Nvidia CEO Jen-Hsun Huang's Surprise Visit to China: A Suit and a Meeting with Liang Wenfeng

![]() 04/18 2025

04/18 2025

![]() 635

635

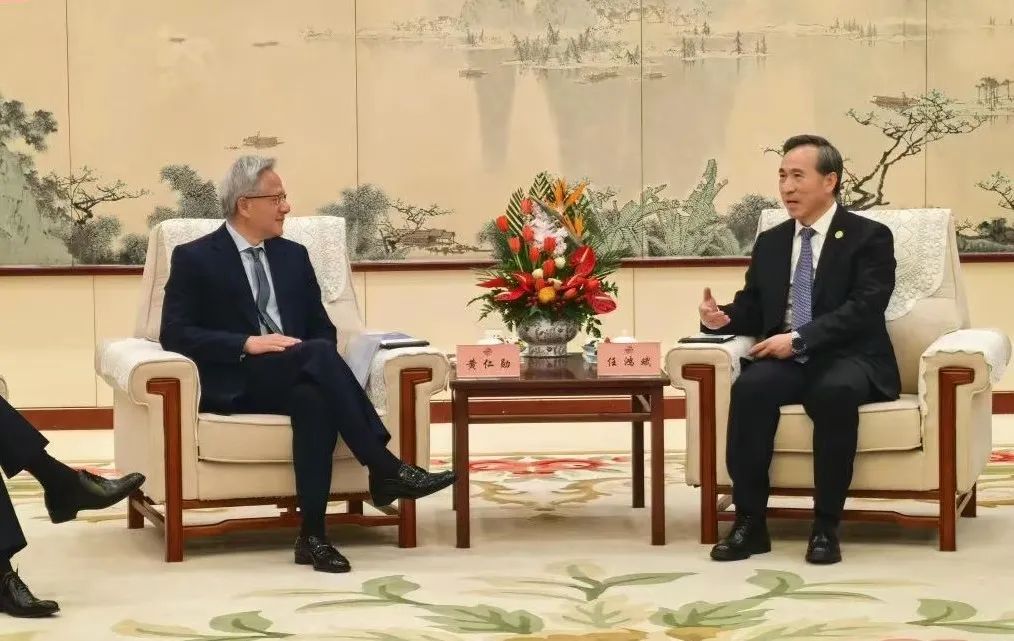

Beyond business, what other motivations lie behind this visit? (Left: Jen-Hsun Huang, Right: Ren Hongbin, President of the China Council for the Promotion of International Trade)

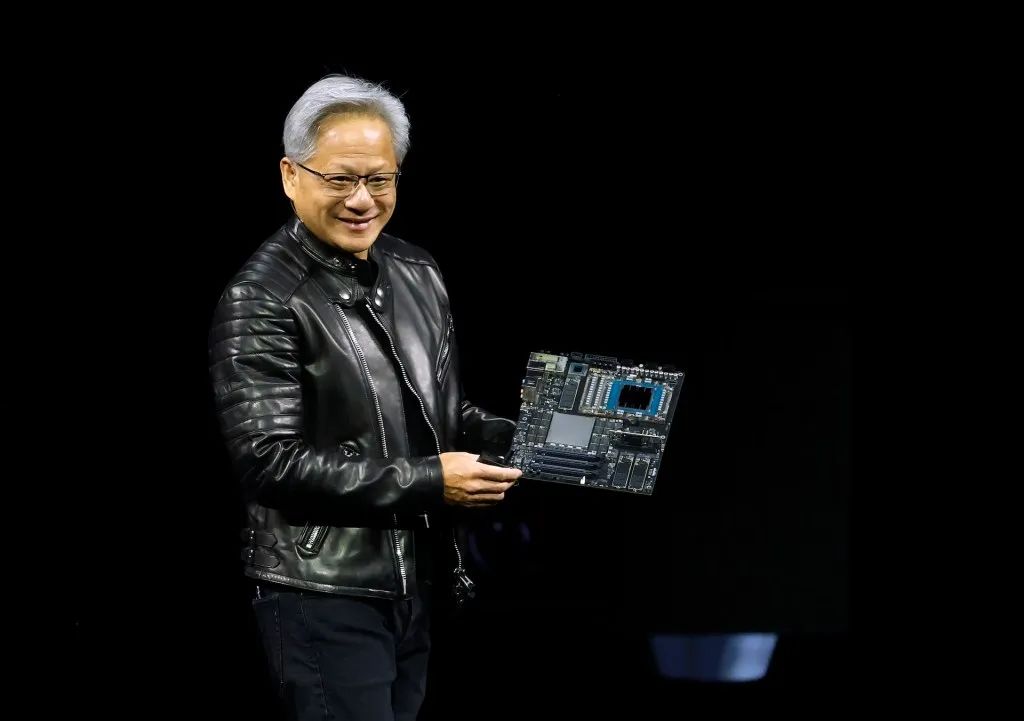

Nvidia CEO Jen-Hsun Huang embarked on his visit to China on April 17, 2025. Notably, in the news footage, he was seen wearing a suit, underscoring the significance he attaches to this trip. Perhaps the booming Chinese market and the ongoing trade war compelled Huang to dress more formally.

