Humanoid Robot Funding Landscape Analysis: Over 10 Billion Yuan Invested Across Three Tiers

![]() 07/01 2025

07/01 2025

![]() 881

881

Author|Xiang Xin

In the race for humanoid robot supremacy, capital investment seems to be outpacing technological evolution.

Despite the nascent stage of application, players are vying to secure a piece of the trillion-dollar market that could spawn the "next Tesla" of the future.

This year alone, several companies have secured single-round financing of up to hundreds of millions of yuan, including Galaxy General, Fourier Intelligence, Zhongqing Robotics, LEJU Robotics, Luming Robotics, and Parsini Perception. Funding enthusiasm continues to soar.

Some firms have raised three rounds of funding in just six months, amassing hundreds of millions of yuan, while others are still navigating their first round, seeking a stable anchor for technology and capital. After roughly three years of growth, the funding landscape within this sector has begun to differentiate.

According to incomplete statistics, from January to June 2025, there were up to 83 financing events in the domestic humanoid robot field, with a disclosed total amount exceeding 6.9 billion yuan.

Who are the star projects that capital is chasing? What determines the choice of investors?

We systematically analyzed 23 core companies in the humanoid robot sector, compiled their financing histories, and outlined the capital landscape behind this burgeoning trend, from enterprise tier classification to investor profiles and emerging industry trends.

Top Tier: Four Humanoid Robot Unicorns

We selected 23 unlisted startups specializing in humanoid robots and scored them based on five dimensions: multi-hundred-million-yuan financing rounds, financing progress and speed, single-round peak value, and cumulative amount. These companies were categorized into three tiers: top, middle, and early.

In general, the funding of humanoid robot companies exhibits the following characteristics:

- Early-stage funding primarily revolves around the A round;

- Funding exploded in 2023 and continued to grow in 2024-2025;

- Since 2024, single-round financing of hundreds of millions of yuan has become commonplace;

- Roughly estimated, the funding scale of domestic humanoid robot companies has surpassed 10 billion yuan.

The top tier comprises four companies: Unitree Robotics, Galaxy General, Zhiyuan Robotics, and Fourier Intelligence, all of which have entered the unicorn club.

The top-tier companies share three financing characteristics:

First, they have raised funds multiple times, with deep progress and advanced financing stages. All four have entered the B round or later, with financing rounds close to or exceeding 9. The top four companies attract at least 60% of the funds among the 23 analyzed.

Second, single-round financing amounts are substantial, with individual rounds exceeding 500 million yuan, and total funding exceeding 1 billion yuan for each company.

For example, Galaxy General recently completed a new round of funding of up to 1.1 billion yuan, Unitree secured nearly 1 billion yuan in February 2024, Fourier Intelligence obtained 800 million yuan in January 2025, and Zhiyuan Robotics received over 600 million yuan in 2023.

Third, there is a significant number of investors with a strong willingness to follow up on investments. Unitree Robotics, Galaxy General, and Zhiyuan Robotics each have over 30 investors. Although Fourier Intelligence has fewer investors, 6 out of its 15 have participated in follow-up investments, representing a 40% re-investment rate.

The robust capital absorption of these top companies is largely attributed to four core competencies: engineering capability + business cash flow + market traction + founding team's aura.

Engineering capability refers to the ability to swiftly transform prototypes into mass-produced products, which is crucial for humanoid robots to enter real-world scenarios. Unitree, Fourier, and Zhiyuan have all achieved mass production and delivery of humanoid robots.

Unitree delivered over 1,500 humanoid robots in 2024 and expects shipments to reach 4,000 in 2025, making it the global leader in humanoid robot shipments.

Zhiyuan Robotics also mass-produced and launched 1,000 general-purpose embodied robots earlier this year.

Fourier Intelligence was the first global player to complete mass production and delivery of humanoid robots, delivering 100 units in September 2024 and expecting to deliver 300 units this year.

Galaxy General expects to mass-produce over 1,000 humanoid robots this year.

