Google Charges Ahead with AI: Unveiling the Untapped Opportunities

![]() 08/04 2025

08/04 2025

![]() 528

528

Reflecting on the second quarter's AI advancements, stock prices have staged a remarkable recovery, with NVDA soaring from a nadir of 86 yuan to its current mark of 175 yuan. Despite this, AI's relentless progress has persisted, previously obscured by numerous short-term disruptions. The sequel to the AI narrative has now commenced.

Will Google's specter of uncertainty dissipate?

Last week, Google's second-quarter earnings report surpassed expectations, with advertising revenue remaining unscathed by AI search. Notably, Google's total search volume continued to expand by 2%, with token invocation volume doubling in the second quarter—from 480 trillion in April to 960 trillion in July—signaling a rapid escalation in demand for Google's AI services.

As illustrated in the chart below, Google's token invocation volume stood at 142.6 trillion per month at the year's outset, surging exponentially within the year. What will this figure be by year's end? Will it multiply tenfold or even twentyfold?

Google's CEO affirmed a significant surge in AI demand, with the AI overview boasting 2 billion monthly active users, an increment of 500 million from the first quarter. Consequently, this year's capital expenditure (capex) guidance has been revised upwards to $85 billion, with projections of continued growth next year, potentially reaching $100 billion.

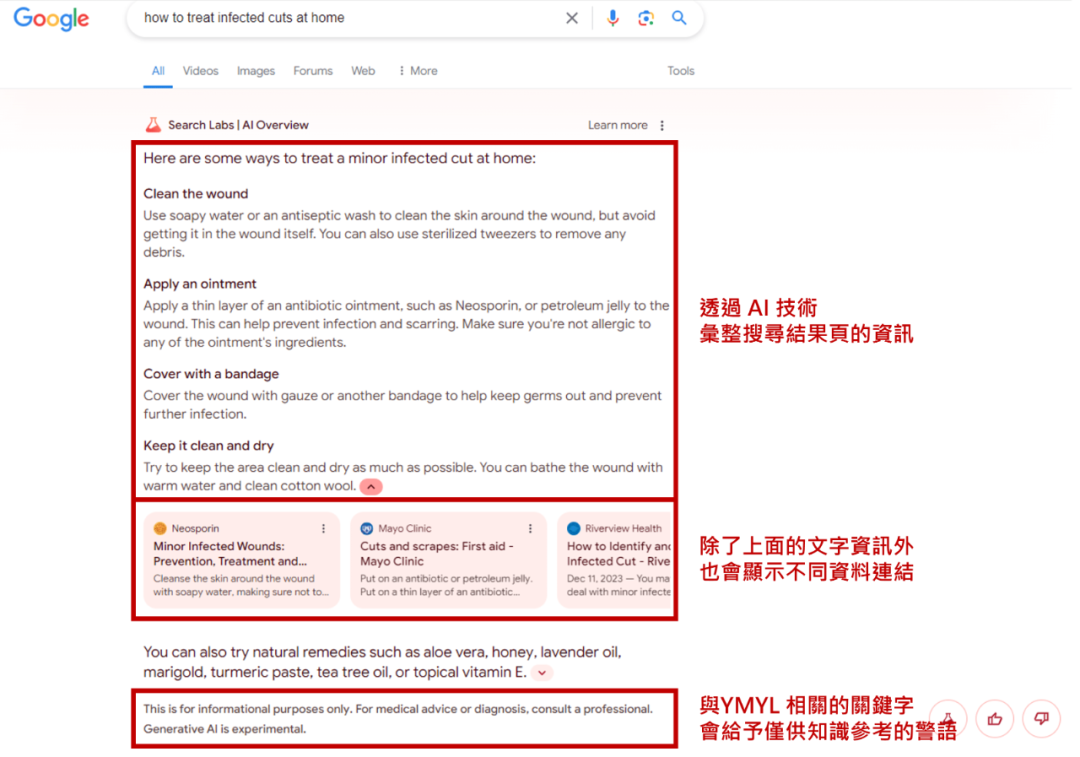

What exactly is the AI overview?

As depicted in the image below, an AI summary is presented at the top of the search results page, inclusive of the information source. Essentially, it is the response to a search query formulated by a large model. Google has integrated Gemini into its search engine, enabling every user to experience Gemini. This explains the surge in Google's token consumption, which is inherently tied to AI search.

Intriguingly, Google is currently the most undervalued by the market, with an estimated price-to-earnings (PE) ratio of less than 20 times.

