Expansion, Decline, Franchising: The Competition Among "Huazhu and Others" Gets More Intense in 2024

![]() 06/04 2024

06/04 2024

![]() 806

806

Written by Su Cheng

Edited by Chen Feng

Driven by "revenge travel" and "revenge business trips" last year, hotel groups generally achieved a recovery in performance.

This year, the tourism industry has continued to show a positive trend, and as a result, the first-quarter financial reports issued by hotels have stabilized growth across various operating indicators.

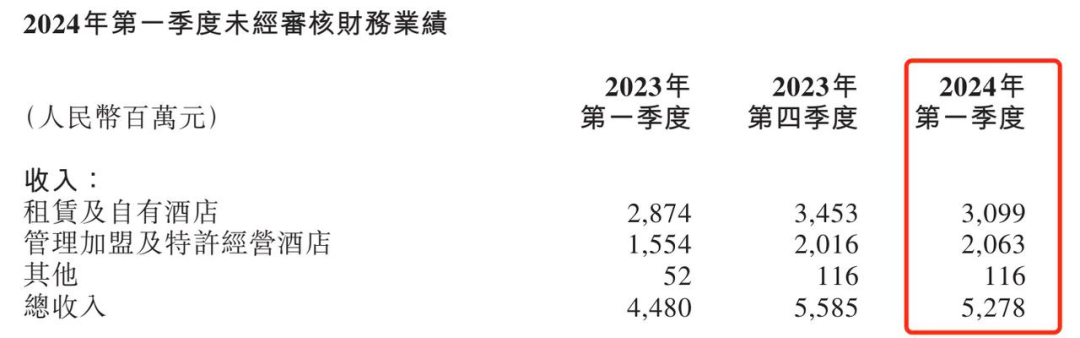

In the first quarter, Huazhu Group's revenue was 5.278 billion yuan, representing a year-on-year increase of 17.81%; Jin Jiang Hotel's revenue was 3.206 billion yuan, an increase of 6.77% from the same period last year; and BTG Hotel's revenue was 1.845 billion yuan, a year-on-year increase of 11.47%.

However, the fundamental changes in the current hotel industry are becoming increasingly complex, and the demand for domestic business travel and leisure tourism is still constantly changing. Specifically, although various travel demands are still being released, with the collective expansion of hotel groups over the past three years, changes have already occurred in the market's supply side.

Put simply, the scenario of "hard to find a room" last year is no longer prevalent, and hotels can no longer achieve revenue growth by raising room prices.

Looking further, it is actually that the past developer model, development zone model, or landmark model in the hotel industry may have gradually stopped. On the one hand, hotel brands need to explore new increments, and on the other hand, they also face real competition in the oversupply stage.

Against this backdrop, ConnectInsight has noticed that the current hotel industry is exhibiting two relatively obvious trends:

First, hotel brands are still focusing on developing the mid-to-high-end market to maintain revenue growth;

Second, the sinking market is accelerating the opening of new incremental spaces in the hotel industry.

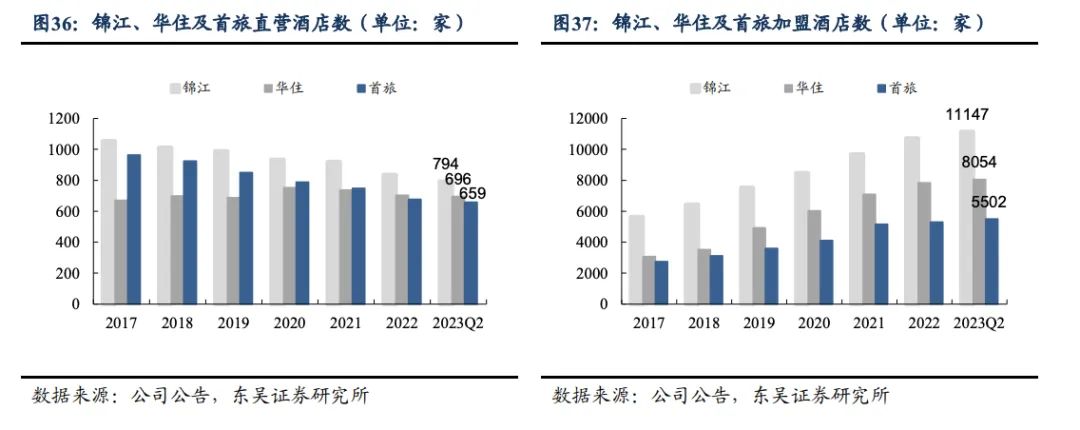

Source: Dongwu Securities

It is not difficult to see that for a host of brands in the hotel industry, whether in the mid-to-high-end market or the sinking market, they are all looking for new opportunities to expand rapidly through a lighter asset model.

