Musk Takes Priority, Trump Team Plans to Ease U.S. Autonomous Vehicle Rules

![]() 11/19 2024

11/19 2024

![]() 485

485

After heavily betting on Trump, Musk is now reaping the rewards.

On November 18, local time, Bloomberg reported that the team of the elected U.S. President Trump plans to make "building a federal framework for fully autonomous vehicles" one of the priorities of the U.S. Department of Transportation.

If the new regulations further ease the rules for autonomous vehicles in the United States, Musk, as the CEO of Tesla, will benefit directly. Bloomberg even points out that policy leaders are working towards Musk's key priorities.

After all, with car sales calming down this year, Musk is placing more future bets on autonomous driving and artificial intelligence for Tesla.

On October 10 this year, Tesla officially unveiled the fully autonomous Robotaxi model, Cybercab, and plans to start mass production as early as 2026.

Tesla Cybercab

Currently, the National Highway Traffic Safety Administration (NHTSA) only allows manufacturers to deploy 2,500 autonomous vehicles per year with exemptions.

Affected by the above news, Tesla's pre-market price jumped more than 8%, with shares nearing $350, approaching the nearly one-year high of $358 set last week.

However, even if Musk has a favorable regulatory environment, Tesla will still face significant technical and legal challenges when deploying autonomous vehicles.

01 Musk Hopes to Establish a "Federal Approval Process for Autonomous Vehicles"

As early as October 23 this year, during Tesla's third-quarter earnings call, Musk stated that Tesla is currently facing a diverse landscape of state laws regarding driverless vehicles, and that "implementing (regulations) state by state is very painful."

He called for national regulations that would allow autonomous vehicles to operate on U.S. roads without traditional driver controls.

At that time, Musk also said that if Trump won and fulfilled his promise of Musk heading the Department of Efficiency, he would use his potential position in the U.S. government to promote a more streamlined regulatory approach to approve the use of fully autonomous vehicles nationwide.

Musk unveils Cybercab on October 11, Beijing time

After all, the current U.S. regulations pose significant obstacles to Musk's so-called Cybercab plan, including limits on deployment caps.

Currently, the NHTSA allows manufacturers to deploy 2,500 autonomous vehicles per year with exemptions. This is negligible for Tesla, which produces millions of vehicles annually.

Now, with Trump's inauguration, Musk has fulfilled his wish to lead the U.S. government's efficiency department. Meanwhile, his influence is on the rise.

According to Reuters, a source close to Musk and Trump's transition team revealed that Musk is expected to influence Trump's choice for the next Secretary of Transportation.

The source said that one of the candidates Trump is considering for the position of Secretary of Transportation is former Uber executive Emil Michael, who has already spoken with Trump's team and potential staff.

Additionally, Republican Representatives Sam Graves of Missouri and Garrett Graves of Louisiana are also potential candidates.

The appointed individual will promote significant changes to autonomous vehicle rules at the national level.

After all, although the U.S. Department of Transportation can promulgate rules through the National Highway Traffic Safety Administration (NHTSA) to facilitate the operation of autonomous vehicles, congressional legislation will pave the way for the large-scale adoption of autonomous vehicles.

In fact, there have been voices in the United States for several years advocating for federal legislation to regulate autonomous vehicles, but they have been hindered.

During Trump's first term, he hoped to increase the number of deployable autonomous vehicles to 100,000 per year. The bill for this goal passed in the House of Representatives but stalled in the Senate. In the first year of the Biden administration, an attempt was made to merge this bill with other legislation, but it ultimately failed due to opposition from some manufacturers and consumer complaints.

Meanwhile, the lack of a steering wheel in the Cybercab design is also an obstacle to its widespread adoption in the United States. As early as early 2022, General Motors applied to the NHTSA for an exemption to deploy driverless vehicles without steering wheels from its Cruise autonomous driving division. However, as the agency took no action on the request for over two years, the automaker ultimately discontinued the plan in July this year.

According to the National Highway Traffic Safety Administration, Tesla has not yet applied for an exemption for the Cybercab. To date, the agency has only approved one such application, allowing startup Nuro to deploy low-speed autonomous delivery vehicles for cargo, not passengers, in 2020.

02 Tesla Robotaxi May "Overtake on a Curve" Through Policy

If the U.S. Department of Transportation makes federal legislation for fully autonomous vehicles a priority during Trump's new term, there is no doubt that Tesla will be the biggest beneficiary.

