Without the Chinese Market, Can NVIDIA Still Rake in Huge Profits?

![]() 09/05 2025

09/05 2025

![]() 731

731

“This quarter, no H20 products were sold to Chinese customers.”

NVIDIA, well aware of investors' keen interest in its China business, proactively highlighted this point at the beginning of its Q2 earnings press release.

Nonetheless, NVIDIA's Q2 earnings report, released on August 27 (U.S. time), was nothing short of impressive:

Total revenue soared to $46.7 billion, marking a 56% year-over-year increase;

Net profit reached $26.42 billion, up 59% from the same period last year.

This performance not only exceeded NVIDIA's guidance in its Q1 earnings report but also surpassed market expectations.

In its Q3 guidance, excluding revenue from H20 product sales to Chinese customers, total revenue is projected to hit $54 billion, with gross margins continuing to climb.

However, the significance and potential of China's AI market are well known. Besides the H20 chip, NVIDIA's Executive Vice President and CFO Colette Kress also disclosed that the Chinese market's contribution to data center revenue dropped to a low single-digit percentage on a quarterly basis.

Following the earnings release, NVIDIA's stock price initially dipped due to concerns over the lack of a China-centric highlight.

During the post-earnings conference call, analysts also brought up this issue. CEO Jensen Huang had to put on a positive spin, stating:

“The scale of opportunities the Chinese market presents to us this year is roughly $50 billion. If we can fully capitalize on this opportunity with competitive products, and given the overall expansion of the global AI market, we anticipate the Chinese market to grow by approximately 50% annually.”

NVIDIA may not need the Chinese market to turn a profit now, but it will in the long term.

Let's delve deeper into more insights from this global chip giant's Q2 earnings report.

01

The Chinese Market: An Essential Piece of the Puzzle

Over the past few years, we've grown accustomed to NVIDIA's remarkable growth.

However, in Q2, NVIDIA's revenue growth slowed to a “moderate” 50-60%, a stark contrast to its previous super-high growth rates. On a quarterly basis, it even seemed a bit “growth-weary,” with revenue up only 6% sequentially.

Breaking down the business segments, while the overall figures looked promising, there were some red flags.

Core data center revenue hit $41.1 billion, up 56% year-over-year but only 5% sequentially;

Gaming and AI PC revenue reached $4.287 billion, up 49% year-over-year and 14% sequentially;

Professional visualization revenue was $601 million, up 32% year-over-year and 18% sequentially;

Automotive and robotics revenue stood at $586 million, up 69% year-over-year and 3% sequentially.

In the data center segment, revenue from the H20 chip, tailored for China, plummeted by $4 billion. The Chinese market's share of data center revenue dwindled to a low single-digit percentage on a quarterly basis.

NVIDIA managed to offset some of the losses by selling approximately $650 million worth of H20 products to unrestricted customers outside China—initially, they expected to lose $8 billion.

Clearly, to sustain high growth, NVIDIA cannot afford to overlook the Chinese market.

The good news is that after negotiations with the Trump administration, NVIDIA secured government approval to sell H20 chips to Chinese companies by “voluntarily” surrendering 15% of its sales.

However, CFO Kress expressed uncertainty about the final revenue scale of H20 this quarter. “But what is certain is that if market demand further surges and sales licenses are further approved, we can still ramp up H20 production capacity and increase deliveries.”

In the data center business, NVIDIA's new-generation Blackwell architecture chips made a bigger contribution. Revenue from this product jumped by 17% sequentially in Q2.

