Dissecting Geely's Open Strategy: Privatizing Zeekr, Reconstructing the Technology-Brand-Market Triangle

![]() 05/09 2025

05/09 2025

![]() 613

613

By | Hengxin

Source | Bowang Finance

On May 7, 2025, Geely announced a non-binding privatization offer for Zeekr, its high-end new energy vehicle brand, aiming to acquire the remaining 34.3% stake at $2.566 per share or $25.66 per American Depositary Share (ADS). Upon completion, Zeekr will delist from the New York Stock Exchange and become a wholly-owned subsidiary of Geely. This move, occurring just a year after Zeekr's listing, marks a new phase of deep integration in China's new energy vehicle industry.

Founded in 1986 and entering the automotive industry in 1997, Geely's business now spans automobiles, upstream and downstream industrial chains, smart mobility services, green logistics, methanol hydrogen ecology, and digital technology. With electrification and intelligent transformation at its core, Geely is fortifying its technological ecosystem in new energy technology, shared mobility, connected vehicles, intelligent driving, and automotive chips, solidifying its position in the industry.

Zeekr, a smart electric vehicle brand under Geely (currently holding around 65.7% of its shares), was officially announced in March 2021. Leveraging Geely's industrial foundation and global resources, Zeekr quickly established a comprehensive pure electric intelligent technology ecosystem, achieving rapid evolution and listing on the New York Stock Exchange on May 10, 2024.

As a key measure in implementing Geely Auto's "Taizhou Declaration" strategy, this acquisition is not just a capital reorganization but a model for traditional automakers to explore systematic solutions in electrification and intelligent transformation.

01

Strategic Motivation: From Scale Expansion to Value Fusion

Zeekr's delisting and integration into Geely can be explained through three aspects:

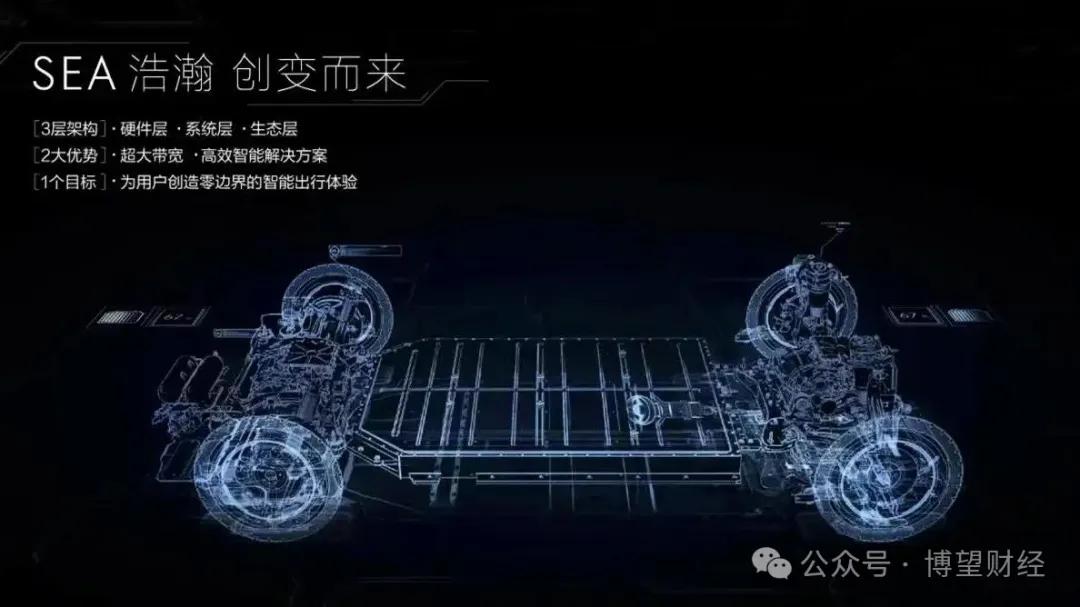

First, addressing resource misallocation by transitioning from a "multi-brand melee" to "strategic focus." Geely's acquisition of Volvo and stakes in Daimler created a diverse brand matrix but also led to resource dispersion. The acquisition of Zeekr by Lynk & Co. resolves direct competition in the 200,000-300,000 yuan price range, achieving significant integration effects. According to Geely Holding Group President An Conghui, "after the merger, R&D investment is expected to decrease by 10%-20%, supply chain costs by 5%-8%, and capacity utilization by 3%-5%." Technology sharing between the SEA vast architecture and CMA platform will also solve repeated R&D investment issues.

