BYD, Geely, Great Wall, NIO, etc.: Is a 60-Day Payment Term a Make-or-Break Challenge?

![]() 06/19 2025

06/19 2025

![]() 608

608

Focusing on the next potential Evergrande-like crisis in the automotive industry, Haitun Jun offers a comprehensive analysis of supply chain payment issues in the sector through its article, "BYD: Will It Become the Next Evergrande?" (Already available on the Changqiao App; access it by adding the WeChat assistant "dolphinR124"). The article highlights:

Companies like BYD, whether engaging in supply chain financing or vertically integrated heavy asset operations, must maintain high sales volumes. Should fierce competition lead to stagnant sales, strong supply chain finance may collapse, severely impacting auto companies' financial statements and triggering systemic risks of capital disruption in upstream supply chains.

However, shortly after Haitun Jun's analysis, the situation abruptly changed following a meeting of auto companies: Starting from the evening of June 10th, within just one day, over 15 auto companies announced they would shorten their supply chain payment terms to 60 days, aligning with the global industry average (45-60 days). By now, nearly all auto companies have stated their intention to shorten payment terms to 60 days.

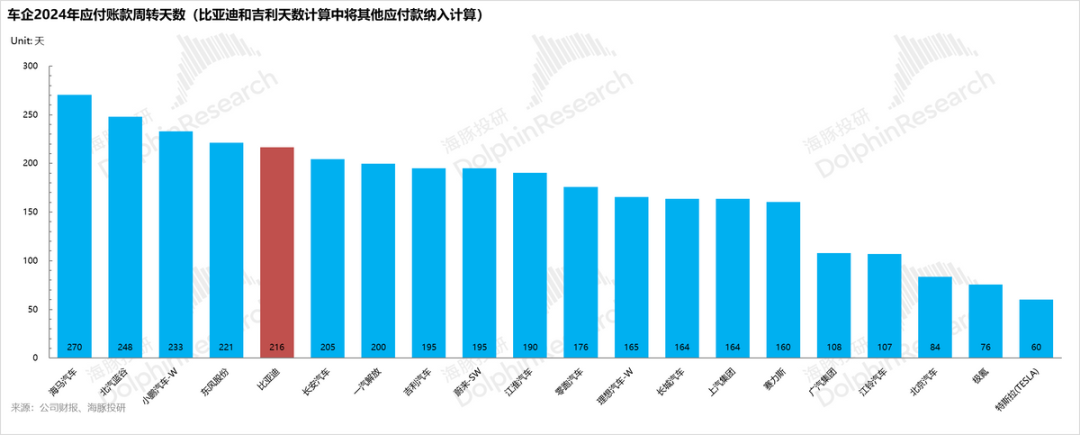

Yet, among the list of automotive companies we compiled, only Tesla will meet the 60-day payment term standard by 2024. The average accounts payable cycle for Chinese auto companies is as long as 5-6 months (BYD is nearly 7 months, while Haima/BAIC BJEV reach 8-9 months).

If the 60-day payment cycle is strictly enforced immediately, auto companies' cash flow will sharply deteriorate. Those with the longest turnover days and insufficient cash reserves will directly face a crisis.

The question arises: How significant is the impact of strictly enforcing the 60-day payment term on each company? Which auto companies are essentially running naked? What are the potential impacts of response plans on capital market investments?

Let's dive right in:

I. Impact of the 60-Day Payment Term and Companies' Response

Using conservative assumptions:

- The company adheres strictly to the 60-day payment term.

- Not only future but also past accounts payable cycles are adjusted to 60 days.

- The 60-day accounts payable cycle applies to all suppliers.

