Freetech rushes towards IPO: revenue and losses soaring, heavily reliant on Geely, yet to turn a profit

![]() 12/02 2024

12/02 2024

![]() 614

614

Another smart driving company has sounded the charge towards the capital market.

Recently, Freetech (Zhejiang) Intelligent Technology Co., Ltd. (hereinafter referred to as "Freetech") submitted a prospectus to the Hong Kong Stock Exchange, with CITIC Securities, CICC, Huatai International, and HSBC as its joint sponsors.

According to the prospectus, Freetech is a provider of intelligent driving solutions, covering Advanced Driver Assistance Systems (ADAS) and Autonomous Driving Systems (ADS) technologies. It is committed to providing safe, comfortable, and intelligent driving experiences for end-users through open and in-depth collaboration with OEM customers.

Globally, under the wave of intelligent driving development, many smart driving companies have entered the capital market. WeRide and Pony.ai have successfully listed on the US stock market, Youjia Innovation has obtained the overseas issuance and listing filing notice issued by the China Securities Regulatory Commission, and Zongmu Technology and Momenta are also accelerating their IPO processes.

However, achieving break-even remains a common challenge for smart driving companies. Whoever can find deterministic increments amid uncertainties will have a stronger foundation for seizing market high ground and attracting investors' attention.

I. Deep dive into autonomous driving, with broad industry prospects

In recent years, with the emergence of advanced safety and comfort features such as Highway NOA and City NOA, automobiles have gradually transformed from traditional transportation tools into intelligent mobile terminals, reshaping the industrial value chain and ecosystem. It is estimated that by 2028, the total potential market for intelligent automotive solutions in China will reach RMB 2.94 trillion.

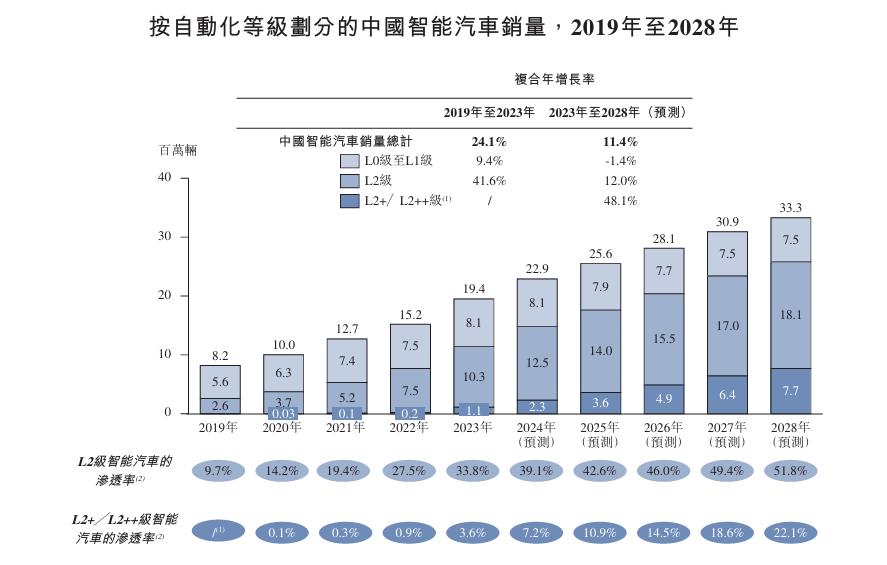

Among them, L2-level intelligent driving solutions have become mainstream in the Chinese market, with a penetration rate of 33.8% in 2023, expected to rise to 51.8% by 2028. The market size is also expected to grow from RMB 40.7 billion in 2023 to RMB 82.3 billion in 2028, with a compound annual growth rate of 15.1%.

With technological advancements and cost reductions, the production of automobiles equipped with L2+/L2++ intelligent driving solutions is expected to increase, with the market size projected to grow from RMB 18.6 billion in 2023 to RMB 120 billion in 2028, representing a compound annual growth rate of 45.2%. The penetration rate will also rise to 22.1% by 2028.

