Navigating Transition: Volkswagen's Q1 2025 Profits Decline 37%, Spotlight on Boosting Chinese Market Demand

![]() 05/12 2025

05/12 2025

![]() 588

588

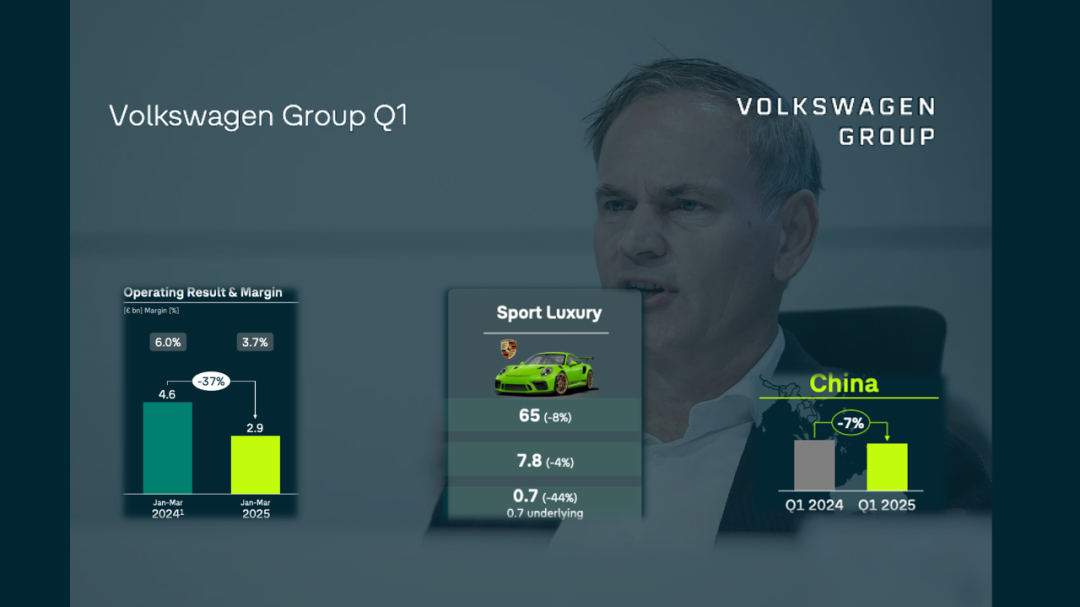

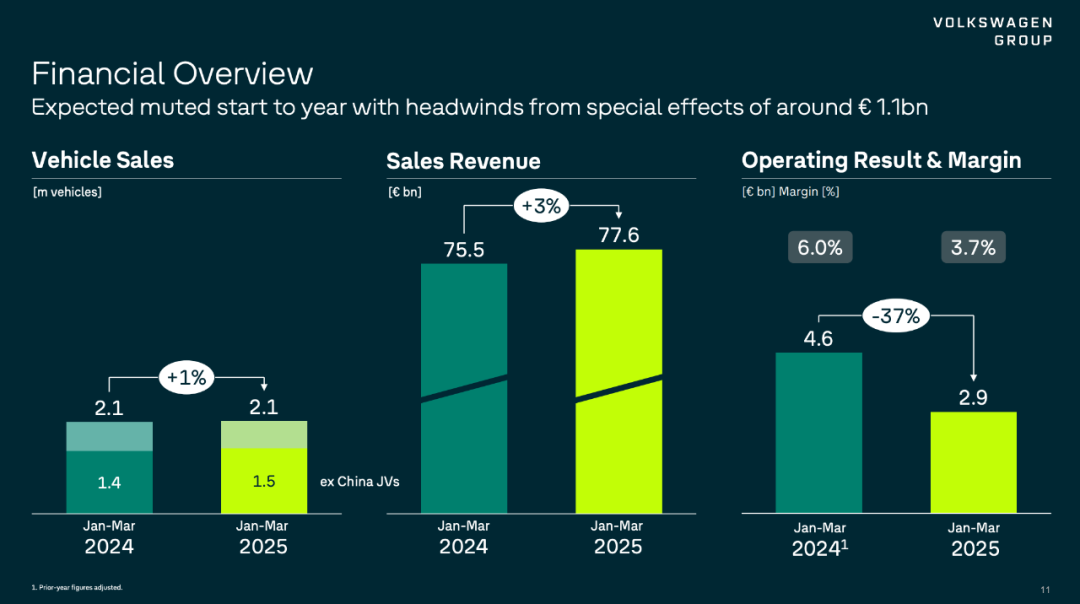

As Volkswagen, the 'global sales giant,' reported revenues of 77.5 billion euros but witnessed a staggering 37% profit drop, the transitional challenges confronting traditional automotive behemoths have come into sharp focus. While electric vehicle orders surged 64% in Western Europe, sales in the Chinese market continued to slide. Simultaneously, Volkswagen incurred significant expenditures on software and battery development, witnessing a 50% decline in Porsche's profits. This mixed financial report underscores the quintessential dilemma of a colossal entity in transition: the narrowing profit margins of fuel vehicles and the intractable high costs of electric vehicles.