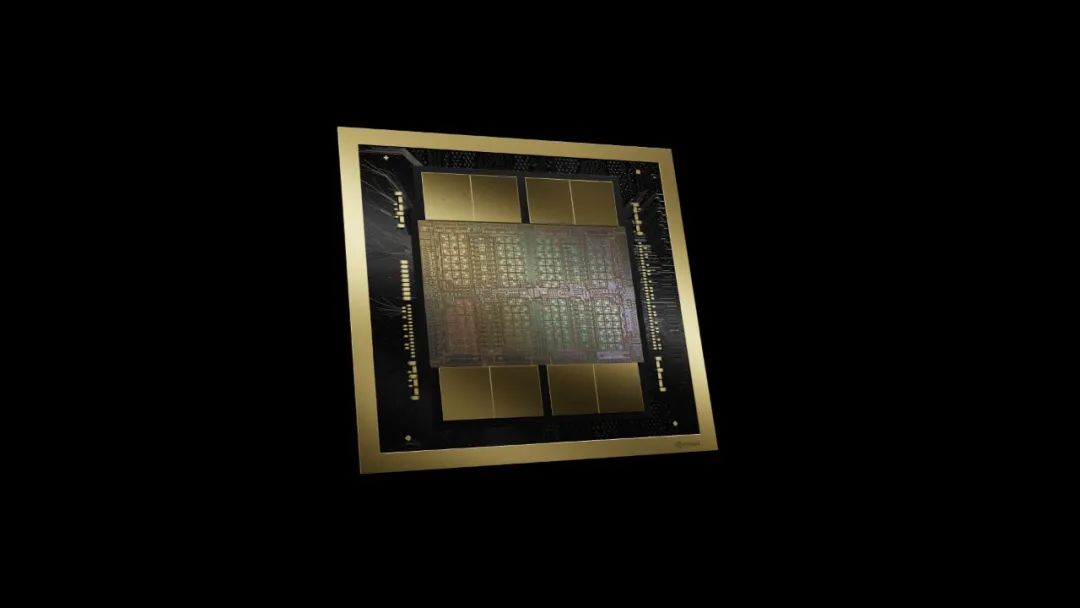

Blackwell Architecture Chip

So, is there a chance to sell Blackwell architecture chips to China? Trump hinted that sales to China could be considered if performance was slightly compromised.

Jensen Huang also chimed in, “I believe there is a real possibility for NVIDIA to introduce Blackwell architecture chips into the Chinese market.”

Previously, it was reported that NVIDIA had developed a “crippled” version of the B30A chip, seeking U.S. government approval for sales to China. This chip also utilizes the Blackwell architecture but has only half the computing speed of the B300.

02

Automotive and Robotics Business: Small Share, Big Growth

Within NVIDIA's revenue portfolio, the automotive and robotics end-device business segment still accounts for a relatively small share.

In Q2, revenue from this segment reached $586 million, up 69% year-over-year and 3% sequentially.

