Epic strategic recalibration in the global automotive industry

![]() 06/25 2025

06/25 2025

![]() 683

683

The essence of this epic strategic recalibration may also be the automotive industry's rite of passage from idealism to realism.

When the red light lit up in the boardroom of Volkswagen's headquarters in Wolfsburg, Germany, and when news spread from the Tokyo headquarters in the middle of the night that engine development budgets had doubled, the global automotive industry was witnessing an epic strategic recalibration.

On the start of summer in 2025, the news that Audi suddenly hit the brakes on electrification was like a shockwave thrown into the deep waters of the industry – it was not just a route adjustment for a single company but a technological uprising by the traditional power system against electrification hegemony. In the shadow of Tesla's 30% market value decline, internal combustion engines are making a comeback in new forms, ushering the power revolution into a more dramatic second chapter.

Wall Street analysts suddenly found that the electrification penetration curves they had meticulously drawn were violently trembling amidst the roar of engines worldwide.

Multinational automakers hit the brakes again

On June 18, Audi announced a strategic adjustment, officially abandoning its plan to achieve full electrification by 2033 and continuing to develop and produce fuel vehicles for the next decade. In other words, Audi will still develop and launch new internal combustion engines in the next nearly 10 years, and internal combustion models will remain an important part of the Audi system during this period.

This decision was led by current CEO Markus Duesmann, who overturned the radical electrification route set by the previous management and stated that this adjustment was not his personal decision but a correction of the previous strategy. Previously, Audi planned to stop introducing new fuel vehicles after 2026 and fully stop producing internal combustion engines by 2033.

Under the radical electrification route, Audi gradually moved towards a situation of "complete electrification failure." Data shows that the global electric vehicle penetration rate in 2024 was only 23% (40% in China, 28% in Europe, and 18% in the United States), far below early predictions. At the same time, Audi's global sales declined by 11.8%, with a 10.9% drop in the Chinese market, and electric vehicle models failed to fill the shrinking share of fuel vehicles.

The closure of the Brussels factory this year also became a physical symbol of Audi's abandonment of "full electrification."

In 2018, against the backdrop of the EU's Paris Agreement, Audi invested 600 million euros in its transformation, turning the 70-year-old factory into a pure electric vehicle production line. This move was once considered a positive investment in the future, with the factory producing 53,000 electric vehicles annually, becoming a key component of Audi's global electric vehicle sales.

However, in February of this year, this carbon-neutral factory, once seen as the "starting point of electrification," ceased production due to the continued sluggish sales of the flagship electric vehicle model Q8 e-tron (a 27% drop in 2024), leaving it a silent steel jungle.

"Audi will launch a new series of internal combustion engines and plug-in hybrid vehicles between 2024 and 2026, which will provide us with greater flexibility for the next decade, and then we will see how the market develops," said Duesmann.

Not only Audi but also automakers like Mercedes-Benz and Volvo have previously adjusted their electrification plans.

Recently, Ola Källenius, CEO of Mercedes-Benz Group, said in an interview with Germany's Auto Motor und Sport that the company would adjust its 2030 electrification strategy, no longer adhering to the goal of "fully transitioning to pure electric sales in markets where conditions allow," instead adopting a flexible strategy for the long-term coexistence of fuel and electric vehicles.

"High-tech fuel engines for electrification will serve for longer. In the current situation where the popularization of electric vehicles falls short of expectations, promoting both fuel and electric vehicles is the most rational choice, and automakers cannot abandon any technology," Källenius believes. It is reported that Mercedes-Benz has adjusted its original plan of "full electrification by 2030" to "up to 50% of new energy vehicles (including hybrids) by 2030" and clearly stated that it will continue to sell electrified internal combustion engine models in major markets such as Europe and North America.

Volvo, on the other hand, announced last year that it was making important adjustments to its long-term electrification strategy, officially abandoning its original single goal of achieving 100% sales of pure electric vehicles by 2030, and instead setting a flexible target of "90% to 100% sales being electric or plug-in hybrids."

