Subsidies cannot buy loyalty: Kimi's commercialization dilemma

![]() 10/14 2024

10/14 2024

![]() 522

522

The deep cultivation of content ecosystems by major tech companies has become an advantage that startups like Kimi find difficult to match.

@ New technological knowledge original

After a long hiatus, the burn-money wars in China's internet industry have resurfaced amidst the competition for AI large model applications.

Looking back over the past decade, every industry disrupted and reinvented by the internet has been accompanied by a fierce burn-money battle. From group buying to food delivery, from e-commerce to travel, from ride-hailing to the sharing economy, the money-sprinkling games played by tech giants and venture capitalists have never stopped.

After the final battle in the community group buying sector ended, under the influence of macroeconomic cycles, internet giants finally put aside their fiery ambitions and began to focus on cultivating their businesses. A few fleeting waves, such as the metaverse and Web3, failed to gain significant traction.

Now, this cost-blind land grab has been reborn in the battle for investment in AI large model applications. Since the beginning of this year, China's "Big Five" AI large model players (Zhipu AI, Dark Side of the Moon, Baichuan AI, MiniMax, and ZeroOne Everything), along with AIGC applications under ByteDance and Tencent, have entered a white-hot competition for customer acquisition on various traffic platforms.

An entrepreneur who entered the large model race following the emergence of ChatGPT told TechNewSense, "Last year, most of my peers were still discussing products and how to catch up with foreign technological levels. This year, everyone's biggest headache is user growth."

Data from the "China Mobile Internet Half-Year Report 2024" shows that as of June this year, the monthly active user base of AIGC apps in China reached 61.7 million, a year-on-year increase of 653%. Behind this influx of users lies soaring customer acquisition costs.

Leading large model applications like Kimi from Dark Side of the Moon and ByteDance's Doubao are gradually turning this epoch-making technological revolution into a money game of competing wallets. Industry investors revealed early in 2023 that Kimi's average customer acquisition cost was 12-13 yuan per user, with daily costs of at least 200,000 yuan. This year, media reports indicate that Kimi spends at least 30 yuan to acquire each registered user on Bilibili.

The rare tranquility in the internet industry has been disrupted, and a new round of burn-money wars is raging. How will upstarts like Dark Side of the Moon compete with established giants like ByteDance?

01. The Battle for Users

Any new business model requires substantial upfront investment with little immediate return for market cultivation. The scale of initial investments by internet companies depends on the continuous support of capital behind them, which values the internet industry's winner-takes-all characteristic that traditional businesses cannot match.

Meituan won the "Thousand Group War" and monopolized merchant resources, solidifying its position as the leading food delivery platform. Didi used capital to absorb competitors like Kuaidi Dache and Uber, making it the dominant player in ride-hailing. However, the food delivery red packets and ride-hailing subsidies enjoyed by users during these burn-money wars have since disappeared.

In the traditional internet model, burning money buys users and market position, or perhaps the next round of funding. But driving investment in AI large model applications involves more than just user growth.

Kimi's soaring user traffic not only bolsters Dark Side of the Moon's standing in front of investors but also provides a continuous stream of fresh data for training the underlying large model.

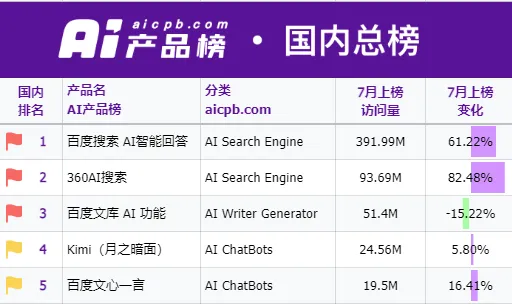

Image source/AI Product Ranking

Once algorithms are upgraded through internal team optimization and iteration, and computing power is unleashed through capital investment, only high-quality data remains as one of the three essential elements of large models. Currently, this can only be obtained through external channels. The industry has proposed using AI-generated data for training, but a study submitted by Oxford University and published in the prestigious academic journal Nature suggests that allowing large models to train themselves with autogenerated data may lead to self-degradation, iterating the original content into gibberish within just a few generations.

Perhaps due to the need for precise data, Kimi chose Bilibili, with its predominantly student and young professional audience, as its primary platform for customer acquisition. According to Bilibili's official data, over 80 million users watch AI-related content on the platform each month. In the past year, daily views of AI content have increased by over 80% year-on-year, and daily active users of AI-related UPs have grown by over 60%.

Kimi's monopoly-like investment in Bilibili has made it difficult for competitors like Zhipu, MiniMax, and Kunlun Tech to match the unit cost, resulting in a one-sided competition. A frequent Bilibili UP who often receives platform orders said, "Apart from Pinduoduo, I've never seen such a wealthy client."

Significant financing and high investment costs have formed a positive flywheel for Dark Side of the Moon. According to July statistics from the third-party platform AI Product Ranking (aicpb.com), Kimi's monthly visits have reached 24.56 million, far ahead of second-placed Baidu Wenxin ERNIE Bot. After the latest round of financing in August, Dark Side of the Moon's post-investment valuation reached US$3.3 billion (RMB 21 billion), leading the domestic large model startup race.

Investment is not just about user-level promotion but also about procuring training data. However, these substantial expenses cannot be covered by new user pay rates. According to Zpeidia statistics, Kimi Assistant received 24.05 million visits in July, with 3.99 million unique visits, meaning each user opened the app an average of six times that month. Even with just a few free uses, new users consume backend computing power costs.