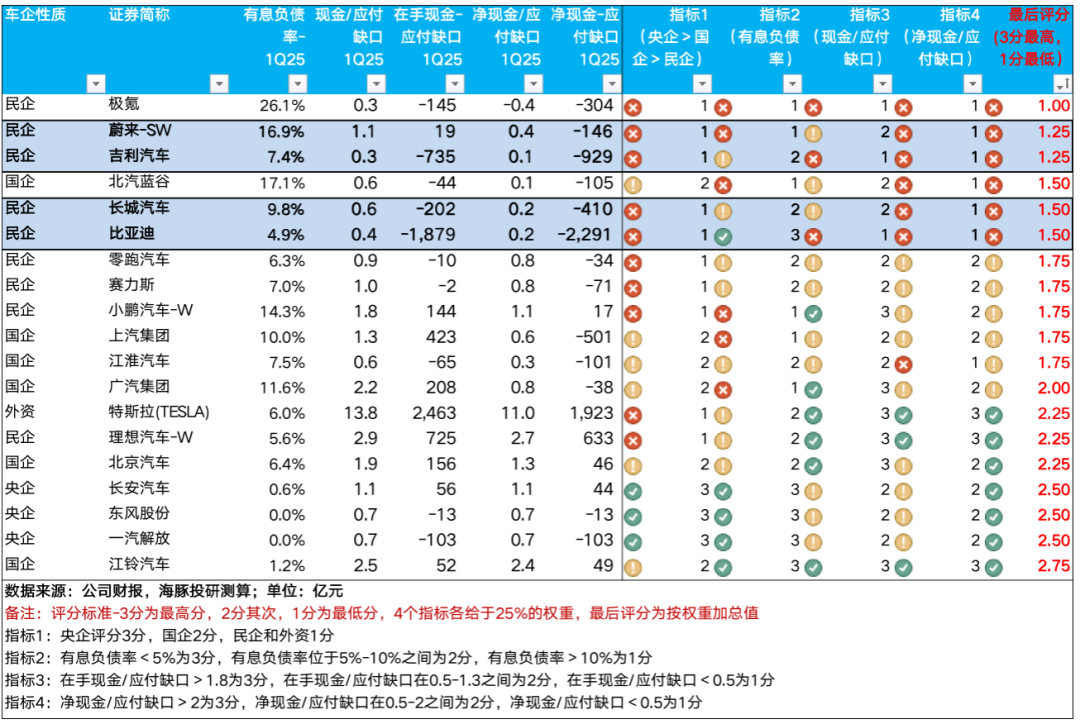

Haitun Jun altered each company's accounts payable turnover days for the first quarter of 2024 and 2025 to a uniform 60 days and calculated:

- The amount of accounts payable each company can occupy under 60-day turnover.

- The difference between the accounts payable amount under the 60-day cycle and the actual amount on the company's financial statements, termed the "accounts payable gap".

- Theoretically, this gap should be covered by the company's cash on hand. Only when cash on hand exceeds this gap is it considered safe.

Haitun Jun recognizes that auto companies' ability to occupy a longer payment term stems from their bargaining power as integrators. Although a 60-day payment term is promised, operational spaces exist, which Haitun Jun does not consider here.

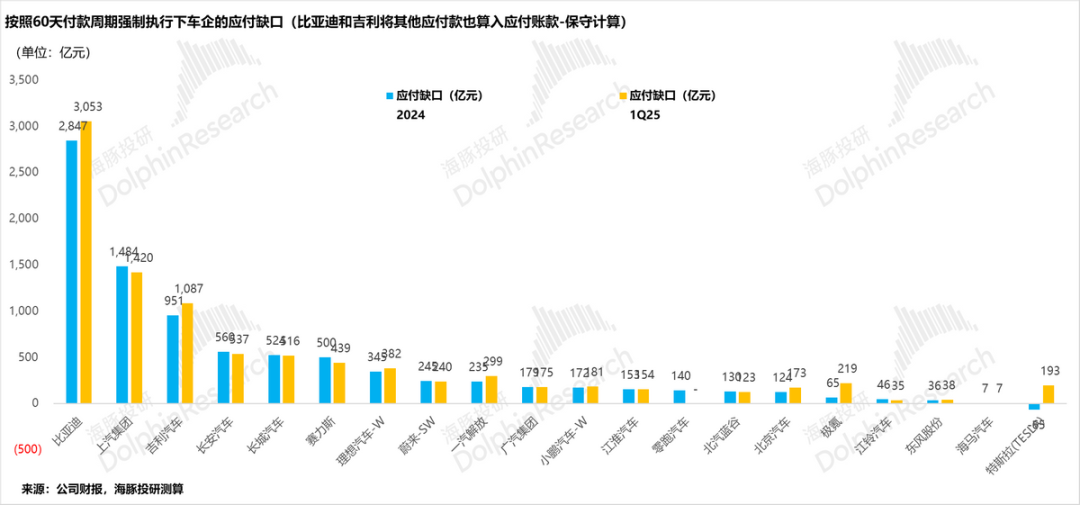

Current accounts payable gaps for auto companies are:

- BYD: Nearly RMB 300 billion, requiring a one-time payment of RMB 300 billion to suppliers.

- SAIC (RMB 142 billion) and Geely (RMB 108.7 billion) follow closely.

