375 winning projects in the storage market reveal four major signals

![]() 10/10 2024

10/10 2024

![]() 516

516

While AI, including large models, is booming, the storage market has also been exceptionally active this year.

In recent months, AI conferences of various sizes have been held across the country. In addition to the heated discussions on large models and computing power, an interesting phenomenon is that storage vendors have also been exceptionally active. Huawei just released its new AI storage and all-flash storage at the Huawei Connect conference, while Sugon Storage announced its plan to “build an advanced storage hub” at the 2024 Data Storage and Computing Ecosystem Conference.

With the combined forces of the rollout of AI large models and the construction of intelligent computing centers, what new changes and progress have occurred in the decades-old storage market this year?

Recently, Digital Frontier analyzed the winning bids for domestic storage projects in the first eight months of 2024 through the China Government Procurement Network platform and observed some characteristics of the storage market. For the complete information on 375 storage projects (some including contact details), please leave a message in the backstage.

01

Over 375 projects, with operators contributing the largest single project

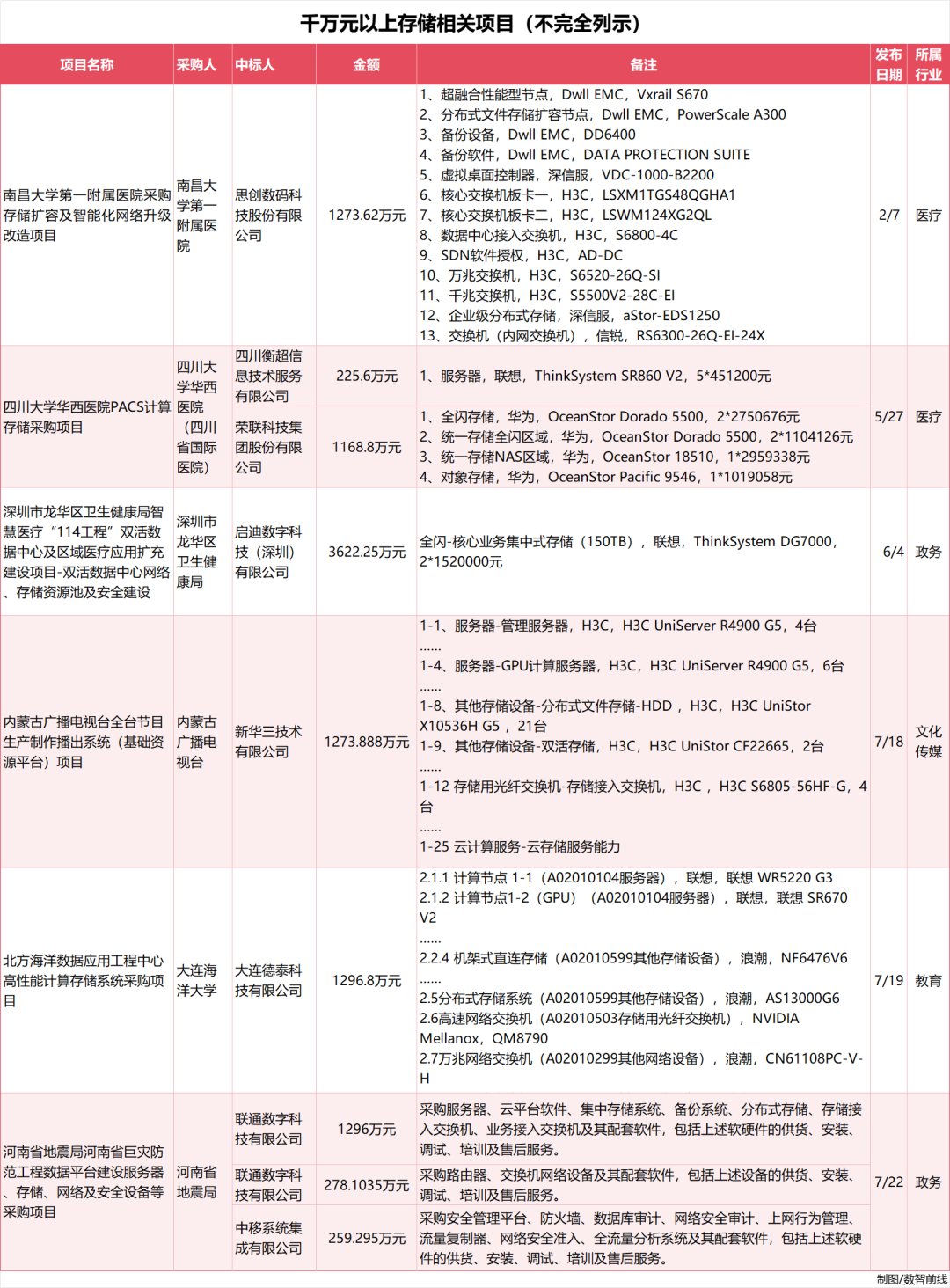

Unlike the large model and intelligent computing center projects that have exploded in popularity in recent years, storage procurement is a large and relatively mature market. Just on the China Government Procurement Network, which we focused on, the buyers are primarily from government agencies and public utilities such as science, education, culture, and health, with at least 375 related winning bid announcements in eight months, widely distributed across various cities in China.

In addition, there are hundreds of projects on other publicly available statistics channels, primarily involving finance, manufacturing, energy, operators, transportation, and other industries. We will conduct special statistics on these industries in the future.

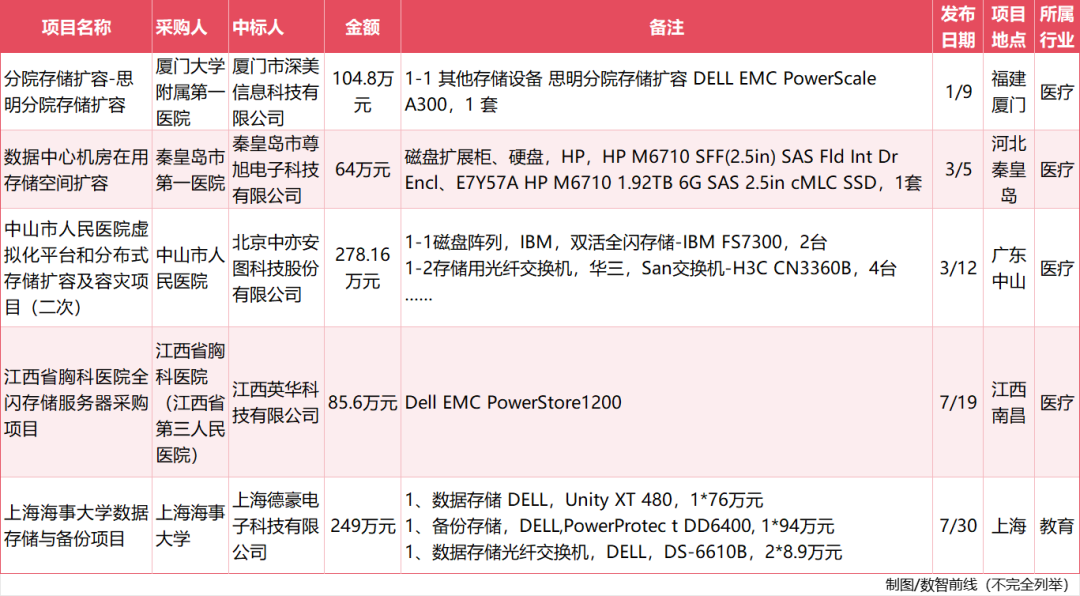

In terms of the primary procurement targets, these projects often involve not just the sole procurement of storage devices but also the supporting procurement of switches, networks, servers, etc., as well as storage expansion, maintenance, and other related projects.

Regarding the bid amounts, most projects, excluding large-scale centralized procurement projects by operators, are generally not significant, ranging from hundreds of thousands to several million yuan.

