The Fierce Game Behind Qingdao Port's Nearly 10 Billion Yuan Restructuring Overhaul

![]() 07/18 2024

07/18 2024

![]() 833

833

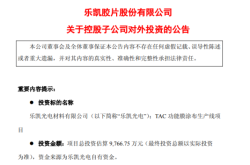

Qingdao Port has finally compromised with the market regarding its restructuring. On the evening of July 12, Qingdao Port disclosed an adjusted asset restructuring plan, proposing to acquire equity assets from four companies under Shandong Port Group through the issuance of shares and cash payments, with a transaction consideration of 9.44 billion yuan. Compared with the previous announcement, the scope of the target assets disclosed in Qingdao Port's new restructuring plan has undergone significant adjustments.

The latest restructuring plan only includes four companies, including one newly added Shandong Gangyuan Pipeline Logistics Co., Ltd., and three of the original eight companies, excluding the five companies previously proposed for acquisition.

Qingdao Port stated that this restructuring will inject the high-quality liquid bulk cargo terminal-related assets of Rizhao Port Group and Yantai Port Group into the listed company, which will help enhance the comprehensive competitive strength of the listed company and increase its corporate value.

In summary, the adjustment to Qingdao Port's restructuring plan mainly involves transferring assets related to the crude oil business within Shandong Port Group to Qingdao Port, aiming to resolve the horizontal competition issues faced by Shandong Port Group since its integration. However, some assets with poor return on investment that may directly lower Qingdao Port's listed company's profitability have been excluded. According to the original plan, Qingdao Port was also set to acquire 100% equity of Rizhao Port Rong Port Service Co., Ltd. held by Rizhao Port Group, 67.56% equity of Yantai Port Co., Ltd. held by Yantai Port Group, 60.00% equity of Yantai Port Group Laizhou Port Co., Ltd., 64.91% equity of Yantai Port Navigation Investment Development Co., Ltd., and 100% equity of Yantai Port Operation Guarantee Co., Ltd. Regarding the exclusion of these five assets, Xinda Securities analyst Zuo Qianming analyzed that it was to better improve the quality of the listed company and its earnings per share by eliminating assets with a return on equity (ROE) below 5% from the original plan.

"After the adjustment, the proposed assets to be acquired have a combined ROE of 11.68% in 2023, higher than all listed companies in the A-share port sector except Qingdao Port." In fact, as a listed company, Qingdao Port's performance has benefited from Shandong Port Group's internal consolidation in recent years. However, at the same time, Qingdao Port's related restructuring has also frequently faced criticism for overpaying for non-performing assets. The reason for this, to a large extent, is related to the special nature of ports. Port restructuring involves both market behavior at the corporate level and the city interests of relevant municipalities. In other words, such mergers and acquisitions must also consider future benefits in the integration process of ports, cities, and industries, including the driving effect on local cities. As Qingdao Port's restructuring moves forward, Shandong Port Group is also planning listing programs for emerging businesses, which will also involve fierce competition.

1

In January 2022, Shandong Port Group, Qingdao Municipal SASAC, and Qingdao Port Group signed an equity transfer agreement without compensation, whereby Qingdao Municipal SASAC transferred 51% of the equity of Qingdao Port Group to Shandong Port Group free of charge. To reduce and avoid potential horizontal competition in the future, Shandong Port Group also issued a "Commitment Letter of Shandong Port Group Co., Ltd. on Avoiding Horizontal Competition," promising:

"Within a five-year transition period starting from the completion of this free transfer, we will make every reasonable effort to take the following measures to resolve issues related to Shandong Port Group's operations of the same or similar businesses as the listed company."

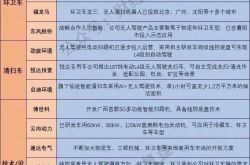

Currently, Shandong Port Group has three listed companies. Among them, Qingdao Port, as the leading listed company, is primarily engaged in the loading and unloading of various types of goods such as containers, dry bulk cargo, and liquid bulk cargo, as well as port-related services. Rizhao Port's listed company mainly operates bulk cargo and breakbulk cargo handling, storage, and transshipment businesses, including metal ores, coal, and its products. It has a high market share in iron ore transshipment ports, with an annual transshipment of over 160 million tons of iron ore, ranking among the top coastal ports in China in terms of cargo throughput. Rizhao Port Yu is a listed company spun off from Rizhao Port and listed on the Hong Kong Stock Exchange in 2019, and it is the largest grain and woodchip import port in China. The first resolution of horizontal competition was actually within Qingdao Port Group.