After all, in the field of autonomous driving, Tesla's business model is completely different from that of Waymo and Cruise. Tesla aims to launch a C2C model where vehicles with autonomous driving capabilities "go out on their own" to earn money for consumers.

As early as 2016, Musk included Robotaxi in Tesla's plans. In 2019, Musk stated that driverless intelligent driving features would soon be realized, and by 2020, Tesla would have 1 million driverless taxis; in 2022, Musk reiterated that Robotaxi would enter mass production in 2024.

According to Musk's statements at Tesla's Autopilot Day event in 2019, the first phase of Robotaxi will resemble the business model of ride-hailing and car-sharing services. Tesla will establish its own fully autonomous Robotaxi fleet, initially operating it on its own, with ride costs lower than current bus fares.

Preview of Tesla's autonomous ride-hailing app

Subsequently, Tesla will not only operate its own fleet but also allow Tesla owners to join the shared fleet, with such owners earning up to $30,000 per year.

The story sounds beautiful and profitable, but reality is harsh.

Currently, Tesla's progress in Robotaxi lags behind that of Waymo and Cruise.

California is Tesla's largest market in the United States and a major testing ground for the autonomous vehicle industry. According to Reuters' review of California regulatory data, six companies currently have autonomous driving test permits in California. These companies typically conduct at least three years of supervised driver testing before obtaining autonomous driving test permits, often logging millions of miles.

For example, Amazon's Zoox has logged over 1.6 million miles of cumulative testing in three years. General Motors' Cruise has logged over 2.1 million miles of cumulative testing in five years. Alphabet's Waymo has logged over 13 million miles of cumulative testing from 2014 to 2023 and obtained seven different regulatory approvals, including approval to charge passengers for driverless taxi services.

Tesla's current autonomous driving test permit in California is the lowest level, allowing testing only under human driver supervision. According to California records, Tesla has only conducted 562 miles of testing since 2016 and has not submitted autonomous driving reports to California regulators since 2019.

Tesla demonstrates FSD technology

The gap between Tesla and its Robotaxi competitors is evident.

However, according to Reuters, autonomous vehicle regulatory experts stated that if Musk can successfully push the U.S. government to introduce federal regulations or laws that take precedence over state regulations, Tesla can circumvent California's regulations. Or, in other words, overtake on a curve.

Of course, even if Musk has a favorable regulatory environment, Tesla will still face significant technical, legal, and even insurance challenges when deploying autonomous vehicles.

03 Rapid Advancement of Autonomous Driving in the United States

In fact, before this, the development speed of Robotaxi in the United States has significantly accelerated this year.

On the one hand, Uber has been very proactive, successively announcing Robotaxi partnerships with Cruise, Waymo, and even BYD. On the other hand, Cruise is conducting tests through "manual driving" and "supervised driving" to gradually resume operations.

Meanwhile, after securing a new round of $5.6 billion in funding, Waymo has entered a "weekly update" mode, publishing the latest order information every week.

The latest data shows that as of the end of October, Waymo One could provide 150,000 paid driverless trips per week, with over 1 million miles of fully autonomous driving.

Status of some U.S. Robotaxi companies. Source: Guotai Junan Securities

Of course, Tesla's "We, Robot" conference on October 10 was also an important catalyst for the U.S. Robotaxi market.

The development of Robotaxi in the United States has also gone through multiple phases, with ups and downs.

The first phase was the nascent stage from 2009 to 2016. Waymo, formerly known as the Google self-driving project established in 2009, became an independent entity in 2016. At this time, the U.S. Robotaxi industry was still in its early stages of development, with no systematic institutional framework, and the industry was just beginning to take shape.

From 2016 to 2022 was a period of rapid development. As Robotaxi technology continued to advance among various companies, policies also continued to "open up," providing a soil for testing, piloting, and commercial deployment. During this time, Waymo also grew rapidly and successfully launched in multiple regions.

In 2023, the industry entered a trough, marked by the suspension of Cruise's Robotaxi business due to a traffic accident. Waymo was also affected, conducting its first layoffs in a decade in 2023 and suspending its autonomous trucking business.

This year, Robotaxi has entered a recovery phase, with enterprises showing strong vitality, continuously increasing investment, and policies also continuously providing support.

