Learning Machines Often Stumble; XRS Is Not the 'Panacea' for TAL

![]() 11/19 2025

11/19 2025

![]() 565

565

Should XRS's budget-friendly learning machine offerings fail to swiftly capture market share and attain economies of scale, TAL's future financial performance could be subjected to even more significant downward pressure.

Author/Wuzi

Produced by/Xinzhai Finance

XRS, a company dedicated to 'redefining learning machines' through AI, has recently encountered setbacks.

Image source: Lizhi News

On November 8, 2025, Lizhi News reported that a netizen from Jining, Shandong, found incorrect answers to questions on their newly purchased XRS learning machine.

When the netizen inquired, 'Who administers Dongping now?' the machine responded, 'Dongping County is under the jurisdiction of Tai'an City and administered by Jining City.' In reality, Dongping County is a county under the jurisdiction of Tai'an City, Shandong Province, and is directly administered by the Tai'an Municipal Government, not Jining City.

In response to the issue, XRS customer service explained, 'This may be due to functional recognition problems. Currently, AI cannot guarantee the accuracy of all answers. Customers are requested to take screenshots and send them to the backend for inspection by maintenance technicians.'

It's undeniable that errors can occur on any content platform. However, learning machines differ from general smart devices as they are entrusted with the responsibility of delivering accurate and detailed knowledge to children. Any inaccuracies could potentially mislead students.

The incorrect answers provided by XRS's learning machine largely reflect the immaturity of its AI technology and application capabilities. Given parents' extreme concern for the teaching quality of educational terminals, if XRS cannot ensure the provision of high-quality teaching content for its learning machines, it may find it challenging to demonstrate competitiveness in the educational hardware market.

I. TAL Bets on 'XRS' After the 'Double Reduction' Policy

As a leading K12 education company in China, TAL initially did not place significant emphasis on the learning content solution businesses represented by XRS. This was because digital learning content solutions were incompatible with TAL's main K12 tutoring business.

However, circumstances changed unexpectedly. In July 2021, the 'Double Reduction' policy was suddenly implemented, placing K12 education companies like TAL under immense downward pressure. Financial reports indicate that from FY2022 to FY2024, TAL's revenue was $4.391 billion, $1.02 billion, and $1.49 billion, respectively, with net profits of -$1.136 billion, -$136 million, and -$3.573 million, respectively.

To quickly outline a growth trajectory that could succeed the K12 tutoring business, TAL brought XRS learning machines to the forefront.

Image source: iiMedia Consulting

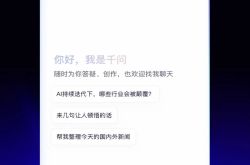

From a market trend perspective, after the implementation of the 'Double Reduction' policy, China's smart learning machine market indeed began to grow rapidly. Data disclosed by iiMedia Consulting shows that from 2021 to 2024, the market size of China's smart learning machines grew from 12.917 billion yuan to 27.072 billion yuan, with a compound annual growth rate as high as 27.97%. It is expected that by 2027, the relevant market size will reach 51.441 billion yuan, maintaining a high growth trend.

Notably, around 2023, AI technology also sparked a new wave of technological innovation, becoming a key engine for the transformation and upgrading of various industries.

Against this backdrop, instead of directly launching traditional learning machine products, XRS embraced the AI technology wave and released its first AI learning machine, Xpad, in February 2023. It not only included free self-developed courses but also featured an AI problem-solving robot.

Indeed, by launching a differentiated AI learning machine in line with industry trends at the earliest opportunity, XRS demonstrated remarkable growth potential. According to Tianyancha data, from FY2023 to FY2025, the revenue of TAL's learning content solution business, represented by XRS learning machines, was $170 million, $440 million, and $720 million, respectively, accounting for 16.3%, 29.4%, and 31.8% of total revenue. It has become the company's 'second growth curve.'

In response, at the FY2025 financial results conference, Peng Zhuangzhuang, President and Chief Financial Officer of TAL, stated, 'Over the past year, our smart learning devices have also made progress and are increasingly becoming an important aid for students' independent learning. Looking ahead, by integrating offline face-to-face services, online interactive courses, and smart learning devices, TAL is confident in its ability to continuously create value for students and families with its full-stack service capabilities.'