From the localization strategy of 'in China, for China' to the ambitious plan to launch 30 new models by 2026, can Volkswagen steer its course amidst the turbulence? The answer may lie in the intricate details of each quarterly financial report. This article delves into: Sales & Finance, Brand Group Performance, Software & Electrification, and Regional Performance. By organizing relevant information from Volkswagen Group's Q1 2025 financial report, we aim to shed light on the nuances hidden within these reports.

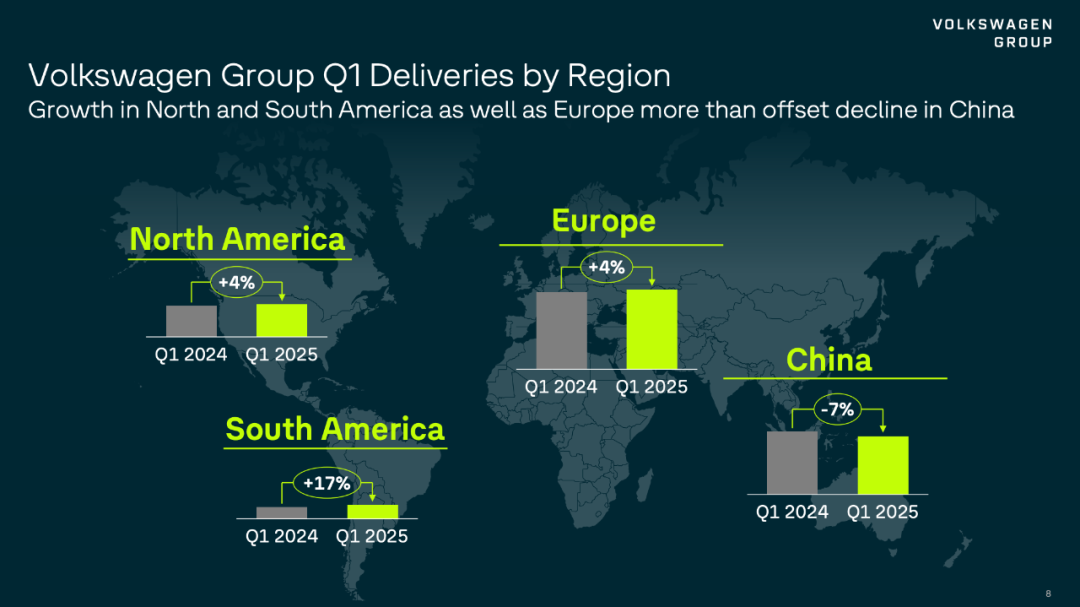

Regional Performance: Western Europe saw a 29% year-on-year increase in orders, with electric vehicle orders surging 64%, leaving 1 million unfulfilled orders (stretching into Q3). North America compensated for the Chinese market decline with a 4% rise in delivery volumes. South America experienced double-digit growth, with sales in Argentina doubling, albeit from a small base. In China, joint venture sales stood at 611,000 units (down 6% year-on-year), but the 'in China, for China' strategy is progressing as scheduled, with 30 new models planned by 2026.