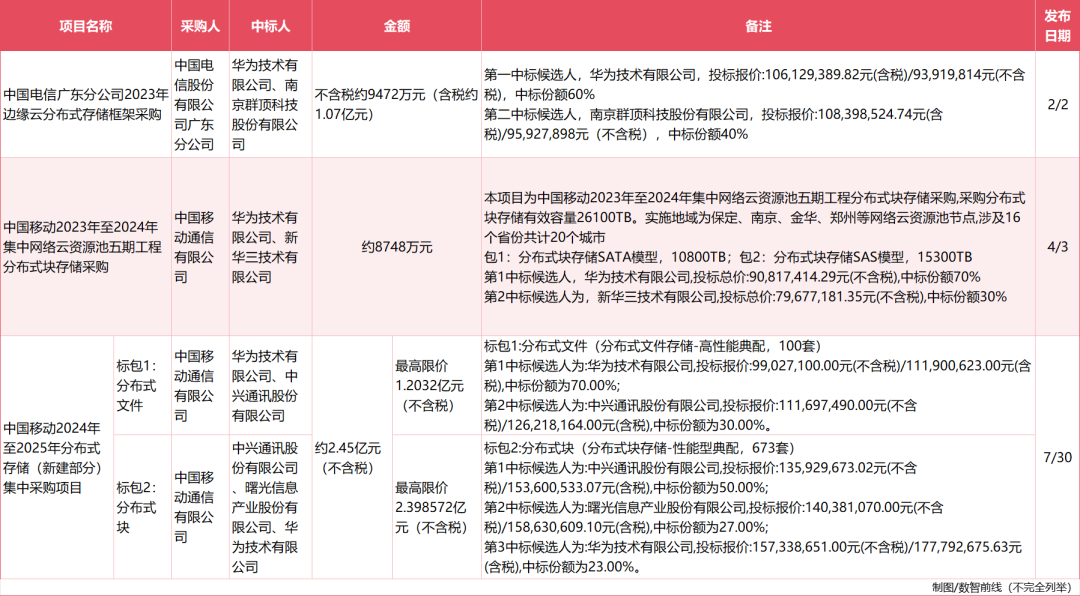

Among the over 375 projects that Digital Frontier analyzed, only 11 projects had winning bids exceeding 10 million yuan, and the top three projects were all tendered by operators.

China Telecom and China Mobile have conducted large-scale storage procurement this year. For example, the “2023 Edge Cloud Distributed Storage Framework Procurement by China Telecom Guangdong Branch” won by Huawei and Qunding Technology is worth approximately 100 million yuan.