Self-sustaining capability ensures stable company development. Unitree's quadruped robot dog business supports continued investment in humanoid robot R&D. Sales reached 23,700 units in 2024, accounting for nearly 70% of the global market share. Wang Xingxing recently revealed that Unitree's annual revenue has surpassed 1 billion yuan. Fourier's rehabilitation robots are also profitable, providing crucial support for the humanoid business.

Market traction captures user attention and aids brand awareness. Unitree leveraged its Spring Festival Gala appearance and ultra-high-performance demonstrations to dominate social media. Zhiyuan Robotics' founder, Huawei's prodigy "Zhihui Jun," as a million-follower blogger, brings his own heat and serves as the company's traffic IP, enhancing brand recognition.

Additionally, the resumes and backgrounds of the founding teams are significant pluses for capital.

Deng Taihua, co-founder of Zhiyuan, was formerly the vice president of Huawei and possesses strong resource integration and technical management capabilities. Fourier and Unitree were also founded by long-time robotics practitioners with deep technical expertise.

Among the four companies, Galaxy General stands out. Its core advantage lies in large model R&D capabilities, achieving zero-shot generalization through self-developed models.

Compared to the other three, which have launched multiple humanoid robots, Galaxy General currently only has one wheeled-legged humanoid robot, with a stable design and no public iterations.

Although it has yet to achieve true self-sustaining capability, Galaxy General's humanoid robots are operational in over ten Beijing stores, with a success rate of over 90% for tasks like desktop and shelf grasping. It expects nationwide deployment in hundreds of stores within the year.

The commonality among these top companies is their ability to not only build but also sell robots or equip them with basic human replacement capabilities, consistently gaining capital recognition.