1. Is the hotel industry also benefiting from the booming tourism market?

Escaping the city and heading to the mountains, tourism has now become a rigid demand in people's lives.

During this year's May Day holiday, the number of domestic travelers once again saw an increase, reaching 1.419 billion, a year-on-year increase of 7.6%. Total domestic tourist spending also increased by 12.7% year-on-year, reaching 166.89 billion yuan.

From a full-year perspective, the China Tourism Academy is optimistic about the growth of the domestic tourism economy in 2024, expecting the number of domestic tourists and domestic tourism revenue to exceed 6 billion trips and 6 trillion yuan, respectively. The number of inbound and outbound tourists and international tourism revenue are also expected to exceed 264 million trips and $107 billion, respectively.

Looking further ahead, the National Tourism Administration predicts that China's cultural and tourism market size is expected to reach 30-50 trillion yuan in the next ten years.

It is worth noting that this growth trend in the tourism industry has been sustained for a long time, driving the growth of the hotel industry in the first quarter of this year. The industry's leading hotel groups, Huazhu, Jin Jiang, and BTG, all achieved varying degrees of revenue growth in the first quarter of 2024 and achieved profitability.

The 2024 Q1 financial reports recently released by the three hotel groups showed that Huazhu Group's Q1 revenue in 2024 was 5.278 billion yuan, representing a year-on-year increase of 17.81%, with a net profit of 659 million yuan; Jin Jiang Hotel's Q1 revenue in 2024 was 3.206 billion yuan, representing a year-on-year increase of 6.77%, with a net profit of 189.9 million yuan; BTG Hotel's Q1 revenue in 2024 was 1.845 billion yuan, representing a year-on-year increase of 11.47%, with a net profit of 120.6 million yuan.

Source: Huazhu Group Financial Report

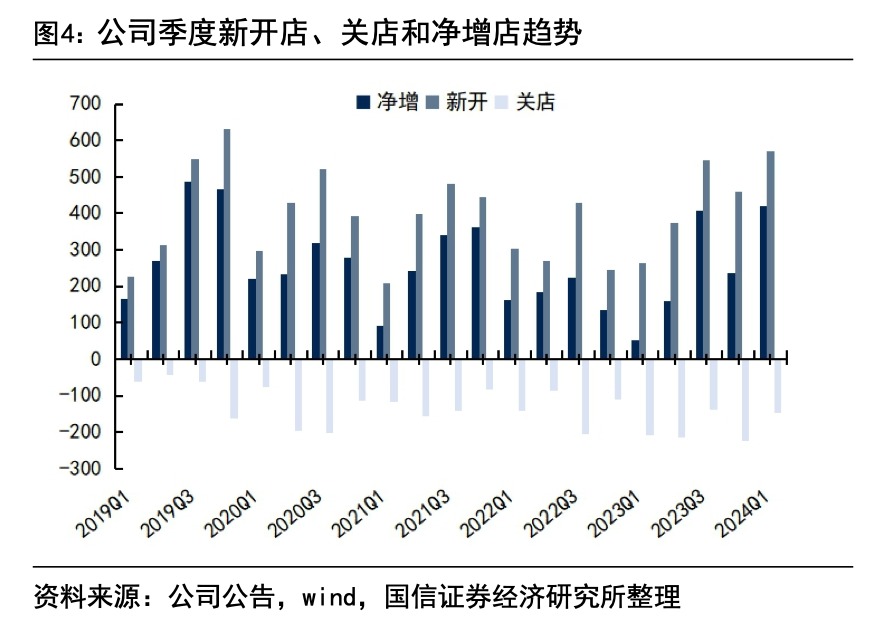

On the other hand, these leading brands are also accelerating store expansion in the first quarter.

In the first quarter, Huazhu China opened 569 new hotels and had 3,138 hotels scheduled to open. Jin Hui, CEO of Huazhu, said that in the first quarter of this year, Huazhu China's total number of opened and scheduled hotels has hit a record high.

