Taobao and Alibaba.com's Global Ascendancy: How the Tariff Crisis Sparked a 'Reverse Sales' Phenomenon

![]() 04/20 2025

04/20 2025

![]() 604

604

"When others fear, find opportunities with your expertise," remarked Chinese foreign trade merchants amid the current tariff crisis.

Taobao's sudden surge in global popularity left many observers puzzled.

Public data reveals that overseas downloads of the Taobao App skyrocketed by 222% compared to the 12th. After reaching second place on the iOS US shopping app download chart, Taobao simultaneously ascended to second place in countries like Canada and the UK, and topped the chart in France. By the 17th, Taobao ranked first on the app download charts in 16 countries and within the top ten in 123 countries.

Not only did Taobao's downloads soar, but Alibaba.com, Alibaba's B2B foreign trade platform, also experienced a traffic surge over the past few days, ranking fifth on the US App Store shopping chart and within the top ten on shopping charts in 120 global markets.

Exploring related discussions on foreign social media during the "tariff crisis" reveals that this traffic surge is akin to the "TikTok refugee wave" previously seen on Xiaohongshu. Many foreign consumers stepped out from under their regional "umbrella" only to find that it wasn't raining outside after all, with an abundance of high-quality goods and services awaiting their selection.

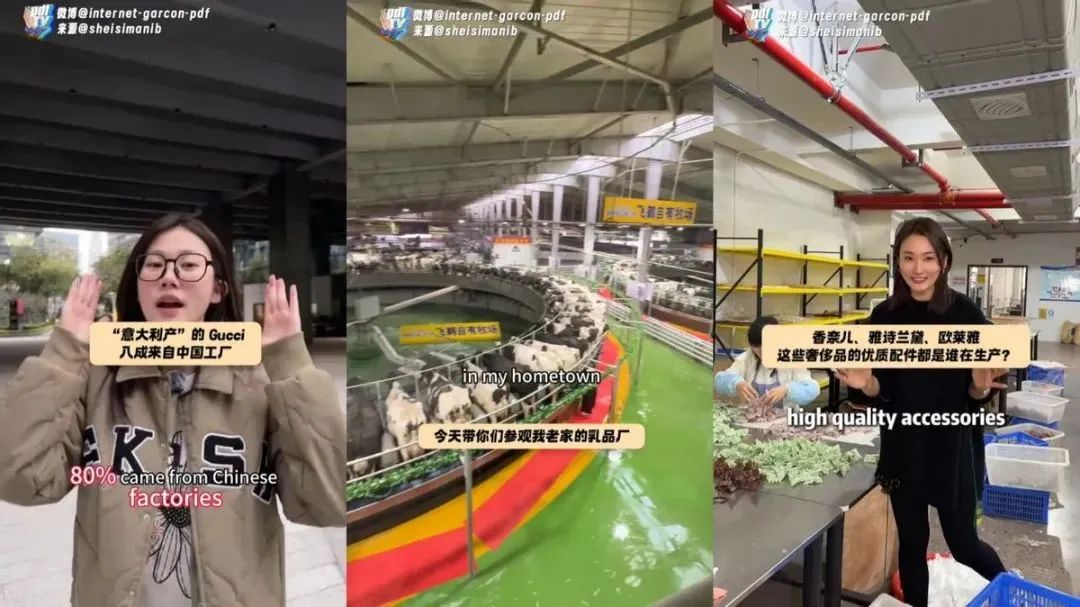

Image source: Weibo @internet-garcon-pdf

Foreign consumers and merchants spontaneously created videos and wrote blog posts highlighting how mature China's supply chain is and how cost-effective Chinese products are, propelling "How to shop on TAOBAO" to the top of traffic charts.

Facts have proven that merchants who proactively anticipate demand and make early layouts can seize opportunities with keen instincts.

01. Foreign Consumers Embark on a 'Buy, Buy, Buy' Frenzy

Starting in April, US consumers embarked on an unprecedented shopping spree due to tariffs.

ABC News reported on a New York City resident who spent approximately $3,500 on auto parts, gardening supplies, and electronics within a week, including items like a 40-inch Hisense TV and a laptop.

Car buyers rushed to purchase vehicles to avoid the 25% tariff on all imported cars that took effect on April 3rd, directly driving a surge of 11.2% in US car sales in March.

While consumers engaged in frantic shopping sprees, corporate inventories also entered a race mode, especially in import-dependent industries. People feared that tariffs would trigger skyrocketing prices, with production costs being passed on to consumers, reducing their quality of life. However, this fear of future uncertainty precisely confirmed the certainty of consumer demand.

A video revealing the luxury goods OEM factory industry chain first went viral on foreign networks. "First, we have the best quality control; second, we have the best craftsmanship; and finally, we have the best supply chain. That's why we're always the best OEM factory for luxury brands. So why don't you contact us directly to make a purchase?"