Middle Tier and Early Tier: Strong Financing Explosiveness

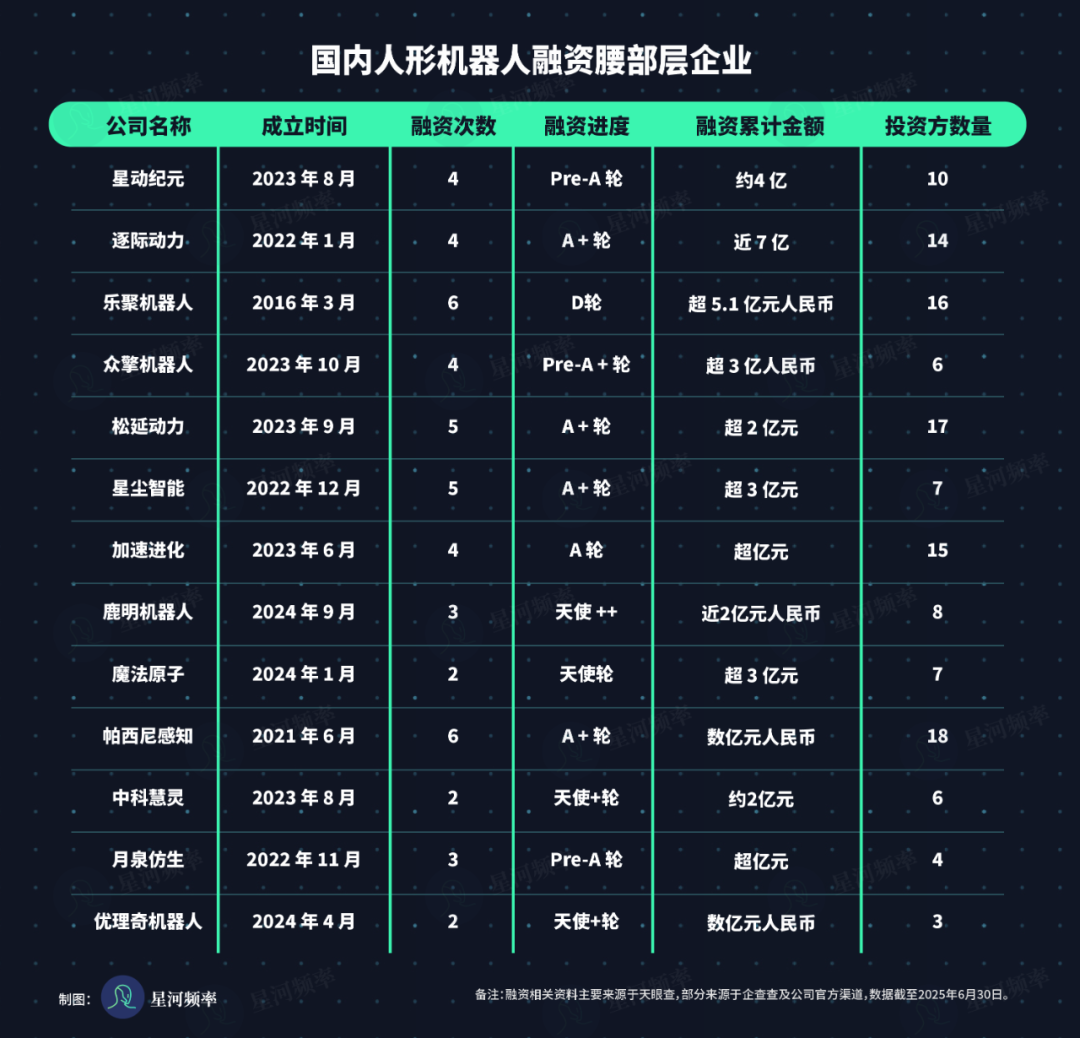

Beyond the top four, the middle tier encompasses 13 companies, such as Xingdong Jiyuan, Zhuji Power, LEJU Robotics, and Zhongqing Robotics. Most are at the A round stage but have attracted considerable funding in the capital market.

Middle-tier companies often exhibit "financing explosiveness," completing multiple rounds of high-value financing in a short period. For instance, Luming Robotics completed three rounds of financing in six months, two of which were hundreds of millions of yuan. Zhuji Power raised 500 million yuan in six months. Established companies like LEJU Robotics and Parsini Perception have completed a cumulative total of six funding rounds.

Team background is crucial for attracting capital in the middle tier.

One type hails from university research systems, such as Xingdong Jiyuan, Songyan Power, and Accelerated Evolution, which excel in technological breakthroughs.

The other type stems from industry practice, including LEJU, Zhongqing, and Magic Atom, which are strong in product delivery and supply chain integration.

Due to the diverse backgrounds of their founding teams, these two types of companies also exhibit differentiation in product performance.

Technology-driven teams focus on underlying innovations like motion control and bionic structures, aiming to build technological barriers.

Product-oriented teams, on the other hand, emphasize delivery capabilities and scenario adaptation, delivering functional robots to customers.

This difference essentially reflects varying core drivers and resource endowments.

The university faction, leveraging university or research institution resources, is suited for long-cycle, high-investment technological R&D.

The industry faction, with resources like supply chains, customer channels, and mass production experience, can swiftly translate technology into implementable products.

For example, Xingdong Jiyuan's STAR1 completed a running challenge in the complex terrain of the Hexi Corridor, with a potential speed of 6m/s, surpassing the world marathon champion's running speed. Meanwhile, Magic Atom has deployed robots for training and operations in Dreame's factory production lines, and LEJU Robotics has been delivered to automobile factories and exhibition halls.

LEJU humanoid robot at FAW Hongqi factory

However, middle-tier companies are still navigating the path to engineering, with mass production generally staying at the scale of hundreds of units. Applications are primarily for testing or verification, significantly lagging behind normalized operation. Their self-sustaining capability is slightly inferior to top-tier companies.

Early-tier companies include Digital Huaxia, Zero-Power Robotics, Lingyu Intelligence, etc. Their funding mostly precedes the A round, with amounts yet to reach hundreds of millions of yuan, mostly in the tens of millions.

Securing tens of millions of yuan in funding at the initial startup stage already surpasses the technology industry average. However, amidst the heated humanoid robot aura and large funding scales of leading companies, often in the hundreds of millions or even billions, tens of millions seem less impressive.

But these early-tier companies, with precise technological positioning (e.g., Zero-Power Robotics using human video data for training) and in-depth cultivation of niche scenarios (e.g., Digital Huaxia focusing on scenarios requiring deep human interaction), are gradually building differentiated competitiveness. Their development potential should not be underestimated.