Second, coping with industry "overcompetition" by transitioning from a price war to a value war. In 2024, the new energy vehicle industry evolved from "dual decline in oil and electricity" to full value chain competition. BYD and Tesla achieved cost control through vertical integration, prompting Geely to build a differentiated moat. Privatizing Zeekr enables Geely to achieve a closed loop in seven technology fields, forming a "technological demotion strike." For example, applying Zeekr 001's carbon fiber body technology to Geely's Xingyue L series enhances its premium capabilities.

Finally, addressing capital operation logic by transitioning from a valuation dilemma on US stock markets to value reconstruction on Hong Kong stock markets. Since its listing at $21 per share in May 2024, Zeekr's share price has remained lower than expected, with its price-to-sales ratio far below that of NIO and Xpeng. Main model Zeekr 001 sales halved due to competition, falling short of the 230,000-unit target. Post-privatization, Geely can release the value of its technological assets through a secondary listing on Hong Kong or A-share markets, potentially boosting the group's valuation.

02

Two-way Impact: Balancing Synergistic Effects and Integration Risks

Overall, the impact on both parties is positive.

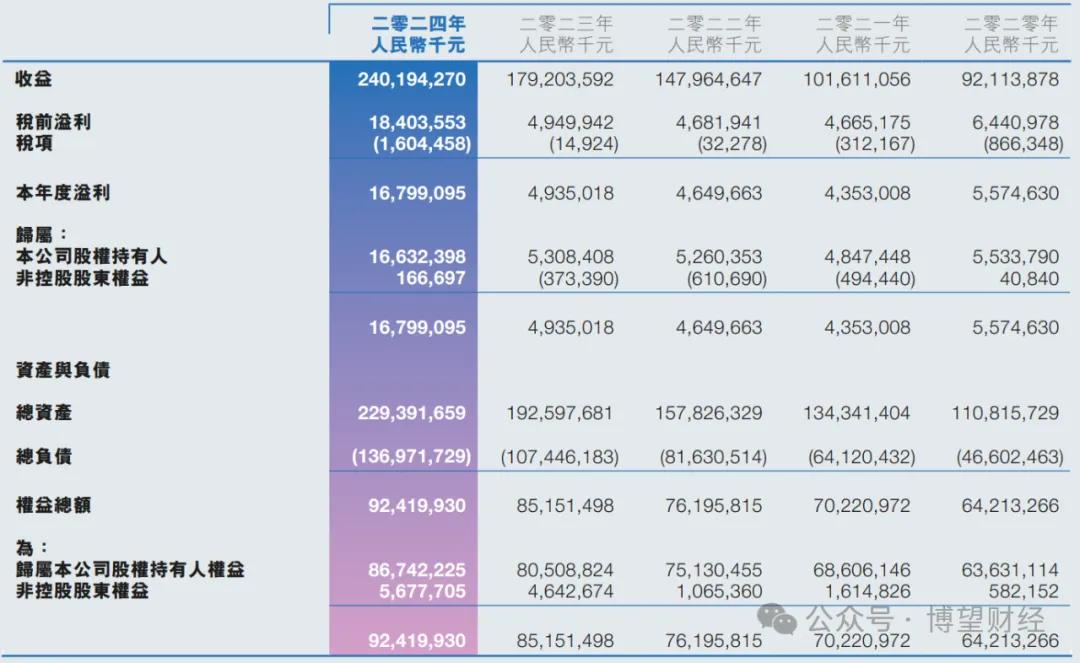

For Geely, there is a dual enhancement of scale effects and strategic initiative. In 2024, Geely Auto's revenue reached 240.2 billion yuan, up 34% year-on-year, with annual profit surging 240% to 16.8 billion yuan. Zeekr's performance was equally impressive, achieving significant growth with annual revenue of 10.6 billion yuan, up 45% year-on-year, and vehicle sales revenue of 7.7 billion yuan, up 61% year-on-year. Merger-induced financial optimization is evident. Additionally, Zeekr's intelligent cockpit (8295 chip application) and energy replenishment network (42 supercharging stations in Europe) will accelerate Geely's global layout and shorten overseas delivery cycles.

