“Have Joint Venture Cars, the ‘Tech-Savvy Guys’, Finally Woken Up?

![]() 05/13 2025

05/13 2025

![]() 703

703

Original by New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 2935 words, reading time: 8 minutes

The recently concluded Shanghai Auto Show marked a notable shift. The newcomers, once dominant, now face stiff competition from joint venture brands, who have mounted a strong counteroffensive.

The seeds of this change were sown even before the auto show opened. The Ministry of Industry and Information Technology's (MIIT) new regulations on excessive intelligent driving marketing forced the surging newcomers to "hit the brakes," allowing joint venture brands to reclaim their voice.

When discussing joint venture brands, people might immediately think of "unbranded electric cars" lacking in intelligence. However, their maturity, technical accumulation, and quality reliability in the fuel vehicle era remain unmatched.

Hence, it's no surprise that joint venture cars gained significant foot traffic at the 2025 Shanghai Auto Show, as the new energy vehicle technology competition shifted back to the track of "safety" and "compliance."

1. Joint Venture Cars Aim to Break Through the Auto Market "Barrier"

In recent years, newcomers have relied on the "software-defined car" label to capture attention with flashy intelligent driving promotions at auto shows.

However, a week before this year's Shanghai Auto Show, on April 16, MIIT issued the "Notice of the First Department of the Equipment Industry Holding a Meeting to Promote the Product Access and Software Online Upgrade Management of Intelligent and Connected Vehicles." The notice clearly stipulated that automakers must clarify system function boundaries and safety response measures, refraining from exaggerated and false propaganda.

Image/Announcement from the Ministry of Industry and Information Technology

Source/Screenshot from the official website of the Ministry of Industry and Information Technology of the People's Republic of China, New Energy Outlook

This means that the "intelligent driving label" once boasted by newcomers now faces stricter implementation thresholds. Joint venture brands, with their historical accumulation in mechanical quality and safety redundancy, naturally enjoy a competitive edge, paving the way for breakthroughs in the new energy market.

The foot traffic distribution at this year's Shanghai Auto Show indirectly confirms this point.

While newcomers still occupied prime positions, some joint venture car booths witnessed a surge in visitors, reversing the past trend of low attendance.

Image/SAIC Volkswagen booth

Source/Photo by New Energy Outlook

Fang Yue (pseudonym), a post-90s individual, expressed excitement when discussing the joint venture car booths at this year's Shanghai Auto Show. "Initially, I was fully focused on the new force models. Their cool tech sense and avant-garde design fascinated me. But when I passed by the Volkswagen booth, I was immediately drawn to the ID. AURA at the center."

Image/ID.AURA concept car

Source/Photo by New Energy Outlook

Fang Yue admitted that he once thought joint venture cars lacked intelligence, struggling with in-car configurations like mobile phone interconnectivity. However, joint venture cars equipped with intelligent driving assistance functions have given him a new perspective. "I used to think joint venture cars' infotainment systems were like Nokias, but this time, I found they had secretly evolved into smartphones."

As a car enthusiast, Cai Siqi (pseudonym) also felt emotional about joint venture cars after visiting the Shanghai Auto Show.

"I once viewed joint venture cars as relatively traditional and inferior to newcomers in intelligence. But this Shanghai Auto Show really opened my eyes. These joint venture cars are no longer what I imagined. They are not only keeping up with the times in car design but also putting in a lot of effort in intelligence and localization, which is quite impressive."

Unlike the above two consumers, some are loyal fans of joint venture cars and headed straight for their booths upon entering the exhibition hall.

Most admitted that the foot traffic at joint venture car booths this year was significantly higher than in previous years. Many new joint venture models equipped with intelligent cockpits and assisted driving technologies demonstrated their sincerity towards consumers and the transformation in direction of joint venture automakers.

"Joint venture cars have become smarter and are no longer just blindly promoting their mechanical quality. Nowadays, they are learning from newcomers in intelligence. I will most likely still choose a joint venture brand for my next car."