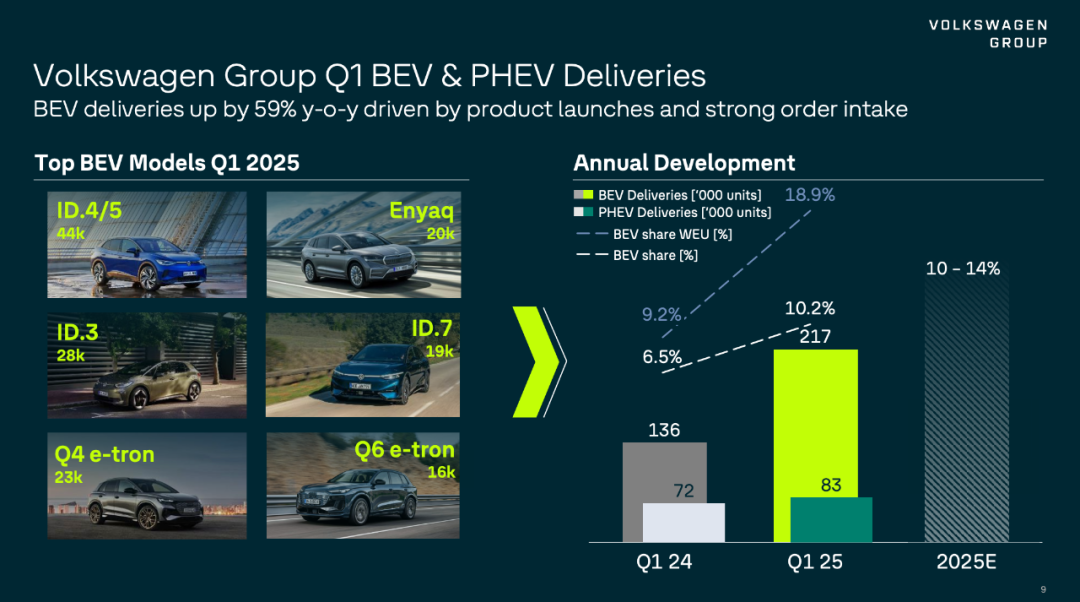

Electric Vehicle Performance: Global electric vehicle deliveries reached 217,000 units (10.2% of total), up 59% year-on-year, with Western Europe accounting for 19%. However, the profit margin of electric vehicles lags significantly behind that of fuel vehicles, weighing down the Group's overall profitability.

The proportion of electric vehicle sales has surged, nearly doubling, but their profit margin remains exceedingly low compared to fuel vehicles. This presents a dilemma: investing heavily hurts immediate finances, while underinvestment jeopardizes future prospects.

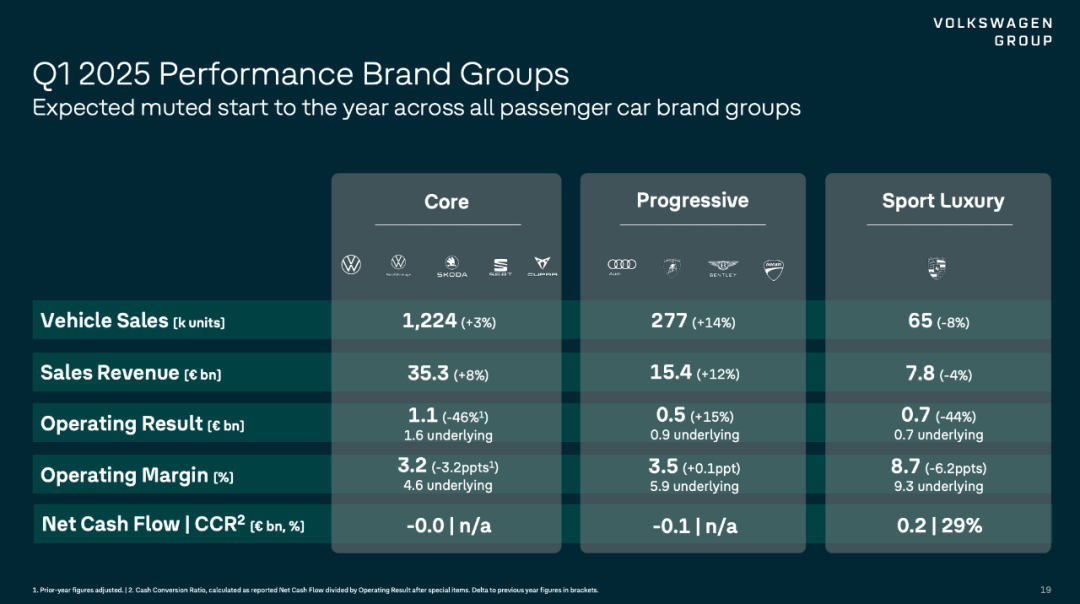

Brand Group Performance: Volkswagen and Porsche brands face pressure, while progressive brands shine. Volkswagen Group classifies its brands into: Brand Group Core (mass market, including Volkswagen), Progressive (luxury, excluding Porsche), and Sport Luxury (Porsche). Brand Group Core reported sales of 1.224 million units (+3% year-on-year), generating 35.3 billion euros in revenue (+8%) but contributing only 1.1 billion euros in profit (-46%). Volkswagen Passenger Cars saw sales of 726,000 units (+5%) and revenue of 21.2 billion euros (+10%), but operating profit plummeted 85% to 10 million euros, with a margin of just 0.5% (down 3.3 percentage points year-on-year). Škoda and SEAT/CUPRA also exhibited mixed performance. Progressive brands led growth with sales of 277,000 units (+14%) and revenue of 15.4 billion euros (+12%), contributing 500 million euros in profit (+15%). Porsche, under the Sport Luxury segment, reported sales of 65,000 units (-8%) and revenue of 7.8 billion euros (-4%), contributing 700 million euros in profit (-44%).