From this vantage point, even "undervalued" Google is augmenting its capex. How much will Meta, Microsoft, and Amazon, which are favored by the market, increase theirs? By $10 billion each? Or perhaps an even more substantial amount?

Current concerns surrounding Google:

Firstly, Google's antitrust lawsuit with the Department of Justice has deterred long-term investors, with only hedge funds purchasing Google stock. Should the lawsuit resolve favorably, long-term investors may resume buying.

Secondly, there is the specter of Google versus AI search. In May, Apple executives stated that Safari search volume had declined, hinting at a potential future collaboration with AI search, causing Google's stock to plummet by 8% that day.

However, subsequent to that steep decline, Google's stock has continued its ascent to the present day. This is attributable to two factors: firstly, foreign research institutions have found that AI search is challenging to commercialize due to higher costs, unlike traditional search engines. Secondly, the decline in search volume mentioned by Apple executives pertains solely to searches on Apple devices, not impacting Google's overall search volume. Notably, following the launch of the AI overview, there is a clear synergistic effect between Gemini and Google search, contributing to Google's continued search volume growth in the second quarter.

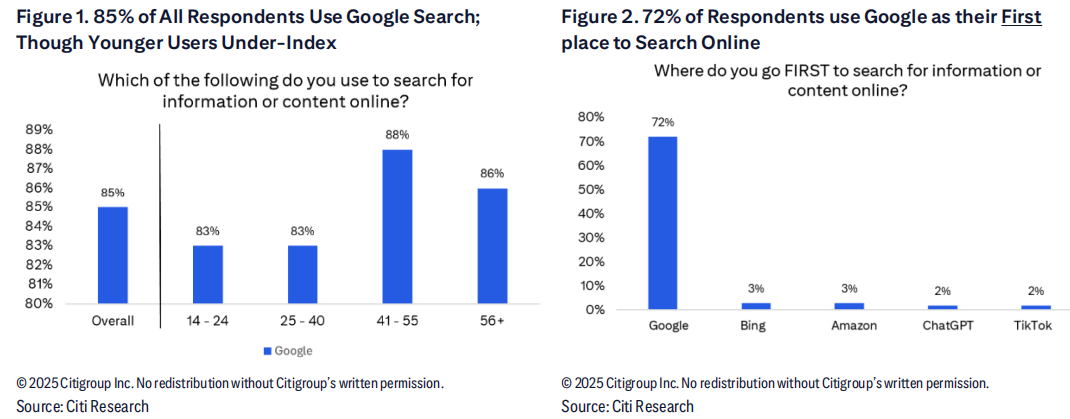

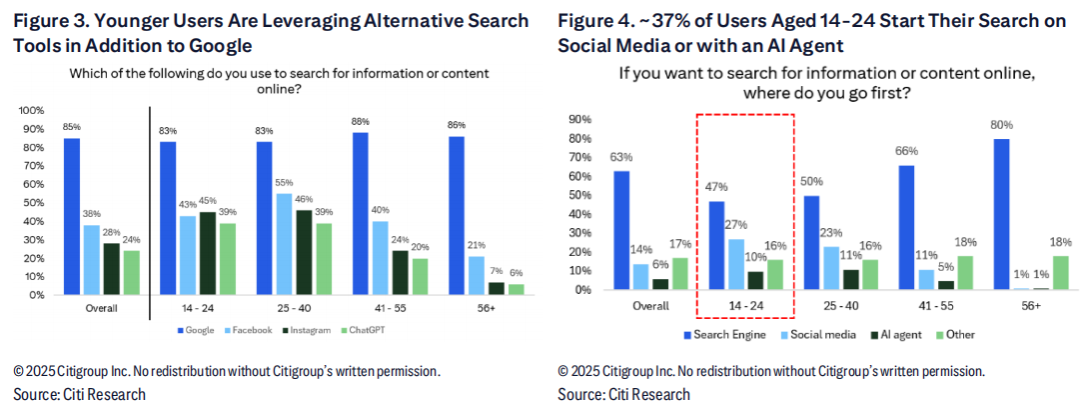

Two data points underscore that after Google launched the Overview, it received positive feedback, with the majority of users still relying on Google search.

Citi report: 85% of respondents utilize Google search, with younger users exhibiting a lower index, while users aged 41-55 utilize Google the most. 72% of respondents stated that Google is their preferred online search tool, with only 2% choosing ChatGPT and Bing.

From a user demographic perspective, younger users are more inclined to use alternative search tools, such as social media (X/INS/TikTok) and AI large models.

While AI search represents a medium- to long-term concern for Google, it remains unrefuted in the short term.

