Unveiling the Automotive Industry's Financial Reality: Who's Swimming Naked in the Debt Ratio Deluge?

![]() 05/12 2025

05/12 2025

![]() 536

536

TEAM

Typesetting: Chen Yujie

Images: Sourced from the internet, please delete if infringement occurs

Produced by Qiancheng Digital Intelligence (Effective Marketing Intelligence Agency)

The current global automotive industry is engaged in a novel iteration of the "hare and tortoise race".

While traditional foreign giants grapple with the heavy baggage of history, Chinese automakers are cornering the market with a lighter asset-liability structure and a more agile innovation mechanism.

Amidst the electrification transformation at the industry's crossroads, the financial reports of various automakers paint vastly different pictures of their development. In this endurance race, size ceases to be a decisive factor, and financial health emerges as a new competitive frontier.

Analyzing financial report data reveals that profits of traditional foreign automakers have plummeted, and debt ratios have soared, whereas Chinese automakers have witnessed profit growth and debt ratio decline, maintaining relative stability within the industry.

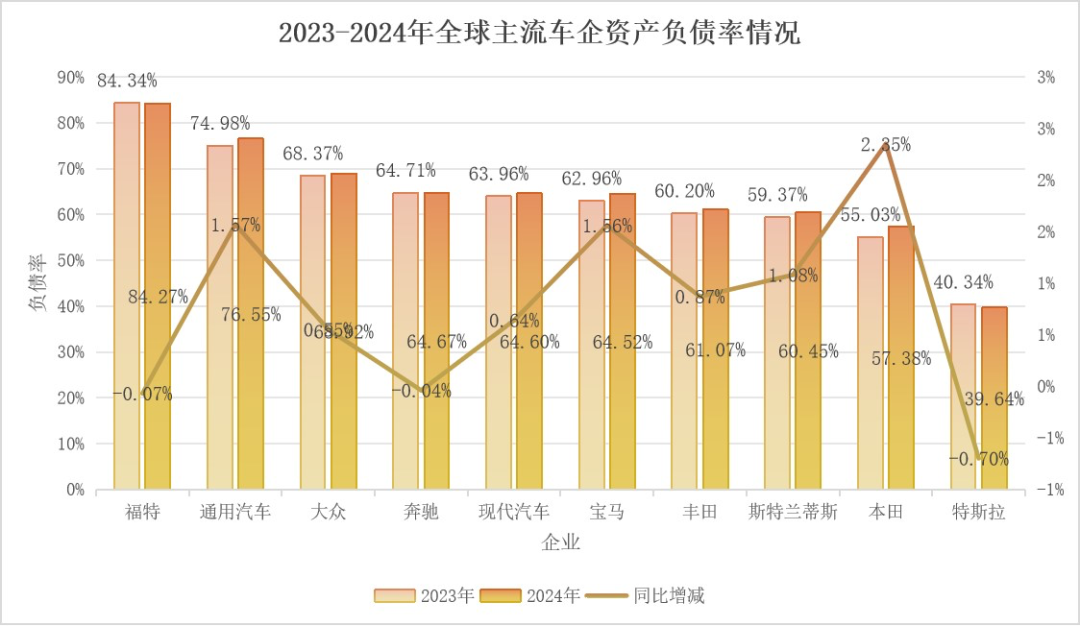

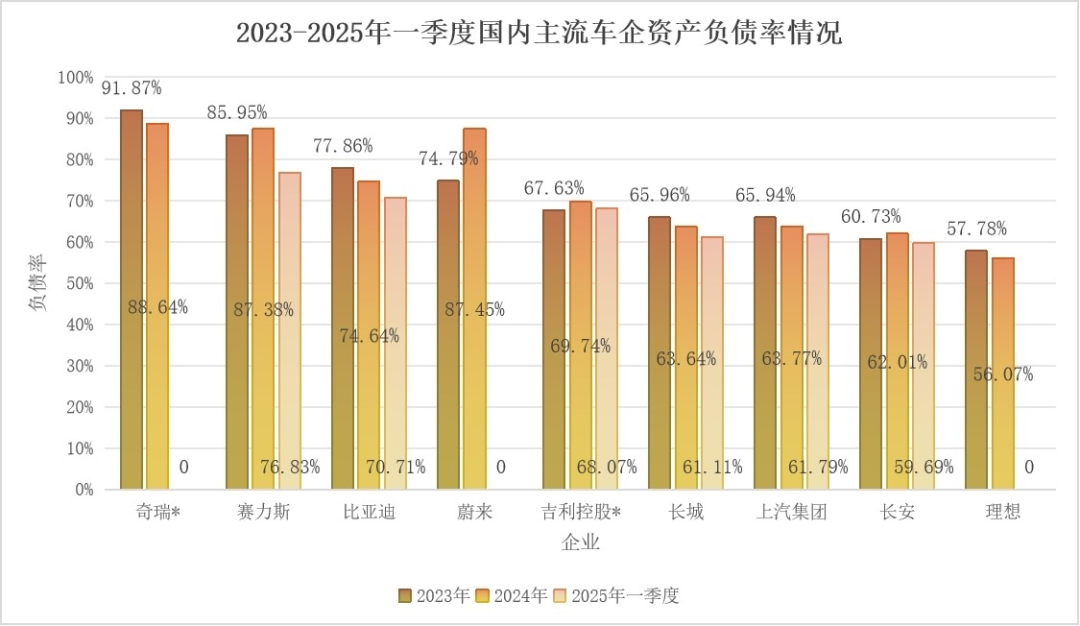

A high debt ratio is a common denominator among global automakers. In 2024, Ford's debt ratio stood at 84.27%, General Motors at 76.55%, and the Volkswagen Group at 68.92%. Mainstream domestic automakers also fall within this range, with Chery at 88.64% (as of the end of the third quarter), NIO at 87.45%, Thalys at 87.38%, BYD at 74.64%, and Geely, SAIC, Great Wall, and Changan all exceeding 60%.