Despite varying sales figures, the profit contributions of these brand groups are not drastically different. Porsche, once the most profitable, has seen a marked decline, posing a significant concern for Volkswagen Group.

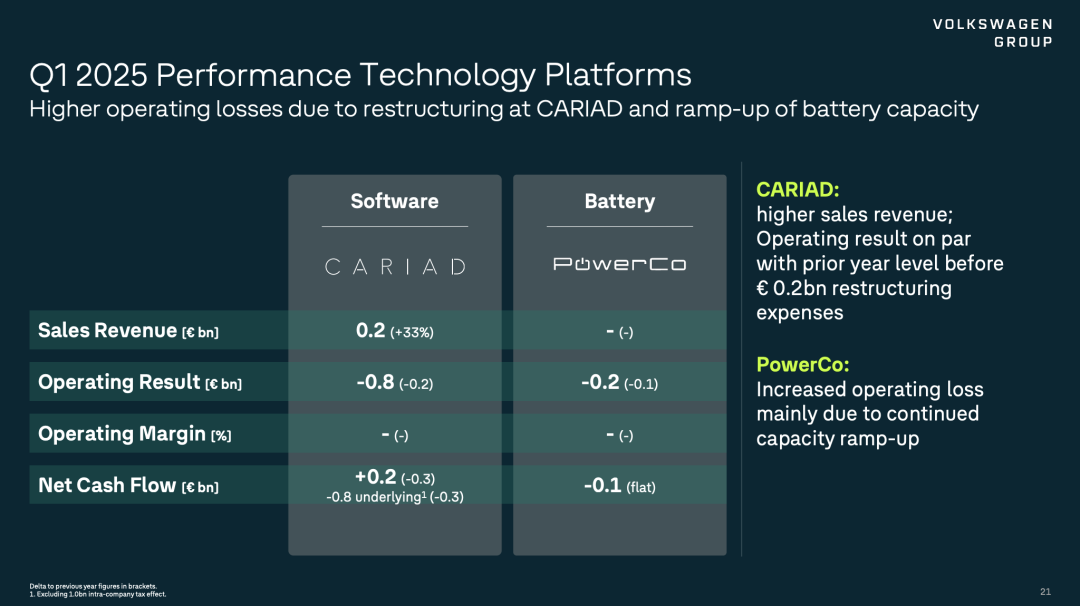

Software & Electrification: Both CARIAD (software division) and PowerCo (battery business) reported revenue growth but continued losses, albeit with a reduction in losses. CARIAD's sales reached 200 million euros (+33% year-on-year), benefiting from increased licensing revenue. Its operating loss stood at -800 million euros, but excluding restructuring costs, the loss was on par with the previous year. PowerCo incurred an operating loss of -200 million euros (+100 million euros year-on-year), mainly due to investments in plant expansion and organizational construction. Strategic advancements include accelerating battery production capacity and transitioning to LFP battery technology to reduce costs (targeting a 40% cost reduction).

Other Highlights: Financial Services generated 15.903 billion euros in revenue and 1.379 billion euros in operating profit (margin of 2.5%), contributing stable cash flow. In conclusion, Volkswagen's Q1 2025 financial report is both a microcosm of the transformation challenges faced by traditional giants and a reflection of the shift from old to new growth drivers. The core contradiction of 'increasing revenues without commensurate profit growth' exposes the industry-wide issue of high electrification costs and shrinking fuel vehicle margins. Despite robust demand in Western Europe and a bright spot in technology, the drag from the Chinese market, Porsche's deceleration, and losses in software/battery businesses cloud the transformation journey. In the short term, Volkswagen must address 'localization in China' and 'cost reduction and efficiency enhancement.' Long-term success hinges on rebuilding brand and product technology barriers in the high-end electric vehicle market (e.g., Porsche and Audi). If the 30 new models planned for 2026 accurately meet market demand, this bold transformational gamble could prove pivotal in Volkswagen's quest to reclaim its throne.

Reference articles and images

Volkswagen Group Q1 2025 Financial Report PPT