Official news indicates that Huang's visit was at the invitation of the China Council for the Promotion of International Trade (CCPIT). Subsequent reports revealed that Huang met with high-ranking government officials and Nvidia clients, including Liang Wenfeng, the founder of DeepSeek.

What prompted Huang's sudden visit to China?

Apart from the CCPIT's invitation, Huang himself undoubtedly had a strong desire to visit China promptly. The Trump administration's trade war had certainly caused him considerable anxiety. Additionally, the rise of DeepSeek played a role.

As we reported last week, following a private dinner at Mar-a-Lago, the Trump administration abruptly lifted export restrictions on Nvidia's latest AI chip, the H20, shocking the world. Huang reportedly attended this million-dollar-per-seat fundraising dinner, pledging to expand investments in AI data centers in the US, which might have swayed Trump's decision.

While the H20 chip was downgraded specifically for export to China, it still outperformed most domestic AI chips. In the first quarter of this year, a stockpile of $16 billion worth of H20 chips was quickly snapped up.

However, the situation changed rapidly. Documents submitted by Nvidia to the US Securities and Exchange Commission revealed that the US government notified Nvidia that a license would be required for exporting the H20 to countries like China, with an "indefinite" duration. Nvidia stated that it would record related expenses of approximately $5.5 billion in the first fiscal quarter ending April 27. Originally designed as a compliant chip specifically for the Chinese market, the ban directly impacted Nvidia's business in China (which accounted for 15.4% of global revenue in 2024, amounting to $12 billion).

Not only does the US restrict exports, but China also imposes additional tariffs on imported chips, further complicating matters for Nvidia.

It's worth noting that, in terms of value, integrated circuits (chips) are China's largest import category. According to 2024 data from China Customs and related industries, China's total imports of integrated circuits amounted to $385.6 billion (approximately RMB 2.8 trillion), with a year-on-year increase of 9.5% to 10.4%. Therefore, the Chinese market is undeniably crucial for high-end chip manufacturers.

Moreover, the emergence of DeepSeek over the past few months has made it evident to the capital market that large model training does not solely rely on chip performance; optimizations in other areas can also reduce dependence on GPU chips, particularly those from Nvidia.

Objectively speaking, DeepSeek initially relied on Nvidia chips for training. However, the ban and insufficient computing power forced DeepSeek to optimize in areas such as algorithms, data transmission/storage, etc., ultimately affecting Nvidia's stock price.

Simultaneously, domestic chips like Huawei's Ascend 910C have made breakthroughs in training efficiency, and the proportion of Chinese tech companies purchasing local AI chips has surged from 12% in 2023 to 37%. Huang admitted that if Nvidia fails to continue customizing products for China, it will miss the opportunity to define industry standards.

Since its peak of over $150 in January, Nvidia's stock price has plummeted by one,- orthird trillions of dollars. This decline is attributed to factors such as the8 impact0 of0 Deep7Seek3/8Hua5weif on2 Nvidia0'db5s00 computingb4 narrative./ andjpgwx Trump"/>__ tariff

9 policies<0.9>Hence0

,c< Huang8p'd>

However, this chip must involve Chinese companies in its R&D design. Otherwise, regardless of its global production location, it will be subject to high tariffs as a US company chip upon import.

This suggests that Nvidia is likely to partner with DeepSeek to develop new chips, possibly locating the R&D team in China. It will also deeply integrate with Chinese companies' large model computing frameworks, like DeepSeek's, creating a globally unique closed-loop ecosystem.

Deep cooperation with the ecosystem chain is indeed one of Huang's key strengths. In the past, his in-depth understanding of the gaming and AI industries, coupled with close collaboration with TSMC, propelled Nvidia to new heights.

For China, it remains to be seen whether Nvidia will invest more in R&D, share more intellectual property rights, and even bring on important partners in high-end chip manufacturing.

Huang's visit and meetings this time reflect the complex dynamics of the Sino-US technology war—a blend of blockade and innovation, cooperation and gamesmanship.

As a Chinese-American and a leading entrepreneur in high-end chips, Huang is undoubtedly a special and pivotal figure in the frontline of Sino-US trade. Is his visit to China a probe for Trump to compromise with China? Or is he acting as an entrepreneur and a messenger? Did the CCPIT provide Huang with a reason to visit China to facilitate further negotiations? We don't know, but anything is possible. We can only wait and see.

or building open-source frameworks to optimize the collaborative design of software and hardware, offering Chinese clients the best chip technology within US policy limits.</p>

<p><img src=)