Jin Jiang Hotel and BTG Hotel followed suit. According to statistics, from January to March 2024, Jin Jiang added 222 newly opened hotels, 75 hotels closed, and a net increase of 147 newly opened hotels; in the first quarter of 2024, BTG opened 205 new stores, including 2 direct-operated stores and 203 franchised stores.

Breaking it down further, Huazhu, Jin Jiang, and BTG have all invested more in the mid-to-high-end market, and the proportion of their mid-to-high-end hotels is gradually increasing.

As of March 31, 2024, Huazhu China had 5,102 economy hotels and 4,582 mid-range, mid-to-high-end, and other hotels; Jin Jiang had 7,384 mid-range hotels (accounting for 58.63%) and 5,150 economy hotels (accounting for 40.89%); BTG had 1,773 mid-to-high-end hotels, accounting for 28.2%.

It is not difficult to see that, on the one hand, leading hotel companies are grabbing market share through new store expansion, and on the other hand, they are focusing on investing in mid-to-high-end hotels to improve profitability. Competition in both the economy hotel market and the mid-to-high-end hotel market remains fierce.

To some extent, this trend in the hotel industry is closely related to the structural adjustment of supply and demand in the tourism industry.

This year, more and more people are choosing to travel to lower-tier cities, and the county tourism market is showing a trend of explosive growth. The "May Day Holiday Travel Summary 2024" pointed out that the year-on-year growth rate of tourism orders in county markets and third- and fourth-tier cities has exceeded that of first- and second-tier cities. Among them, the average growth rate of tourism orders in cities like Tonglu, Dujiangyan, Yangshuo, Mile, and Yiwu reached 36%.

On the other hand, China's starred hotels are also undergoing structural changes. A research report from HuaFu Securities pointed out that currently, China's starred hotel structure is transitioning from a traditional "pyramid" shape to an "olive" shape, with a clear trend towards mid-to-high-end upgrades.

In summary, the continuously recovering tourism market has indeed contributed to the growth momentum of the hotel industry. However, in the long run, with the ongoing structural changes in supply and demand in the tourism and hotel industries, hotel brands need to be prepared in both the mid-to-high-end hotel market and the sinking market.

2. The hotel market is also focusing on "quality-to-price ratio," so how do brands attract users?

Since the lifting of restrictions last year, people's travel needs have returned with a vengeance. During the summer of 2023, the number of tourists received by many popular travel destinations in China reached historical highs, and hotel bookings also increased by 1.4 times compared to 2019. Keywords like "thousand-yuan economy hotel" and "hotel assassin" frequently appeared on social media's trending lists.

Looking at this year, hotel room prices are no longer rising.

Returning to the hotel industry's more fundamental key business indicators, in the first quarter of this year, Huazhu China's average daily rate (ADR) was 280 yuan, compared to 277 yuan in the same period last year, representing a year-on-year increase of 1%. The occupancy rate (OCC) was 77.2%, up 1.6% year-on-year from 75.6% in the same period last year. The average revenue per available room (RevPAR = ADR * OCC) was 216 yuan, up 3.1% year-on-year from 210 yuan in the same period last year.

If compared to the same period in 2019, both the average daily rate and mixed average revenue per available room of Huazhu China showed slight growth, but the occupancy rate decreased by 3.4 percentage points.

For all Huazhu China hotels that have been operating for at least 18 months, the average revenue per available room in the first quarter of 2024 was 218 yuan, representing a 0.9% increase from 216 yuan in the first quarter of 2023. The average daily rate decreased by 0.6%, and the occupancy rate increased by 1.1%.

In fact, apart from a slight increase in Huazhu's same-store occupancy rate, the occupancy rates of BTG and Jin Jiang in the first quarter of this year showed a slight decline year-on-year, while the average daily rates both increased to a certain extent.

However, as the supply-demand relationship in the market gradually balances, it is difficult for hotels to raise prices again. From a broader perspective, in April this year, China's retail sales of consumer goods grew by 2.3%, lower than the expected over 3.1%. When demand falls short of expectations, how to attract customers becomes the key.

The "2023 China Hotel Group and Brand Development Report" released by the China Hotel Association pointed out that one of the next development trends for hotels is the upgrade of economy hotels brought about by consumption upgrades.

