Will New EU Technology Transfer Regulations Cloud the Future of Chinese Automakers?

![]() 11/05 2025

11/05 2025

![]() 456

456

Lead | Introduction

Chinese automakers are currently flourishing in the EU market, enjoying clear advantages in terms of product quality and cost. However, this promising scenario may soon face challenges due to the introduction of new EU regulations.

Published by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

Word Count: 2,681 Chinese characters

Estimated Reading Time: 4 minutes

Recently, foreign media outlets have reported that the EU Trade Commissioner and the Danish Foreign Minister have indicated that the EU is exploring preconditions for Chinese companies' investments in Europe. These include technology transfer and know-how sharing. Additionally, the EU may impose other requirements, such as mandating the use of a certain amount of EU-sourced goods or labor and increasing product value within the EU. Chinese automobiles and batteries are likely to be the first sectors affected. The EU's ambition to gain a share of China's new energy vehicle industry is becoming increasingly apparent. Related policies could be introduced as early as November, with the European Commission expected to submit a comprehensive report by the end of the year to evaluate these regulations.

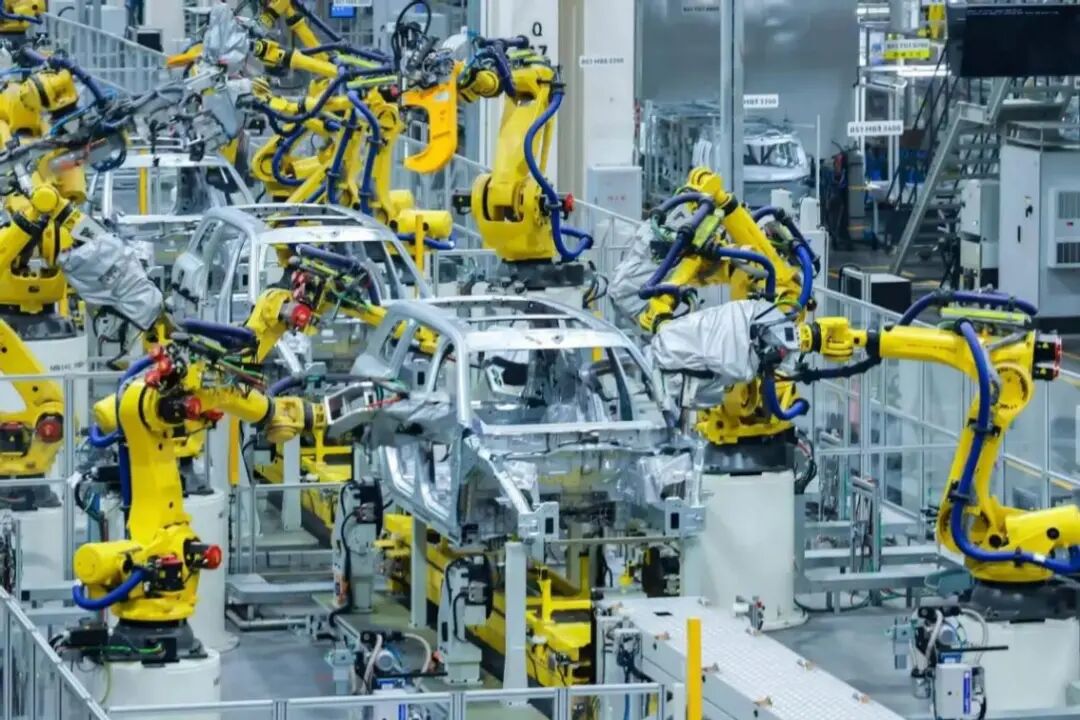

△ The EU is exploring preconditions for Chinese companies' investments in Europe

Why is the EU Introducing New Regulations?

According to data from the European Automobile Manufacturers Association (ACEA), nearly 5.58 million new vehicles were sold in the EU in the first half of this year, maintaining its position as the world's third-largest automotive market. Consumers in the EU demonstrate strong purchasing power. Within the EU automotive sales structure, the rapid increase in electric vehicle (EV) sales is particularly attractive to Chinese automakers, who possess generational advantages in EV product quality and cost control. Specifically, 869,300 pure EVs were sold in the EU during the first half of the year, marking an 8% year-on-year increase and outpacing the overall EU automotive market's growth. The market share of pure EVs rose to 15.6%. Additionally, hybrid vehicles accounted for 34.8% of the market, plug-in hybrids for 8.4%, gasoline vehicles for over 28%, and diesel vehicles for nearly 10%.

Despite the EU imposing tariffs of up to 35.3% on Chinese EVs in 2024 to curb their rapid expansion, China's automotive exports to the EU have continued to grow through plug-in hybrid and fuel-powered vehicles. According to customs data, China exported approximately 601,000 vehicles to the EU in the first half of this year, a 19.6% year-on-year increase, surpassing the overall export growth rate. Thus, the competitiveness of Chinese automakers is no longer confined to EVs, where they have a first-mover advantage. With higher cost-effectiveness and stronger product quality, fuel-powered vehicles are also gaining ground in the EU automotive market, directly impacting the competitiveness of local EU automakers. If Chinese exports of plug-in hybrids and fuel-powered vehicles to the EU continue to rise, the EU may impose tariffs on other vehicle types beyond EVs in the future.

