What Are the Capabilities of Robot Dogs? What's the Size of This Market?

![]() 12/30 2025

12/30 2025

![]() 436

436

Produced by Zhineng Technology

In 2025, the financing landscape in the entire embodied intelligence sector is experiencing an unprecedented boom, and we've also taken a comprehensive look at major companies in this field.

Our discussion centers around the shipment volumes of robot dogs and robots in 2025, as well as their functionalities. Currently, the development of quadruped robots and humanoid robots in 2025 has witnessed accelerated progress at every stage, transitioning from laboratory R&D to real-world implementation. So, what shifts are occurring in market demand?

01 What Are the Specific Capabilities of Robot Dogs?

Robot dog combat might seem like a novel concept. According to IDC statistics, in 2024, the global market size for quadruped robots reached approximately $180 million, encompassing both consumer-grade and commercial-grade models, with shipments totaling around 20,000 units.

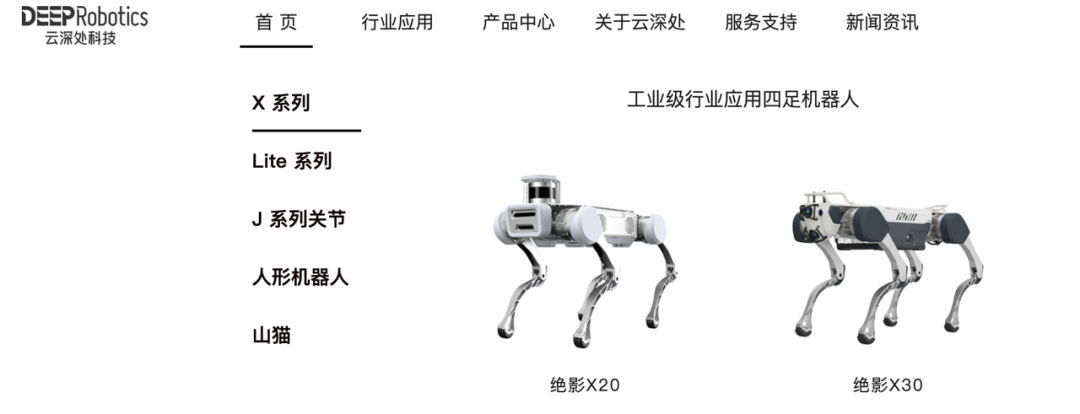

● Deep Robotics secured the second position with an 18.9% market share in sales, trailing just behind Unitree (which held a 32.4% share).

Looking ahead to 2025, estimating Deep Robotics' product data is relatively straightforward. Founder Zhu Qiuguo disclosed that the company's robot shipments are projected to hit the 10,000-unit mark in 2025, penetrating markets across the Asia-Pacific, Middle East, Europe, and the Americas. Given the product matrix structure, it's reasonable to assume that the majority of these will be robot dogs.

Deep Robotics' self-developed 'Jueying' series and Lynx series robots have been deployed in diverse environments, including power inspection, security patrols, surveying and exploration, public rescue operations, tunnel and pipeline inspections, metal smelting, construction surveying, as well as education and research. These applications predominantly fall under typical 2B scenarios, where enterprises acquire these robot dogs for remote control and operation in specific contexts.

● Unitree is currently in the IPO tutoring stage and lacks a comprehensive 2025 financial and sales report. Based on past research data, it's estimated that Unitree sold approximately 23,000 robot dogs in 2024, with experts projecting sales to surpass 30,000 units in 2025.

Unitree's focus in 2025 is on humanoid robots, although its robot dogs have been among the earliest quadruped platforms to achieve large-scale applications in China. They cover five core scenarios: industrial inspection, emergency rescue, cultural tourism and public services, scientific research and education, and consumer entertainment. These robot dogs replace human labor in high-risk, low-efficiency, and unstructured terrain operations while also expanding human-robot interaction and scientific research capabilities.

◎ In industrial and energy inspection scenarios, the B1/B2 industrial-grade robot dogs have been deployed in power, energy storage, port, and factory systems, undertaking tasks such as substation inspections, infrared temperature measurements, and equipment anomaly identification. Notable examples include State Grid and Ningbo Zhoushan Port, where autonomous obstacle crossing and data transmission capabilities reduce risks and costs associated with manual inspections.

◎ In emergency rescue operations, robot dogs showcase their 'high-value' attributes by conducting reconnaissance in collapsed, oxygen-deprived, and high-temperature environments for firefighting, forest fire prevention, and police bomb disposal. The Qingdao Fire Department and Beijing Shunyi Forest Fire Prevention System have achieved regular utilization of these robots.

◎ In cultural tourism and public services, robot dogs are beginning to scale up, not only for material handling and patrol maintenance in scenic areas but also for community companionship, publicity, and environmental monitoring. The case of the Taishan B2 robot dog replacing 'mountain porters' highlights its practical value in heavy-duty and complex terrain operations.

Unitree maintains an open approach in scientific research education and development ecosystems, serving universities, laboratories, and developers to drive algorithm and application iterations for quadruped robots. The Go2 series targets the consumer market but has limited applications.

The combined sales of the top two players are projected to exceed 40,000 units in 2025. Given the relatively high prices in industrial scenarios, at around 20,000 yuan each, this translates to approximately 1 billion yuan in revenue.

02 What Are the Capabilities of Robot Dogs in the Consumer Market?

For robot dogs currently available in the consumer market, they are not designed to perform household chores or replace human labor. What is truly being marketed is a form of 'relationship'—companionship, a sense of participation, and emotional connection.

For family users, a robot dog represents a movable, interactive, and persistently present object, distinct from smart hardware with specific functions like robotic vacuum cleaners or smart speakers. While robotic vacuum cleaners solve specific tasks, robot dogs cater to the need for 'having someone by your side.'

● Children's 'Outdoor Traction Device': Many parents are concerned about their children not going outside, exercising, or exploring the world. Robot dogs, with their ability to run, follow, and respond, naturally provide traction. They can accompany children on walks, initially serving as a more advanced playmate.

Of course, given children's short-lived enthusiasm, this effect may only last a week. Whether they continue to take it out afterward requires more data.

● Elderly 'Walking Companion': For the elderly, robot dogs can accompany them on walks and assist with small tasks. They can follow, provide lighting, carry loads, and patrol, offering stability, safety, and predictability.

● Middle-Aged Men: For highly educated middle-class men, taking a robot dog out for camping, exploration, remote control, or surrogate exploration in various scenarios can provide a sense of 'playing with the future' and test whether it qualifies as a high-end AI consumer product.

Robot dogs pose relatively low implementation risks in family scenarios and appear more akin to consumer products. With prices now around 10,000 yuan, they may find a niche market among early adopters.

However, robot dogs face challenges in family settings, such as noise, difficulty navigating stairs (requiring elevators), and limited functionality (e.g., inability to perfectly retrieve deliveries or dispose of garbage). These issues often lead to idleness after purchase, fueling a booming rental market.

Whether robot dogs can evolve into long-term intelligent entities accepted as 'family members' remains to be seen.

Summary

In the niche market for robot dogs, if considered as toys, Chinese toy companies can produce them for a few hundred yuan. However, when evaluating the scenarios in which a complete robot dog can function effectively, we find no significant breakthroughs in 2025 compared to 2024.