The first-tier property market has finally arrived

![]() 05/28 2024

05/28 2024

![]() 807

807

Text/Leju Finance Deng Rufei

Since the central bank issued three new policies on real estate finance in succession, many cities have actively followed up with policies, and Shanghai has even ushered in unexpected relaxation.

On May 27, the Shanghai Housing and Urban-Rural Construction Management Commission, the Municipal Housing Management Bureau, the Municipal Planning and Resources Bureau, and the Municipal Taxation Bureau jointly issued the "Notice on Optimizing Policies and Measures for the Steady and Healthy Development of the Real Estate Market in the City".

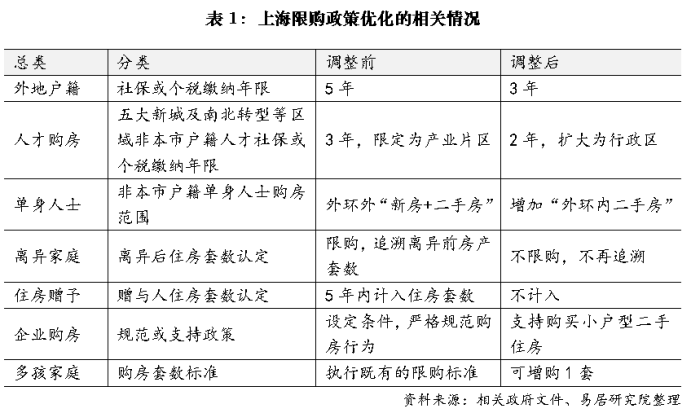

Specifically, the new policies include the following aspects: The social security duration for non-local household registration to purchase a house is adjusted from 5 years to 3 years; single individuals without local household registration can purchase second-hand houses within the outer ring; the talent housing purchase duration is changed from 3 years to 2 years, and the scope is expanded from industrial areas to administrative districts; the policy of combining the number of restricted purchases for divorced individuals within three years is canceled; the policy of counting the number of housing units gifted within 5 years is canceled; enterprises are supported to purchase small second-hand houses; multi-child families can additionally increase one purchase quota.

Source: E-House China Research Institute

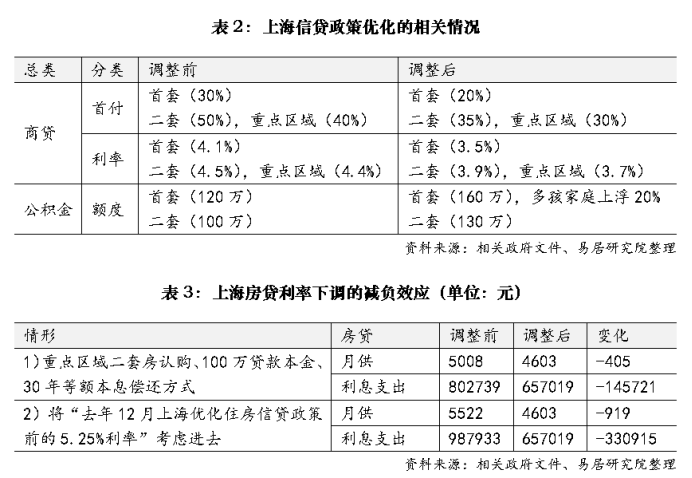

In addition, the new policies continue to reduce mortgage costs and purchasing difficulties in terms of credit policies, by adopting measures such as reducing the down payment ratio, lowering commercial loan interest rates, and increasing the amount of provident fund loans. Among them, the "key areas" referred to in the report are the Lingang New Area and the six administrative districts of Jiading, Qingpu, Songjiang, Fengxian, Baoshan, and Jinshan.

Source: E-House China Research Institute

Zhang Hongwei, the founder of Jingjian Consulting, said that the further reduction in loan costs will prompt some home buyers to enter the market in the next 1 to 2 months. "June is already the stage when real estate companies sprint to achieve their performance goals, so it is no problem to maintain the rebound in sales volume during these two months."

In terms of "trade-in" policies, it is proposed that within one year from the implementation date of the "Notice", residents who sell their only housing completed before 2000 and with a floor area of less than 70 square meters within the outer ring and purchase a new home outside the outer ring can apply for a subsidy from the district real estate trading center after obtaining the new real estate ownership certificate. Among them, the subsidy amount is 20,000 yuan for buildings with a floor area of less than 30 square meters, 25,000 yuan for 30 to 50 square meters, and 30,000 yuan for 50 to 70 square meters.

In addition, the new policies have also implemented relevant policies in optimizing land and housing supply, establishing and improving the housing security system, accelerating urban renewal such as the "two old villages" renovation, improving housing quality, and strengthening monitoring and supervision.

Turning our attention to other first-tier cities, Beijing and Guangzhou have implemented new interest rates for housing provident fund loans since the central bank's new policies were issued on May 18, reducing the personal housing provident fund loan interest rate by 0.25 percentage points. Shenzhen issued a policy to optimize housing purchase restrictions by district before the central bank's new policies. Compared with other first-tier cities, it can be said that Shanghai's relaxation policies have covered all aspects and are unprecedented in terms of intensity.

Industry experts believe that this policy not only exceeded expectations but also implemented precise policies in a "comprehensive and multi-angled" manner.

Yan Yuejin, Research Director of Shanghai E-House Real Estate Research Institute, also said that this package of real estate policies in Shanghai will play a positive role and effect. The implementation of the policies will better guide market expectations and enhance market confidence, and will further promote the steady and healthy development of the Shanghai real estate market.

On the evening when the new policies were implemented, the market has already shown positive feedback. Some new home sales offices announced that they would stay open, some brokers postponed their rest days to seize transactions, and several properties released promotional posters stating that they would gradually withdraw discounts starting on May 28.

Some real estate agents said that some landlords started to raise prices after the new policies. The original price was 9.99 million yuan, but now it has been adjusted to 10.5 million yuan. There are also landlords who are not in a hurry to sell their houses and choose not to sell. However, some brokers said that there were indeed many customer inquiries that evening, but as the new policies have just been implemented, it remains to be seen how they will develop in the coming days. The new policies are more beneficial to some customers who were originally hesitant, prompting them to accelerate their decisions.

Are measures such as relaxing purchase restrictions and reducing down payments effective? Zhang Hongwei believes that the current constraint is residents' ability to pay, so measures such as housing security banks and a new round of economic stimulus plans are needed. Storing up inventory for affordable housing has taken an important and correct step, with 300 billion yuan in reloans being the first step. In the future, more than 3 trillion yuan will be needed to establish a large-scale housing security system, resolve liquidity issues for high-quality real estate companies and local finances, and mitigate financial risks, achieving multiple benefits. At the same time, a new round of economic stimulus plans should be launched, through ultra-long-term treasuries and quantitative easing, fiscal expansion, boosting demand, and preventing balance sheet recessions.

In other words, after the current policies are introduced to rescue the market, in order for the real estate market transaction volume to continue to grow steadily, it requires the implementation of macro monetary and fiscal policy measures, such as multiple interest rate cuts and reserve requirement ratio reductions, tax and fee reductions, encouraging the private sector, and other stimulus measures to quickly restore economic growth and stabilize and increase homebuyers' incomes. Only when the above policies are effectively implemented, will measures such as reducing down payments and interest rates have further positive significance for the sustained and stable growth of transaction volumes in the real estate market.