Unlike Meituan and Didi, which can cancel subsidies after users develop consumption habits, Dark Side of the Moon's current investments fail to retain enough sticky users, making this unprofitable business model unsustainable in the long run.

02. Using ToB to Fill ToC Gaps

The ToC path for large model applications is challenging, with subscription fees as the primary revenue model.

For example, ChatGPT's parent company OpenAI, a global leader, has 7.7 million subscribers worldwide, generating US$1.9 billion in C-end revenue. However, this pales in comparison to its annual operating costs of US$8.5 billion, as reported in internal financial data.

Dark Side of the Moon once introduced a paid feature called "Cheer Kimi On," where users could purchase gifts ranging from 5.2 yuan to 399 yuan to reward Kimi and gain priority access during peak hours. This test of paid willingness feels more like user research than a well-thought-out revenue model.

Image source/iMedia

Can ToB make up for ToC shortcomings? There has been significant debate within the industry. Ren Wanzhi, founder of ZeroOne Everything, has publicly stated, "ZeroOne Everything is firmly committed to ToC business and will not engage in unprofitable ToB operations." In contrast, Zhipu AI CEO Zhang Peng has repeatedly argued that the B-end market has a stronger willingness to pay compared to the C-end market.

Ren's concerns are valid. While the ToB business model for large models has a clearer revenue model and customer willingness to pay, the industry has fallen into a price war initiated by powerful tech giants.

According to Caijing magazine, before May this year, the gross margin of domestic large model inference computing power was over 60%, similar to international peers. However, after consecutive price cuts in May, the gross margin plummeted to negative figures.

Alibaba, Baidu, ByteDance, and Tencent, which have joined the large model price war without hesitation, have their cloud business profits as a hedge. Just as OpenAI's continuous losses have led to a surge in performance for majority shareholder Microsoft due to increased demand for cloud server rentals, ByteDance's recent US$1 billion venture capital round for Dark Side of the Moon included US$790 million led by Alibaba, with US$600 million required to be placed in an escrow account for consumption of Alibaba Cloud services.

While venturing into ToB may seem like a desperate measure, it is a necessary step for large model startups. Zhipu AI practices its CEO's philosophy by focusing on ToB while not abandoning ToC exploration. MiniMax has a presence in both B and C ends and launched an enterprise-level API in August, riding on Kimi's fame in the C-end market.

A similar scenario played out in the autonomous driving sector. Similar to how Dark Side of the Moon burns money for data acquisition, autonomous driving companies need to quickly deploy their software solutions on vehicles to collect data from real-world driving conditions to improve driving intelligence.

Automotive companies with both vehicle products and autonomous driving solutions can rely on hardware revenue to offset software investments. Those with only software products must choose the ToB model to collaborate with automotive companies, either by charging service fees or securing on-board rights through partnerships.

The difficulties faced by small and medium-sized startups against industry giants are an inevitable reality across all sectors.

03. The Shadow of Big Tech Ecosystems

Back in the days of burn-money wars in the internet industry, startups were often asked during venture capital pitches, "What if BAT copies you?" This tricky question remains difficult to answer in today's large model race.

On its first anniversary, Dark Side of the Moon announced that Kimi's long-text capability had expanded from 200,000 to 2 million characters. According to Similarweb analysis, this leading long-text capability briefly pushed Kimi's web version's daily active user peak to 346,000, with weekly active data growing by 45% month-on-month.

Once a trump card is played, it will inevitably be learned by competitors in the market. Within a month, Alibaba's Tongyi Qianwen and 360 AI Browser successively announced support for 10 million and 5 million character long texts. Subsequently, Baidu also announced an upgrade to Wenxin ERNIE Bot, opening long-text capabilities with a range of 2 to 5 million characters.

After being copied on long texts, Doubao emerged as Kimi's formidable rival in the investment battle. Industry insiders revealed that for a time, Douyin almost "banned" all other large model application ads, fully supporting Doubao. After capturing Douyin users' minds, Doubao began counterattacking Kimi's stronghold on Bilibili by purchasing ad space for the search keyword "Kimi." This fierce competition forced players like Zhipu to retreat to other community platforms like Zhihu and Weibo.

Facing the financial muscle of big tech, Dark Side of the Moon, backed by capital, still has a fighting chance. However, when it comes to information channels that impact large model product experiences, the content ecosystems cultivated by ByteDance and Tencent over the years become an unattainable advantage for startups.

For example, when asking different large model applications the same question, Wenxin ERNIE Bot's answers often draw from Baidu's Baijiahao and other channels. Tencent's Yuanbao was launched with a focus on information channels on WeChat Official Accounts, while Doubao is deeply integrated with ByteDance's Toutiao. In contrast, startups like Kimi and Zhipu Qingyan often source their answers from official public information and third-party media channels.

The information sources of different products directly impact how well the generated content matches the demander's needs. OpenAI has already invested heavily in purchasing data channels from popular community platforms, a cost that will inevitably fall on the shoulders of startups like Dark Side of the Moon.

Capital concentration accelerates technological breakthroughs and industry development, which is a positive trend. However, as the operators of burn-money strategies, companies have the obligation to spend money where it yields long-term returns. Being unable to answer "What if BAT copies you?" for a while is not a big deal, but failing to do so consistently may lead to the next stage: "How to get acquired by BAT?"