Behind the "Runaway" Scandal of Manus: The Commercialization Dilemma of AI Agents

![]() 07/22 2025

07/22 2025

![]() 641

641

Remember the AI Agent that captivated the entire internet just three months ago?

In March 2025, Manus burst onto the scene, becoming an overnight sensation in the tech world with a demo video showcasing an "intelligent agent autonomously completing tasks." Within a week, 2 million users scrambled to make reservations, and beta access codes were sold for up to $100,000, heralding the next AI revolution akin to ChatGPT.

However, this euphoria lasted only 130 days. When the first batch of users truly experienced the product, their initial excitement was shattered by the reality of its performance. People discovered that this supposed all-around assistant relied heavily on stitching together large model APIs, performing only a few standardized tasks, and often struggling with complex scenarios.

Manus' plight is not an isolated case. Another star Agent company, Lanma Tech, ceased paying employee salaries for several months due to funding disruptions early in 2025 and is currently seeking merger and acquisition opportunities.

Although general-purpose agents are widely seen as the necessary path to achieving AGI, reality has dealt a heavy blow to this vision. Industry reports predict that by 2027, around 40% of AI Agent projects may be eliminated due to cost overruns or unclear business models.

So, does the struggle of general Agents reflect the difficulties of the entire Agent industry? What must future Agents do to be accepted by the market?

In the video that catapulted Manus to fame, the intelligent agent could automatically screen resumes, analyze stocks, plan travel, and even "think" about complex tasks like a human. Beta access codes became scarce, capital flocked in, and Benchmark, a top Silicon Valley venture capital firm, led a $75 million investment, driving the company's valuation to $500 million. Media outlets hailed it as the next paradigm for human-machine collaboration.

For a time, Manus became the benchmark for AI startups, as if it truly had the potential to change the world.

However, beneath the fanatical adulation, whispers of doubt emerged quietly.

As time passed, users discovered that Manus' actual experience fell far short of the hype. The buzz quickly faded, and visitor numbers declined month by month.

On one hand, Manus' core capabilities were not self-developed but relied on third-party large models like OpenAI's GPT-4 and Anthropic's Claude, with Manus only providing the packaging. Insiders mocked it as an "AI shell agent"—able to break down tasks but reliant on preset RPA for execution, leading to failures when unexpected situations arose. For example, after a massive influx of users, Manus' response speed slowed significantly, revealing a bottleneck in computing power. Some users reported that Manus often failed in complex tasks, providing unreasonable answers.

On the other hand, the high price deterred many users. Pricing ranging from $19 to $199 per month was even on par with leading large language models like ChatGPT, but its actual performance lagged far behind. This imbalance in cost-effectiveness left many paying users feeling deceived. For example, Manus claimed to be able to complete complex tasks like e-commerce price comparisons but omitted data from platforms like Pinduoduo and Tmall during actual operations, even containing factual errors in core data; in financial modeling, Manus still used beta values from 2023, severely disconnected from the real-time market with deviations exceeding 15%; and in video capabilities, when given the instruction "a warm scene of harmonious cat-dog coexistence," Manus produced a "Frankenstein"-like creature with a dog's head and a cat's body.

In a sense, those who subscribed at high prices ($19-$199 per month) were not greeted by an intelligent assistant but rather a compilation and stitching of model capabilities that could malfunction at any time.

In fact, Manus' declining reputation was not accidental; its plight reflects the collective dilemma of the entire general AI Agent track—rushing to commercialization before the technology is mature, with capital-fueled bubbles masking product flaws.

Gartner predicts that by 2027, 40% of agent projects will be eliminated due to "excessive costs and unclear commercial value."

And when the tide recedes, those swimming naked will be exposed. The story of Manus may be just the beginning of this wave of winnowing.

Just a few months ago, Manus' sudden popularity led people to believe that the era of general-purpose intelligent agents had arrived, with entrepreneurs flocking to this track, as if simply labeling their products as Agents would easily attract capital favor. However, the reality is that a large number of general AI Agent products have failed, and the initial impetuosity and bubbles in the industry are gradually becoming apparent.