L2-level and L2+/L2++ intelligent driving solutions are precisely the sectors where Freetech has long been deployed. According to the same source, in terms of the number of installations of L2-level and L2+/L2++ intelligent driving solutions in China in 2023, Freetech ranks third among independent suppliers with a market share of 14.6%.

Additionally, Freetech has developed China's first set of core components for an independently developed L3-level solution, which has been successfully designated for new vehicle models. It is also one of the first domestic suppliers to mass-produce the FVC3.0, an all-in-one device equipped with an 8-megapixel camera, and the FVR40, a vehicle-grade 4D millimeter-wave imaging radar.

Freetech stated in its prospectus that as of the end of June 2024, it had established business partnerships with 46 OEMs, covering all ten domestic top OEMs based on 2023 automobile sales, and had accumulated over 280 designated projects and over 200 mass production projects, covering a diverse and growing range of vehicle models.

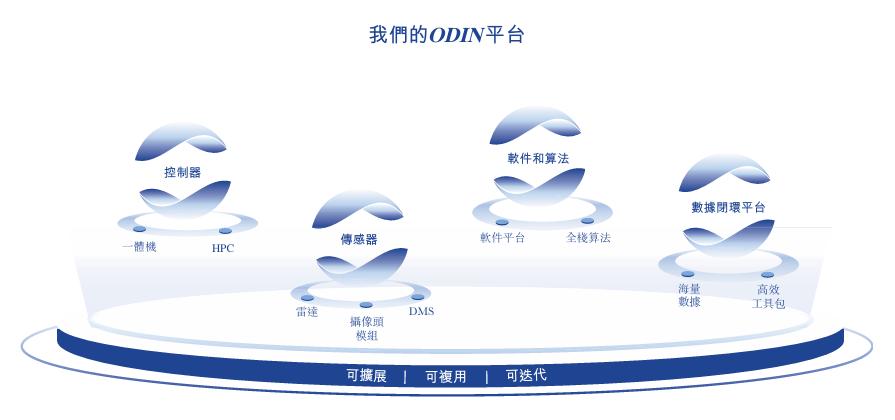

The ability of Freetech to consistently provide one-stop intelligent driving solutions is largely attributed to its self-developed integrated intelligent driving platform ODIN, which combines hardware and software. ODIN can integrate cutting-edge intelligent driving technologies and utilize a data closed-loop platform for continuous upgrades and efficient iterations to achieve optimal performance.

Through ODIN's scalable, reusable, and iterable modular functions, Freetech can provide customers with intelligent driving solutions including FT Pro, FT Max, and FT Ultra, covering L0 to L3 intelligent driving capabilities across various scenarios such as highway and urban driving, and parking.

II. Revenue doubles, but gross profit decreases

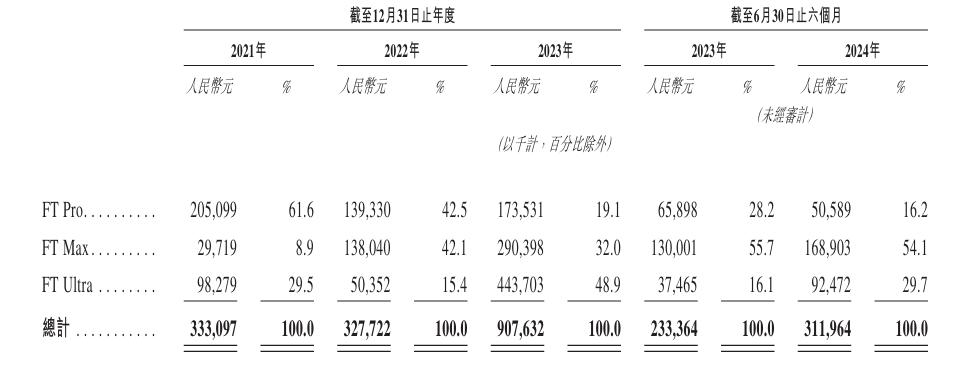

Beiduo Finance observed significant changes in Freetech's revenue structure across its three intelligent driving solutions. In 2021, the company's FT Pro solution generated revenue of RMB 205 million, accounting for 61.6% of its total revenue; revenues from FT Max and FT Ultra solutions were both less than RMB 100 million.