The comments were overwhelmingly supportive and praising.

Subsequently, "Chinese factories" became a trending topic on TikTok. On one side, foreign traders enthusiastically introduced the technological strengths and production capacity advantages of their factories; on the other side, foreign consumers were amazed at being able to buy high-quality goods at low prices, sharing their shopping records one after another.

Image source: Weibo @internet-garcon-pdf

Thus, Taobao and Alibaba.com were propelled to the forefront of app download charts by the surging consumer enthusiasm.

Foreign consumers cannot do without Chinese products and China's mature supply chain. This is not intentional propaganda by China's cross-border e-commerce players but a naturally fermented perception among local consumer groups.

Take the testimony of a small American business owner as an example. The keychain she mainly sells is indeed designed and manufactured in the United States, but the American manufacturer does not offer double-sided printing, and the accessories are of poor quality, made from cheap materials with unpolished edges. In contrast, similar products from Chinese manufacturers feature double-sided printing, delicate buckles, and beautifully polished round edges. For an order of 10 products, the former costs $3.10 each, while the latter only costs $2.09.

Image source: Bilibili @shengxiaodege

The uncertainty of unexpected events cannot offset the certainty of demand. As long as demand exists, the race will continue.

Relying solely on low prices and advertising stimuli to maintain customer flow has obviously become outdated. According to mediapost.com, Temu, which once surged ahead in the US, stopped using Google Shopping ads in the US due to the impact of tariff policies at the beginning of April, causing its ranking on the App Store to plummet from third or fourth to 68th within three days.

Driven by rigid demand, the perception that Chinese manufacturing leads the world has been formed, and it's now time for a real showdown of hard power.

02. Comparing Who Has Deeper Roots and Thicker Health Bars

The reason why Taobao and Alibaba.com were able to catch this wave of traffic is not complicated. Alibaba's overseas business layout is early, well-prepared, and "fully established." When foreign consumers want to find a representative of "Chinese e-commerce," they naturally turn to the all-encompassing Taobao.

Under tariff pressure, only locally rooted e-commerce platforms can navigate the situation with ease. If a platform does not prioritize collaborating with merchants and benefiting consumers, it will struggle to survive in the new environment. For example, when the US announced the cancellation of the "small package tax exemption" policy, the soaring cost of direct mail eliminated the low-price advantage of the fully managed model. Starting in March, Temu accelerated the transformation of its supply chain from a fully managed to a semi-managed model.

Compared to other cross-border e-commerce platforms, going overseas was originally an additional growth strategy provided by Taobao for merchants, but it won due to its adequate preparation and full consideration of merchants' operational convenience and local consumer needs.

A large number of small and medium-sized merchants on Taobao do not have experience in cross-border operations, logistics, and customs clearance, nor can they afford the costs of expanding overseas markets. To minimize their initial costs for going overseas, in July last year, Taobao launched a "0 returns, 0 refunds, one-click sell globally" overseas model.

There is no need to open another store or make special settings for products. Taobao's overseas expansion is achieved by connecting inventory to Alibaba's international e-commerce system, such as through the Taobao App for overseas Chinese and through AliExpress and Lazada for global niche markets. Merchants don't have to worry about operating costs or logistics. For cross-language operations, Taobao's AI can provide full-scene translation.

Fully managed is a buzzword in cross-border e-commerce in recent years, but merchants under the fully managed model have long suffered from the loss of operational autonomy. Taobao is not short of local merchants with original design and manufacturing capabilities, such as the iFashion category in the apparel industry, which brings together a large number of brands with fast updates, high frequency, and diversified styles. The platform's intention is to help genuine Chinese brands and designs go overseas while ensuring their operational autonomy.

Another keyword for systematization is collaboration.

According to People's Daily, Alibaba.com has recently initiated a special action to fully support small and medium-sized foreign trade merchants facing difficulties. Since April, it has dispatched thousands of staff to foreign trade industrial belts across the country. At the same time, Alibaba.com has connected with domestic sales channels such as Taobao Factory and Tmall Supermarket, launching a dedicated sign-up entrance on the merchant backend to simplify processes, prioritize reviews, and provide dedicated follow-up support, helping foreign trade enterprises expand into the domestic market.

On April 15th, Taobao and Tmall launched the "Foreign Trade Selection" special action, planning to support at least 10,000 foreign trade merchants and 100,000 foreign trade products through measures such as quick entry, semi-managed services, localized guidance, special foreign trade week marketing events, and direct procurement by Tmall Supermarket, assisting foreign trade merchants in connecting with the domestic market.

1688, Alibaba's sourcing platform for factory goods, has also recently launched a series of relief measures for export-impeded enterprises and factories with foreign trade to domestic trade needs.