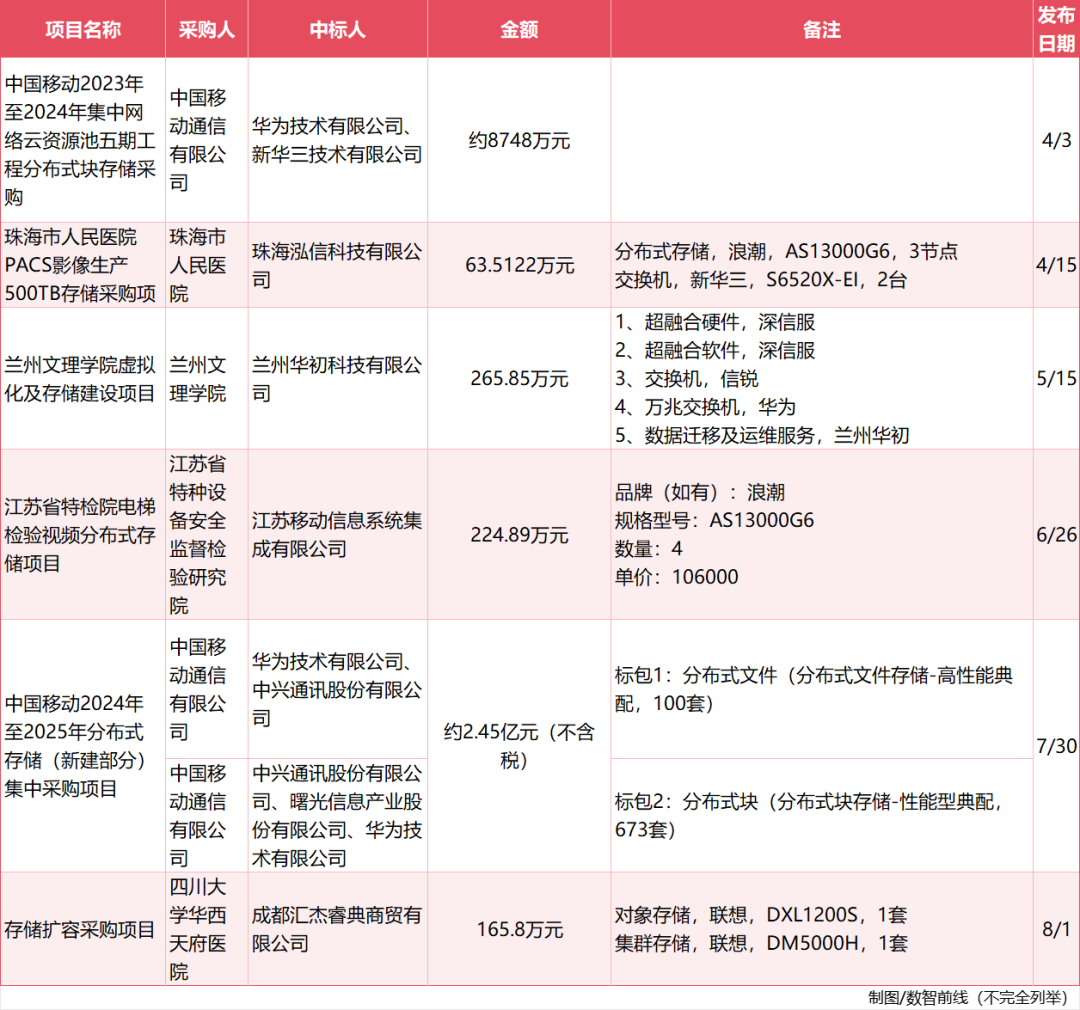

The largest winning bid in the first eight months of 2024 was for a distributed storage centralized procurement project tendered by China Mobile, with a total value exceeding 200 million yuan. Among them, Package 1 (Distributed File Storage - High-Performance Typical Configuration) was won by Huawei and ZTE, while Package 2 (Distributed Block Storage - Performance-Oriented Typical Configuration) was won by ZTE, Sugon, and Huawei.

Industry observers note that although China Mobile headquarters conducts large-scale centralized procurement of distributed storage products annually, the procurement volume and budget have increased this year compared to last year.