- Other auto companies also need to bridge gaps, as shown below:

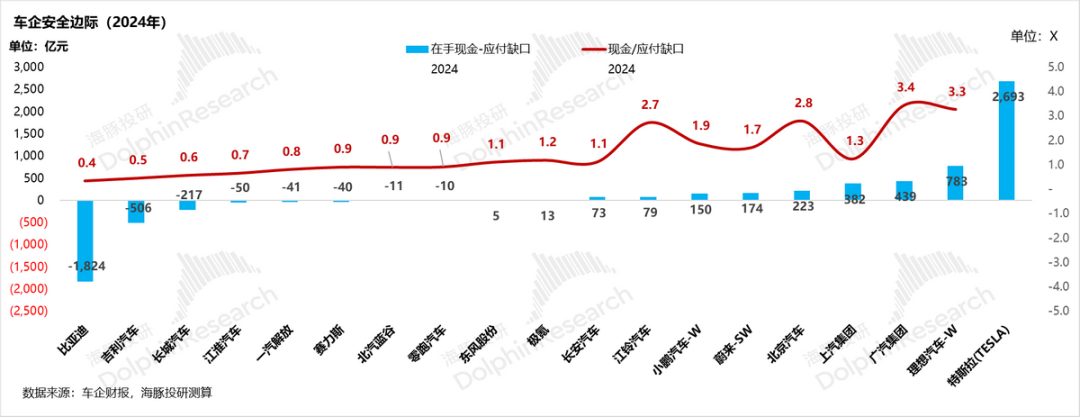

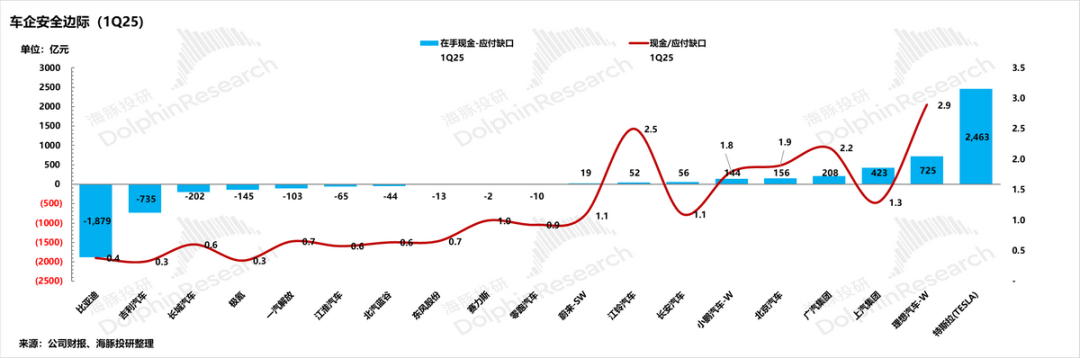

II. Sufficiency of Auto Companies' Cash Flow and Safety Margins

Let's look at the data:

- Highest Safety Margin: Tesla (short payment term + high cash on hand) and Li Auto (ample operating cash flow). Their cash can fully cover the gap with some left for daily operations.

- Relatively High Safety: Guangzhou Automobile Group and Beijing Automotive Group, both state-owned enterprises, with cash 2-3 times their accounts payable gap.

- Red Line Warning: ZeroRun, NIO, Jiangling, Changan, and Thalys. Their cash can cover the gap but leaves little for daily operations.

- At Risk: BYD, Geely, Great Wall, FAW, JAC, BAIC BJEV, and Dongfeng. They lack cash to repay and need external financing.

Under the most extreme scenario, only Tesla, Li Auto, Guangzhou Automobile Group, and Beijing Automotive Group can avoid negative impacts. Other companies will face cash flow crises and need external financing.

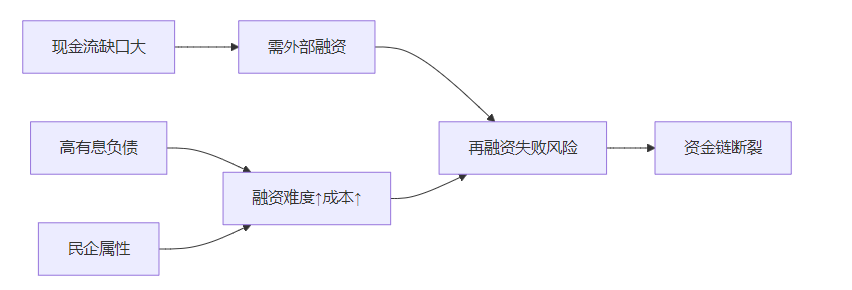

If the strict situation continues, it can be predicted that:

- High cash flow gaps and low safety margins.

- High proportion of interest-bearing liabilities, making refinancing difficult and increasing costs.

- Private enterprises face more borrowing difficulties than state-owned enterprises.

