"Big Model's Soft Rice, Hard Eating"

![]() 10/09 2024

10/09 2024

![]() 598

598

Author | Hao Xin

Editor | Wu Xianzhi

The "oligopoly effect" in the big model industry is becoming stronger and stronger, with more followers and fewer innovators.

Investors need more certainty in their "good projects," preferably with proven cases. On the other hand, big model companies are eager to sell their "APIs," exchanging computing power for tokens to regain financial stability.

Recently, a project that meets both these needs has emerged—AI toys. The principle is to equip hardware with software, enabling role-playing conversations with children by calling big model APIs, similar to a "Character AI" disguised as a doll.

One practitioner joked, "They say big models are 'toys,' and now we're really making 'toys.'"

The project has gained popularity both domestically and internationally. Skyrocket, a foreign toy manufacturer, launched its first AI storytelling teddy bear priced at $50 each, powered by ElevenLabs for voice functions and Microsoft Azure and GPT-4o for storytelling. Silicon Valley startup Curio released three "talking toys" priced at $99, also powered by GPT-3.5 Turbo.

AI startups in China are not to be left behind. Haivivi, a startup, launched its plush toy AI accessory BubblePal priced at 499 yuan, powered by a fine-tuned version of an open-source big model. Another startup, FoloToy, has also garnered attention with its AI toys like Fofo the Rabbit and the "meme" cactus, offering monthly subscription plans starting at 258 yuan for six months of dialogue services. These toys are supported by most major big models and cloud platforms in China.

A horror story unfolds regarding big models: selling dolls not only earns more than tokens but also provides a continuous revenue stream.

For reference, GPT-3.5 Turbo charges $2 per million tokens for input and output. Currently, AI toys, while equipped with big models, are more like pre-set role-playing, storytelling, and dialogue tools, with minimal reliance on cloud functions. Parents who have purchased domestic AI toys have reported issues like repetitive questions and system crashes upon asking too many questions. This suggests that even lower-tier big models may suffice for domestic manufacturers.

As Lao Luo once joked in a livestream, "It used to be a bit silly when we talked about it, not easy to fool kids, but now big models are good enough to fool them."

"Clearing Inventory" with Big Models

The education hardware business, even with big models, is still about "clearing inventory."

Before the advent of big models, education hardware primarily relied on scavenging chips from smartphone manufacturers that were surplus or obsolete.

Take the popular "Xiaotiancai Watch" among primary and middle school students as an example. Its latest Z10 Aerospace and Z10 Junior versions use Qualcomm Snapdragon Wear 5100 processors, officially launched in May 2023. However, according to our research, the Snapdragon Wear 5100 was first revealed in 2021 and was used in the OPPO Watch 3 Pro in August 2022, a gap of two years.

This trend continues with earlier models. The Xiaotiancai Watch Z9 Junior and Children's versions use Qualcomm Snapdragon Wear 4100 chips, officially launched in May 2023, while the chip was first used in 2020 and updated watches like the OPPO Watch 2 and Meizu Full Smart Watch were released in 2021.

After clearing hardware inventory, attention shifted to software, and the same logic is playing out in "big models + toys."

Currently, the To C business model for AI toys comprises two parts: hardware and software. Hardware is a one-time sale, while software generates recurring revenue and is the focus of marketing. Unlike previous storytelling or early education devices, the biggest difference lies in interactivity and feedback, transforming them into two-way conversations. One brand's livestreamer emphasized, "It's much better than certain competitors."

FoloToy's popular AI cactus toy costs less than 20 yuan for hardware alone but is priced at 258-298 yuan with embedded software. The product supports various models like ChatGPT, Douban, Kouzi, Tongyi Qianwen, Dark Side of the Moon, Baidu ERNIE, and Deepseek.

Baidu ERNIE offers two free models, ERNIE Speed and ERNIE Lite, primarily for vertical domains and lightweight inference, suitable for AI toy conversations. Considering cost-effectiveness, new AI toy players are likely to choose free or lower-tier flagship models. "Yueran Innovation" has revealed that to control costs, when a "high-scoring conversation" occurs, it automatically requests a substitution with another model to supplement long token content.