Therefore, the forthcoming trend might entail long-term investors reallocating their positions in Google after the antitrust lawsuit is resolved, given that Google's search volume is still expanding, whereas AI search will not grow as swiftly due to higher costs and monetization challenges.

However, considering the market's ongoing focus on the long-term narrative that AI search is the ultimate goal, Google's valuation will remain moderate, such as the current PE ratio of less than 20 times, or possibly 20-25 times if it improves marginally.

Hence, Google stands as the tech stock with the most pronounced expectations gap. If it can seamlessly integrate search and AI in the future, will the underestimated Google truly emerge as the leader in AI search?

Cheaper AI hardware post-capex increase.

Following Google's capex augmentation, AI hardware stocks collectively surged. The rationale is straightforward: token invocation volume is doubling, and the demand for inference from Meta, Amazon, and Microsoft is skyrocketing. It is inevitable that these cloud service providers (CSPs) will also elevate their capex during their earnings announcements in the coming days, as company communications indicate that hardware orders for next year have been significantly revised upwards.

For instance, optical module companies like InnoLight Technology, Sunrise Optics, and Shenghong Technology have witnessed their stock prices more than double since April, yet their valuations are becoming increasingly attractive, with orders continuously increasing. By next year's 800G era, with the release of 1.6T products, these companies' performance will accelerate even further than this year. The growth of AI hardware is merely beginning to revert to reasonable valuations.

We have been meticulously tracking AI hardware opportunities on our knowledge platform.

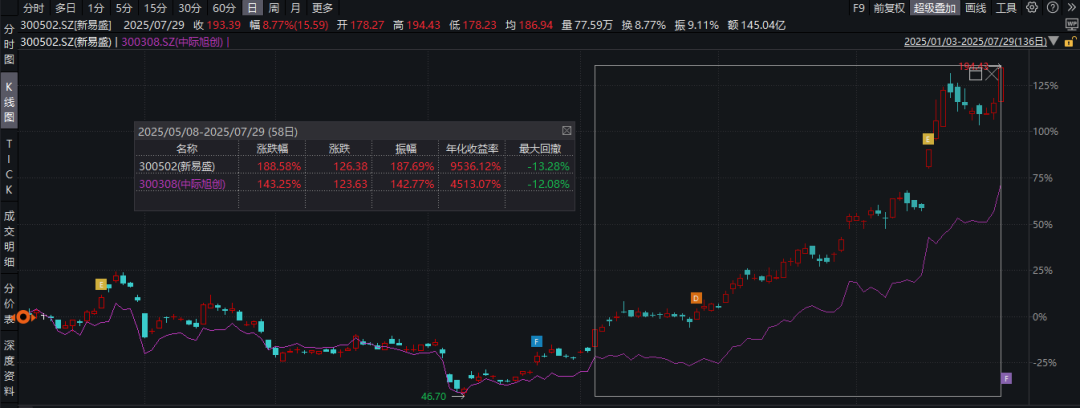

Since May 8th, Sunrise Optics has surged nearly 200%, and InnoLight Technology has risen over 140%.

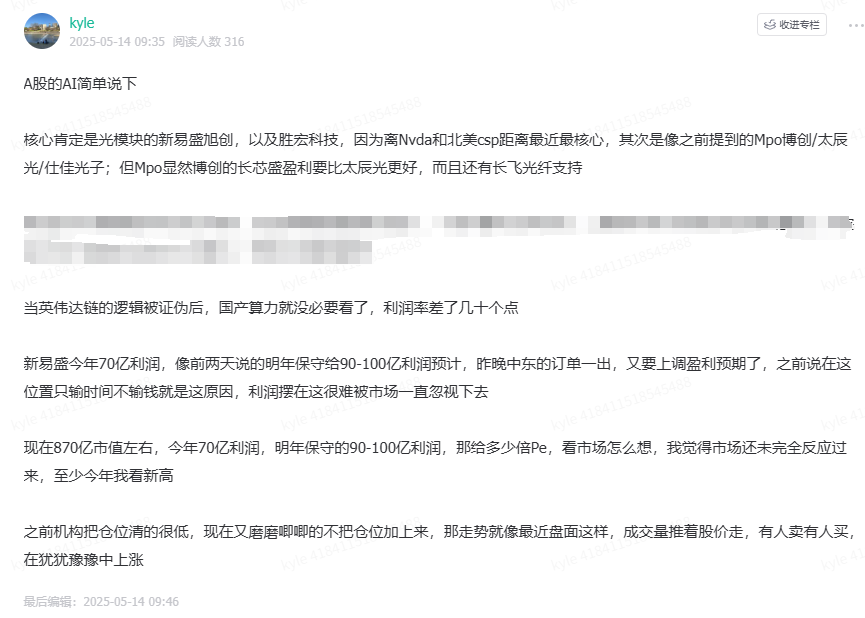

In May, we highlighted on our platform that the current market valuation was overly conservative and that the market had yet to fully react, with new highs anticipated at least within the year. Our report mentioned that Sunrise Optics would be the primary beneficiary of 800G optical modules next year, when the stock price was still hovering around 80 yuan.