Auto companies falling into these categories may face the greatest refinancing risk. Haitun Jun scores based on four indicators (each weighted 25%; final score sorted from low to high). The highest-risk companies are: NIO, Geely Automobile, Great Wall Motor, and BYD.

Although BAIC BJEV scores low, as a state-owned enterprise, its short-term risks are controllable.

III. Why Are Auto Companies Shortening Payment Terms?

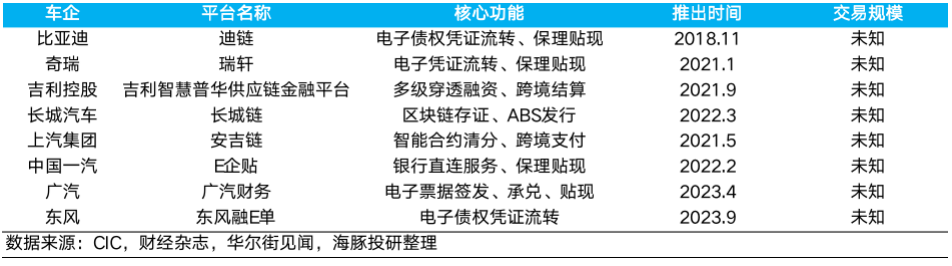

China's automotive industry's average six-month accounts payable cycle implies high upstream supply chain fund occupation. With the intelligence inflection point not reached and electrification innovation nearing its end, barriers are low, and competition is high. "Price wars" are effective, especially in the rigid demand price band.

However, under price wars, auto companies not only suffer from impaired profit margins but also transfer cash flow pressure to upstream supply chain manufacturers. Especially, small and medium parts manufacturers are at a weak position and must accept "annual price reductions + extended payment terms".

Most auto companies exhibit "one loss and two highs": continuous losses, high operating liabilities, and sometimes high interest-bearing liabilities.

If price wars continue, auto companies meeting these criteria will face "capacity clearing," triggering upstream supply chain bad debts. Chinese auto companies' price wars have evolved into a comprehensive war involving upstream and downstream industry chains.

The official attitude has shifted from appeals to verbal guidance, emphasizing controlling price wars to prevent systemic risks, thereby protecting upstream supply chains. Otherwise, head auto companies may implode, triggering industry chain collapse. Especially the high-risk companies listed by Haitun Jun.

If the policy strictly limits upstream accounts payable turnover days, it will naturally restrict:

- Disorderly capacity expansion leveraging supply chain leverage.

- Industry price wars by increasing cash gaps for companies with long payment terms, consuming their cash flow and reducing funds for price reductions.

Haitun Jun expects the regulation to lean towards a "soft landing," likely starting with industry self-discipline and gradually incorporating financial supervision. It will not clear past payment terms but control newly added ones. Otherwise, only Tesla, Li Auto, and state-owned enterprises can safely survive.

Other auto companies facing a "hard landing" scenario will trigger a new wave of financing, likely replacing upstream supply chain interest-free liabilities with bank "interest-bearing loans" or equity financing.

However, the risk transfers from upstream supply chains to banks or investors, potentially leading to accelerated mergers and acquisitions, contradicting the policy's original intention.

In summary, the policy aims to force competition back to "product quality" by cutting off the cycle of "auto companies relying on payment term financing to engage in disorderly capacity expansion and price wars".

IV. Will Auto Companies' Investment Logic Change?

From a short-term investment perspective, Haitun Jun anticipates that the policy will not adopt a "hard landing" approach this time around, allowing automakers some leeway for transition and adjustment. However, Haitun Jun maintains that the fundamental aim of the policy—preventing systemic risks within the automotive supply chain—remains unchanged. Consequently, there is a strong likelihood of stringent requirements to manage supply chain payment terms, albeit with a grace period for automakers, ensuring that they are not immediately compelled to clear past debts.

In the industry that Haitun Jun observes, given China's current ample capacity, such supply-side policies aimed at curbing price wars are not uncommon.

For industry players with relatively inelastic demand in the terminal market, supply-side restrictions temporarily slow down price wars, and price recovery does not adversely affect terminal demand. This leads to a valuation recovery for most industry participants. However, in the long run, for companies that initially pursued a strategy of increasing market share, their long-term growth potential or valuation upside is suppressed.