After abandoning full electrification, Volvo launched the SMA architecture for super hybrids in Shanghai this year, which originated from Geely. The company believes that super hybrid technology is the best balance between current market demand and future technological trends, serving as a "flexible transition" solution for electrification transformation.

Honda has also announced that it will adjust its pure electric vehicle (EV) strategy, reducing the 10 trillion yen originally planned for pure electric vehicle and software development to 7 trillion yen by 2030, a 30% decrease. At the same time, Honda will also reduce pure electric vehicle sales.

Toshihiro Mibe, President and CEO of Honda Motor Co., Ltd., said that Honda will revise the proportion of pure electric vehicles in total vehicle sales by 2030, expecting it to drop from the previous 40% to below 30%. "The automotive industry environment is rapidly changing, and business environment uncertainties are increasing. The development of the electric vehicle market has fallen short of expectations, and environmental restrictions in major overseas markets have also loosened."

"A multi-power combination approach can give automakers greater flexibility and stability in future market competition."

In the view of industry insiders, a single power combination cannot meet diverse needs, and technological openness will replace ALL-IN. The differentiated choice of technological routes is essentially a balancing act by various camps based on their own resource endowments between the "carbon neutrality goal" and "business sustainability."

Struggles amidst the fuel vehicle complex

Since last year, according to incomplete statistics, eight companies, including four automakers (Volkswagen, Audi, Ford, and Stellantis) and four automotive parts suppliers (Bosch, Schaeffler, Michelin, and ZF), are expected to lay off a total of about 50,000 employees in Europe.

ZF's layoff announcement pointed more directly to the current challenges faced by the European automotive industry in its transition to electrification.

ZF stated, "We want to maintain jobs, but we know that the transition to electric vehicles alone will lead to a reduction in jobs. Because compared to internal combustion engine automotive parts, some electric vehicle parts require only half the labor force for manufacturing."

Some analysts believe that the electrification transformation of the automotive industry has had a huge impact on traditional automakers and the supply chain. The development of electric vehicle parts requires significant investment, and at the same time, some European companies must maintain their leading position in the traditional fuel vehicle field, which also means that European traditional suppliers have to make double investments in two technological platforms.

More and more people are also beginning to think about the problems faced by European traditional automakers in their transition to electrification.

In addition to the continuous pressure of green transformation policies, some European countries have reduced subsidies for automakers' electrification transformation. The dilemma of automakers in software development has become an insurmountable obstacle in the electrification process. Issues such as insufficient charging infrastructure and range anxiety continue to suppress consumer enthusiasm, leading to European electric vehicle sales falling short of expectations.

Faced with various unfavorable situations, at the policy level, the pressure on European automakers from the EU's green transformation has also eased.

According to Xinhua News Agency, on May 8, 2025, local time, the European Parliament passed a regulatory amendment that will provide automakers with more flexible emission compliance options regarding new passenger cars and vans' CO2 emission reduction targets. It allows automakers to measure whether they have met the emission reduction targets based on the average CO2 emission levels over the three years from 2025 to 2027, rather than annual audits.

As electric vehicle markets in many countries worldwide cool down and multiple traditional automakers adjust their "full electrification" goals, China's automotive market has also seen some subtle changes in its attitude towards fuel vehicles.

As we all know, China's new energy automotive industry has achieved rapid development under policy guidance and market drive, with the current market penetration rate exceeding 50%. However, the industry is facing structural development difficulties.

On the one hand, traditional automakers generally use profits from fuel vehicle businesses to subsidize new energy businesses. On the other hand, new energy automakers continue to initiate price competitions to expand their market share, leading to a significant decline in the industry's overall profitability. According to industry data, only three of the 71 major passenger vehicle companies in China have achieved three consecutive years of profitability. This irrational competition has triggered a chain reaction, including corporate layoffs and supply chain pressures, posing severe challenges to the healthy and sustainable development of the industry.