The platform paves the way, and merchants speed ahead. Whether it's cross-border exports or foreign trade to domestic sales, having a strong third party safeguarding business operations may become the new normal in the new environment.

03. Brave Merchants Enjoy the World First

"After tariffs really came, I found that the impact on us was not that great!"

Xiong Weiping, a merchant specializing in home furnishing and building materials on Alibaba.com, fully experienced the process from panic to reassurance since the tariff crisis began.

Since starting his business on Alibaba.com in 2021, Xiong Weiping has created technological discontinuities and product barriers, with his largest market being the United States. In 2024, his sales amounted to 103 million yuan, with all orders coming from Alibaba.com. When "reciprocal tariffs" hit the globe, he, like most foreign traders, prepared for a halving of orders and the coming storm.

Two orders from the US changed his mind.

The first order came on April 2nd, the day reciprocal tariffs in the US took effect. A buyer from Boston directly booked a flight for Xiong Weiping's team to custom-make and measure a pavilion for his ski resort. The expected income from this order is 2 million USD.

The second order came from a buyer in Florida inquiring about whether they could order just one set, and Xiong Weiping has recently encountered many such inquiries. Just as we mentioned earlier, overseas consumers have noticed China's supply chain, and Xiong Weiping found that after tariff increases, many large consumers also came to Alibaba.com to find source factories, and some even gathered together to get a "group purchase price." Old orders have not declined, and new inquiries are on the rise. Xiong Weiping used various semi-managed services and AI reception on Alibaba.com to handle new customers, and his overall business has even expanded.

"Tariffs cannot completely have no impact on trade, but Americans cannot do without Chinese factories." From a merchant's perspective, this rigid demand means that after tariff increases, customers cannot find a "replacement" for China's supply chain globally, as China can provide a complete industrial chain for overall procurement.

As Xiong Weiping's Boston client often says, "Time is money." He is also concerned about the impact of tariffs, but if tariffs delay the infrastructure construction of his resort, the subsequent losses will be even more unbearable.

As one of the first merchants to sign up for Taobao's "Big Apparel Overseas Plan," Chen Qiaozhi has a more intuitive understanding of how this overseas opportunity has accumulated and burst forth.

Chen Qiaozhi is the founder of a Taobao women's clothing store. After Taobao joined forces with Alibaba International in September last year to help merchants go overseas with one click, they specifically developed styles for overseas consumers. "The sizes and styles preferred by foreigners are quite different from those of Chinese consumers. Last year, we specifically established a team to develop overseas products." Times often "favor" those who are prepared.

Starting on April 12th, Chen Qiaozhi's customer service team received over a dozen inquiries from "obviously non-Chinese" Wangwang users every day, some of which were clearly translated by translation software, and some were even in English. The store's overseas traffic surged, leaving the team confused. It was only after communicating with peers and discovering similar situations that they realized Taobao had become a global hit.

From the screenshot of the store backend shown by Chen Qiaozhi, it can be seen that from April 12th to 15th, the store's overseas visitors increased by 11% compared to the previous period, and overseas buyers increased by 4.2%. Key operating indicators such as GMV and order volume have increased to varying degrees.

If last year was a "preparatory period," Taobao's overseas expansion has already achieved remarkable results. During the Double 11 period, nearly 70,000 merchants participating in Taobao and Tmall's overseas expansion growth plan achieved doubling of transactions. Now, as overseas user demand is exploding, it is a wise choice for Taobao merchants to join the overseas expansion and seek opportunities at this juncture; for merchants already engaged in cross-border business, they can also gain more security from this certain demand and solidly carry out their business.

04. Final Thoughts

Foreign consumers' curiosity, exploration, and inquiries about Chinese products continue unabated.

On April 17th, the topic "Surge in English Inquiries to Taobao Customer Service" became a trending hashtag on Weibo. Many merchants promptly arranged for foreign language-speaking customer service staff to take shifts or utilized translation software to serve overseas users. Some stores even went so far as to directly post bilingual announcements stating: "Welcome people from all over the world to visit our little shop." The influx of consumer demand continues unabated. As Xiong Weiping observed, insiders see the substance, while outsiders merely enjoy the spectacle. Only those actively engaged in the field understand its intricacies and can identify opportunities.

Considering Taobao's overseas expansion efforts and Alibaba.com's business trends this year, actions such as integrating large models, upgrading AI, and optimizing the supply system all suggest that Alibaba will maintain a strong focus on international expansion in 2023. This strategy effectively aligns Chinese merchants' manufacturing capabilities with genuine overseas demand. Those "foreign trade end-of-line orders" languishing in merchants' warehouses may well be viewed as "treasures of overseas shopping" by foreigners.

Capitalizing on this market reshuffle, seasoned merchants are already boldly moving forward.

*The lead image and images within the text are sourced from the internet.