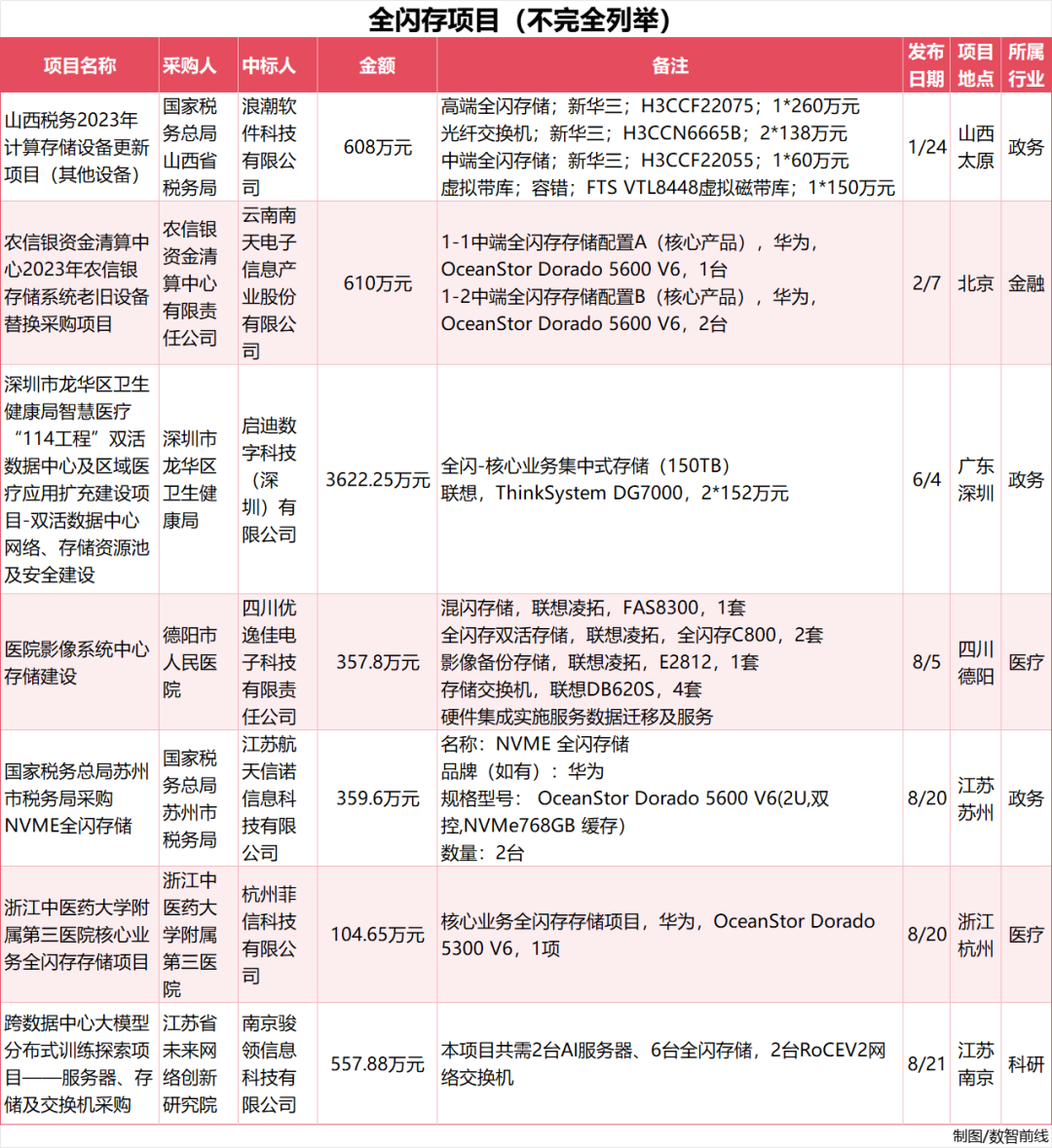

Apart from operators, industries such as healthcare, government, culture, and education have also emerged with projects exceeding 10 million yuan, primarily involving the procurement of high-end storage devices or synchronized procurement with servers, switches, etc. For example, in the PACS computing and storage procurement project of West China Hospital of Sichuan University, the price of a single all-flash storage and object storage reached over 2 million yuan and over 1 million yuan, respectively.

02

In government affairs and public utilities, healthcare procurement accounts for over 40%