For the automotive industry, such debt ratios generally fall within a reasonable and healthy range. Moreover, a high debt ratio doesn't necessarily signal danger. "We can't conclude a restaurant is bankrupt merely because it has loans. We need to consider its overall business performance," noted an industry financial analyst.

The automotive manufacturing industry is inherently capital-intensive, akin to running a restaurant that demands substantial investment in decoration and menu R&D. Similarly, the development of the automotive industry necessitates massive investments and R&D expenditures.

So, how do we determine the ultimate winner? Financial experts liken evaluating automakers' debt to assessing a restaurant's operations. It's not merely about the size and amount of debt but also the interest rate, whether earnings suffice to repay it, and the turnover speed.

Total debt is broadly categorized into two types: interest-bearing debt, often sourced from financial institutions or capital markets, entailing significant interest payments; and interest-free debt, comprising unpaid supplier invoices, pending employee salaries, unmatured taxes and fees, and contract liabilities (e.g., customer advances for vehicle purchases, converting to revenue upon product delivery) without interest costs.

Interest-bearing debt better reflects a company's true debt burden. An excessive proportion could indicate a liquidity crisis.

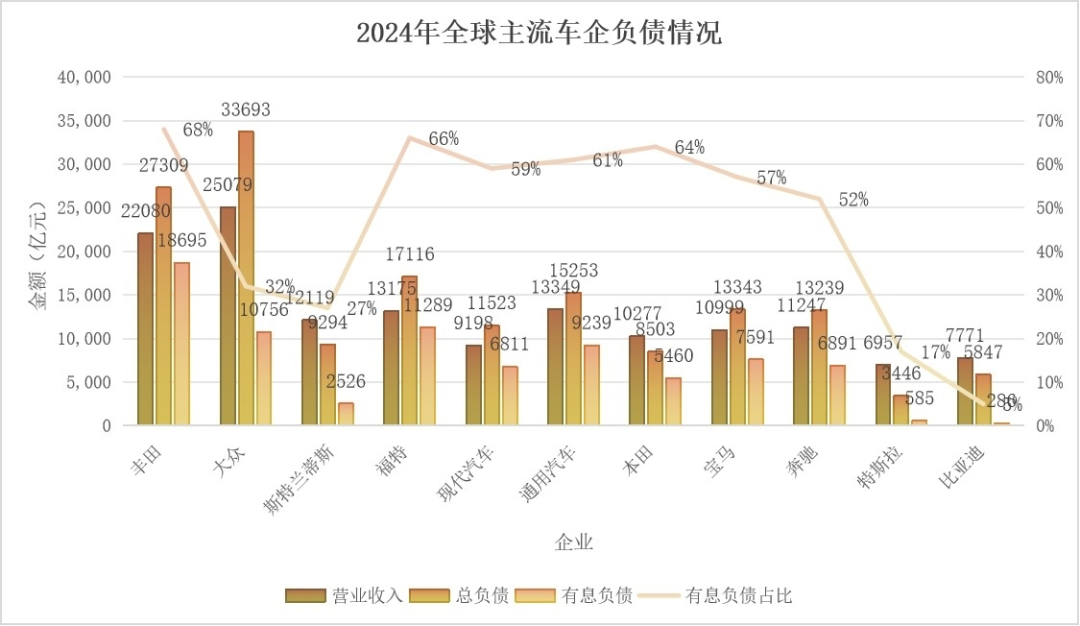

Data indicates that global leading automakers rely heavily on interest-bearing debt. Toyota's interest-bearing debt approximates RMB 1.87 trillion, accounting for 68% of total debt; the Volkswagen Group's is around RMB 1 trillion, accounting for 32%; Ford's is about RMB 1.1 trillion, accounting for 66%. General Motors, Mercedes-Benz, BMW, Stellantis, Honda, and Hyundai Motor's interest-bearing debts also amount to tens of billions of yuan.