"Even a small fly is still meat," indirectly helping big model manufacturers clear inventory, complementary to the broader trend of selling APIs at a discount.

The added value of software lies in customization options like defining doll character types, voices, question settings, and sensitive words, similar to configuring a Chatbot or Agent. The final product is an app downloaded to parents' phones, allowing them to view their children's conversation history with the toy.

Currently, under this stripped-down version of Character AI for children, vendors claim to offer chat, companionship, question answering, and role-playing functions. Naturally carrying early education and enlightenment genes, these toys are a step closer to becoming mobile "learning machines," further increasing their value by selling courses.

Li Yong, CEO of "Yueran Innovation," revealed in an interview, "If parents have a need, we can collaborate with online education companies to offer paid courses like pinyin and English within the app. After payment, the plush toy unlocks these functions."

"Trials" of Big Model Deployment on the Edge Side

The education hardware sector, including AI toys, has suddenly become more imaginative due to advancements on the edge side. Compared to distant prospects like VR glasses and embodied AI, education hardware provides a quicker path for big models to take root.

The education hardware sector has inherent advantages: students' rigid demand, parents' willingness to pay, and long payment cycles. Targeting young children allows for higher technical tolerance, as imaginative conversations are more in line with their nature than definitive answers. Even if the model generates odd responses, children often find it amusing, turning the model's delusions into an advantage.

Currently, domestic AI toys are priced similarly to e-readers, early education devices, and enlightenment machines in the same user market. After the previous "smart" market education, parents have shown significant interest in trying out new products. BubblePal, launched on July 30, has sold over 1,000 units on Taobao's official flagship store and over 3,000 units on Douyin's official sales platform.

Deploying big models in AI toys involves several ends: the cloud (big model + PaaS platform), hardware, and mobile devices. While technologies like speech-to-text, big models, and text-to-speech have open-source support, the key lies in optimizing engineering and algorithms to integrate the entire technology chain and enhance dialogue quality by leveraging edge capabilities.

Our research revealed that unresolved issues have led to AI toys becoming "five-minute wonders." Firstly, speech recognition poses a challenge, as children's voices differ significantly from adults in pitch and articulation, while most open-source speech recognition samples are from adults. Secondly, a common issue with AI assistants is generating long responses to brief prompts, which may not engage children in conversational scenarios due to a lack of participation. Lastly, misunderstandings and the need for repeated questions can detract from the experience, reverting to pre-set dialogue once the toy's context is lost.

Such issues can easily revert promising AI hardware back to a one-time sale.

There's also an offline edge solution, where FaceAI, specializing in edge-side models, has partnered with Elephant Robotics to implant the MiniCPM edge model into the companion robot pet Mita. This solution enables the robot to understand natural language and respond with sound, light, electricity, and movement without relying on networks or complex hardware modifications.

Currently, AI toy companies targeting To B customers offer integrated "hardware + software + algorithm" solutions. Industry reports show the smart toy market grew from $12.14 billion to $13.92 billion in 2023, a year-over-year increase of 18%. With the potential for AI integration across all toys, this is an attractive market. Existing toy manufacturers have hardware, supply chains, and production lines, making edge-side implantation a more acceptable option due to lower modification costs and time.

Can Big Models Revive Education Hardware?

The education sector has undergone an adjustment period, where "selling courses" could no longer sustain growth. Instead, previously overlooked segments like educational aids, vocational training, quality education, and smart education hardware have become increasingly attractive.

With the advent of big models, the concept of "AI in education" has gained traction. Compared to K-12 and adult education, early childhood applications have seen faster adoption and more buzz, particularly in AI oral conversation coaching and AI classes.

Continuing the "hardware + software" approach, AI coaches and teachers powered by big models are software that encapsulates years of educational research data and course resources. AI education hardware, such as learning machines, tablets, and translation pens, serve as the best platforms for these AI teachers.

Investors note that while transforming education hardware with big models seems straightforward, there are three key requirements: strong AI capabilities to control content for younger users; hardware capabilities involving supply chains, product development, and IP acquisition; and robust educational data and resources.

