Kuaishou's KeLing, Determined for Quick Revenge

![]() 12/03 2024

12/03 2024

![]() 752

752

Author | Hao Xin

"Five cents for a video, you won't lose. It's a great deal for our loyal users, come and get 66 inspiration points as a gift!"

Kuaishou's KeLing has become an AI application that thrives both domestically and internationally. During the peak of its internal beta testing, over 100,000 people lined up in China, while overseas users begged for a "Chinese account". According to Kuaishou, since its launch in June 2024, KeLing AI has served over 5 million users.

Cheng Yixiao mentioned in the Q3 2024 financial report, "KeLing achieved over 1.5 million monthly active users in September."

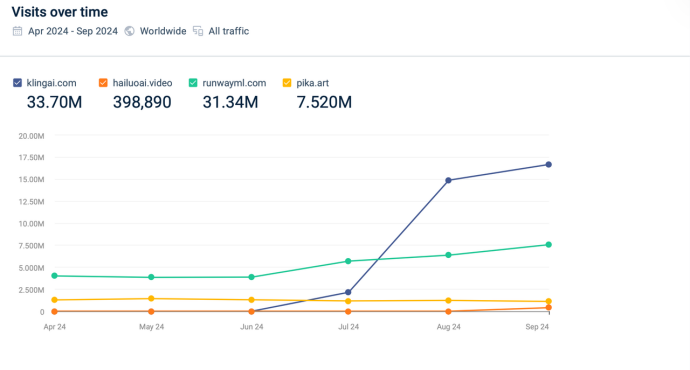

According to Similarweb, an international website analysis tool, KeLing's traffic growth among AI video products during the same period was very rapid. As of September 24th, KeLing's total visits reached 33.7 million, surpassing Runway (31.34 million) and Pika (7.52 million), which were already released earlier.

(Image source: Similarweb)

However, this success is inseparable from the generous support of "loyal users". According to reports from Silicon Valley AI News, "Hash Growth" was one of the driving forces behind Kuaishou's KeLing's international expansion, helping it place advertisements on multiple overseas media platforms such as X, YouTube, and Newsletters.

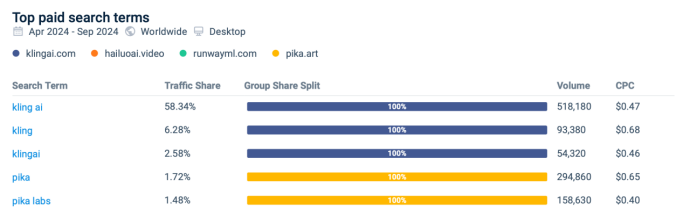

From June 24th to September 24th, Kuaishou conducted large-scale advertising campaigns overseas using keywords like "King ai", "King", and "Kingai". The CPC (cost per click) for paid search has reached the top level in this field. According to Similarweb's estimates, during these three months, KeLing's overseas advertising costs were approximately $332,000, equivalent to about 2.324 million yuan. In comparison, the startup Pika, during the same period, only spent one-ninth of that, with a total advertising cost of only $255,000.

(Image source: Similarweb)

At Kuaishou's "money-spending" rate, it may be difficult for other AI video startups to keep up. Relying on advertising overseas, they quickly started a charging model with low prices to attract users.

Cheng Yixiao stated, "KeLing AI's monthly revenue exceeds 10 million yuan, and we are confident in achieving rapid revenue growth next year."

The breakdown is as follows: millions in marketing costs, tens of millions in revenue, billions in model training costs, and over a thousand yuan per video generated.

Faced with Douyin's fierce competition, Kuaishou has played its trump card with KeLing. Like domestic AI application advertising, trading volume for volume will ultimately hurt oneself. Returning to Kuaishou itself, it still needs to prove to the market that large models and AI can make a significant contribution to its next quarterly financial report.

KeLing, the "Pinduoduo" of AI videos

The outside world has labeled ByteDance as an "AI application factory", and Kuaishou has also accumulated quite a bit, "lurking in the shadows".

At the model level, ByteDance and Kuaishou mainly focus on audio and video. For general large language models, ByteDance has "Doubao", while Kuaishou has "Kuaiyi"; for image generation, ByteDance has "SDXL-Lighting" and "ResAdapter", while Kuaishou has "Ketu"; for video generation, ByteDance has "AnimateDiff-Lightning", while Kuaishou has the "KeLing large model".

Specifically at the application level, ByteDance's AI applications cover various fields and are launched independently both domestically and internationally. However, Kuaishou has tightened its strategy, focusing on popular application sectors. For video editing tools with AI capabilities, ByteDance has "Jianying", while Kuaishou has "Kuaiying"; for AI video generation, ByteDance has "Jimeng", while Kuaishou has "KeLing"; for AI companionship applications, ByteDance has "Maoxiang", while Kuaishou has an independent application called "Feichuan" and an embedded feature called "Kuaizai Peiliao"; for AI image generation, ByteDance has an independent application called "Xinghui", while Kuaishou has placed similar functionalities within the "Ketu Mini Program".

