It will take another three years before capital can swallow Musk's pie

![]() 10/14 2024

10/14 2024

![]() 440

440

Musk might indeed be too eager to "throw a party."

At 11 a.m. Beijing time on October 11, Musk, who was an hour late, arrived at Warner Bros. Studios in a Tesla Robotaxi amidst the anxious anticipation of tech enthusiasts worldwide.

During the much-hyped "historic" Tesla "We, Robot" event, Musk spent just 20 minutes speaking before summoning robots to "dance and pour drinks" for the crowd.

Looking back at the entire event, Musk showcased four products: Cybercab (driverless taxi Robotaxi), Robovan (driverless minibus), the latest FSD updates, and the robot Optimus.

Perhaps because Musk transitioned too quickly from his speech to the party, investors, who did not hear specific technical and commercialization details, expressed their dissatisfaction with Musk's "pie in the sky" promises by driving Tesla's market value down by over 9% the following day.

Upon closer examination of Tesla's product designs, we can still see Musk's ambition to achieve fully autonomous driving. By accelerating the iteration of intelligent driving capabilities through Robotaxi, Tesla hopes to emerge victorious from the competition with Baidu and Waymo, positioning itself as a car manufacturer.

However, as all the products showcased during the demonstration are still "futures" that will take at least a year to materialize, Musk's plans may have been announced too soon. It seems that Musk still has a ways to go before realizing his goal of fully autonomous driving. But with Tesla facing increasingly fierce competition in the automotive market, its window of opportunity to maintain technological leadership is rapidly closing.

First, Tesla has achieved a high level of product maturity with its Cybercab.

Specifically, the interior is devoid of a steering wheel and pedals, complemented by a small space that comfortably seats two passengers, giving it a "minimalist vehicle" vibe. Additionally, to facilitate operation and maintenance and reduce the need for human intervention in recharging the Robotaxi, the Cybercab lacks a charging port and supports only wireless charging. In terms of autonomous driving technology, the Cybercab remains consistent with Tesla's offerings, utilizing a pure vision-based FSD solution.

For production, Tesla currently anticipates a launch no later than 2027. If customers wish to experience the technology sooner, they can opt for Tesla's fully autonomous vehicles, which are scheduled to be introduced in Texas and California next year, and experience driverless taxi services through existing models. Finally, regarding costs, the estimated operating cost of the Cybercab is approximately $0.20 per mile (roughly equivalent to 0.9 yuan per kilometer in China). The current cost guidance for purchasing a Cybercab is below $30,000.

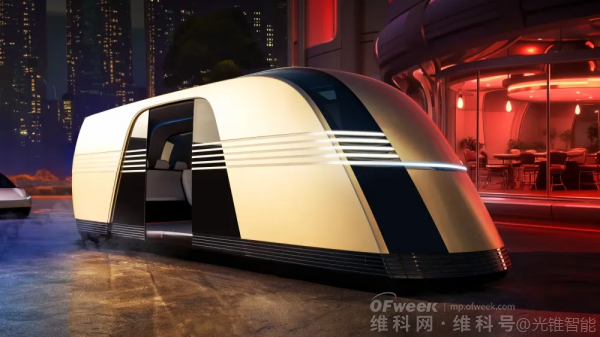

Next up is the Robovan, essentially a larger version of the Cybercab, with an appearance reminiscent of a common MPV. In terms of intended use, Tesla believes the Robovan can accommodate up to 20 passengers or transport goods. If used as a tourist shuttle, the travel cost is approximately $0.05 to $0.10 per mile (roughly equivalent to 0.2 to 0.4 yuan per kilometer in China).

Regarding the latest FSD developments, Tesla did not reveal information about FSD v13, as some had anticipated. Apart from Musk's belief that fully unsupervised FSD will be available in Texas and California next year, the company reiterated its vast amount of training data and the assertion that FSD will ultimately be safer than human driving.

Lastly, for the robot Optimus, Musk projected a future cost of $20,000 to $30,000. He did not mention any other advancements, and based on the on-site demonstration of Tesla robots dancing, greeting, and pouring drinks, there does not appear to be a significant improvement from the showcase earlier this year. Perhaps this appearance was merely meant to set the mood for the party.

Perhaps due to the brevity of the presentation, which mentioned four products that are all "futures" not deliverable within the year, or because Musk was vague in his explanations, investors were clearly dissatisfied with Tesla. This dissatisfaction was reflected in the company's market value, which plummeted by over 9% the day after the event.

At the same time, many analysts expressed concern that even if Tesla's Cybercab can overcome issues such as stainless steel body production capacity, local regulations, and wireless charging station construction to achieve mass production, the company's operational space may already be eroded by other Robotaxi giants during the three-year wait. Furthermore, considering Musk's tendency to repeatedly delay timelines, there is a risk that Tesla's Robotaxi ambitions, first mooted in 2019, may end up being delayed indefinitely.

Is Tesla's entry into the Robotaxi market truly a case of "forcing a duck to walk on water"?

Robotaxi has finally entered a stage of imminent large-scale commercialization. In October of this year, global Robotaxi giants have unanimously sounded the call for expansion.

First, on October 4, Reuters reported that Waymo announced the addition of Hyundai vehicles to its autonomous fleet. This collaboration further expands Waymo's global influence among automakers, following similar deals with Tata Motors in India and Zeekr in China.

Subsequently, on October 9, Nikkei reported that Baidu plans to expand its Apollo Go robot taxi service to markets outside China. To accelerate overseas deployment, Baidu has actively sought partnerships with foreign automakers, ride-hailing platforms, and other tech companies to jointly promote Robotaxi services.

