Wang Chuanfu's Emotional Outburst: A Genuine Reflection of BYD's Challenges

![]() 06/18 2025

06/18 2025

![]() 500

500

By Li Yue

Produced by Five-Star Car Reviews

On the auspicious date of June 6, symbolizing "smooth sailing," Chairman Wang Chuanfu of BYD displayed genuine emotion at the company's 2024 annual shareholders' meeting: "BYD is my sole company, with a straightforward shareholder structure free from corporate entanglements. All our businesses are contained within BYD, and we have dedicated ourselves wholeheartedly to its growth."

Addressing the recent market turmoil caused by internal competition, Wang Chuanfu expressed a steadfast commitment to avoiding confrontations: "No matter how much injustice we endure, we will not retaliate by dragging others down but instead focus solely on delivering our best."

Some industry insiders have suggested that Wang Chuanfu's display was mere "crocodile tears," a pretense of victimhood while aggressively expanding territory through price cuts. However, is this assessment accurate?

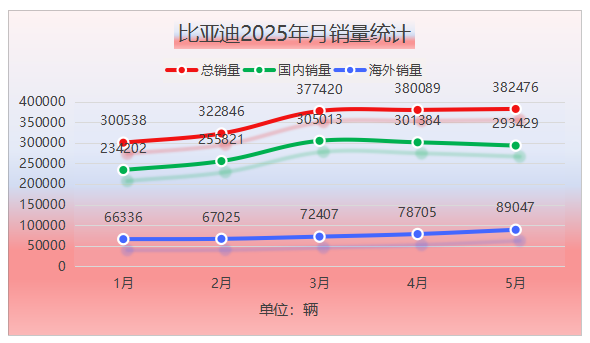

In recent years, BYD has surged ahead in the domestic new energy vehicle market. However, from January to May 2025, the company experienced a high start followed by sluggish growth. In January, total sales reached 300,500 units, with domestic sales of 234,200 units. In February, total sales increased to 322,800 units, with domestic sales of 255,800 units. By March, total sales climbed to 377,400 units, with domestic sales of 305,000 units, firmly establishing BYD among the top brands in the domestic market.

Models from the Dynasty and Ocean series have significantly contributed to BYD's rapid expansion. The Qin, Song, and Seagull series have garnered consumer favor due to their respective strengths, resulting in impressive sales performances.

However, the situation changed in April. While total sales marginally increased to 380,000 units, domestic sales dipped from 305,000 units in March to 301,300 units. In May, total sales stood at 382,400 units, with domestic sales further declining to 293,400 units.

Previously, BYD relied on a price war strategy to swiftly capture market share in the domestic market. In the 100,000-200,000 yuan price range, the company leveraged technological advantages and cost control to offer "same price for oil and electric vehicles," significantly impacting traditional fuel vehicles. However, in 2025, industry trends shifted, with increasing calls for "anti-internal competition." The China Association of Automobile Manufacturers issued an initiative, and regulatory scrutiny tightened, rendering the price war strategy unsustainable.

Concurrently, competition in the domestic new energy vehicle market intensified, with other manufacturers vigorously counterattacking BYD. Geely Automobile stands out as a typical representative. In January 2025, Geely's Xingyue L topped the national monthly car sales chart with 29,434 units sold. The cost-effective and stylish Xingyuan model followed closely with 28,146 units sold. In May, Geely Xingyuan outsold BYD's competitive models with 38,715 units sold.

The booming sales of multiple models have successfully displaced several long-dominant BYD models from the sales charts. Besides Geely, other automakers are also putting forth efforts, continuously launching new models and technologies to seize market share. BYD's competitive pressure in the domestic market is mounting daily.

In terms of technological research and development, although BYD has consistently invested in technologies such as the "Divine Eye" assisted driving system, it appears to lack a clear advantage in the field of intelligent driving, making it challenging for the company to distinguish itself in the market through intelligence.

Practically speaking, BYD still lags behind leading new-force brands in key indicators of intelligent driving technology, such as autonomous driving safety and intelligent interaction smoothness, which also affects the competitiveness of its products in the market.

With limited domestic market growth, Wang Chuanfu has pinned high hopes on the overseas market. "Overseas market prices are relatively stable, which is very beneficial to the company's profitability," Wang Chuanfu said. Currently, the company's sales in multiple overseas markets are improving monthly, and he believes that overseas sales will continue to rise in the future.