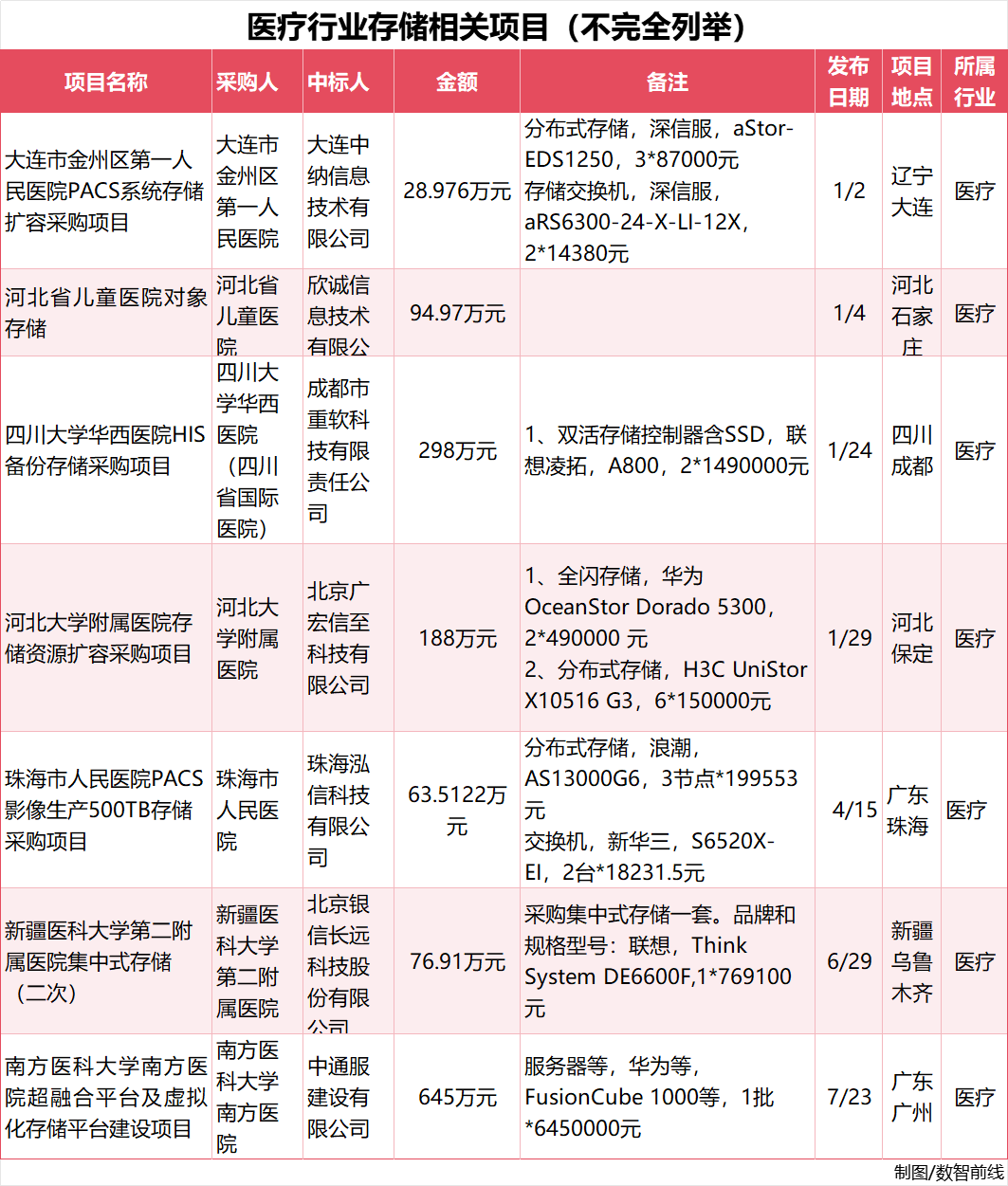

According to incomplete statistics from Digital Frontier on the China Government Procurement Network, among government and public utilities, healthcare, government, and education are the industries with the highest number of bids, contributing over 40%, over 30%, and over 10% of the total project count, respectively.

Especially in the healthcare sector, a total of 135 hospitals of various sizes from across the country have completed over 160 storage-related projects, many of which involve storage expansion projects for HIS, PACS, etc. “The demand for healthcare cloud services is continuously driving the procurement of storage in this industry,” a senior industry expert told Digital Frontier. Currently, the policy drive for investment in healthcare clouds is evident, with not only large tertiary hospitals but also a large number of small and medium-sized medical institutions accelerating the upload of medical data.

Moreover, it is worth mentioning that more hyper-converged storage system projects are emerging in hospital storage procurements.

In the past, when buying clouds and storage in the healthcare industry, two major infrastructure providers were often required, and medical users' own operations and maintenance personnel needed to coordinate platform docking and debugging. Hyper-converged systems, with their virtualization capabilities, can achieve "out-of-the-box" functionality more effectively than traditional methods of separately procuring virtualization platforms/software and hardware devices. For some users, hyper-convergence enables faster access to computing power, storage, and cloud platform management capabilities, making it favored in industries such as healthcare clouds.