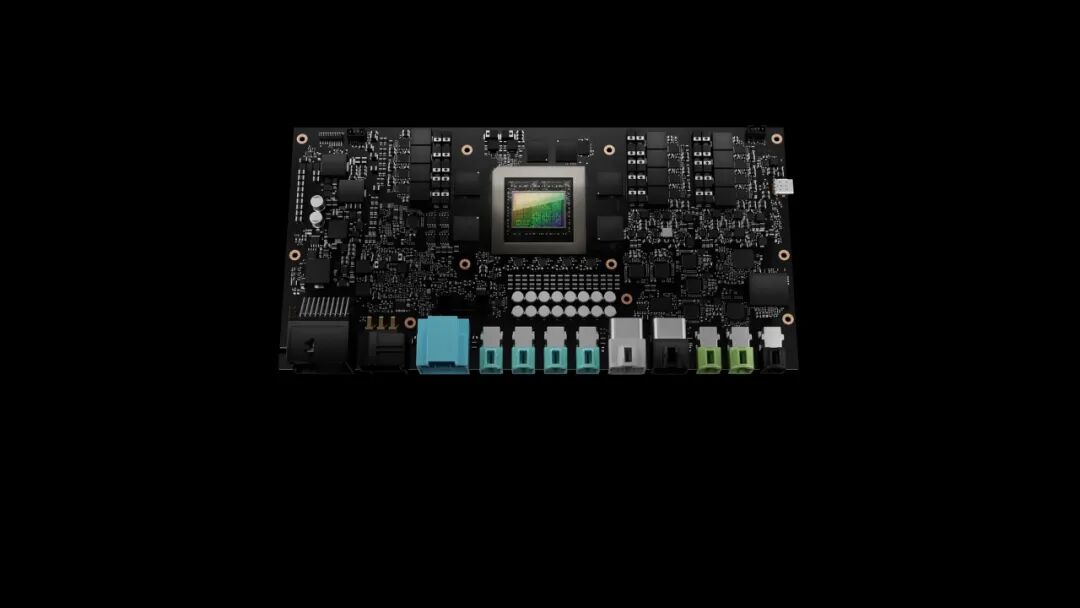

Kress attributed the growth mainly to autonomous driving solutions. “We have commenced deliveries of the NVIDIA Thor SoC, which succeeds Orin. Thor's launch aligns with a critical juncture in the industry's acceleration towards vision, language, model architecture, generative AI, and higher-level autonomous driving technologies. It is our most successful robotics and autonomous driving computing product to date.”

Thor SoC

Kress projected that Thor “opens up new revenue opportunities worth billions of dollars.”

This segment has a stronger connection to China. On one hand, almost all the first batch of companies adopting Thor chips in their vehicles are Chinese automakers: Li Auto, Zeekr, WeRide, etc. On the other hand, the two largest previous buyers, NIO and XPeng, have started using self-developed chips to replace NVIDIA's. These two companies purchased nearly 1 million NVIDIA ORIN chips in 2024.

This partly explains why the automotive business's sequential growth nearly stalled. Looking ahead, Li Auto and Xiaomi will inevitably develop their own chips and integrate them into their vehicles in real-time.

Moreover, mid-to-low-end Chinese automakers will also adopt chips from Horizon Robotics, Huawei, etc. NVIDIA's once-dominant position in automotive computing chips has started to erode.

Regarding the robotics business, NVIDIA remains optimistic, stating that leading companies across various industries have adopted Thor. Meanwhile, the computing demand for robotics applications on the device side and infrastructure side is growing exponentially, which will become a significant driver of long-term demand for NVIDIA's data center platform.

03

Is There an AI Bubble?

Over the past year or two, the AI trend has surged, propelling all AI-related stocks upward. NVIDIA alone boasts a market capitalization of over $4 trillion globally, thanks to the AI boom.

Against this backdrop, top U.S. tech companies, including some Chinese firms, are engaged in a computing power arms race, much to NVIDIA's silent delight.

However, there have been persistent doubts about whether AI is still a bubble.

Unexpectedly, Sam Altman, CEO of OpenAI, another major beneficiary of the AI bubble, recently raised the “AI bubble theory.”

Sam Altman

He said, “Are investors overall too optimistic about artificial intelligence right now? My answer is yes. But is AI the most important transformation in a long time? My answer is also yes.” He added, “When a bubble forms, smart people get overly excited about a core truth.”

His words easily evoke memories of the “Internet bubble” in the 1990s, undoubtedly causing investor concerns.

However, from Jensen Huang's perspective, there is no AI bubble.

He stated on the conference call that NVIDIA's growth will be fundamentally driven by the evolution and implementation of reasoning AI agents.

Compared to past chatbots, reasoning AI agent models may require 100 to 1,000 times more computing power. If they involve more complex research tasks (such as reading and understanding large volumes of literature), computing demand may even be higher.

Meanwhile, with AI agents and visual language models, breakthroughs have been achieved in the physical world AI, robotics, and autonomous systems.

Jensen Huang predicted that over the next five years, the global AI infrastructure market opportunity would reach $3 trillion to $4 trillion. “In the past few years, the capital expenditures of just the four major cloud service providers (CSPs) have doubled, totaling about $600 billion.”

Jensen Huang said, “We are at the initial stage of AI infrastructure construction, and AI technological advancements are genuinely driving its implementation across various industries to solve practical problems.”

Jensen Huang also responded to the challenge of application-specific integrated circuits (ASICs). “Currently, many ASIC projects have been launched, and numerous related startups have emerged, but very few products can achieve mass production. The core reason is the extremely high difficulty of ASIC development.”