On the evening of May 16, 2022, Qingdao Port announced that to resolve horizontal competition, the company planned to acquire 51% equity of Shandong Weihai Port Development Co., Ltd. (hereinafter referred to as "Weihai Port Development") held by Shandong Port Weihai Port Co., Ltd. (hereinafter referred to as "Weihai Port") for 984 million yuan. After the completion of this transaction, Qingdao Port will hold 51% equity of Weihai Port Development, while Weihai Port will hold the remaining 49% equity.

Three years ago, on July 9, 2019, 100% equity of Weihai Port Group was transferred to Qingdao Port Group free of charge. Compared to Qingdao Port's "quick, accurate, and decisive" acquisition of Weihai Port, the progress of acquiring multiple assets in the integration of Yantai Port and Rizhao Port has been slow.

On the evening of June 27, 2023, Qingdao Port issued a "Suspension Announcement on the Planning of Major Asset Restructuring Matters," disclosing for the first time that it would acquire several companies under Rizhao Port Group and Yantai Port Group and suspending trading.

The announcement showed that Qingdao Port planned to acquire 100% equity of the oil company held by Rizhao Port Group, 50% equity of Rizhao Shihua, 100% equity of Rizhao Port Rong, 67.56% equity of Yantai Port shares held by Yantai Port Group, 60% equity of Laizhou Port, 53.88% equity of United Pipeline, 64.91% equity of Port and Navigation Investment, and 100% equity of Operation Guarantee Company through the issuance of shares and cash payments for assets. At the same time, the company planned to raise supporting funds by issuing shares through inquiry. However, after more than a year of delays, the restructuring plan underwent significant changes, with the acquisition targets becoming the latest "100% equity of the oil company held by Rizhao Port Group, 50% equity of Rizhao Shihua, 67.56% equity of Yantai Port shares held by Yantai Port Group, and 51.00% equity of Gangyuan Pipeline." Even if this restructuring is successfully completed, the issue of horizontal competition between Shandong Port Group's internal operations and listed companies is far from over. On the one hand, there is the question of when the other five companies with poor asset returns will be merged into Qingdao Port. On the other hand, there is also the issue of horizontal competition between Qingdao Port and Rizhao Port, the two existing listed companies within Shandong Port Group.

On the evening of July 26 last year, Qingdao Port (601298.SH) responded to this, stating that Rizhao Port (600017.SH) is special in that it is a listed company on the Shanghai Stock Exchange's main board, and the resolution of horizontal competition issues will involve the supervision of state-owned assets and the interests of many small and medium-sized shareholders. There are many factors to consider, and the relevant assets still need to be sorted out or integrated, limiting the ability to resolve the horizontal competition between the company and Rizhao Port through asset, business, or equity integrations at present. The relevant plan is still under study. Qingdao Port also stated in its reply letter to the Shanghai Stock Exchange:

Shandong Port Group will strive to complete asset rectification before the expiration of its commitment to resolve horizontal competition (January 2027) by integrating assets and businesses related to enterprises within Shandong Port Group that overlap with Qingdao Port's operations to address horizontal competition issues.

2

Whether it was the previous acquisition of Weihai Development or the eight companies initially planned for acquisition, Qingdao Port has repeatedly faced质疑 of "injecting inefficient assets at high prices." For example, during Qingdao Port's acquisition of 51% equity of Weihai Development for 980 million yuan, some voices argued that "it is equivalent to buying the company for 1.93 billion yuan. The acquired Weihai Port Development had a net asset value of 1.23 billion yuan and a net profit of 36 million yuan at the end of 2021, which is equivalent to buying an ordinary bulk cargo port company at 1.57PB and 54PE. For comparison, the mainstream port stocks on the market at that time generally had a PB of less than 1 and a PE of around 10."