II. Expanding into Lower-Tier Markets, XRS Faces High Costs

Despite the rising performance of XRS's business lines, overall, XRS is not the leader in China's learning machine market. Data disclosed by Lottotech shows that in the first half of 2025, in China's online learning tablet market, Zuoyebang held a 33.4% sales share, ranking first. XRS ranked second with a 19.8% share.

Image source: Shangpu Consulting

The primary reason is that XRS focuses on the high-end price segment, which has limited market space. In May 2025, Shangpu Consulting awarded XRS the certification for 'National Sales Champion in the High-End Learning Machine Segment.'

Image source: iiMedia Consulting

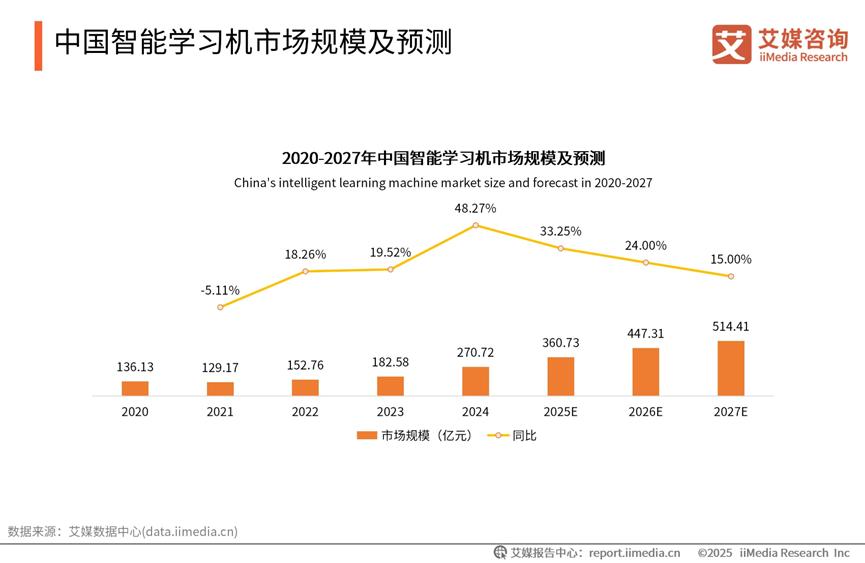

Although high-end learning machines offer larger profit margins, their high prices limit market acceptance. iiMedia Consulting data shows that in 2024, only about 30% of consumers accepted high-end learning machine products. Lottotech data shows that in the first half of 2025, in China's online learning tablet market, the sales share of products in the 3,000-3,999 yuan price segment fell by 5.9 percentage points year-on-year.

Therefore, if XRS seeks broader business opportunities, it must delve into lower-tier markets and engage in direct competition with brands like Zuoyebang, iFLYTEK, and Xiaoyuan. To this end, in May 2025, XRS released three new learning machine models, including the P4 standard model priced at just 2,699 yuan, promoting it as a 'highly cost-effective choice for families to purchase learning machines in the AI era.'

It should be noted that due to intense competition in lower-tier markets, after venturing into affordable learning machines, TAL's operating costs have significantly increased.