However, over time, the revenue from the FT Pro solution has narrowed. It dropped sharply to RMB 139 million in 2022 and rebounded slightly in 2023. Its revenue share has steadily declined from over 60% initially to 19.1% in 2023. In the first half of 2024, this business generated only RMB 50.589 million, a year-on-year decrease of 23.2%.

In contrast, the revenue scales of FT Max and FT Ultra solutions have shown an upward trend. FT Max's revenue increased from RMB 29.719 million in 2021 to RMB 290 million in 2023, nearly a tenfold increase in just two years. In the first half of 2024, it contributed over half of Freetech's revenue with a scale of RMB 169 million.

Freetech stated that FT Pro is its basic intelligent driving solution, primarily covering L0 and L1 automation levels. The decrease in revenue contribution from this business is mainly due to the company's proactive strategic resource optimization to meet the growing demand of L2 solution customer groups.

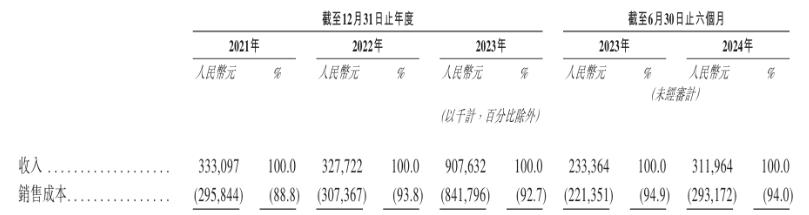

Freetech's total revenues in 2021 and 2022 were RMB 333 million and RMB 328 million, respectively. Entering 2023, due to increased market and user demand, as well as a shift in its commercialization and production strategy towards higher-level intelligent driving solutions, the company's revenue increased significantly by 176.95% to a new high of RMB 908 million.

In the first half of 2024, Freetech's revenue was RMB 312 million, up 33.7% from RMB 233 million in the same period of 2023, maintaining a good growth momentum. Freetech stated that the increase in revenue was attributed to the continuous diversification of vehicle models and customer bases, as the company closely grasped market demand and proactively adjusted its product supply strategy.

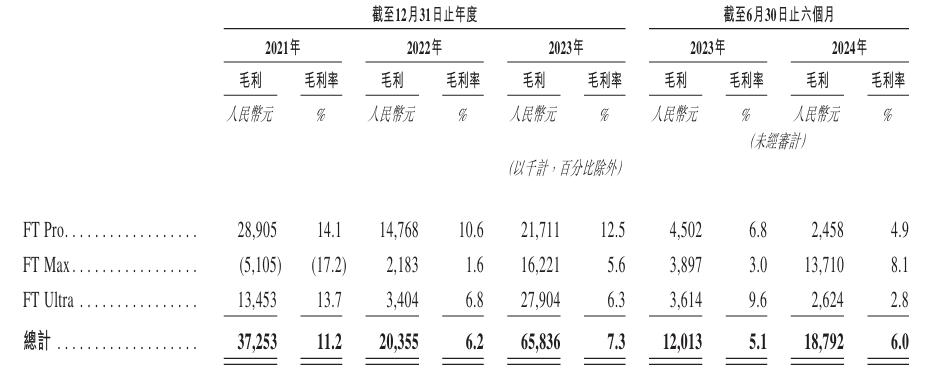

However, Freetech's gross profit margin is moving in the opposite direction of its growing revenue scale. The company's gross profit margins for 2021, 2022, 2023, and the first half of 2024 (collectively referred to as the "reporting period") were 11.2%, 6.2%, 7.3%, and 6.0%, respectively, with a nearly 50% decrease in gross profit margin over three and a half years.