Why haven't general Agents continued to excite the market like large language models?

Because the general AI Agent products on the market, despite their many flaws, are essentially just a layer of skin over large models. They call upon APIs from leading models like GPT-4 or Claude, add a customized frontend interface, and call themselves Agents. This model has a low development threshold and fast launch speed but also means severe homogenization and a thin moat. Similar products all perform the same process of "receiving input → calling the model → parsing output → displaying results," lacking competitiveness, and once the prices of large model interfaces rise or policies change, they may become unsustainable.

Furthermore, general Agents' dependence on large models leads to a lack of a unified underlying architectural design, often falling into grandiose narratives that are broad but not deep, lacking a clear product positioning.

General Agents actually have an unflattering nickname among the public—"Frankensteins." That is, to showcase multifunctionality, products forcibly integrate RPA, web crawlers, data analysis tools, resulting in bloated systems that cannot truly adapt to complex tasks, leading to poor user experiences. The AI Agent developed by McDonald's in collaboration with IBM was eventually abandoned due to frequent errors in real restaurant environments. Due to the discrepancy between technical effects and business needs, when companies discover that the Agent products they have invested heavily in do not bring the expected efficiency improvements, they naturally abandon further investment.

No one is willing to pay, leading to low user retention and conversion rates, but the costs of general Agents are not low. Compared to specialized Agents, general Agents rely on multiple large model APIs, consuming more tokens. And due to their higher task generalization, the development and maintenance of general Agent products require continuous investment in significant computing power and engineering resources. However, many startups blindly adopt the free customer acquisition model of "acquire users first, monetize later" from the internet era at the initial stage, ignoring the high-cost nature of general Agent services. This contradiction between high costs and low conversions directly leads to a cash flow crisis once financing cannot keep up.

It is not difficult to see that the bubble of general Agent startups is bursting, and those companies that cannot achieve commercialization and rely solely on storytelling and stacking models to attract capital are destined to be eliminated.

But does the lack of optimism for general intelligent agents mean that the path of Agents is blocked?

The current AI Agent field is undergoing a brutal reshuffle—high research and development costs and unclear commercialization paths have caused many players to withdraw in disappointment. However, amidst the widespread despair, there are still companies like GenSpark and Salesforce that have grown against the trend, not only surviving but also running sustainable business models.

Why is the Agent track experiencing such contrasting fortunes? Perhaps we can explore the survival models of these successful profitable companies to find out.

First, small and exquisite is better than large and comprehensive.

Many AI Agents have failed because they tried to create a universal assistant, resulting in neither surpassing general large models nor truly landing in specific scenarios. They excessively pursued the versatility and intelligence of technology but overlooked the real concerns of enterprise customers—what can I actually do with this thing?

Unlike the blind pursuit of general intelligence, some AI Agent companies choose to delve deeply into vertical fields, providing customized solutions to address pain points and embedding agents into customers' business processes, establishing technological and data barriers.

For example, this year, a dark horse in the Agent field suddenly burst into the public eye—Genspark. With only 20 employees, the company achieved an annual recurring revenue of $36 million just 45 days after launching Super Agent.

An important reason is finding the right specialized track.

Genspark initially focused on AI search but found that the field was already dominated by giants like Google and Perplexity, so it decisively transformed into AI Agents, focusing on rigid enterprise needs such as office automation, data analysis, and file management.

It is reported that Genspark's verification efficiency is 60% higher than traditional search engines, with a false information filtration rate of up to 98%. In practical application scenarios, financial industry clients using GenSpark shortened the time to write investment research reports from 3 days to 8 hours; academic institution users reported a 50% increase in efficiency when using GenSpark for literature reviews.

By achieving excellence in vertical fields, the halfway converted Genspark was able to stand out in the Agent competition.

Secondly, unlocking the willingness to pay is crucial.

After solving the question of what to do, another question arises: how much money can this AI actually help customers earn or save?