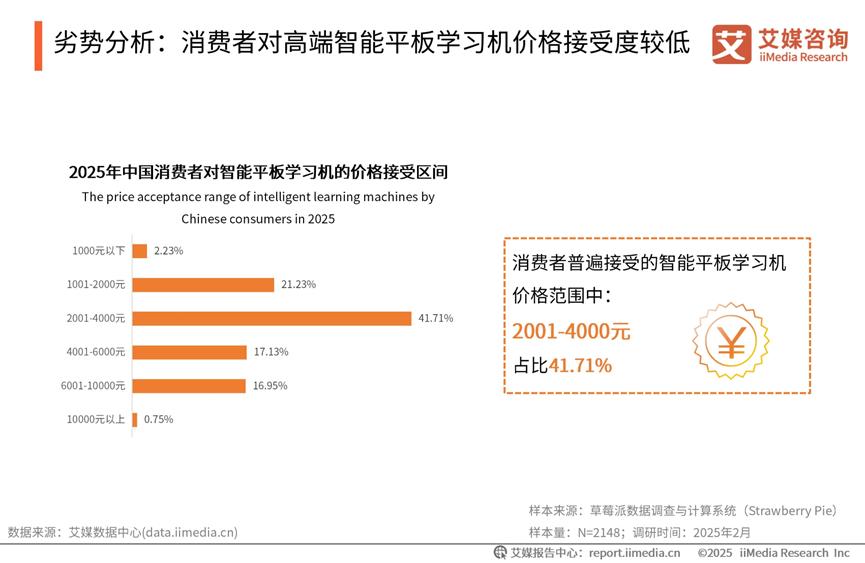

Financial reports show that in Q2 of FY2026, TAL's operating costs and expenses were $767 million, a sharp year-on-year increase of 34%. Among them, revenue costs were $370 million, up 36.8% year-on-year; sales and marketing expenses were $267 million, up 46.9% year-on-year; and general and administrative expenses were $129 million, up 8% year-on-year.

Image source: TAL's Q2 FY2026 financial report

Against this backdrop, TAL's cash flow shows signs of narrowing. As of the end of August 2025, TAL held a total balance of $3.249 billion in cash, cash equivalents, and short-term investments, a 10.2% decrease from $3.618 billion six months earlier, 'primarily due to strategic investments and operational expenditures.'

Should XRS's budget-friendly learning machine offerings fail to swiftly capture market share and attain economies of scale, TAL's future financial performance could be subjected to even more significant downward pressure.

III. Frequent Consumer Disappointments, XRS Struggles to Win the Reputation Battle

Unlike manufacturers of smartphones and PCs, who can win consumers by simply creating outstanding hardware without delving into specific content, educational companies that create learning machines not only need to develop hardware but also need to create high-quality teaching content to match it.

Image source: XRS

For example, although the XRS P4 standard learning machine is priced at just 2,699 yuan, it offers a complete learning solution covering all academic levels from early childhood education to senior high school third year. It integrates XRS's classic practice modules and includes 50 major AI learning tools.

The content-driven nature of learning machines places higher demands on educational companies—beyond outstanding hardware quality, they must also possess high-quality teaching content. If the content quality of learning machines created by educational companies is poor, it can easily lead to a backlash in reputation.

Unfortunately, perhaps due to an excessive focus on sales and performance, the content of XRS learning machine products has frequently 'betrayed' users.