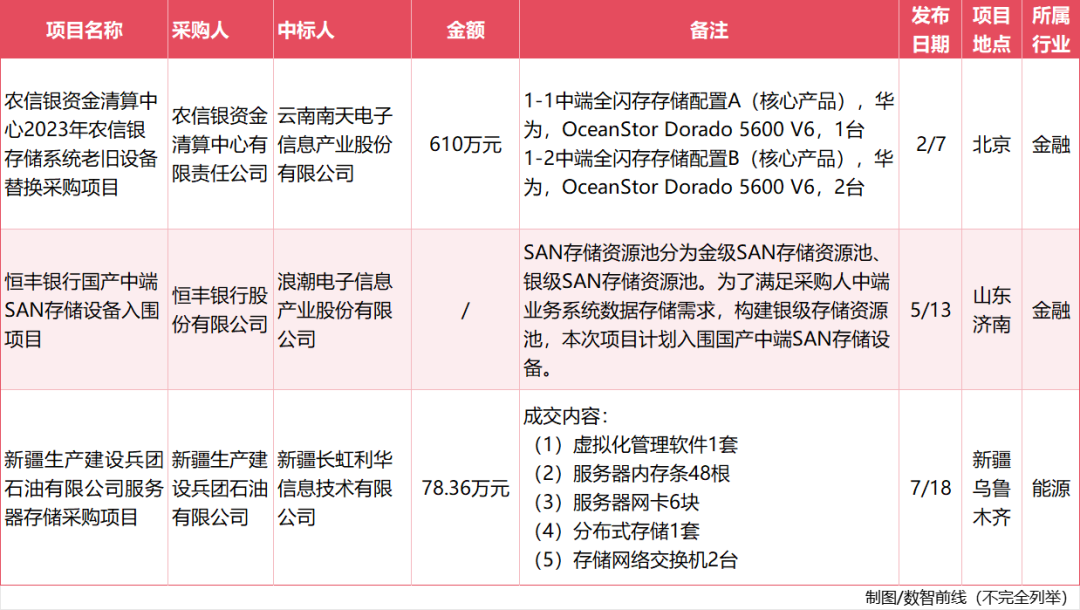

While the projects aggregated on the China Government Procurement Network are primarily from government agencies and public institutions such as science, education, culture, and health, they also involve winning bids in fields like finance, transportation, and energy. For example, the “2023 Replacement Procurement Project for Aging Storage Systems by the Agricultural Credit and Banking Clearing Center” is worth 6.1 million yuan, and the “Server Storage Procurement Project” by the Xinjiang Production and Construction Corps Petroleum Co., Ltd. is worth 783,600 yuan, with procurement requirements including distributed storage, storage network switches, virtualization management software, server memory modules, and server network cards.

Industry observers note that after a relatively strong procurement cycle from 2022 to the first half of 2023, the financial industry's storage procurement efforts have declined slightly this year. While some small and medium-sized financial institutions at the municipal level still have procurement needs for storage, large national and central banks have shifted their focus to computing power this year, with storage procurement plans for the next cycle still in development.

Undeniably, manufacturing is also a major buyer in the storage market this year. Yang Yunxu, Research Manager at IDC China, told Digital Frontier that manufacturing procurement needs have persisted since 2023, with manufacturing enterprises restoring procurement demand for both domestic and global supply chains. For example, food manufacturers such as Yili Group, automakers such as BYD, and shoe and apparel manufacturers all have stable procurement needs for storage systems.

“Manufacturing procurement needs are gradually shifting towards distributed systems,” said Yang. Taking automotive manufacturing as an example, core or AI-related businesses still have stable procurement needs for high-end all-flash storage, while smart parks and industrial control systems are increasing their procurement needs for distributed storage solutions. At the same time, demands for production data security and compliance are directing procurement towards backup systems.

“In the first half of 2024, the Chinese enterprise storage market demonstrated higher-than-expected growth,” Yang told Digital Frontier. One of the main drivers of this growth is the recovery of domestic demand, with significant increases in storage procurement demand observed in industries such as manufacturing, transportation, government, and telecommunications.

03

Obvious head effect, further acceleration of storage localization

In the first eight months of 2024, although the specific winners were diverse, there was a notable head effect in terms of the brands involved in the final bids.

Storage products from foreign vendors such as Dell, HP, and IBM still appeared frequently, with Dell, in particular, involved in the final bids for at least 10 projects.

However, in the past year or two, the trend towards localization of storage has become more pronounced. Domestic brands such as Huawei, H3C, Inspur, Sugon, Lenovo, ZTE, and Sangfor have become mainstream.