Mainstream domestic automakers exhibit relatively lower interest-bearing debt. Geely Holding's interest-bearing debt stands at RMB 86 billion, accounting for 17% of total debt; Chery's is RMB 21.1 billion, accounting for 12% (as of the end of the third quarter); Great Wall Motor's is RMB 16.8 billion, accounting for 12%. Notably, BYD's interest-bearing debt is approximately RMB 28.6 billion, accounting for merely 5% of total debt.

One might ask, "Do they possess the repayment capacity?" Taking Toyota as an example, its RMB 1.87 trillion interest-bearing debt consumes RMB 20 billion in profits annually just in interest payments. For these global automakers, total debt often surpasses total revenue. As of 2024's end, the Volkswagen Group's revenue was RMB 2.5 trillion, with total debt reaching RMB 3.4 trillion, 136% of revenue for the same period; Toyota's revenue was RMB 2.2 trillion, with total debt reaching RMB 2.7 trillion, 123% of revenue; Ford's revenue was RMB 1.3 trillion, with total debt reaching RMB 1.7 trillion, 131% of revenue.

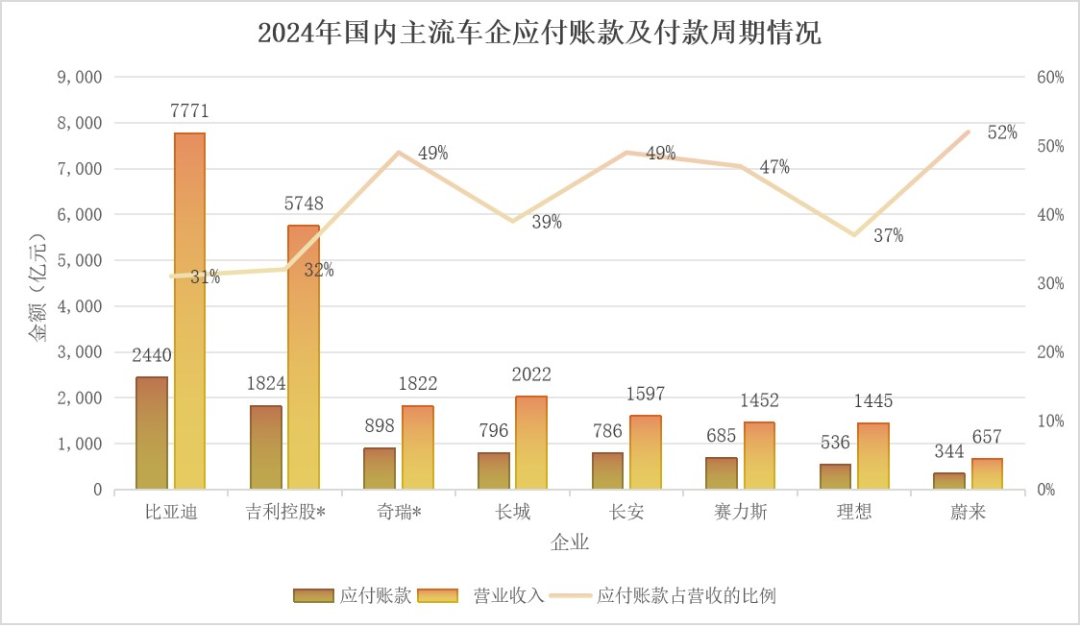

In today's automotive industry, advocating "long-termism," establishing healthy long-term cooperation with supply chain vendors is crucial in this "long-distance race." A key indicator is accounts receivable, representing unpaid supplier invoices.

Extended turnover days for accounts receivable indicate slow turnover, prompting suppliers to pursue debt collection. According to Wind data, as of 2024's end, BYD's average payment cycle to upstream suppliers was 127 days, Chery's was 143 days (as of the third quarter), Great Wall Motor's was 163 days, NIO's was 195 days, and Changan's exceeded 200 days.

Thus, a high debt ratio doesn't inherently imply high risk. Automakers should be vigilant about the "hidden killers" lurking in financial statements.

First, excessive interest-bearing debt, akin to living on credit cards, accumulates interest upon default, consuming cash flow through dangerous maturity mismatches.

Second, the financial repercussions of a "technological gamble." For instance, when an automaker bets 15% of its annual revenue on an unproven technology, its R&D expenditures exceed three times its net profit. This all-in approach, regardless of cost, resembles gambling at the table. A misjudgment in technology can directly collapse the financial system.

Third, insufficient operating cash flow. An automaker's financial report might show profit, but continuous negative operating cash flow signifies inadequate risk-bearing capacity.

A truly healthy financial structure mirrors the human body's blood circulation: R&D investment as hematopoietic stem cells, operating cash flow as arterial blood, and moderate debt merely assisting in venous return. Any obstruction in this system may trigger a fatal "financial heart attack." The most perilous aren't those bravely facing transformation pain but the "sub-healthy" enterprises masking their ailments with financial gimmicks.