△ Chinese automobiles are making significant inroads into the EU market

What is even more concerning for the EU and its member states is that, in addition to imported complete vehicles from China, Chinese automakers are making remarkable progress in establishing local factories in the EU. BYD plans to set up its European headquarters and a passenger vehicle factory in Hungary, investing approximately 40 billion yuan to build a production capacity of 200,000 units. Chery is not only constructing a joint venture factory in Barcelona, Spain, to produce models such as Omoda and Jaecoo but is also in talks with the Italian and UK governments about building factories, with rumors even suggesting potential acquisitions of brands under Stellantis. SAIC Motor is considering France to further expand MG's sales in the European market. As for Xpeng and Leapmotor, the former has already engaged Magna, the manufacturer of the Mercedes-Benz G-Class, for contract manufacturing, while the latter is expected to leverage the capabilities of its shareholder Stellantis for European production. Additionally, Geely, Dongfeng, GAC, and Great Wall Motor are all reported to be scouting locations. Undoubtedly, Chinese automakers are seeking rapid expansion of their market share in Europe, which will inevitably have a significant impact on local European automakers.

△ Xpeng will entrust Magna's factory in the EU for contract manufacturing

Raising the Bar for Entry into the EU

Under such circumstances, it is only natural for the EU to introduce new policies to curb the development of Chinese automakers. For Chinese companies, the short-term impact of the EU's new regulations will be significant, but the EU market cannot be abandoned. Chinese automakers will undoubtedly make every effort to adapt to the new EU market regulations, making it imperative to conduct prompt assessments and develop contingency plans.

△ The EU automotive market is crucial for Chinese automakers

Intellectual property (IP) work requires special attention. If technology transfer is inevitable in the initial stages, a comprehensive IP contract will serve as a strong constraint on the technology recipient, maximizing the protection of Chinese companies' core interests.

Business plans need to be updated. The introduction of new regulations means a substantial change in the overall logic of investing in the EU. Whether establishing joint ventures, setting up local R&D centers, hiring more local workers, or using local products, the entire business plan must be revised to calculate the return on investment. The automotive industry is highly interconnected, and changes in one area can affect the entire ecosystem.

Moreover, Chinese automakers' local investments in the EU will face stricter scrutiny. More operational data, such as technology sources and product value-added data, will need to be submitted, increasing local operational costs. Companies will also need to adjust their organizational structures by establishing dedicated compliance teams to coordinate across departments and avoid non-compliance issues.

The EU is Not an Absolute Winner

However, every policy has its pros and cons.

The governments of countries affected by the new regulations will inevitably take countermeasures against the EU's new policies, whether through the WTO framework, tariffs, or market access restrictions, to retaliate against EU companies.

Once the new regulations are implemented, defining "technology transfer" or "IP sharing" will raise significant questions. If only assembly technology is transferred, the impact on Chinese companies will be minimal. After all, for Chinese automakers to assemble complete vehicles or battery packs locally in Europe, local entities must know the assembly parameters; otherwise, the work cannot proceed. However, if product design know-how is transferred, it could touch upon the core interests of Chinese companies. Nevertheless, this can be viewed from two perspectives. If some companies are willing to transfer technology and the recipient companies are willing to pay a reasonable amount, the issue is not significant. There is already a case in China where Xpeng transferred technology to Volkswagen, which was a purely commercial decision. Ultimately, both Xpeng and Volkswagen achieved mutual benefits and a win-win outcome. However, if the EU forces companies unwilling to transfer their core technologies to do so, especially when some Chinese automakers' local factories are already in operation, it would be a typical example of exploitative logic taking advantage of a desperate situation.

△ If only assembly technology is transferred, the impact on Chinese automakers will be minimal

Additionally, it must be noted that the EU is, in essence, a loose alliance, with each member state government having its own calculations. Chinese automakers have made significant investments in Hungary and Spain, while German and Swedish automakers have substantial interests in China. Even France, which has a relatively tough stance on Chinese new energy vehicles, has its major brand, Renault, engaging in comprehensive cooperation with Chinese automakers. Therefore, considering all these factors, the EU is not a unified bloc. After all, the Chinese and European automotive industries are deeply interconnected, and changes in one area can affect the entire ecosystem.

△ The Chinese and European automotive industries are deeply interconnected

In fact, compared to government-level competition, a decrease in corporate investment willingness poses a greater hidden risk for the EU and its member states. Take Chinese complete vehicle and battery companies as examples; they are actively setting up factories in the EU not only to avoid the high EV import tariffs imposed last year but also to establish a stronger local presence and respond more quickly to customer needs. Such investments have created numerous job opportunities and revitalized several factories that were previously on the brink of closure or had ceased operations. While imported complete vehicles may be suspected of displacing local jobs, Chinese automakers producing locally are essentially no different from local automakers.

Commentary

The competitiveness of the Chinese automotive industry has undergone a remarkable transformation. It not only holds a significant advantage in EVs but also demonstrates strong competitiveness in traditional fuel-powered and hybrid vehicles, thanks to China's well-established automotive industry supply chain and accumulated experience. Chinese automakers have become a formidable force globally. Therefore, it is inevitable that major automotive manufacturing countries, such as those in Europe and the United States, will impose restrictions to protect their own interests, leading to an increase in trade barriers. Nevertheless, Chinese automakers are continuously enhancing their internal capabilities, and their global expansion is unstoppable.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)