He listed the many advantages of NVIDIA's general-purpose chips. First, its products cover all cloud platforms and collaborate with all computer manufacturers; from cloud data centers to on-premises deployments, from edge devices to robots, they all use a unified programming model. “When you develop a new model architecture, choosing to release it on NVIDIA's platform is undoubtedly the most reasonable decision.”

Additionally, he reminded that today's AI systems have become extremely complex and comprehensive problems. “People often only focus on the chips themselves—for example, the ASIC chips frequently discussed. But to develop a complete platform like Blackwell and Rubin, you need to build an entire technological system: including CPUs, GPUs, super NICs, horizontal scaling switches, and the latest cross-domain scaling switches that can connect high-speed memory...”

Jensen Huang said that whether from the perspective of growth opportunities or gross margin potential, NVIDIA's architecture is the best choice.

How much of the future $3 trillion to $4 trillion market does NVIDIA plan to capture?

Jensen Huang stated that currently, the construction cost of a 1-gigawatt AI factory is usually between $50 billion and $60 billion, with NVIDIA's contribution accounting for about 35%.

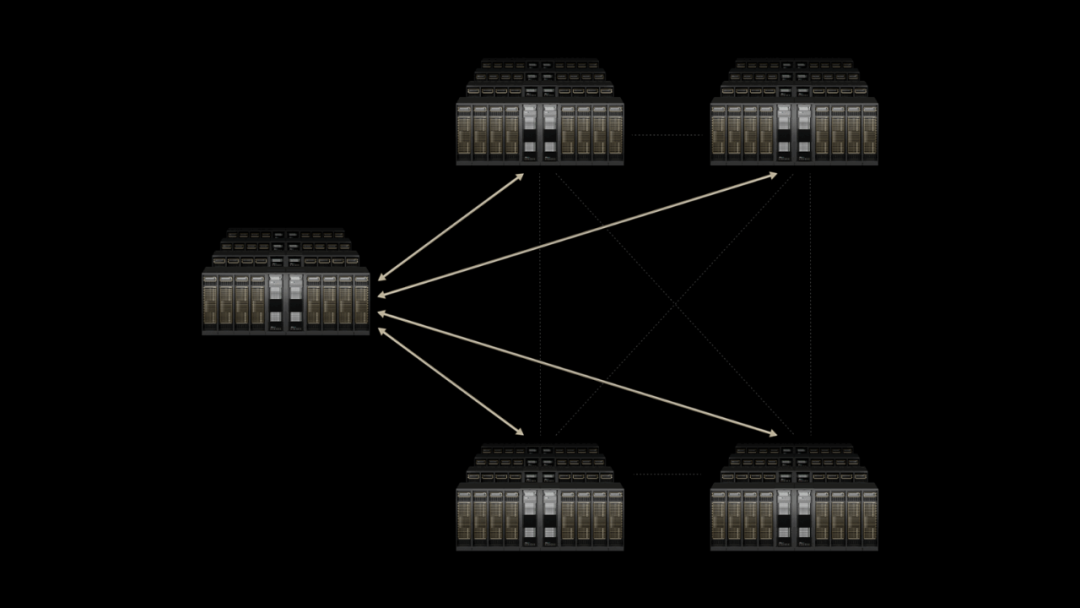

NVIDIA Spectrum-XGS Ethernet can combine multiple distributed data centers into an AI super factory.

He also emphasized that NVIDIA is not just providing GPUs but has successfully transformed into an AI infrastructure company. Building a single Rubin AI supercomputer requires six different types of chips; scaling it to 1 gigawatt requires hundreds of thousands of GPU computing nodes and a large amount of rack equipment. NVIDIA can provide all of these.

Based on Jensen Huang's simple calculation of a $3 trillion to $4 trillion market and NVIDIA capturing over 35%, in the next five years, NVIDIA's annual revenue could reach $1 trillion to $1.4 trillion, multiplying several times from its current revenue of nearly $200 billion!

-END-