Qingdao's Listed Firms Make Bold Forays into Humanoid Robotics

![]() 11/19 2025

11/19 2025

![]() 471

471

China's two most valuable humanoid robot unicorns have made significant moves one after another.

On November 6, SWEM announced that Zhiyuan Robotics had completed the acquisition of its equity. This indicates that just four months after SWEM's initial announcement in early July about a change in ownership, Zhiyuan Robotics has successfully taken over the company.

Although Zhiyuan Robotics has consistently denied that this move is a backdoor listing, from the perspective of deploying its management team to support SWEM, using the transaction to gain access to A-share financing channels, and securing upstream core materials, Zhiyuan Robotics has effectively become the de facto 'first A-share humanoid robot stock.'

Meanwhile, Unitree Technology also finished its listing counseling on November 15, just over four months after starting the process in early July.

Notably, Qingdao-based enterprises are involved in both Zhiyuan Robotics and Unitree Technology.

Hexagon Software Technology (Qingdao) Co., Ltd. is a shareholder of Unitree Technology, holding a 1.48% stake.

Zhenhe Industry, a leading enterprise in China's chain transmission industry, announced in May this year that it had signed an agreement as a limited partner with Shanghai Muhua Jinyu Equity Investment Management Partnership (Limited Partnership) and others to increase capital and acquire a stake in Gongqingcheng Muhua No. 7 Equity Investment Partnership (Limited Partnership) (referred to as the 'Partnership'). The total planned capital contribution by all partners is RMB 110.31 million, with Zhenhe Industry contributing RMB 5 million of its own funds, accounting for 4.53% of the Partnership's total planned capital contribution.

According to the announcement, the Partnership will make a dedicated equity investment in Shanghai Zhiyuan Xinchuang Technology Co., Ltd., i.e., Zhiyuan Robotics. As of August this year, Zhenhe Industry replied on an investor platform that the Partnership had completed the industrial and commercial registration of changes and fund filing procedures.

In addition to investing in Zhiyuan Robotics and Unitree Technology, in June this year, Caos, a subsidiary of Qingdao home appliance giant Haier, successfully acquired industrial robot company STEP Electric Corporation.

From an operational standpoint, based on long-term accumulation in relevant fields, Caos and STEP Electric Corporation, as well as Hexagon and Unitree Technology, have achieved synergistic development.

Caos and STEP Electric Corporation have strengthened their collaboration along the industrial automation upstream and downstream supply chains, helping the latter enhance its key technologies and product capabilities in industrial robots, enabling it to turn from losses to profits.

Hexagon's sensors are a crucial component in the manufacturing of humanoid robots. According to previous reports, Hexagon views Unitree as an important ecological partner and has already applied its sensors in robotic scenarios.