Investor Profile: Venture Capital Firms and Industrial Capital as the Main Force

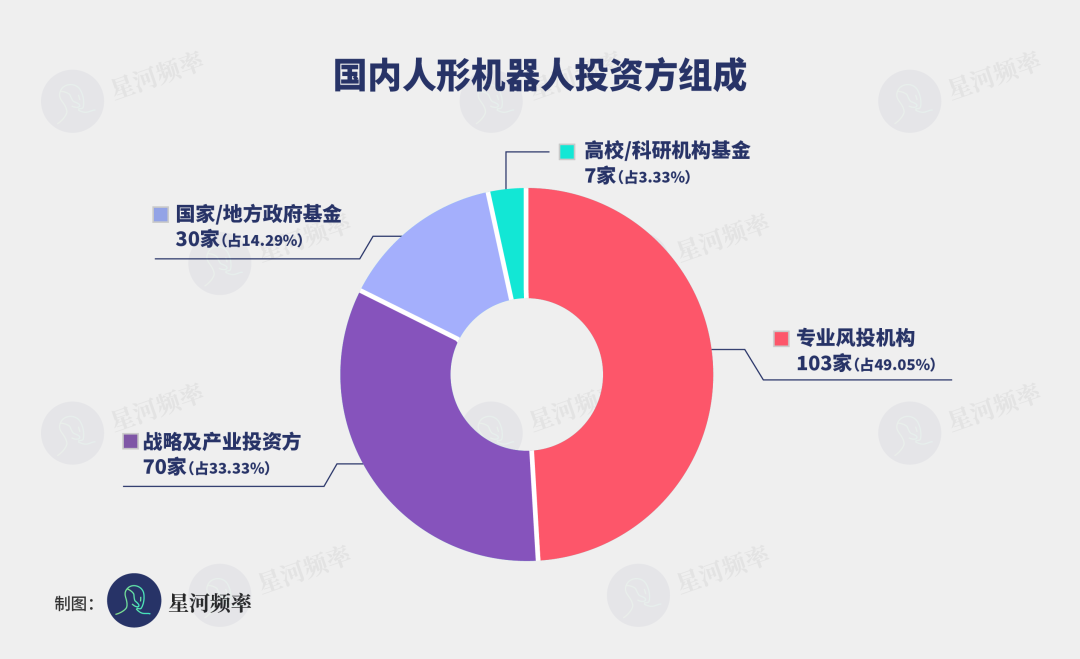

As the industry heats up, investors have become increasingly diverse. The 23 humanoid robot companies have attracted over 200 investment institutions, spanning four major categories: professional venture capital firms, industrial capital, government funds, and university/research institution funds.

Professional venture capital firms such as Sequoia China, Matrix Partners China, BlueRun Ventures, and IDG Capital have invested swiftly and broadly, engaging with various enterprises and rounds. With the largest number and a significant "bet on the sector" tendency, they are the backbone driving the "humanoid robot fever."

Strategic and industrial investors' goals are more inclined towards long-term collaborative implementation, representing "deeply bound" investments. The involved industrial parties are diverse, including Alibaba, Meituan, Ant Group, Lenovo, JD.com, BYD, BAIC Group, China Mobile, Geely Automobile, etc.

Some invested companies conduct joint technical research and scenario validation with their industrial partners. For example, Galaxy General, invested by Meituan, has strategically cooperated to create the world's first humanoid robot smart pharmacy solution.

National/local government funds involve regions like Beijing, Shanghai, Shenzhen, Zhejiang, Jiangsu, Hunan, Henan, and Anhui. These funds are characterized by obvious policy orientation and a preference for investing in local or key industrial projects.

Among them, Beijing, Shanghai, and Shenzhen are the most active, primarily due to their status as core hubs for national strategy implementation and advantages in policy support, academic resources, and complete industrial chains.

Beijing has established a government investment fund with a total scale of 100 billion yuan to support the development of artificial intelligence and robotics industries.

