AI first made Bilibili profitable

![]() 11/26 2024

11/26 2024

![]() 592

592

Author | Sun Pengyue

Editor | Da Feng

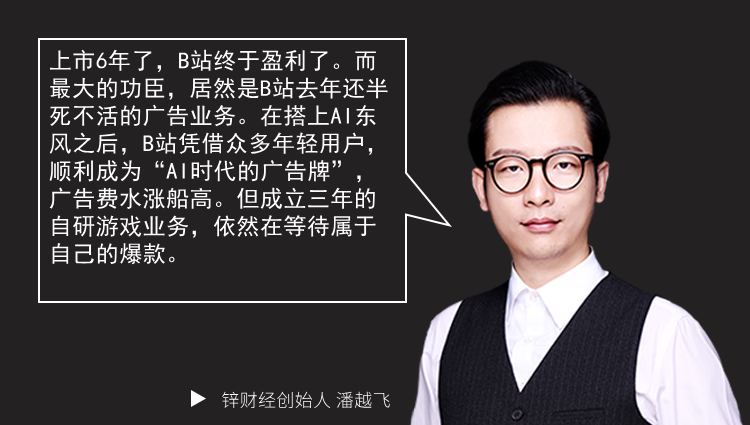

After six years of being listed, Bilibili (B-station for short) has finally become profitable. Financial reports show that in the third quarter of this year, Bilibili's total revenue increased by 26% year-on-year to RMB 7.31 billion; the daily active users reached 107 million, and monthly active users reached 348 million; the adjusted net profit was RMB 240 million, achieving the company's first quarterly profit since its listing. More surprisingly, Bilibili did not achieve this "breakthrough" through anime games, anime, or live e-commerce. Instead, it was AI companies, which have little to do with Bilibili, that made the platform highly profitable.

Becoming the Billboard of the AI Era

Bilibili's revenue of RMB 7.31 billion is primarily driven by its advertising and gaming businesses. Among them, advertising revenue reached RMB 2.09 billion, a year-on-year increase of 28%; gaming revenue was RMB 1.823 billion, an 86% increase year-on-year. Bilibili's advertising business, which had been on a downward trend, suddenly showed signs of revival and even became the core business with the highest revenue, which is somewhat puzzling. A typical indicator of the surge in Bilibili's advertising revenue is the increase in payments to content creators. In early April 2023, Bilibili faced controversies due to reducing the revenue sharing for creators, leading some to stop updating their content; however, in March of this year, Bilibili launched a new annual video creation incentive plan, increasing the income for creators who have not yet achieved profitability, with a reward cap of RMB 2,000 for creators whose average monthly platform income is less than RMB 5,000 over the past six months. The usually "cash-strapped" Bilibili suddenly became generous to content creators for one reason: it found a major sponsor, which is enough to stimulate it to comprehensively enhance its content creation capabilities. And only the current hottest AI has the power to make such a change for Bilibili.

In the general public's perception, what can earn money in the field of AI? Firstly, there are AI companies, whether they are large model companies, AI application companies, or AI product segments, these practitioners constitute the majority in the AI field, accounting for over 90% of players. Another group is the "shovel sellers," specifically referring to computing power enterprises led by NVIDIA, which provide hardware computing power support for AI. Although most of them operate behind the scenes, their scale and profits cannot be underestimated. Besides AI and computing power enterprises, which can be considered as "science majors," there is also a place for "liberal arts majors" in the AI field. That is, serving as an "AI billboard" to promote AI products.

At Bilibili's 15th-anniversary celebration in June this year, Chairman and CEO Chen Rui highlighted that "Bilibili is the community with the strongest AI mindset in China." He also revealed that currently, more than 90% of domestic AI vendors choose to communicate with users on Bilibili. According to official Bilibili data, in 2023, the daily average video playback volume of AI-related content on Bilibili increased by more than 80% year-on-year, with popular content covering science popularization, AI technology applications, digital humans, and creative applications. NVIDIA, similar to a "shovel seller," may become the "billboard seller" of Bilibili.

2024, the Year of AI Promotion

2023 was the first year of AI, witnessing the massive establishment of numerous AI enterprises. In 2023, defining product forms and consolidating product foundations were the primary tasks for AI enterprises. By 2024, the direction for AI enterprises shifted to "how to get more users to use their products." While product implementation is important, making ordinary users aware of these products is even more crucial. Under this logic, AI enterprises such as Alibaba Tongyi Qianwen, ByteDance Doubao, Tencent Yuanbao, Baidu ERNIE Bot, Kimi, Spark, and others have shifted part of their R&D expenses to advertising and content marketing. Among them, ByteDance's Doubao model has spent the most money.