For example, Huawei won at least 11 projects as the bidding entity of “Huawei Technologies Co., Ltd.,” all of which were tendered by China Telecom, China Mobile, and China Unicom, the three major operators. Huawei was also involved in the three largest projects (with winning bids exceeding 80 million yuan each), and there were over 50 additional storage projects involving Huawei-related products.

Huawei's public data also provides evidence of this trend. In the first half of 2024, Huawei's revenue from data storage in the commercial market increased by 75% year-on-year, with a 37% increase in the number of partners and a 49% increase in the number of customers. Industry observers note that Huawei is currently vigorously promoting the “all-flash democratization” initiative, which is expected to give it more product advantages in the small and medium-sized customer market.

Other domestic vendors such as Inspur, H3C, Sugon, Lenovo, and ZTE have also either won large contracts themselves or appeared on the procurement lists of numerous projects.

For example, the “Inner Mongolia Radio and Television Station’s Full-Station Program Production and Broadcasting System (Basic Resource Platform) Project,” worth 12.74 million yuan, was directly won by H3C Technologies Co., Ltd., with procurement targets including dual-active storage, distributed storage, storage access switches, and many other products. ZTE, Sugon, and H3C also directly won two large centralized procurement projects worth over 80 million yuan tendered by China Mobile.

“The application of localized components is driving a new round of procurement, with a notable demand for ARM-based products and other x86 components,” Yang Yunxu, Research Manager at IDC China, told Digital Frontier. This is also one of the main drivers of the higher-than-expected growth in the storage market in the first half of this year.

04

All-flash storage becoming the choice of more users

With the accelerated rollout of AI large models and the construction boom of intelligent computing centers this year, new requirements are being placed on storage. Leading infrastructure vendors such as Huawei, H3C, Inspur, and Sugon, as well as cloud vendors like Alibaba Cloud, Tencent Cloud, and Baidu Intelligent Cloud, are optimizing and enhancing storage products for high performance, multi-protocol, customization, and high security in response to these new demands.

Against this backdrop, all-flash storage is becoming the choice of more users. Among the 375 winning projects analyzed by Digital Frontier, at least 20 projects explicitly included the procurement of all-flash products, with a wide range of industries involved, including hospitals, government, finance, operators, and research. Hospitals, in particular, had the most projects, with 11 contributing over half of the total.

In terms of the primary bids, the procurement of all-flash storage currently exhibits an obvious head effect, with products from domestic storage giants such as Huawei, H3C, and Lenovo Lingtuo being procured more frequently. For example, there were at least 11 projects involving Huawei's all-flash products. Dell and IBM were also key procurement brands.

Apart from these projects, industries such as energy and transportation have also procured all-flash products. For example, CNOOC Tianjin Branch completed the procurement of “New Purchase of 2024 Scientific Research Hardware - NAS All-Flash Storage and Expansion of Existing Storage” in September this year, while China Railway Hohhot Bureau Group Co., Ltd. completed the procurement of the “All-Flash Storage and Other Information Equipment Project.”

All-flash storage can be divided into two types: centralized all-flash and distributed all-flash. Centralized all-flash is primarily suitable for high-performance computing and high IOPS scenarios, such as gene sequencing. Meanwhile, with the development of software-defined storage and hyper-convergence, distributed all-flash is supporting more scenarios like generative AI.

According to IDC statistics, while all-flash storage accounts for nearly 40% of global storage shipments, it only accounts for 25% in China, with “centralized storage potentially accounting for 35%.” However, as component prices gradually stabilize, users prioritize performance in their work scenarios, and vendors like Huawei and Inspur increase their self-developed SSD production, SSD deployment capacity is gradually increasing. All-flash storage is expected to continue growing at a rate faster than the market average, becoming a major trend in the future.

In response to this definitive trend, various players are accelerating their layouts in all-flash products. In May, Inspur Information released the AS13000G7-N series of distributed all-flash storage specifically optimized for large models. In June, Sugon Storage announced the upgrade of its distributed storage ParaStor and officially launched FlashNexus, the world's first centralized all-flash storage with billions of IOPS. Meanwhile, in September, Huawei launched its new generation of OceanStor Dorado all-flash storage, boasting extreme performance, resilience, and AI-Readiness.

We will continue to follow the developments in the storage market.