Freetech attributed the decline in gross profit margin to its early commercialization stage and production scale, as well as the increase in sales of new solutions that have not yet reached normal gross profit margin levels. The company believes that as the production volume of its FT Ultra solution increases due to economies of scale, the gross profit margin will return to a normal development trajectory.

III. Heavily reliant on Geely, profitability remains a challenge

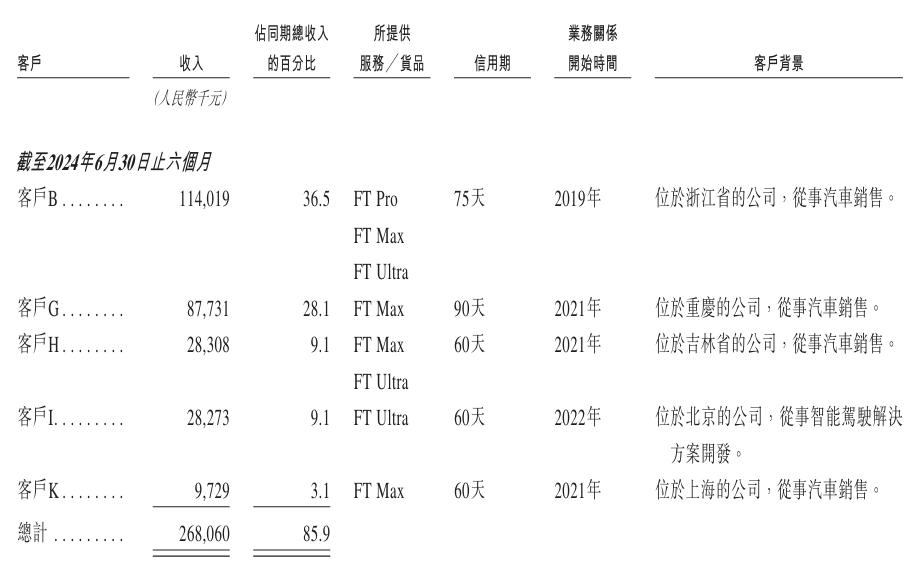

It is noteworthy that most of Freetech's revenue comes from a relatively concentrated customer base. During the reporting period, the company's revenue from its top five customers accounted for 84.0%, 73.6%, 76.4%, and 85.9% of its total revenue, respectively. The revenue share from its largest customer was as high as 43.5%, 22.0%, 43.3%, and 36.5%, respectively.

Among Freetech's top five customers is Geely Holding, one of its shareholders. Before this IPO, Ningbo Junma held a 12.31% stake in Freetech, and Sanya Huima, which holds a 99.99% stake in Ningbo Junma, is effectively controlled by Li Shufu, the chairman of Geely Holding.

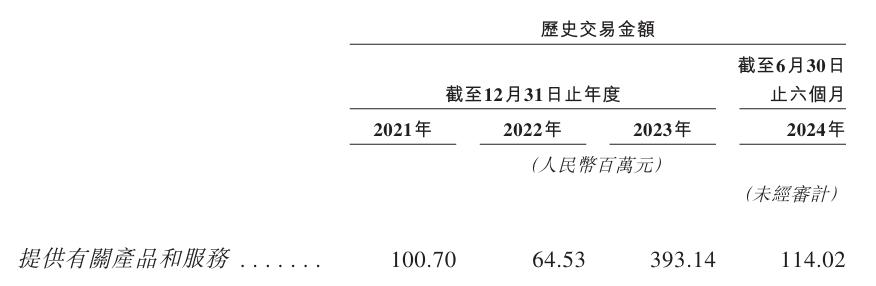

It is understood that Freetech also disclosed related-party transactions with Geely Holding in its prospectus. During the reporting period, the company provided products and services to Geely Holding for amounts of RMB 101 million, RMB 64.53 million, RMB 393 million, and RMB 114 million, respectively. Comparing these figures with the revenue from the top five customers, it is evident that Geely Holding is Freetech's single largest customer.