Compared to ByteDance's aggressive approach to AI, Kuaishou appears more conservative.

ByteDance takes individual model capabilities and turns them into products, aiming to find the next "Douyin". Under ByteDance's standardized production process, most AI applications currently score above average. Even faced with the pursuit and blockade of startups, its products can still maintain a good monthly active user base and growth rate. Kuaishou's approach is more focused, serving existing scenarios and business ecosystems, amplifying existing content production, understanding, and recommendation capabilities, with its main focus still on the "Kuaishou" base camp.

As a result, until KeLing emerged, most of Kuaishou's AI applications did not create much of a splash.

In the field of "Sora"-like products, KeLing is a rising star. Previously, this sector already had applications such as Runway, Pika, Jimeng, and PixVerse. However, due to the fragmentation of AI-generated video capabilities, there has been no way to form a monopoly, and KeLing has seized the market gap, directly dominating the niche market of "physical logic generation".

KeLing's popularity can be considered a successful marketing campaign. Initially, a small group of professionals participated in the internal beta test and praised the generation results, piquing the industry's curiosity about KeLing. Subsequently, overseas marketing campaigns followed, with foreign tech influencers leading the way in sharing KeLing's generation cases, creating the impression that KeLing was "exploding" overseas. This popularity then spread to China, naturally leading to another wave of marketing momentum.

Similarweb data shows that relying on marketing did indeed bring positive help to KeLing.

Before large-scale advertising campaigns, Runway dominated most of the traffic under similar keywords, making it difficult for other competitors to compete. After Kuaishou's investment, KeLing's search traffic soared, rapidly narrowing the gap with Runway and becoming a top player. The cost was paying a fee higher than the market average. According to Similarweb, the CPC quote for Runway-related keywords ranges from $0.38 to $0.65, while KeLing's ranges from $0.46 to $0.68.

Kuaishou's "money-spending" behavior has made overseas AI video startups struggle to breathe, and its low-price strategy dealt another blow. Kuaishou's "loyal user" vibe overflowed from the screen, offering 66 inspiration points right away, with a monthly subscription of 66 yuan for Gold members and 666 yuan for Diamond members.

After comparing the prices of most products on the market, Guangzi Planet found that KeLing can be considered the "Pinduoduo" of the AI video world. Whether domestically or internationally, KeLing has pushed prices to the limit.

Based on the standard version prices of each company, using Runway as a benchmark, the price for generating a 5-second video is $1.20 (approximately 8.4 yuan). Under the same conditions, Pika costs $0.20 (approximately 1.4 yuan), Jimeng costs $0.30 (approximately 2.1 yuan), while KeLing's discounted price is only $0.10 (approximately 0.7 yuan).

Before KeLing and its counterparts ventured overseas, the positioning in the foreign AI video sector was very clear: a high-end, professional route represented by Runway and a low-cost, popular route represented by Pika. However, the Chinese product's "Pinduoduo"-style pricing strategy made it difficult for Pika and others to compete, directly slashing the monthly price from $10 to $3.88.

After Kuaishou's strategy was proven successful, Minimax's Hailuo AI also embarked on the same path, with the "productization + advertising + low price" formula for going overseas proving effective time and again.

AI Ignites the Second Video Competition

KeLing allowed Kuaishou to shine in front of ByteDance, but the "Sora"-style narrative is full of bubbles.

A report revealed that the computational load for training Sora is enormous. It requires 4,211 to 10,528 NVIDIA H100 GPUs to run for a month. This computational load is equivalent to 14,739 H100 GPUs running for a month, costing approximately $440 million at current market prices. An NVIDIA H100 GPU can generate approximately 5 minutes of video per hour, and as the number of users increases, the cost of inference calculations will also increase.

For Kuaishou, KeLing, and for ByteDance, Jimeng, short-term investments are bottomless pits, with revenues barely making a dent. The limitations of technology and resources have destined AI videos to be a relatively niche market, with the broader arena still returning to Jianying and Kuaiying.

AI is currently the biggest variable. The huge user base of editing tools fills the imagination for AI transformation, leading to new breakthroughs in user numbers and commercialization.

Recent public data shows that Jianying had 100 million monthly active users in 2021. According to the latest data from Sensor Tower, since ByteDance launched CapCut overseas in 2020, its monthly active user base has exceeded 300 million, accounting for 81% of the total active users of mobile video editors. Before Sora's debut, Douyin CEO Zhang Nan was appointed as the head of Jianying, showing ByteDance's strategic importance.