However, hotel upgrades are not just about price increases but also mean upgrades in hotel services, facilities, and other aspects within the same price range, making them more attractive to consumers. At the same time, rapid product upgrades and iterations will undoubtedly attract more franchisees to join and help hotel groups compete for market share.

In other words, the competition in the hotel industry will focus more on the comparison of service capabilities.

A relevant person in charge of Huazhu told ConnectInsight: "Beyond the vast sinking market that remains to be explored, the greater dividend for mid-range hotel brands lies in changes in people's consumption behavior. Under such a trend, hotel brands are paying more attention to lifestyle creation. Elements such as dining, architectural aesthetics, lobbies, room sizes, convenience of front desk services, room furniture, and equipment are the decisive factors in value competition."

We have also seen that at the end of last year, major hotel groups have iterated on their mid-to-high-end hotel brands.

In November, Atour released its new product version 4.0 "Jianye," with a design concept of "natural tranquility," upgrading aspects such as breakfast, sleep, and business space based on the original version;

In December, Huazhu Group released its new Hanting 5.0 product, iterating on aesthetics, experience, space, and business models;

In addition, BTG Homeinn Hotel Group also launched its Homeinn Select 4.0 version in December, creating an investment model combining strong experience and high returns through design upgrades, spatial integration, and service overlays.

Source: Huazhu Group's official website

How the new generation of products from various hotel groups will perform remains to be tested by the market, but it is clear that players with established brand advantages will have a greater chance of capturing more market share.

As of the end of the first quarter of 2024, Huazhu China had 686 hotels in operation in the mid-to-high-end segment, representing a year-on-year increase of 28% and a quarter-on-quarter increase of 6%. There are 430 hotels scheduled to open, representing a year-on-year increase of 81% and a quarter-on-quarter increase of 11%. BTG Hotel has 1,773 mid-to-high-end hotels, with the speed of opening mid-to-high-end hotels accelerating in the first quarter, representing a year-on-year increase of 50.0%. As of March 31, 2024, the company's mid-to-high-end hotel volume ratio has increased to 40.2%.

In summary, mid-to-high-end hotels have become the focus of competition among major hotel groups. How to attract consumers while providing stable supply chains and lower operating costs for franchisees is a challenge faced by major hotel groups, including Huazhu.

3. Accelerating store expansion and relying on franchisees to penetrate the sinking market

With room prices no longer rising, to maintain growth, it is necessary to continue expanding operations, with the mass consumer market as the foundation. Many hotel groups have targeted China's sinking market.

The "2022 China Lodging Industry Development Report" showed that at the end of 2022, the chain rates of third-tier and below cities were 24.19% and 15.40%, respectively, far below the 44% and 36% of first- and second-tier cities. Compared to over 70% in developed countries, China's third- and fourth-tier cities have significant room for development in the chain hotel market.

At the same time, the impact of "black swan" events from 2020 to 2022 led to a 17% decrease in the overall number of domestic hotels, with many tail hotels with insufficient financial strength exiting the market. This has also released new expansion space for leading hotels represented by Huazhu.

As of March 31, 2024, Huazhu China had 9,684 hotels in operation, including 598 leased and owned hotels and 9,086 managed franchised and franchised hotels. Among them, Huazhu China has covered 1,290 cities nationwide, an increase of 158 cities compared to the same period last year, continuing to move towards the goal of "Huazhu in every county."

Huazhu's store expansion trend, source: Guosen Securities

BTG has also expressed its intention to further explore the sinking market space, developing a light management model with characteristics such as "small investment, high empowerment, and fast return," making it the main force for its store expansion. Brands such as "Yun" and "Huayi" have the characteristics of more sinking products and more flexible models.

Not only domestic leading hotels but also international hotel giants are also expanding their territories in the sinking market. In 2023, more than 70% of InterContinental Hotels' newly opened hotels and 85% of hotels under construction were located in second- to fourth-tier cities. Hotel groups such as Marriott and Hilton have also increased their bets on the sinking market.

Behind this is that after the recovery of travel consumption in 2023, the entire hotel industry is scrambling for territory. Data from the China Hotel Association showed that in 2023, a large number of previously withdrawn hotel properties re-entered the market, with supply growth hitting a new high of 16% in recent years.

Notably, in this new round of territory scrambles, the franchising model has become a common choice for hotel brands to expand their markets.

<