Shanghai Pudong District has also launched a humanoid robot industry fund with a scale of ten billion yuan.

Shenzhen has established multiple funds to support the humanoid robot industry, with a total scale of approximately 60 billion yuan.

University and research institution funds prefer investing in alumni projects or pioneering research teams, thereby playing a pivotal role in the nascent stages of enterprise incubation. For instance, the Tsinghua Waterwood Alumni Fund has invested multiple times in university-affiliated teams, such as Songyan Power, Accelerated Evolution, and Lingyu Intelligence, all of whose founders hail from Tsinghua University.

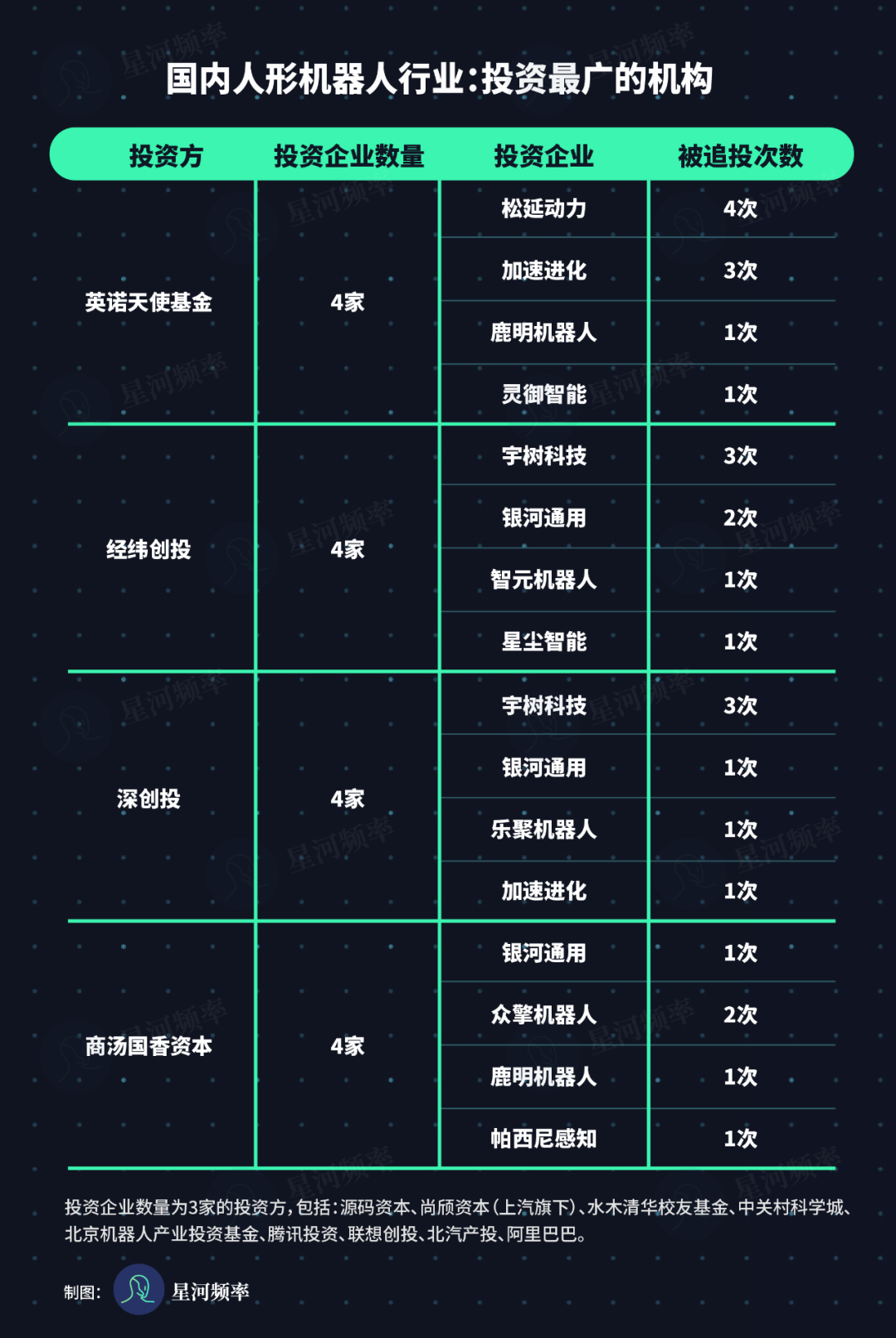

Many investors diversify their bets across multiple companies. Among them, Ennovation Ventures, Matrix Partners China, Shenzhen Capital Group, and SenseTime Capital stand out as the most prolific investors, each participating in funding for four companies. Notably, Galaxy General has emerged as the most favored recipient of these investments.