With Tesla's official entry into the market, the global Robotaxi industry is poised to form a three-way standoff between Tesla, Waymo, and Baidu.

Both Baidu and Waymo are currently in a similar position, having initiated operations and preliminarily validated their business models. Their global expansion efforts essentially represent a commercial push from "pilot operations" towards seeking economies of scale.

On Tesla's side, while Musk only showcased "prototypes" during the event, with an uncertain launch timeline (Cybercab is projected for production in 2026, with a possible delay until 2027), Tesla's Robotaxi announcement was not akin to the hurried deployments of Baidu and Waymo. For Tesla, success in the Robotaxi sector may ultimately hinge on automakers' ability to iterate on autonomous driving technology and manufacturing.

Based on the information presented at the "We, Robot" event, Tesla's Robotaxi validates the "gradual" evolution path towards L4 autonomous driving.

This means that achieving Robotaxi does not necessarily require the extensive investments in vehicle-to-road-to-cloud coordination seen in Baidu's approach or Waymo's customized L4 algorithms and sensor designs. Automakers with strong autonomous driving capabilities can rely on a universal autonomous driving development model (such as Tesla's end-to-end + pure vision approach) and simply upgrade the corresponding computing hardware (the AI5 platform projected for the Cybercab boasts approximately 10 times the computing power of HW4.0) to introduce autonomous driving and Robotaxi products to the market.

In other words, according to Tesla's strategy, the Robotaxi business is essentially another battleground for autonomous driving players competing for sales. Ultimately, if we calculate Robotaxi shipments based solely on operational breakeven points, the result, as shared by Zhang Ning, Vice President of Pony.ai and Head of the company's Robotaxi autonomous driving mobility business, with Guangzhui Intelligence, suggests that "500 to 1,000 vehicles need to be deployed in a single city."

In this process, automakers gain higher revenue from Robotaxi operations (either through operations or direct sales). Additionally, the incremental driving data generated by Robotaxi further accelerates autonomous driving iterations. Enhanced autonomous driving capabilities, in turn, allow automakers to negotiate from a stronger position.

While there are currently no automakers that excel in both autonomous driving and Robotaxi, we can draw insights from the sales structure changes at NIO this year, illustrating the direct impact of improved autonomous driving capabilities. "Since the release of version 6.0 (upgrade), which was just 1-2 months ago, our AD Max adoption rate has surpassed 50%, with over 10% month-on-month growth," Lang Xianpeng, Vice President of Intelligent Driving Research and Development at NIO, shared with Guangzhui Intelligence during an August communication session.

In this context, Tesla is projected to generate more revenue from FSD subscriptions, truly closing the commercialization loop for software (AI) revenue as a tech company.

Although 80% of Tesla's revenue (based on 2023 annual report data) comes from car sales, Wall Street has long believed that half of Tesla's nearly 5 trillion yuan market valuation stems from its AI capabilities.

This is because when Tesla emerged as the global leader in new energy vehicles in 2020, its advanced centralized EE architecture design and Musk's pursuit of autonomous driving gave it a dual identity: automotive industry (optional consumer goods, traditional value stock) + FSD subscriptions (software sales, tech stock). Under this model, when the capital market uses the PS (price-to-sales) ratio to simply estimate the valuation of these two attributes, it forms a fundamental basis where Tesla's car sales are merely the foundation, while the AI side carries a "very high valuation leverage."

Put simply, as long as car sales do not collapse, Tesla's AI deliverables will largely determine the direction of the company's market value.

The sharp drop in Tesla's market value following the "We, Robot" event reflects the capital market's dissatisfaction with Tesla not only failing to introduce anything new but also with Musk himself being unsure about when Cybercab production will commence.

Perhaps the capital market has been somewhat "lenient" in its "punishment" of Tesla.

According to Musk's projections, Cybercab production hinges on the unsupervised autonomous driving capabilities of the Model 3 and Model Y by next year. Admittedly, under the end-to-end autonomous driving development model, Tesla has overhauled most of its autonomous driving functionalities throughout the FSD v12 iteration. The intelligence of FSD is such that it can even navigate with a bug (no destination set), as demonstrated when it took He Xiaopeng, Chairman of Xpeng Motors, for a joyride around the city.

Considering the current performance of FSD and Musk's 2016 promise that Tesla cars would be able to drive autonomously from New York to Los Angeles by next year, it remains questionable whether Tesla can truly achieve unsupervised autonomous driving by 2025. Perhaps Tesla's goal of leveraging Robotaxi to achieve dual growth in sales and FSD subscription revenue is merely another "plausible" story Musk is telling the market.

However, the market's appetite for "pies" is ultimately limited.

Looking around, Tesla's heyday is long gone in China's smart car market, which leads the way. In terms of automobile manufacturing, Tesla has already been surpassed by BYD in both global sales and automotive gross margin (excluding the impact of carbon credits). On the other hand, while Chinese autonomous driving players have yet to achieve full end-to-end capabilities, Tesla does not hold a significant advantage when compared to the "door-to-door" autonomous driving experiences that many Chinese manufacturers aim to deliver by 2025.

Perhaps, following the "formulaic" narrative of "Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future," Musk's quest for fully autonomous driving is still in the "desperate struggle and repeated delays" phase. But Tesla's window of opportunity to reclaim the top spot in global autonomous driving, leveraging fully autonomous driving, is clearly closing rapidly.