2025 January-April New Energy Vehicle Sales Rankings: XPeng Tops, ZERO in Second

![]() 05/12 2025

05/12 2025

![]() 394

394

Following weekly and monthly sales rankings, we now turn our attention to cumulative sales rankings. Today, we present the new energy vehicle sales rankings from January to April 2025. With one-third of the year already gone, let's explore the sales performance of each competitor in this burgeoning sector!

At the top of the rankings, we have XPeng with 129,053 sales, closely followed by ZERO with 128,591 sales, and Lixiang with 126,803 sales. All three have surpassed the 120,000-vehicle mark. The competition among these top three is fierce, with less than 1,000 vehicles separating the champion from the runner-up and less than 2,000 vehicles between the runner-up and third place. In 2025, XPeng, ZERO, and Lixiang have emerged as the new leaders, while NIO has fallen out of the top three. Even with Ledao and Firefly, NIO's sales are only half that of the top three, hinting at a slight decline.

In the first four months, XPeng leads in sales, but with ZERO's B10 and B01 models experiencing rapid sales growth, they could unexpectedly snatch the top spot in both monthly and cumulative sales. XPeng's MONA M03 continues to sell well, but the lack of a successor with blockbuster potential poses a risk. Lixiang's L series models have recently been refreshed and launched, and it's hoped that their sales stability can endure, awaiting the release of their pure electric vehicle to ignite a sales surge.

Next, Xiaomi ranks fourth with 97,000 sales, followed by Deep Blue in fifth with 87,822 sales, and Zeekr in sixth with 55,130 sales. Xiaomi, Deep Blue, and Zeekr can be considered the second tier, closely trailing the top three. Recently, Xiaomi has encountered challenges, not only facing public controversy over the front hood of the Xiaomi SU7 Ultra but also ranking last in quality in the first quarter of the China Automobile Quality Ranking for medium and large vehicles (pure electric models). Founder Lei Jun has kept a low profile for some time.

Further down the rankings, NIO sits in seventh with 46,582 sales, followed by Avita in eighth with 36,164 sales, Hovo Auto in ninth with 36,053 sales, and Ledao in tenth with 19,181 sales. Combining NIO and Ledao's sales would place them in the second tier with a total of 65,763 vehicles. However, Ledao's overall performance has been disappointing, and the future of Firefly remains uncertain. Avita and Hovo Auto, representatives of Chinese intelligent driving assistance, are both striving to boost sales and are performing well.

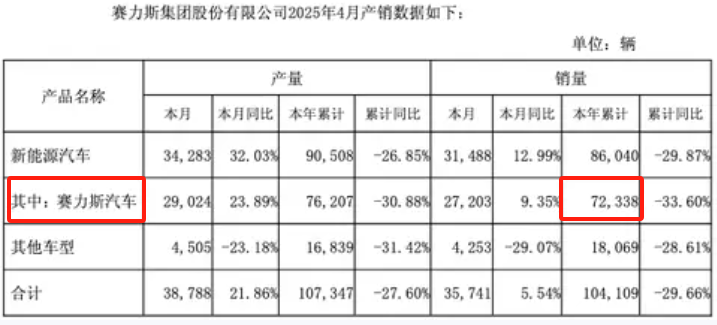

It's unfortunate that AITO has yet to announce its April sales, and there's no news regarding HarmonyOS Intelligent Driving. Additionally, Thalys Group released its production and sales bulletin, revealing that it sold 72,338 vehicles from January to April 2025, a year-on-year decline of 33.60%, indicating poor performance. This concludes the 2025 cumulative sales rankings for new energy vehicles. Besides AITO, Nezha Auto, a regular on previous rankings, also lacks sales figures. This year's automotive market competition promises to be even more intense. Who will fall behind in 2025?