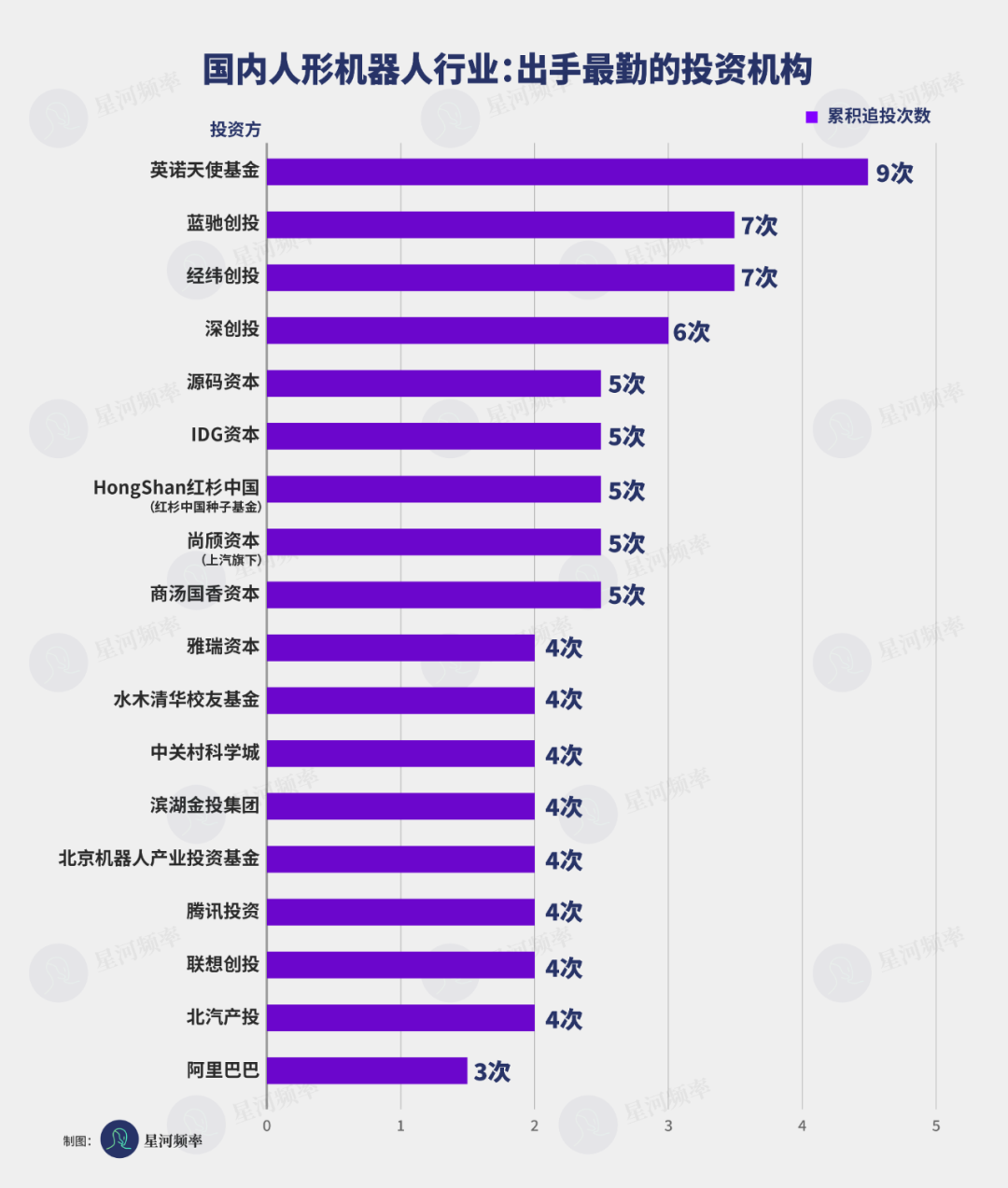

When identifying investors who are particularly keen on following up on their investments, Ennovation Ventures, Matrix Partners China, BlueRun Ventures, and Shenzhen Capital Group frequently reappear across multiple funding rounds, with 9, 7, 7, and 6 investments, respectively.

These investment patterns reveal that venture capital firms that follow a track-based approach tend to secure positions early on, while industrial players prioritize the long-term benefits of deep collaboration.

Investment Trend: Shifting Focus from Ontology to Infrastructure

Capital flows are undergoing subtle shifts. Humanoid robots have entered the technology validation phase, yet many ontology enterprises remain in the engineering ascent phase, characterized by limited application scenarios and extended commercial return cycles.

Concurrently, the debate on "whether it is necessary to build humanoid robots" has emerged as a new focal point within the industry.

Brett Adcock, the founder of Figure AI, the most popular humanoid robot company in the United States, maintains that humanoid robots are the optimal solution. He argues that designing task-specific robots would necessitate millions of robot forms, each with a limited market size, potentially leading to many companies failing to survive the competition. Thus, the "versatile" form of humanoid robots represents the ultimate answer.

Jensen Huang, CEO of NVIDIA, echoes this sentiment, believing that humanoid robots may be the only viable robot option. He has stated that there are only two types of robotic systems in the world that can be easily deployed: autonomous vehicles and humanoid robots.

Conversely, "AI Godmother" Fei-Fei Li holds a contrasting view. She contends that robots have diverse and extensive task requirements. Limiting them to humanoid forms would result in low energy efficiency. To adapt to various functions, robots must exhibit diversity in form, thereby enhancing overall efficiency and productivity. For example, underwater robots are more efficient with a fish-like structure, while aerial robots need to be aerodynamically optimized.