He emphasized that expanding overseas and pursuing high-end products are crucial strategies for the company. From January to May 2025, BYD exported 374,200 vehicles overseas, marking a year-on-year increase of 112%. In May, exports reached a record high of 89,000 units. The establishment of the European headquarters in Hungary and the simultaneous launch of the Seagull model in 15 countries seem to indicate a favorable situation. However, an in-depth analysis reveals significant uncertainties in overseas market expansion.

In most regions of the world, fuel vehicles still dominate, and the scale of the new energy vehicle market is limited. Despite rapid growth in recent years, traditional fuel vehicles firmly occupy the mainstream market in many countries and regions due to mature infrastructure, long-standing consumer habits, and relatively low prices. When promoting new energy vehicles overseas, BYD faces challenges such as limited consumer awareness and acceptance, and inadequate charging infrastructure.

Furthermore, overseas markets may present "acclimatization" challenges. For instance, the European market has stringent environmental and safety standards for automobiles, setting a high bar for BYD's entry.

Cultural and consumption habit differences also pose challenges to BYD's overseas expansion. This means that BYD cannot simply replicate its successful domestic model but must tailor strategies for different markets, refining aspects from product design, supply chain layout, to marketing channels.

This endeavor requires substantial capital investment and time to accumulate experience. During this process, the market is unpredictable, and it remains questionable whether BYD can successfully break the deadlock.

BYD has always aspired to become an automaker akin to Toyota. At this shareholders' meeting, Wang Chuanfu clearly articulated the vision of "becoming the next Toyota." He emphasized that becoming Toyota is BYD's goal, spreading Chinese products, technologies, and concepts worldwide. The target is 10 million vehicles, and the time to achieve it is not far off.

However, various data indicate a significant gap between BYD and Toyota. In terms of sales volume, Toyota's global sales in 2024 were 10.82 million units, while BYD's were 4.27 million units, less than half of Toyota's sales.

The profitability gap is even wider. Toyota's net profit in 2024 reached 230 billion yuan, while BYD's net profit was 40.2 billion yuan. Toyota's net profit is nearly six times that of BYD. Toyota maintains high profits through years of large-scale production, mature supply chain management, and premium brand models like Lexus. In contrast, BYD relies on the quick turnover of new energy vehicle models with small profits and a higher proportion of R&D investment, putting it at a disadvantage compared to Toyota in terms of profitability.

There are also notable differences in technological approach and market strategy between the two companies. Toyota focuses on safety features, introducing the T-Pilot intelligent driving system to entry-level models like the Levin, while avoiding over-promotion of "autonomous driving" and emphasizing reliability. BYD leverages scale to reduce costs, bringing high-level intelligent driving features to the 70,000 yuan Seagull model, emphasizing "intelligent driving for all." In terms of power technology, Toyota prioritizes hybrid electric vehicles (HEV) and plans to launch a new generation of plug-in hybrid technology in 2027. BYD, on the other hand, has risen to prominence with its dual approach of plug-in hybrids (DM-i) and pure electric vehicles.

In terms of globalization maturity, Toyota boasts a well-established global supply chain and localized production system, with high brand recognition and channel advantages in markets such as North America and Southeast Asia. Although sales in the Chinese market declined to 1.776 million units in 2024, its global market share remained stable. BYD's overseas market growth is rapid, with overseas sales of 414,700 units in 2024, marking a year-on-year increase of about 71%. However, the base is still low, and overseas factories in Thailand and Uzbekistan have just commenced production, with brand influence and service systems still needing to be built up.

Wang Chuanfu's emotional outburst reflects the immense pressure BYD is currently under. The domestic market growth bottleneck, strong counterattacks from other automakers, uncertainties in overseas markets, and significant gaps with traditional giants like Toyota are all pressing issues that need urgent resolution. In technological research and development, while BYD has consistently invested and attempted to overcome challenges through innovation, such as megawatt flash charging technology and the "Divine Eye" intelligent driving system, it still lags behind some competitors in the field of intelligent driving, and its technological advantages have yet to be effectively translated into sales growth.

BYD has adjusted its domestic market strategy, optimized its overseas market layout, and explored a second growth curve, but the effects are yet to be fully evident. Various signs indicate that BYD's future development is fraught with challenges, and if it cannot effectively address the current issues, maintaining its past glory may prove difficult.