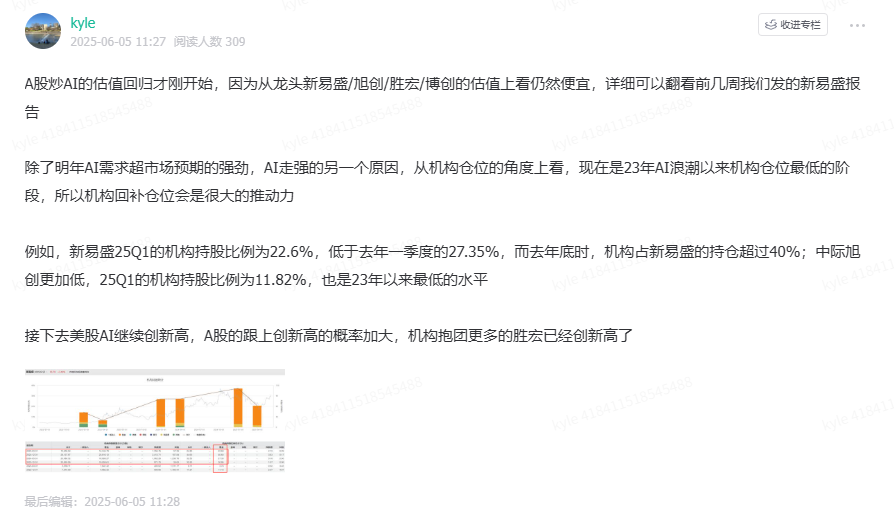

In early June, we also emphasized that the valuation recovery of AI had just commenced, with InnoLight Technology, Sunrise Optics, Shenghong Technology, and BOC Telecom still offering attractive valuations.

We promptly update our platform with valuable sell-side reports and real-time market interpretations, encompassing extensive AI opportunities. For instance, in February, we covered a report on MPO by Longxin Bocreat, and in July, we featured Yangtze Optical Fiber and Cable, all of which have performed admirably since our tracking began.

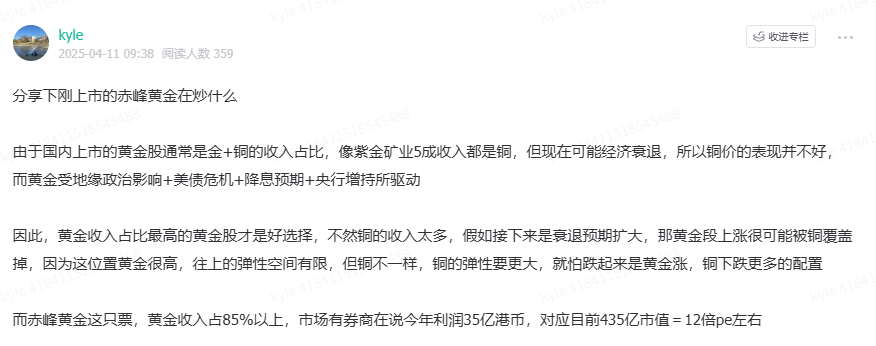

Amid the overarching trend of increasing AI capex by U.S. tech stocks, we believe that the AI hardware market is far from its conclusion, with numerous segmented Alpha opportunities awaiting discovery, such as MPO by Longxin Bocreat and Credo in the U.S. stock market. Beyond the AI industry, we cover a broader spectrum of Hong Kong-listed companies, including Mogoping and Bricks for IPO recommendations, Jayin Technology mentioned in our March report, Chifeng Gold in the H-share market highlighted in April, Hua Hong Semiconductor in May, AI hardware in the A-share market, and snack stores discussed in June.

Most recently, in July, we highlighted the opportunity in ETH, which was priced at $3,000 at the time and is now nearing the $4,000 mark.

In summary, we anticipate that the Hong Kong stock market will continue to improve in the second half of the year, with numerous new stocks sustaining the IPO bull market. Trust us to uncover and analyze these opportunities for you. Welcome to join our platform!