2. From "Passive Defenders" to "Active Attackers"

The awakening of joint venture cars in the Chinese market is not a coincidence but rather a strategic restructuring with deep-rooted logic.

From a broader perspective, in early 2023, a price war initiated by Tesla quickly spread throughout the Chinese auto market. As many independent brands followed suit, joint venture brands realized they could no longer rely on "brand premium" comfort zones.

In July of that year, North and South Volkswagen led the charge in price reductions among joint venture brands, with SAIC-GM and FAW Toyota swiftly joining the "price reduction army."

Image/Some pure electric models under Volkswagen

Source/Internet screenshot from New Energy Outlook

To date, facing the lingering price war, many joint venture brands such as Dongfeng Nissan, GAC Honda, and Beijing Hyundai have played the "fixed price" card, covering their main models.

Image/Some pure electric models under Nissan

Source/Internet screenshot from New Energy Outlook

Industry insiders believe that this competitive strategy essentially relies on low prices to attract more customer orders, but "fixed prices" make prices more transparent and attractive.

Of course, the price war is just the tip of the iceberg. Facing the rapid rise and spread of new energy vehicles, from 2023 to the present, joint venture brands have not given up on increasing their layout in the new energy field.

To date, Volkswagen has multiple pure electric models on sale, including ID.3, ID.4X, ID.6 CROZZ, etc. Toyota has bz3X, bz4X, bZ4X, etc. Nissan has N7, ARIYA, etc.

Image/Some pure electric models under Toyota

Source/Internet screenshot from New Energy Outlook

However, the data tells a different story. From 2020 to 2024, the market share of mainstream joint venture brands has shown a continuous downward trend, plummeting by nearly 24 percentage points to 27.5% in 2024.

Therefore, facing the increasingly fierce competition in the new energy market, joint venture cars, which were slow in electrification, cannot rely on a "one-shot victory."

Realizing this, many joint venture brands began focusing on strong alliances and cooperation with Chinese brands to launch localized products, enhancing their competitiveness.

Taking the joint venture new energy vehicles unveiled at this year's Shanghai Auto Show as an example, FAW-Volkswagen's concept car ID. AURA is a pure electric sedan equipped with an L2-level intelligent driving assistance system. Behind it lies not only China's exclusive CMP platform but also the CEA electronic and electrical architecture integrated with Xiaopeng's technological capabilities.

GAC Toyota's bz7 is a D-class pure electric sedan built on Toyota China's self-developed system and is the first Toyota product equipped with a HarmonyOS cockpit.

GAC Honda's concept car Ye GT emphasizes "developed in China" and "made in China," collaborating with local Chinese enterprises such as CATL, Huawei, and iFLYTEK in battery cells, intelligent cockpits, and voice interaction.

Image/Ye GT

Source/Photo by New Energy Outlook

"I chose the Volkswagen ID.3 not only because Volkswagen has profound historical accumulation and reliable technology but also because it is strict in selecting component suppliers. For example, it chooses CATL for core components like batteries, providing more assurance in safety and endurance stability."

"This year, after attending the Shanghai Auto Show, I saw that joint venture cars have caught up in intelligence. Not only is the infotainment system smooth to operate, but it also has intelligent driving assistance functions." Many consumers who recently purchased joint venture new energy vehicles said so.

3. Does the Future of Joint Venture Cars Still Require Continued Efforts?

It's worth noting that while the Shanghai Auto Show has changed the market and consumers' perceptions of joint venture cars, they cannot afford to relax. After all, compared to independent brands, joint venture cars still lag in the new energy field.

The latest data from the China Passenger Car Association shows that in the first quarter, mainstream joint venture brands' cumulative retail sales were 1.306 million units, a year-on-year decline of 14%. In contrast, independent brands continued to show positive market performance with cumulative retail sales of 3.219 million units, a year-on-year increase of 20.9%.

Specifically for brands, the situation for joint venture cars seems even more challenging.