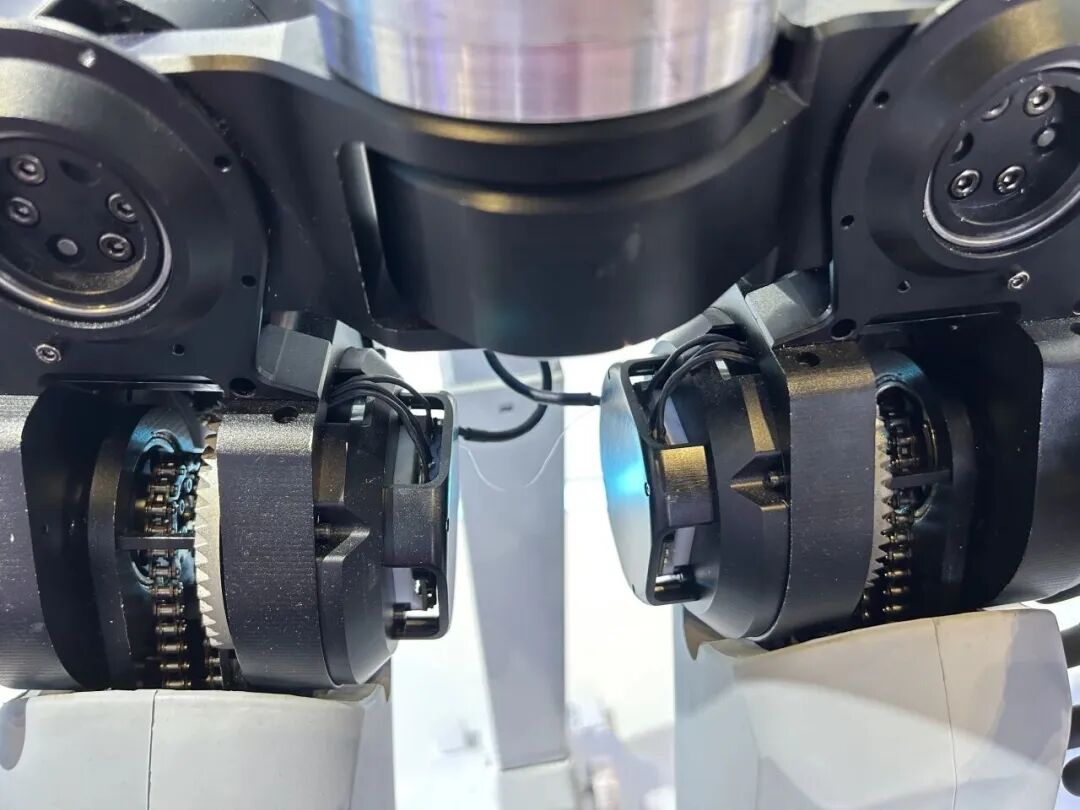

Zhenhe Industry, a newcomer in the humanoid robot sector, is still in the early stages of business layout. Currently, Zhenhe Industry is leveraging its accumulated expertise in chain transmission technology to develop micro-chain technology while focusing more on the technical field of dexterous hands.

In August this year, Zhenhe Industry disclosed a private placement contingency plan worth RMB 818 million, of which RMB 53.8236 million is earmarked for the 'R&D Project for the Integration of Hardware and Software in Micro-Chain Systems.' According to the announcement, Zhenhe Industry's chain transmission technology holds research and application value in the field of intelligent dexterous hands. The project will drive the company's development from a single micro-chain system towards the integration of hardware and software and downstream dexterous hands.

Dexterous hands are also a major technological advantage of Zhiyuan Robotics. On August 17, Zhiyuan Robotics launched the OmniHand 2025 series of dexterous hands, providing a strong boost for upgrading industrial manufacturing, scientific research and education, and interactive services.

Looking ahead, with Zhiyuan Robotics taking over SWEM and securing upstream core materials, the focus will shift to the field of key robot components.

In addition to investing in Zhiyuan Robotics, Zhenhe Industry also signed a strategic cooperation agreement with Shanghai Zhuoyide Robotics this year, focusing on collaboration in production and research, as well as robot and dexterous hand scenario training.

The leg chains of Zhuoyide's full-size bipedal humanoid robot

As humanoid robots accelerate their industrialization and continue to attract high levels of capital, Zhenhe Industry's series of investment moves also reflect a broader trend of listed companies across the city and even the province making bold 'crossovers' into the humanoid robot sector.

Many of these companies have chosen to enter the sector through robot materials and key components.

For instance, Guoen Technology is expanding its reach into the humanoid robot sector based on its foundation in new materials.

On November 11, Guoen Future, a subsidiary of Guoen Technology, held a new product launch event for artificial intelligence in Shenzhen, showcasing technological breakthroughs in robot structural design, motion control, environmental perception, and human-machine interaction.

Leveraging the advantages of Guoen Technology's vertically integrated industrial platform for new materials, especially its full industrial chain capability for PEEK (polyether ether ketone) materials from upstream polymerization to downstream products, Guoen Future's robots will have core advantages in terms of lightweight design, high load capacity, and long lifespan.