According to AppGrowing statistics, in early June alone, Doubao's advertising expenditure reached RMB 124 million. However, most of ByteDance's advertising fees are spent within its own Chuanshanjia Alliance, resulting in lower costs. There are numerous content platforms in China. According to the latest data released by QuestMobile, the monthly active user base in the short video industry has surpassed 1.026 billion, with Douyin and Kuaishou accounting for nearly 70% of the total user time share in the market. So, why has Bilibili become the "billboard of the AI era"? The reason lies in Bilibili's younger user base and their stronger preference for trendy technology. Currently, short video platforms have strict "domain divisions."

If you want to have fun and watch entertaining borderline videos, you go to Douyin or Kuaishou; if you want to learn new knowledge and skills, Bilibili will be your first choice. Bilibili's in-depth content can better support areas with higher thresholds for AI learning. Besides users, Bilibili's content creators also have a high "technological content." For example, Li Mu, a senior principal scientist at Amazon, chose to join Bilibili in March 2021 to teach AI-related courses. Besides the user base, Bilibili has also actively introduced AI technology, enhancing content recommendation and user behavior analysis, utilizing user-generated data to improve content accuracy and precisely target sponsors' advertisements to the right users.

Kimi's parent company, Dark Side of the Moon, with a valuation exceeding USD 3 billion, is Bilibili's largest sponsor. According to 36Kr, Kimi is associated with almost all Bilibili's terms related to "AI." Kimi's Cost Per Action (CPA) quotation on Bilibili is as high as around RMB 30. This means that for every registered user Kimi acquires through Bilibili, Dark Side of the Moon has to pay at least RMB 30. Despite spending a significant amount on marketing, Kimi has also gained a lot. In April 2024, with a 60% increase in PC traffic, Kimi ranked first on the AI product list, outperforming many internet giants. Kimi's popularity has also made Bilibili a sought-after promotion channel for AI enterprises. Following Kimi, Bilibili has seen the emergence of AI products like ByteDance's "Doubao," Tiangong AI, and MiniMax's "Xingye" under keywords such as "AI tools," "useful products," and "Apps." Similarly, Bilibili's advertising fees have also increased accordingly.

Bilibili's self-developed games are still awaiting a hit

Although leveraging its reputation as the "billboard of the AI world," Bilibili has earned a considerable amount of money and achieved its first profit since being listed six years ago. However, Bilibili still faces a significant hidden danger, which is its gaming business. In the third quarter of 2024, Bilibili's gaming business generated revenue of RMB 1.823 billion, seemingly a model of steady progress leading to sudden success. However, even Bilibili itself was somewhat surprised by this outcome. The biggest contributor to the RMB 1.823 billion revenue was an SLG game called "Three Kingdoms: Strategize for Dominance," primarily targeting middle-aged individuals. This is far from aligning with Bilibili's primary focus on Genshin Impact-like and anime games. In reality, "Three Kingdoms: Strategize for Dominance" was developed by a small studio, and Bilibili merely served as the distributor. Essentially, it was one of the dozens of gaming projects that Bilibili had invested in over the years, and its success was quite accidental and uncertain, not representing a breakthrough in Bilibili's gaming business.

In 2021, Bilibili made self-developed games the primary focus of its gaming business, consecutively establishing six gaming studios with a total team size exceeding 1,000 people. However, three years have passed, and Bilibili has spent billions, but only one of the six gaming studios remains. Several launched games, such as "Reload Battle Maiden," "Sluder," "Elushir: Star Dawn," and "Yao Guang Lu: Princess of Chaos," received lukewarm responses, and some projects even ceased operation within a year. Since the fourth quarter of 2022, Bilibili's gaming business has experienced six consecutive quarters of negative growth. Throughout 2023, gaming revenue decreased by 20% year-on-year. Although a distributed game has become a hit, Bilibili's self-developed games are still eagerly awaiting a breakthrough. Moreover, for the gaming business to form a healthy structure, at least two to three profitable games are needed. Relying solely on distribution is insufficient to support a company. At least in the gaming field, Bilibili still has a long way to go.