From January to April, SAIC Volkswagen's cumulative sales were 311,000 units, a year-on-year decline of 8.64%; Honda's cumulative sales in the Chinese market were 281,000 units, down 10.9% from the same period last year; Nissan's cumulative sales in the Chinese market were 222,000 units, basically the same as the same period last year, but this was based on a reduction of about 21,000 units in 2024.

Image/SAIC Volkswagen's April 2025 production and sales bulletin

Source/Internet screenshot from New Energy Outlook

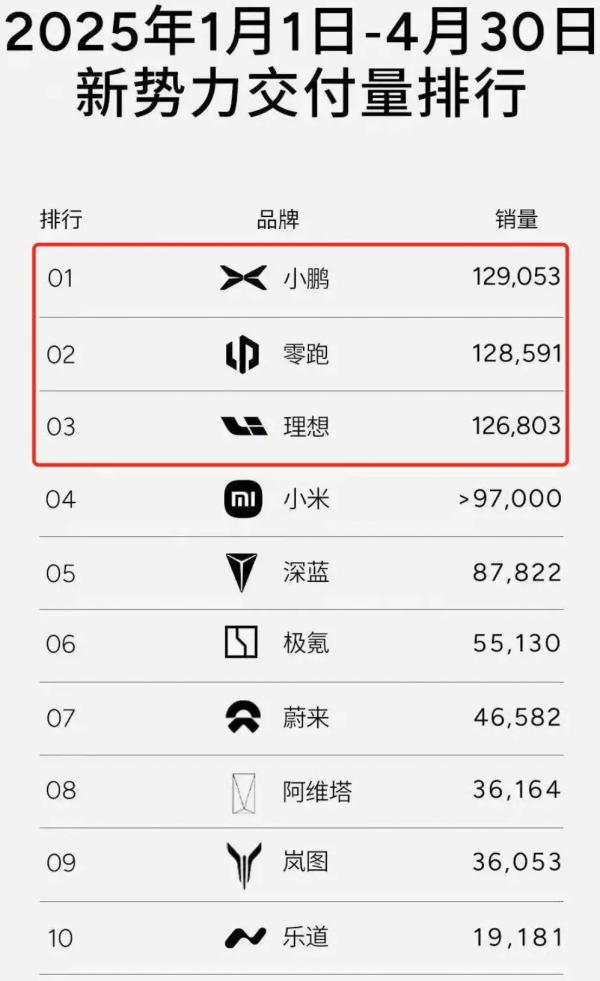

In contrast, from January to April, Li Auto's cumulative sales were 127,000 units, a year-on-year increase of 19.4%; XPeng's cumulative sales were 129,100 units, a year-on-year increase of 313%; NIO's cumulative sales were 128,600 units, a year-on-year increase of 165.7%.

Image/New force delivery rankings from January to April 2025

Source/Internet screenshot from New Energy Outlook

Through interactions with many consumers, it's evident that most young consumers have a "stereotype" of joint venture cars being outdated. This cognitive gap stems not only from conservative brand communication strategies but also from the pace of product iteration.

"Every time I see the front of a joint venture car, I easily associate it with the cars my parents used to drive."

Lin Wei (pseudonym), a post-95s individual, did not hesitate to choose a new force brand when purchasing her first car. She believes that while joint venture cars now have intelligent cockpits, they still lack the technological flair of newcomers. "I always feel that the design and technological configuration of joint venture brands are a bit out of sync. The new forces' promotions understand our young people's preferences better."

Chen Ziang (pseudonym), also a member of Generation Z, said, "The exterior design of joint venture cars always gives the impression that it hasn't changed in years. Every time I take a taxi that's a joint venture car, it feels like I've gone back to the Nokia era."

However, there are exceptions. Some young consumers frankly said they would consider joint venture cars when buying a car due to factors such as long-term vehicle usage costs and reliability.

For joint venture cars, this cognitive battle is long and arduous. To truly usher in a rebirth, they must continue focusing on the current "localization + intelligence" approach, targeting young users, and creating personalized and differentiated models. Only then can they truly shed the label of being "half a step behind."