Based on the R&D, production, and sales of high-hardness and brittle material cutting equipment and cutting consumables, GCE Technologies is expanding into the field of core components and processing equipment for humanoid robots.

It is understood that the company has utilized its R&D experience in tungsten wire and steel wire materials to introduce low-creep, high-wear-resistant composite metal tendon ropes, addressing issues such as large bending radii, poor wear resistance, and short service life of ordinary metal tendon ropes. Currently, the company has achieved small-batch sales and shipments to multiple customers.

On November 13, GCE Technologies established GCE Wisdom (Shanghai) Robotics Co., Ltd. in Shanghai, with a registered capital of RMB 100 million. According to reports, this new business layout represents the precise transfer of GCE Technologies' autonomous core technologies and the efficient integration of advantageous resources, aiming to address industry pain points with an integrated 'equipment + tools + processes' solution.

Another listed company in Qingdao, Fengguang Precision, mainly produces harmonic reducers for humanoid robots. In June this year, the company released a record of investor relations activities, responding to questions about its product layout and capacity planning in the humanoid robot sector. According to the disclosure, by the end of 2024, Fengguang Precision will have the mass production capacity for the full range of 03-32 series harmonic reducers in the humanoid robot sector, with the 03 model filling the gap in domestic miniature high-precision robot joint components. The planned capacity for the first phase is 300,000 units, with a target of reaching 100,000 units this year.

Analytically, it is not difficult to understand why listed companies in Qingdao are the first to enter the humanoid robot materials and key components sectors. Shandong is a major province for materials and manufacturing, with strong capabilities in related industries, providing a solid foundation for entering the robot sector.

In fact, from the overall development of the humanoid robot industry, materials and key components have become two trump cards for China to lead the global robot industry. In the capital market, automotive parts and precision manufacturing enterprises such as Tuopu Group, Sanhua Intelligent Controls, Zhenyu Technology, and Wuzhou New Spring, as well as materials companies like Kingfa Science and Technology and Walter Stock, are all expanding into the humanoid robot business.

With a solid industrial foundation and industry trends, the entire province of Shandong is providing substantial financial support to encourage related companies to transition into the robot sector.

In June this year, 25 departments in Shandong Province jointly issued the 'Shandong Province Robot Industry High-Quality Development Action Plan (2025 - 2027),' which explicitly states, 'Around whole-machine products, key components, and intelligent systems, we will cultivate a tier (echelon) of innovative SMEs, specialized and sophisticated SMEs, and specialized and sophisticated 'little giant' enterprises,' and 'Focus on cultivating and growing terminal products such as embodied intelligent robots, providing one-time rewards of up to RMB 8 million and RMB 3 million to enterprises engaged in whole-machine humanoid robots and core components, respectively.'

Clearly, the development of the humanoid robot industry requires not only order support in terms of application scenarios in Shandong's advantageous manufacturing sector but also comprehensive support for enterprise development in terms of key industrial chain matching (support), cluster cultivation, and financing.

Taking Luoxi Robotics, which is rooted in Shandong, as an example, it has entered the field of collaborative robots for industrial production, with a precise positioning, while forming an industrial ecosystem together with upstream and downstream enterprises.

It is reported that Luoxi Robotics is the only company in China capable of mass-producing both industrial robots and collaborative robots. Founded in 2014 and previously headquartered in Beijing, the company relocated its headquarters to Jining at the end of 2023. After settling in Jining, Luoxi Robotics successfully attracted more than 20 supporting enterprises to locate in Jining, including upstream component companies Suzhou Mingchi and Keben Electric, as well as downstream system integrator Tianda Hangke.

Currently, Luoxi Robotics ranks third in the country in terms of shipments, with its flexible collaborative robots ranking first domestically. It has accumulated over 40,000 installed units, serving more than 1,000 enterprise customers globally, covering over 40 countries and regions. In September this year, Luoxi Robotics initiated its listing on the Hong Kong Stock Exchange.