Many general Agent companies are obsessed with showing off their skills but overlook the real pain point of business operations—ROI (Return on Investment). When every product claims to have Agent capabilities, what sets the game-changers apart?

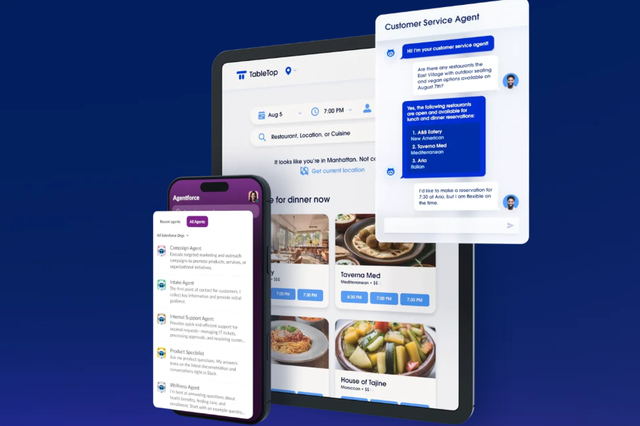

The key lies in helping customers define the value anchor of AI. The reason Salesforce's Agentforce was able to attract 5,000 institutions for deployment and achieve an annualized revenue of $1 billion within a year of its launch is that it combines two features: explainability and pay-as-you-go. Explainability means that every AI decision can trace back its reasoning process, allowing enterprises to clearly understand "why the AI made this judgment," lowering the trust threshold; pay-as-you-go, in addition to the membership model, the platform also offers a business model where enterprises pay per conversation, providing more flexibility and transparency in the cost structure.

AI Agents deeply integrated into business processes obtain sustained commercial revenue by directly addressing enterprise pain points. This also illustrates that enterprise customers do not pay solely for the concept of Agents but rather for quantifiable, auditable, cost-saving solutions.

Finally, data feedback and community innovation establish an ecological moat.

Technology is evolving rapidly, and for enterprises to survive, they must maintain competitiveness and make their products smarter over time. To keep up with the times, the above-mentioned successfully deployed, market-recognized specialized Agent products must further collect a large amount of user feedback in real scenarios, build data loops, and establish community networks to further nurture the rapid iteration of agents.

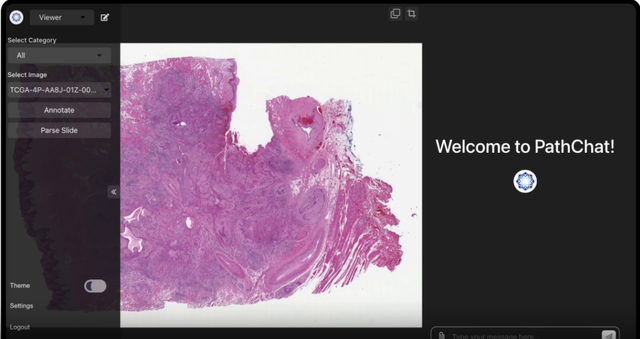

Medical Agent PathChat helps doctors quickly identify tumors by analyzing microscope images and patient data. After accumulating a large amount of exclusive medical data, it improved the recognition accuracy rate from 78.1% to 89.5%, further consolidating its professional moat; Salesforce's launched Agent platform allows developers to create various industry Agent applications, with the participation of third parties enriching platform functionality, which in turn attracts more enterprise customers to adopt Salesforce's AI solutions.

Agent companies that elevate single products into ecosystems will be harder to shake.

In short, although the enterprises that remain standing amidst the AI Agent winter have their own unique strategies, they are all pragmatic practitioners who deeply integrate technology with scenarios. Those speculators who blindly chase trends and ignore user needs will eventually be eliminated by history. The story of Manus may not yet have a definitive conclusion, but the discussion it leaves behind for the industry is valuable: The mission of AI Agents is to become capable assistants to humans, not castles in the air in capital games.

Any technology that does not want to be just a flash in the pan must be down-to-earth, focus on scenarios, and create value to truly emerge from its predicament and usher in its own spring.