Regardless of the outcome of this debate, capital is already shifting from ontology to "infrastructure" providers with higher technical barriers and scarcity of supply. Companies specializing in dexterous hands, joints, sensors, etc., have become new financing favorites over the past six months. Additionally, more and more firms focused on embodied large models have entered investors' radar, complementing the limitations of robot brains.

Since the beginning of this year, dexterous hand specialists like Lingxin Qiaoshou, In-time Robotics, and Aoyi Technology have secured funding of nearly 100 million yuan each. Robot joint module enterprises such as Nanjing Inks and Motorevo have also received funding ranging from tens of millions to 100 million yuan. The financing of large model enterprises like Zhipingfang Technology, Wisdom Without Boundaries, Qianxun Intelligence, and Independent Variable Robotics is rapidly catching up.

In the past, the ability to create mobile robots was a point of investment. However, by 2025, the capability to create ontologies will no longer be newsworthy. Capital is now seeking robots that can think, adapt, and possess a comprehensive set of ecological components enabling them to move more like humans and operate more reliably.

Capital's bets are transitioning from "investing in technological potential" to "betting on industrial capabilities." For humanoid robot enterprises focused on ontology, the ability to establish a closed loop of "data-model-action-feedback" becomes increasingly crucial.

Under this trend, the tickets to the second wave of financing climax are likely to be held by humanoid robot enterprises that exhibit the following three characteristics:

- Strong Integration Capabilities: Able to integrate both brains (large models and algorithms) and bodies (modular ontologies, actuators, etc.).

- Strong Scene Stickiness: Capable of achieving ROI in specific scenarios and possessing self-hematopoietic capabilities.

- Cost and Scale Control Capabilities: Possessing a clear cost reduction roadmap, as well as the ability to deliver in batches or ship standard modules.

The capital battle for humanoid robots has commenced, but the true industry battlefield is just emerging.