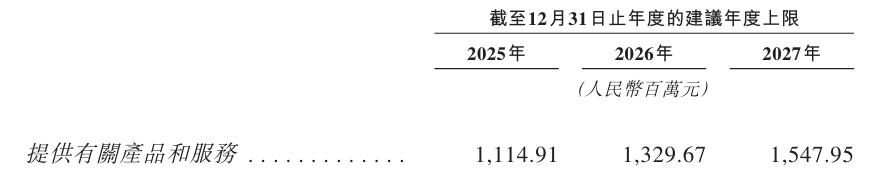

According to Freetech's forecast, based on the framework agreement signed between the two parties, related-party transactions between the company and Geely Holding will continue in the future. The annual upper limits for the provision of products and services to Geely Holding from 2025 to 2027 are RMB 1.115 billion, RMB 1.33 billion, and RMB 1.548 billion, respectively.

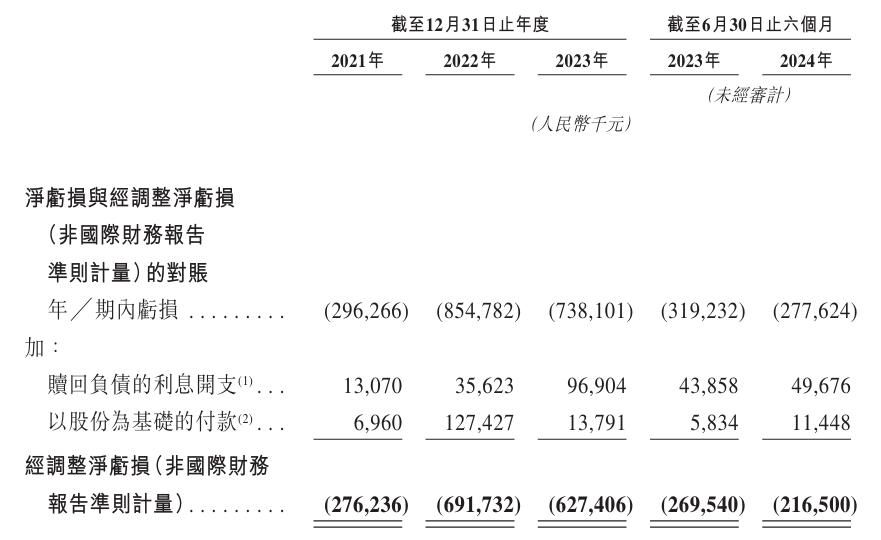

Another issue to note is that although Freetech has embarked on a commercialization path, it has yet to achieve profitability. During the reporting period, the company recorded net losses of RMB 296 million, RMB 855 million, RMB 738 million, and RMB 277 million, respectively, with adjusted net losses of RMB 276 million, RMB 692 million, RMB 627 million, and RMB 217 million.

Freetech also candidly admitted in its risk warning that the company is still in the early stages of operational expansion and scale enlargement. With business expansion, increasing cost expenses, and continuous investment in research and development, the company's losses may persist for some time. However, new products and technologies are seen as key to sustainable profit growth.

However, judging from its current performance, Freetech's path to profitability is clearly not easy. During the reporting period, the company's R&D expenses were RMB 185 million, RMB 515 million, RMB 561 million, and RMB 187 million, respectively, investing nearly RMB 1.5 billion in R&D over three and a half years. Future R&D expenditures are expected to further increase.

For smart driving companies that have not yet formed a profitable closed loop, continuous expenditure is clearly a significant constraint. It is reported that Hodo Technology fell into a financial crisis this year due to a broken capital chain, which not only disrupted its reorganization plan with GAC Group but also led to the disbandment of its core departments and a halt in R&D activities.

As of the end of June 2024, Freetech's net cash flow from operating activities was -RMB 172 million, with continuous cash outflows and a tight capital chain. How to promote the large-scale development of key technologies and transform technology into endogenous growth drivers for performance improvement is undoubtedly an urgent issue for Freetech.