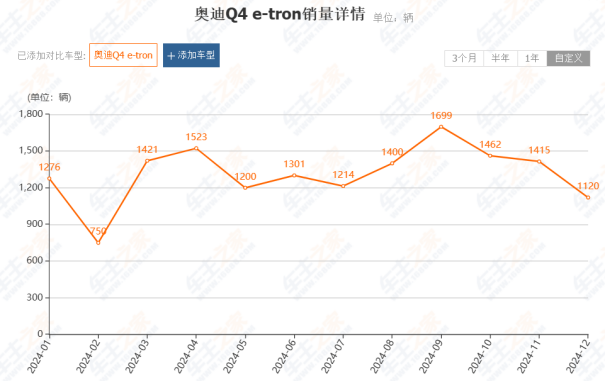

Securities Star noticed that amidst the domestic electric wave, Audi has shown signs of "not being acclimatized," with its foundation still heavily reliant on internal combustion engine vehicles to support sales. Data from Chezhuzhijia reveals that among FAW-Volkswagen Audi's many new energy models, the Audi Q4 e-tron has the best sales performance, but its cumulative sales in 2024 declined by over 30% year-on-year to approximately 15,800 units, even less than the monthly sales of leading domestic new energy vehicles.

How to avoid falling behind in the electric transition has become an urgent issue for Audi. The company has announced plans to create the largest product lineup in its brand history for the Chinese market. Currently, the PPE plant of FAW-Volkswagen Audi in Changchun has commenced production, serving as Audi's first pure electric vehicle production base in China, with the Audi Q6 e-tron series being the first to roll off the line. In 2025, FAW-Volkswagen Audi plans to launch five new models, three of which will be pure electric products.

To focus on the new energy sector, Audi has also jointly launched a new luxury pure electric vehicle brand, AUDI, with SAIC Motor. Audi officials stated that the new brand AUDI is tailored for the Chinese market and plans to deliver the first concept car, AUDI E, in 2025. Over the next three years, it will introduce three pure electric models catering to the B-segment and C-segment markets.

"Currently, this product has no direct competitors. At least during the development process, we did not benchmark a specific product, market segment, or brand," said Song Feiming, CEO of the Audi-SAIC cooperation project. He believes that the key issue for the project team to consider is how to make the product stand out in the market. Can Audi's all-out efforts in the pure electric field break its current inferior position to "NIO, Li Auto, and Xpeng" in the new energy market? Time will tell.

03. Significant Cost Reductions Amid Profit "Plunge"

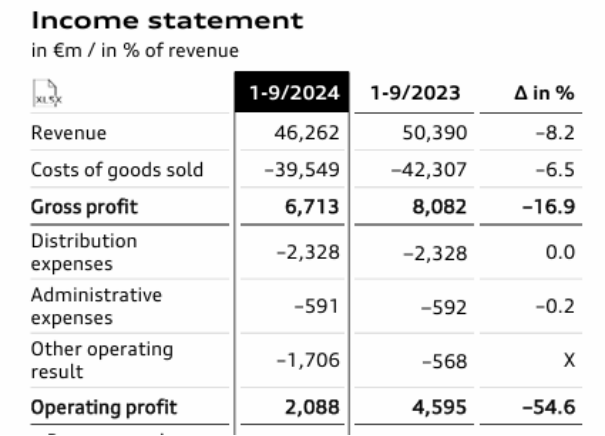

According to the third-quarter report for 2024, Audi generated revenue of 46.262 billion euros in the first three quarters of last year, a year-on-year decline of 8.2%; operating profit was 2.088 billion euros, a year-on-year plunge of 54.6%. Audi attributed the decline in performance to challenges in the macroeconomic situation, restructuring costs at the Brussels plant, and model transitions. Notably, the company's third-quarter operating profit plummeted 91% to 106 million euros.

Securities Star noted that Audi's operating profit margin was 4.5% in the first three quarters of last year. The company had previously announced plans to increase its profit margin to 14%, but this target is no longer mentioned internally. In comparison, Mercedes-Benz expects a profit margin of 6%-8% this year, while BMW aims for 8%-10%.

Amid the challenges of electric transformation and profit pressure, Audi has embarked on drastic reforms. Starting from March 1, Audi established a new "Transformation, Consulting, and Organization" department aimed at integrating internal resources and accelerating corporate transformation. The new department will be led by Yvonne Bettkober, who previously oversaw global organizational development and transformation at Volkswagen and its software subsidiary CARIAD. This is seen as Audi's self-rescue action amidst declining sales and a stalled electric transformation.

The changes are not limited to the establishment of a new department; Audi is also implementing a stringent cost reduction plan. According to Germany's Handelsblatt, Audi plans to cumulatively reduce material costs by 8 billion euros and labor costs by 10 billion euros by 2030, with average annual reductions of 1.6 billion euros and 1 billion euros, respectively.

To achieve this, Audi will significantly reduce positions, eliminate fringe benefits, and outsource some work. According to Germany's Manager Magazin, Audi plans to shrink its workforce by cutting jobs outside production, with thousands of positions at risk of layoffs. Although Audi's employment guarantee agreement with German trade unions currently extends to 2029, the company can still optimize its personnel through voluntary departures and early retirements. (This article was originally published on Securities Star, author | Lu Wenyan)

- End -