Faced with the realistic gap with Douyin, Kuaishou is more urgent. Historical lessons constantly remind Kuaishou that it cannot abandon AI, as it may be the key to defeating Douyin.

Kuaishou has paid a heavy price for neglecting Douyin's "development". During the intense competition between Douyin and Kuaishou from 2018 to 2021, Kuaishou comprehensively imitated Douyin, investing heavily in acquiring and retaining users. During the peak period, the cost per MAU reached 22.43 yuan.

After the "miracle through great effort", Douyin and Kuaishou entered a stalemate, expanding outward within their respective circles. According to data from ZhiKe Research Institute and Quest Mobile, the overall user overlap rate between Douyin and Kuaishou platforms was as high as 47% in May 2019 and dropped to 33% in September 2023, gradually differentiating the two platforms.

AI has the potential to once again disrupt this delicate balance and ignite the second video competition.

Douyin and Kuaishou are like two large bubbles moving towards smaller bubbles with AI attributes and labels. Whoever can integrate with these small bubbles first will be able to expand their original bubble. At the same time, more attractive AI features may also cause some people to switch camps. Once mobility occurs, the stalemate no longer exists, potentially opening up new possibilities for Kuaishou.

After comparison, it can be found that under similar functional positioning, Kuaiying places more emphasis on the AI label. Its newly launched AI features are deliberately designed to attract traffic to Kuaiying. During the internal beta testing of KeLing, it was embedded in Kuaiying's promotions, guiding hundreds of thousands of people to download Kuaiying to apply for beta testing and experience the features.

However, the likelihood of Kuaishou's success needs comprehensive consideration. Faced with the gap in user scale and retention between the two, it is unclear whether KeLing's new users can fill the gap. For To C, what matters is user perception. Currently, ByteDance has incubated over a dozen AI applications that mutually direct traffic with Douyin, indirectly planting the mindset of using AI. Until now, the only AI product Kuaishou can showcase is KeLing.

Long-term Value of Content Platforms Still Needs to Be Realized

If Sora is considered separately, its value can only be seen as a technology, just like what Li Yanhong said, "It may take ten years to see any returns." However, if a content production scenario is found, it hides the transformation path of "UGC-PGC-AIGC", which is also the long-term value of AI videos in the future.

Combining Douyin and Kuaishou, the only definite sector we can currently see is short dramas. Short dramas provide ample room for trial and error for AI video technology in terms of themes, duration, and user groups. Currently, KeLing and Jimeng have greatly lowered the threshold for video generation. For ordinary people, generating a few seconds of footage is not a problem. The difficulty lies in accurately grasping the generated content and post-production editing. It is still common for a one- to two-minute short drama video to take several hours to produce.

Previously, Kuaishou collaborated with leading AI video creators to produce the industry's first AI short drama as a gimmick. Although it gained exposure and popularity at the time, subsequent AI short dramas did not become an independent unit and remained under traditional categories such as "mystery", "urban", and "period".

For the entire industry, only a few can produce AI short dramas above an acceptable level. Currently, the supply of AI short dramas is a significant issue. Just like early, wildly growing GIFs and short videos, there now needs to be a first wave of creators to provide content in order to revitalize the AI short drama sector.

The current state of AI short dramas provides inspiration for content platforms like Kuaishou. In the traditional short drama production and distribution process, Douyin and Kuaishou's "cash cow" revenue comes from short drama advertising. There are layers of relationships involved, including content creators, production teams, distributors, and resellers. Due to the complexity of the industry chain, there are many gray areas.

As a new species, AI short dramas have the potential to subvert these relationships from the ground up. Kuaishou is attempting to make AI short drama creation, distribution, and monetization transparent, becoming a semi- or fully-managed AI content creation platform.

Through incentives such as AI video creation competitions, the binding relationship between content creators and video generation tools is strengthened. The more generous the video generation quota, the more it can cultivate creators' usage habits, which is particularly important in the early stages when companies are still competing for market share. The generated video content flows into Kuaishou's content pool as a supplement, satisfying users' consumption needs, while also attempting to adjust the business logic of the short drama industry chain.

Just last month, Kuaishou's short drama section launched a distribution matchmaking recruitment mode, allowing copyright owners to post recruitment tasks on the platform. Distributors can select and submit distribution applications in the drama selection plaza, while copyright owners have control over the number of distributors, preview episodes, listing times, and cooperation durations.

In the future, Douyin and Kuaishou will be involved in the entire AI short drama process. An integrated platform will have various functions such as AI video generation, editing, distribution, advertising, dynamic monitoring, and data analysis, achieving fully automated production. By then, the value of Sora and KeLing can be unleashed as part of the production process.