Nevertheless, automobiles are not inelastic demand products; they are quintessential discretionary high-ticket consumer electronics. Furthermore, automakers possess a strong heavy asset attribute and a substantial demand for cash flow. Therefore, in the short term, the situation is not universally favorable:

1. In terms of short-term investment logic (which may be somewhat bearish for automakers with lengthy payment terms but bullish for upstream suppliers):

① BYD's investment thesis may encounter a jolt: In "BYD: Will It Become the Next Evergrande?" (Haitun Jun has emphasized that BYD heavily relies on supply chain financing and boasts the highest degree of vertical integration, necessitating robust sales growth. However, in 2025, the impact of the new product cycle initiated by the "Intelligent Driving Equality" strategy was modest:

- Rigid demand users do not have a high demand for high-speed NOA;

- Geely directly competes with BYD's popular models;

- XPeng's Mona successfully created a buzz through exceptional product definition (user-centric thinking) + upgraded marketing strategies + introducing high-level urban NOA to the 10-150,000 yuan price range;

- ZeroRun's B series also posed a challenge to BYD.

Behind these competitions, to a certain extent, issues stemming from BYD's engineering-centric rather than user-centric thinking and marketing shortcomings have come to light.

Initially, Dolphin Insights believed that BYD had no immediate concerns based on the logic that even if users had insufficient demand for high-speed NOA, cost-effectiveness in the inelastic demand price range remained a "powerful weapon" (despite the cost-effectiveness moat being constantly eroded). BYD's advantages of high gross profit margin + robust overseas growth (with higher gross profit margins for overseas models, which can feed back into the domestic market) could provide ample cash flow and gross profit safety cushions to sustain price wars, while the likelihood of peers continuing to follow suit was relatively limited (e.g., Geely).

Dolphin Insights anticipates that although this regulation will provide automakers with a transition buffer period, supervision over supplier payment terms will gradually intensify, and the industry's ability to initiate large-scale price wars will certainly face increased scrutiny (especially for automakers that heavily leverage the supply chain to wage price wars). This implies that amid currently weak demand, BYD may find it challenging to continue launching large-scale "price wars" as a potent weapon, and the pressure to continually boost sales is significant. This year, BYD can only rely on overseas growth (but even if the anticipated 900,000 vehicles are sold, their contribution to the overall sales target of 5.5 million is still relatively limited).

Under the extreme assumption of the policy being rigidly enforced, BYD, Geely, Great Wall Motors, and NIO will all confront refinancing pressures, with NIO being even more vulnerable due to its lack of self-sustaining capabilities.

② However, for upstream suppliers, they may swiftly receive payments, which is a short-term positive for them:

Upstream suppliers' payment cycles will be shortened (they will not need to discount the ultra-long bills provided by automakers by paying interest themselves), they will receive cash payments in advance, discount costs will decrease, and cash flow and profit statements will further improve.

③ Lixiang Auto and Tesla are the least affected by the policy, regardless of whether it is a hard or soft landing, and currently appear to be the safest bets.

2. In the long-term logic, the core of industry competition will shift from "payment term financing capabilities" to automakers' intrinsic capabilities:

From a long-term standpoint, policies are also compelling automakers to transition from "highly reliant on operational leverage to drive growth" to "driving competition through self-sustaining capabilities". Competition among automakers will also evolve from relying on operational leverage to initiate disorderly price wars and capacity expansions to higher-compliance automakers relying on their own self-sustaining capabilities to launch orderly and controllable price wars.

Moreover, automakers' competition will increasingly focus on internally capable players (relying on their own profitability):

- Product definition capabilities (gradually shifting from engineering-centric to user-centric thinking);

- Lean management efficiency (single-vehicle cost control, cost control capabilities);

- Technological moat (the inflection point for intelligent driving is not far off).

#BYD #NewEnergyVehicles #GeelyAuto #NewEnergy

- END -

// Repost Authorization This article is an original work of Dolphin Insights. Please obtain authorization for reprinting.

// Disclaimer and General Disclosure This report is for general comprehensive data use only, intended for general browsing and data reference by users of Dolphin Insights and its affiliates, and does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information mentioned in this report bears the risk themselves. Dolphin Insights shall not be liable for any direct or indirect liability or loss that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Insights strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report may not be construed or deemed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or promotions for relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for or to be distributed to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would contravene applicable laws or regulations or cause Dolphin Insights and/or its subsidiaries or affiliated companies to comply with any registration or licensing requirements in such jurisdictions.

This report only reflects the personal views, opinions, and analytical methods of the relevant authors and does not represent the position of Dolphin Insights and/or its affiliates.

This report is produced by Dolphin Insights, and the copyright belongs solely to Dolphin Insights. Without the prior written consent of Dolphin Insights, no organization or individual may (i) produce, copy, replicate, reprint, forward, or otherwise distribute any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Insights reserves all relevant rights.