Image source: Phoenix Technology

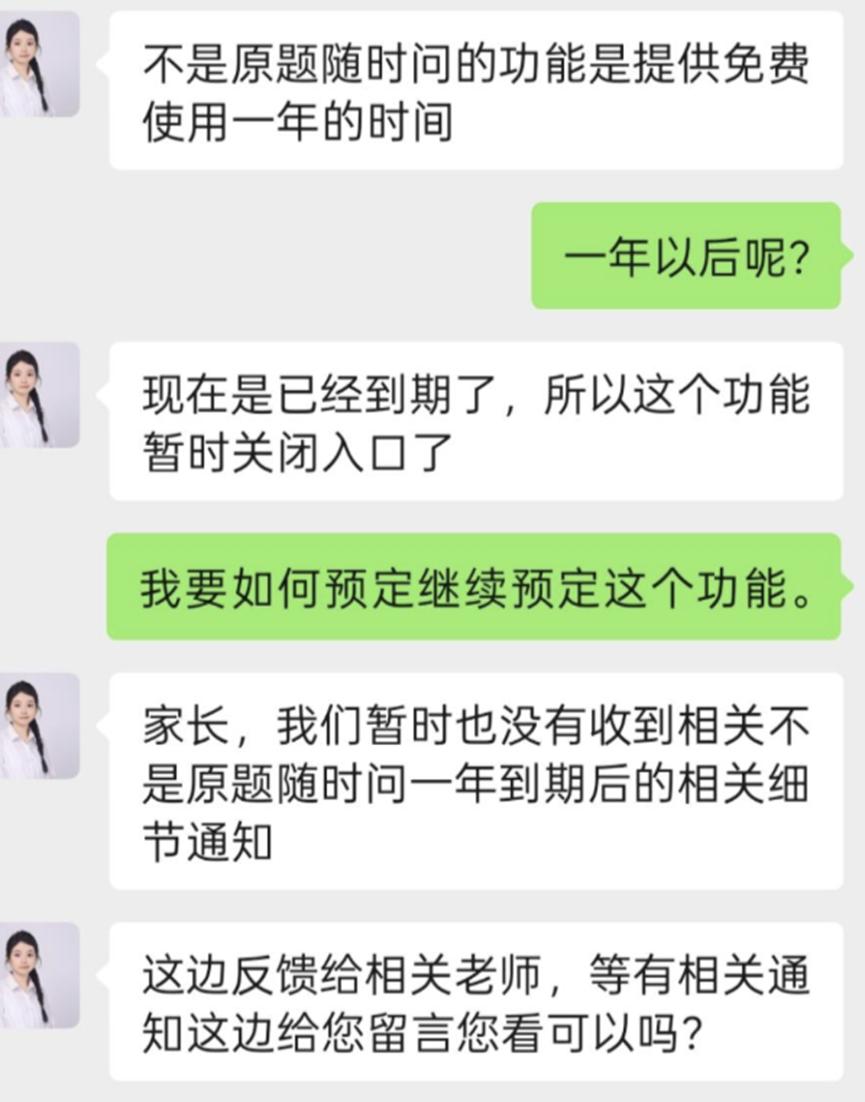

In June 2025, Phoenix Technology reported that a consumer stated they had spent over 8,000 yuan on an XRS learning machine, which promised a 'real-time human inquiry' feature. However, a year later, the feature was suddenly discontinued and could not be renewed.

Image source: Phoenix Technology

In response, a parent from Beijing consulted XRS customer service, who replied that the 'real-time human inquiry' feature was only free for the first year and could not be renewed. Many parents disagreed, complaining that 'this should have been clarified at the time of sale. This approach feels like a betrayal of loyal users.'

Image source: Black Cat Complaints

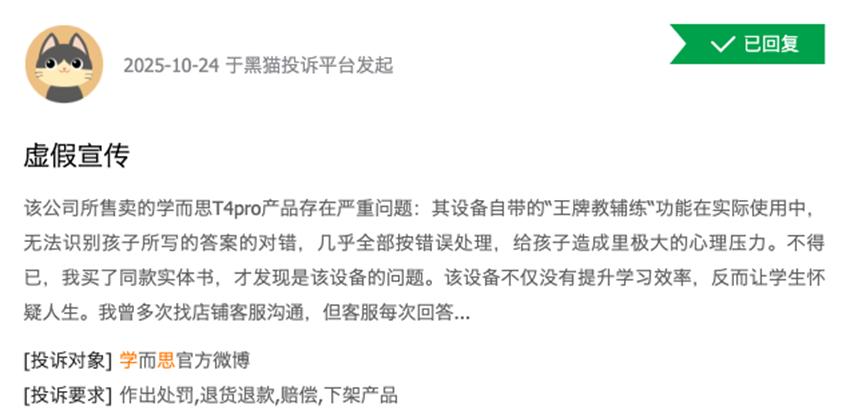

In fact, besides arbitrarily adjusting product features, XRS learning machines have also frequently encountered issues with imparting incorrect knowledge. A search for 'XRS' on Black Cat Complaints reveals approximately 6,500 complaints, with many users alleging that XRS learning machines have issues such as incorrect homework grading, inaccurate explanations, and inability to recognize the correctness of children's answers.

While 'hallucinations' are a common issue with AI technology, this is not an excuse for XRS learning machines to mislead students. Since the target audience is students, learning machines must provide accurate and authoritative knowledge content.

From this perspective, although significant price reductions can reach a broader audience, XRS learning machines may struggle to quickly win the market and become industry leaders.

Unlike smartphones and PCs, which can become 'popular choices' based solely on cost-effectiveness, learning machines need to enhance students' academic performance through high-quality educational content, forming a closed-loop value system. Due to an excessive reliance on not entirely reliable AI technology, the content of XRS learning machines is currently widely criticized.

If XRS continues to 'betray' users in terms of content, even if it can temporarily win the market with cost-effectiveness, it will still face the challenge of subsequent reputation collapse.