Additionally, in the "Pre-announcement (Revised Draft) of Qingdao Port International Co., Ltd.'s Issuance of Shares and Payment of Cash for Assets and Raising Supporting Funds and Related Party Transactions" (hereinafter referred to as the "Pre-announcement") issued by Qingdao Port in response to the Shanghai Stock Exchange's inquiry letter in July last year, it was also clearly stated:

"The net sales profit rate and total asset return rate of the oil company and Yantai Port shares are lower than the average level of port listed companies. Port and Navigation Investment, Rizhao Port Rong, and Operation Guarantee Company mainly operate port-related businesses, and their relevant indicators are not comparable to port listed companies."

The problem here lies in the strong regional attributes of ports, and the integration of ports, industries, and cities is an important driving force for the development of the host city. In other words, the assets proposed for restructuring by Qingdao Port, while seemingly just port operations, also have growth potential stemming from the geographical advantages of the city's economic hinterland. Taking Weihai Port as an example, in the two years since its acquisition by Qingdao Port, Weihai Port has broken the shackles of not opening new routes for a decade, opening 12 new routes to ports such as Binzhou, Weifang, Yantai, Rizhao, Lianyungang, and Taicang, and starting eight major construction projects. For the first time in a decade, profit, revenue, and throughput have achieved double-digit growth.

As a logistics hub connecting Liaodong, the Bohai Bay, and linking South Korea and Japan, Weihai Port has recently opened the first major sea-land route for commercial vehicles in East Asia, pioneered a new model of bonded transit of North Korean glass and foreign trade bulk-to-container conversion, put the No. 1 warehouse of the China-South Korea Free Trade Zone into use, launched cold chain cloud warehouse business, and leveraged JD.com's self-operated platform to create an aquatic product distribution center, effectively upgrading the service efficiency of Weihai Port.

According to reports, Weihai Port has reduced its financing scale by 4.2 billion yuan in recent years, with its asset-liability ratio falling from 86.6% at the initial stage of integration to 52.5%. All 2 billion yuan of historical over-range guarantees have been cleared, 378 million yuan of overdue accounts receivable have been recovered, and 15 inefficient and ineffective enterprises have been eliminated. In 2023, four enterprises, including Weihai Port itself, achieved profitability.

In the previously issued "Pre-announcement," Qingdao Port also provided corresponding development plans for different target companies.

For example, by promoting the landing of surrounding port-adjacent industries of Yantai Port shares, increasing cargo sources, and optimizing the cargo mix.

Another example is that target companies such as Port and Navigation Investment own core and scarce port land assets. After the injection, Qingdao Port will carry out more scientific port planning based on the regional characteristics and advantages of each port area to further improve the port layout. At the same time, leveraging Qingdao Port's low-cost financing advantages, it will build projects with higher investment returns in the future to improve the operational efficiency of existing assets.