Based on these criteria, companies deeply rooted in education hardware have an advantage in quickly integrating new AI software features with upgraded hardware. In June 2023, NetEase Youdao launched "Youdao Xiao P," featuring an "AI tutor for the family." Within two months, it was integrated into the Youdao Dictionary Pen X7 Pro. According to Youdao's Q2 earnings call, users accessed the Xiao P function nearly 2 million times in its first month, becoming the second most frequently used feature after word translation. Sales of the Youdao Dictionary Pen surpassed 8 million units.

Industry insiders reveal that while AI applications in education hardware generate buzz, "they're still in the exploratory stage and not fully mature." One issue is insufficient AI content, as AI family tutors and conversation coaches rely on databases and knowledge points to trigger interactions.

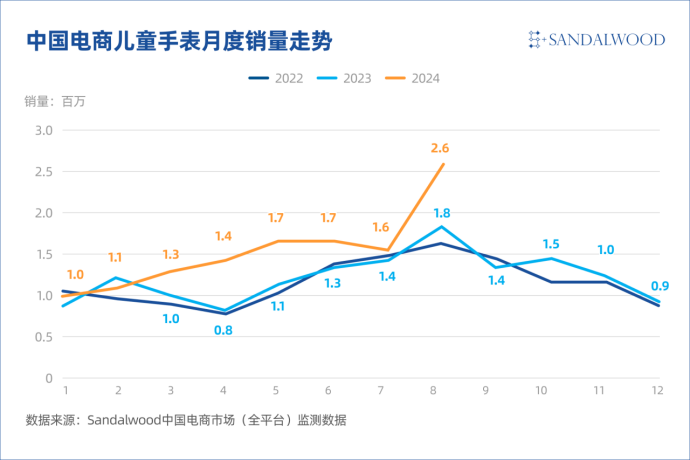

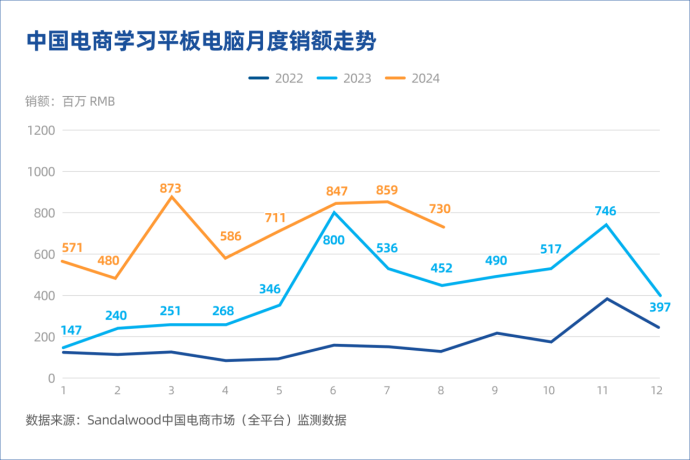

Overall, AI's impact on the education hardware sector is becoming increasingly evident. According to Sandalwood e-commerce monitoring data, during the summer holidays in July and August 2024, children's watches and learning tablets maintained double-digit year-over-year growth. Children's watch sales increased by 27%, while learning tablet sales surged by 57%.

Xiaotiancai watches remained the market leader, accounting for 40% of sales in August, followed by Huawei at 10% and Mibo at 8%. According to the brands' official websites, their flagship products now feature AI functions. Increased sales in May and June support this trend, as major children's watch manufacturers launched AI-enabled models in May, driving sales growth over the following two months.

Additionally, learning tablet sales continued to grow year-over-year. With AI concept promotion, iFLYTEK tablets became best-sellers on Douyin during the summer, overtaking Xueersi to reclaim the top spot in the learning tablet market. More impressively, AI-enabled learning tablets experienced significant price hikes, exceeding 5,000 yuan and approaching 10,000 yuan. As of August 2024, monthly minimum and maximum sales of learning tablets increased by 226.5% and 9.1%, respectively, year-over-year.

Under the new wave of big model adoption, more entrepreneurs are expected to enter the education hardware sector, with both new and established players facing unique challenges. New players have limited resources and must consider token costs and market expansion expenses as user bases grow. Established players, often "technologically limited," may struggle to fully comprehend big models, risking obsolescence if they fail to adapt.