Starting this year, multiple Chinese brands, including Geely and Chery, have expressed their commitment to actively promoting "equal rights for fuel and electric vehicles."

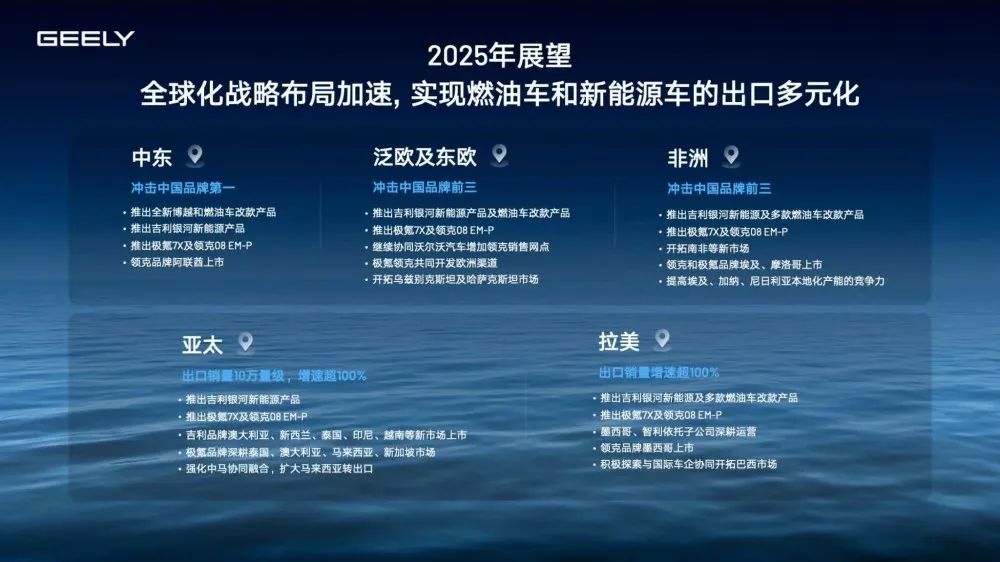

At Geely's 2024 performance conference, the company emphasized the huge value of fuel vehicles for the company in market competition in the coming years.

In the view of Gui Shengyue, Chief Executive Officer and Executive Director of Geely Automobile Holdings Limited, "Automobile companies that do not make money will inevitably be eliminated; in another two or three years, China will definitely achieve equal rights for fuel and electric vehicles, and the way capital markets value Chinese automobile companies will change at that time."

Chery also stated, "We don't just look at the domestic market; globally, fuel vehicles account for 85% of the market share, while new energy vehicles only account for 15%. From a global perspective, fuel vehicles are still the main market, which is the foundation for Chery's insistence on a global layout with fuel and electric coordination. We will continue to make significant investments in fuel vehicles because we occupy a large market demand internationally."

Additionally, according to the China Passenger Car Association (CPCA), China's overall automobile exports are expected to increase to 7 million vehicles in 2025, with a year-on-year growth rate of about 10%. Due to external environmental and geopolitical factors, the export volume of pure electric vehicles is expected to remain flat year-on-year, while the export volume of fuel vehicles is expected to increase by 9%, and the export volume of plug-in hybrid vehicles is expected to grow by 70%. Fuel vehicles will remain the main force in exports.

In fact, the global automotive industry is currently undergoing profound structural adjustments. Whether it is the policy easing in Europe or the trend of "equal rights for fuel and electric vehicles" promoted by Chinese automakers, they collectively reveal an industry consensus – fuel vehicles and new energy vehicles are not substitutes but complementary technologies.

The essence of this epic strategic recalibration may also be the automotive industry's rite of passage from idealism to realism. Only by breaking down the opposition between technological routes and establishing a global combat system for fuel and electric coordination can we truly achieve technological breakthroughs that "go up" and market conquests that "go out."

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.