3

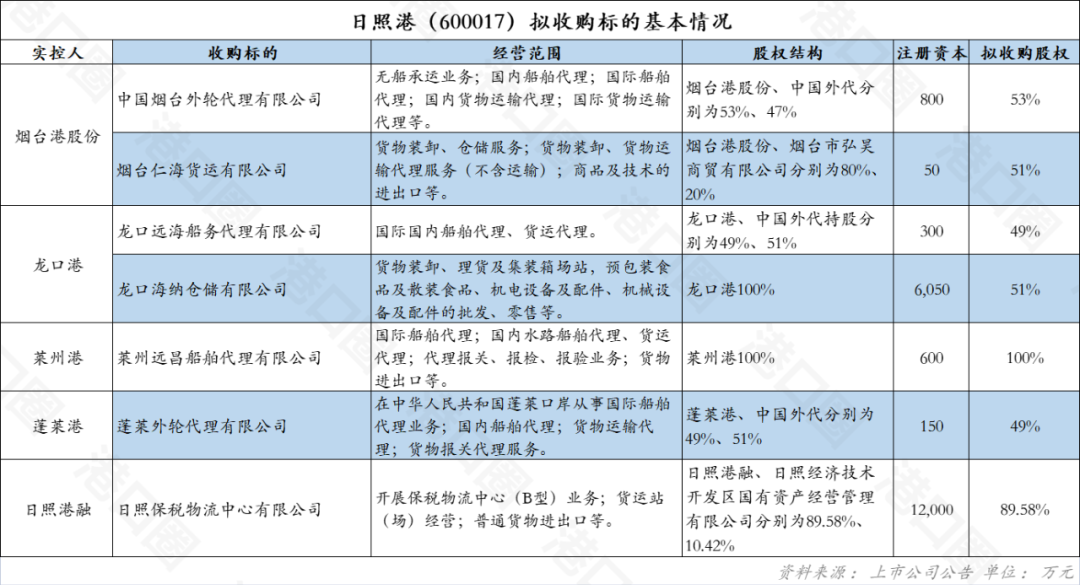

Apart from Qingdao Port, the restructuring of another listed company is also underway. On July 1, 2023, Rizhao Port Co., Ltd., a listed company under Rizhao Port Group, announced its intention to acquire some assets from Yantai Port, Laizhou Port, Longkou Port, Penglai Port, and Rizhao Port Group.

Through this acquisition, Rizhao Port Co., Ltd. will receive the injection of logistics business from ports such as Yantai Port, Longkou Port, and Penglai Port, while the assets of Rizhao Bonded Logistics Center Co., Ltd. will also be transferred to Rizhao Port Co., Ltd., successfully expanding its logistics business. In other words, Rizhao Port's listed company may become the main player in Shandong Port Group's logistics business in the future. So the question arises: Will Qingdao Port's logistics business, as Shandong Port Group's most premium logistics asset, also be injected into Rizhao Port? According to Qingdao Port's 2023 annual report, revenue from logistics and port value-added services was 6.949 billion yuan, a year-on-year decrease of 14.7%, accounting for 38.2% of Qingdao Port's total revenue.

Another question is how to handle the relationship between Shandong Port Land-Sea International Logistics Group Co., Ltd., the current main entity of Shandong Port Group's logistics sector registered in Jinan, and Rizhao Port, the listed company undertaking logistics business. Apart from the logistics sector, Shandong Port Group's shipping sector, another major business, may also go public independently. On November 7, 2023, Shandong Port and Navigation publicly selected an IPO financial audit institution, revealing progress in its listing plans. As an enterprise under Shandong Port Group, Shandong Port and Navigation was established in March 2020 and is primarily engaged in container transportation and agency, bunkering and transportation, dry bulk transportation, passenger and container liner transportation, and other businesses. It currently operates 25 domestic feeder lines, 5 domestic trunk lines, and 8 foreign trade trunk lines, with 58 vessels under its management. From the perspective of Shandong Port Group's overall business segments, there are currently 12 segment groups, including investment and control, logistics, shipping, and trade, forming a "1+4+12+N" development pattern comprising the headquarters, four port groups, 12 segment groups, and numerous inland ports. The group is accelerating its transformation from a "single port operator" to a "comprehensive supply chain service provider," striving to build a first-class supply chain service system.

According to Huo Gaoyuan, Chairman of Shandong Port Group, "The contribution rate of traditional and emerging businesses will shift from the current 7:3 to a 50:50 split during the 14th Five-Year Plan period, and by 2035, the contribution rate will become a 'reversed three-seven,' with traditional businesses accounting for 30% and emerging businesses accounting for 70%."

Traditional businesses are represented by the traditional port operations of the four major ports, while emerging businesses are represented by finance, logistics, shipping, and other sectors.

Taking the Port of London as an example, its annual throughput is only over 50 million tons, and loading and unloading operations contribute only 5% of its profits. The remaining 95% of its profits come from high-end service sectors such as finance, trade, and shipping services.

In other words, within Shandong Port Group, each segment will have a main entity in the future to avoid horizontal competition issues. For example, port-related businesses will be concentrated in Qingdao Port, the listed company; logistics-related businesses may be concentrated in Rizhao Port, the listed company; and shipping-related businesses will be in Shandong Port and Navigation. And so on.

However, whether Shandong Port's emerging businesses will independently go public in the future and how they will be deployed in relevant cities are likely to involve more interest distribution.