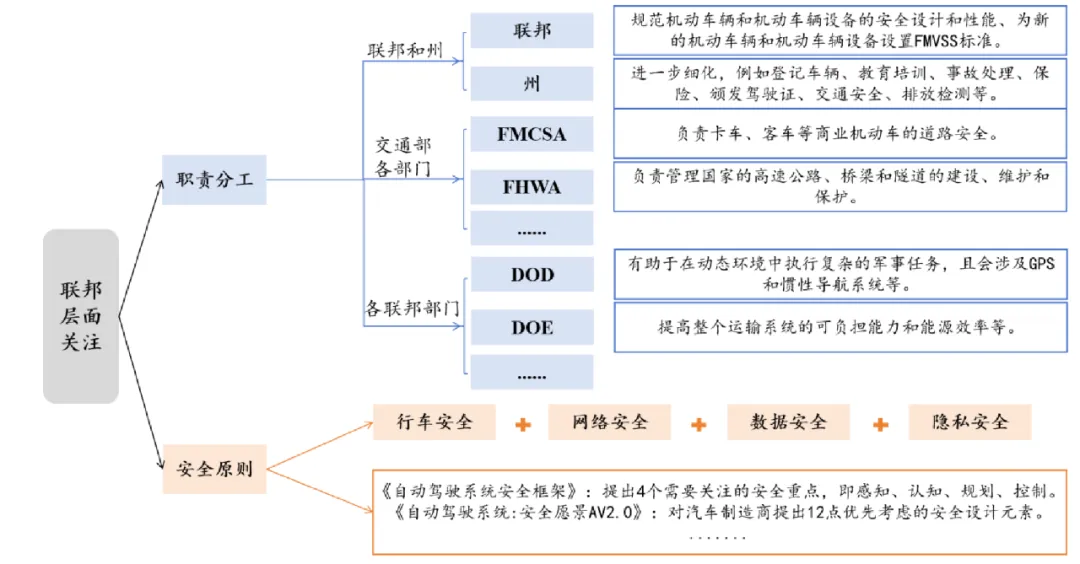

The U.S. federal government provides a safety framework for autonomous driving. Source: Guotai Junan Securities

Overall, the U.S. federal government and states have a relatively open attitude towards autonomous driving, mainly reflected in safety officer requirements and in-vehicle design.

Regarding safety officers, some states allow autonomous vehicles (SAE Levels L4/5) used for testing and operations to operate without in-vehicle safety officers under certain conditions, such as being able to execute minimum risk conditions, complying with local traffic safety regulations, having insurance, and having a communication link with remote safety officers.

In terms of in-vehicle design, in March 2022, the NHTSA issued a document stating that L4/5 autonomous vehicles are allowed to eliminate traditional equipment such as steering wheels, accelerators, and brake pedals, but they must meet the same safety standards as existing vehicles. During the process of issuing test and operation licenses, if autonomous vehicles do not meet existing FMVSS standards, OEMs can also seek exemptions from the NHTSA for test operations.

At the same time, after obtaining the approval of various states, Robotaxi manufacturers can conduct tests. According to the "State of AV" report released by the U.S. Autonomous Vehicle Industry Association (AVIA) in April 2024, manufacturers have conducted autonomous vehicle tests in Oregon, Arkansas, Ohio, Pennsylvania, and other states in the United States.

Among the states that have opened up Robotaxi operations, California has made relatively rapid progress, and manufacturers need to go through the three stages of "testing, piloting, and deployment" in the state in sequence. The difference between "deployment" and "piloting" is that during the deployment phase, Robotaxi manufacturers can charge fees, similar to commercialization, while during the piloting phase, fees cannot be charged.

However, similar to China, pilot areas are not open to the entire region but operate in designated areas. For example, as of August 2024, Waymo's operating areas in the Phoenix metropolitan area, the San Francisco Bay Area, and Los Angeles County were only 315 square miles, 55 square miles, and 79 square miles, respectively; this means that Waymo's operating areas accounted for only 2.16%, 0.79%, and 1.93% of the total areas of these three locations, respectively, which is a very small proportion.

Meanwhile, during the testing and operation process, Robotaxi manufacturers still need to comply with the requirements on operation hours, speed, and weather conditions, and submit data reports every quarter.

Although still relatively weak, with the efforts of all parties, the influence of Robotaxi has greatly increased, and the industry seems to be improving. -END-