However, post-acquisition management challenges include cultural conflicts between Zeekr's internet-oriented team (average age of 28) and Geely's traditional structure (average age of 35), requiring a "dual-track promotion system" to bridge the gap.

For Zeekr, delisting from US stock markets reduces compliance costs and information disclosure pressure, enabling more flexible strategy formulation and adjustment, and a focus on long-term development. For example, Zeekr's 9X flagship model plans to adopt solid-state battery technology. Under independent operation, more technical details would need to be disclosed, whereas under the group, research and development can advance under confidentiality.

Nevertheless, the acquisition may bring negative impacts to Zeekr, such as potentially losing financing channels in the short term and the risk of "Geelyization" weakening its high-end attributes.

Maintaining a balance between brand independence and resource synergy will be a key challenge for both Geely and Zeekr.

03

Future Layout: Constructing a "Technology-Brand-Market" Triangular Ecosystem

The future layout of both parties can be discerned through three aspects: "technology synergy + brand matrix + global breakthrough."

First, technology synergy, from platform sharing to standard output. Geely plans to open up cutting-edge technologies like the vast architecture and intelligent driving to all brands, unifying energy replenishment networks and after-sales systems. Technology sharing can increase R&D efficiency by 30% and reduce user charging anxiety by 50%. The PMA pure electric platform jointly developed with Volvo will be upgraded to a "global technical standard," building competitive barriers through patent pools.

Second, the brand matrix, a three-step strategic depth. This integration uses equity reorganization as a fulcrum, incorporating Zeekr, Lynk & Co., and Geely Galaxy into clear tracks of "luxury technology - high-end new energy - mainstream market." Zeekr focuses on the market above 300,000 yuan, launching the shooting brake 007 GT and flagship SUV 9X in 2025, competing with NIO's ET7 and Mercedes-Benz's EQE. Lynk & Co. targets the 200,000-300,000 yuan range, with four out of five new models in 2025 being hybrid vehicles equipped with the Galaxy OS system for "intelligent equity." Geely Galaxy covers the 100,000-200,000 yuan price range, achieving "high configuration at a low price" through CMA architecture decentralization, directly competing with BYD's Qin PLUS.

Third, the global breakthrough, from product exports to ecosystem output. Zeekr's European channels (42 stores in Norway and Germany) will synergize with Lynk & Co.'s Asia-Pacific network (a factory in Thailand with an annual capacity of 100,000 units), aiming for overseas sales to account for 25% of total sales in 2025. Notably, Geely plans to introduce methanol fuel cell technology into Eastern European markets, leveraging local biomass raw material advantages to build differentiated competitiveness, distinguishing itself from Tesla's pure electric route.

Geely's acquisition of Zeekr is a systematic experiment by a traditional automaker to reconstruct its competitiveness in the era of intelligent electric vehicles. Short-term, it achieves technology synergy and cost optimization through capital integration, alleviating industry overcompetition pressure. Long-term, its "strategic contraction - value fusion" path provides a new paradigm: as scale expansion's marginal benefits diminish, focusing on core capabilities and building an open ecosystem may be the key to automakers' breakthrough.

Success hinges on balancing technology sharing and brand differentiation, scale effects and innovation agility, and capital efficiency and user experience. If successful, Geely may reshape the global automotive industry landscape, proving Chinese automakers can win the transformation initiative through strategic determination rather than capital games. If not, it may become another footnote to the "big company disease" in the new era.

Regardless, this experiment's value transcends the enterprise level, becoming an important window for observing China's automotive industry evolution. Bowang Finance will continue to closely monitor developments.