Who picked the first fruits of AI large models?

![]() 12/03 2024

12/03 2024

![]() 646

646

This article is written based on publicly available information and is intended for information exchange only, not constituting any investment advice

In early 2023, GPT3.5 was released, causing astonishment worldwide. People panicked, fearing the era of artificial intelligence had arrived. Following this, major internet companies began competing in large models, with new large models emerging almost every month and competing with "GPT x.x" in certain parameters.

As large models continue to iterate and infiltrate, a key question arises: Who are the biggest beneficiaries of the large model wave?

01 The biggest beneficiaries are hidden in vertical applications

After two years of development, it has become a consensus that large models are moving towards vertical applications. Meta recently appointed an AI Business Lead to help Meta AI find a commercialization path as soon as possible.

In fact, Meta's Advantage+ platform has already been using generative AI to help boost marketing revenue. Meta revealed that the median cost of conversion has decreased by 7%, the average cost per click, lead, or landing page view has decreased by 28%, and GenAI tools have created over 15 million ads. We estimate that enterprises using image generation have seen a 7% increase in conversion rates. On the user side, improvements in AI-driven news feed and video recommendations have increased Facebook usage time by 8% and Instagram usage time by 6%. Another notable vertical application is primarily in the marketing field, using large generative models to generate advertising materials and improve ad targeting, precise audience positioning, and audience profiling, thereby increasing ad output ratios. Even in post-investment analysis, A/B testing, and automation processes, large models are gradually being applied.

Meta, Google, and Microsoft have all entered the application phase in the above directions. According to their recent quarterly financial reports, revenue is gradually reflecting benefits from the large model ecosystem. However, due to their large size, incremental revenue in the tens of millions of dollars may only represent single-digit percentage growth, which may not excite investors. Additionally, Peel off the revenue increment from large models is challenging due to the complex business ecosystems of these companies. On the other hand, some medium-sized companies with quarterly revenues of around $1 billion can more easily identify the driving factors behind their incremental revenue. Such companies seem to provide a clearer picture of how large models can benefit companies and how much this gold rush can benefit competitors. Medium-sized companies are not lagging behind in technology and applications. From the financial reports and public reports of Applovin and Pinterest, we can qualitatively analyze what kinds of companies will benefit from large models.

02 Applovin: Large models are reshaping online advertising, with a tenfold increase in market value in two years

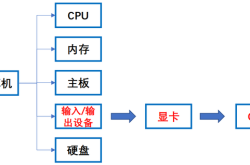

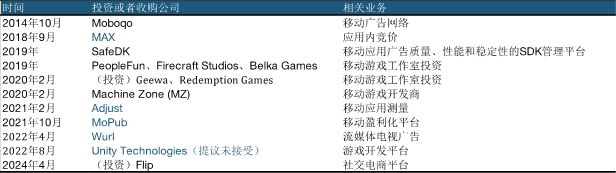

AppLovin is a mobile advertising technology company that currently offers a full suite of mobile online marketing products, including advertisers, publishers, and creative content generation. From its inception, Applovin focused on performance marketing, emphasizing technological upgrades to improve ad ROI. Early on, Applovin partnered with developers to monetize apps, particularly through CPI monetization rather than the traditional CPM model. AppLovin also excels in corporate operations, with many key members of its product matrix acquired through mergers and acquisitions, such as Adjust, Max, and MoPub from Twitter.

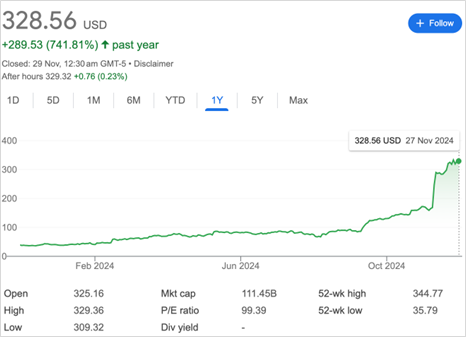

Applovin's business model primarily relies on two major revenue sources: software platforms (online advertising) and self-developed in-app subscription revenue, with the former being the primary source of income. In 2021, Applovin listed on Nasdaq and, riding the wave of large models, its market value has increased tenfold from its low point over the past two years, currently reaching $110 billion with a PE ratio close to 100. 1. Performance Leap

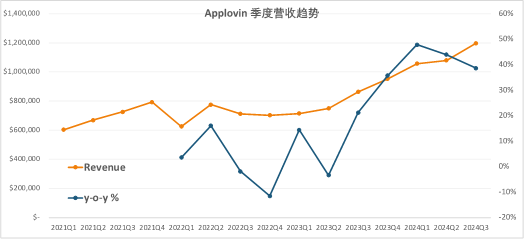

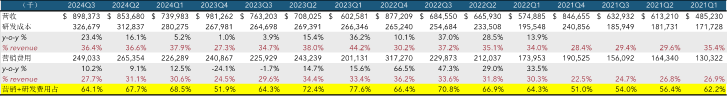

Q3 2024 financial performance: - Total revenue reached $1.2 billion, a year-over-year increase of 39%. - Adjusted EBITDA was $722 million, a year-over-year increase of 72%, with an adjusted EBITDA margin of 60%. - Free cash flow reached $545 million, a year-over-year increase of 182% and a quarter-over-quarter increase of 22%. The Software Platform contributed nearly 70% of revenue and performed even more impressively: - Software Platform revenue was $835 million, a year-over-year increase of 66%. - Adjusted EBITDA was $653 million, a year-over-year increase of 79%, with a profit margin of 78%. - The conversion rate from revenue to adjusted EBITDA was 107%, primarily benefiting from one-time cost advantages (such as Google Cloud contract renewals). Judging from Applovin's revenue and growth trends over the past four years, the company's performance has taken off since 2023, attracting attention from the capital market.

Applovin's share price has also soared alongside its performance, increasing by 700% in the past year:

2. Axon 2.0

Applovin's AI applications are primarily realized through its engine algorithm, Axon. As of the third-quarter 2024 financial report, Axon had iterated to version 2.0. Axon was first released in 2022 and iterated to 2.0 in early 2023. The previous version was more efficient and effective, with improved targeting capabilities and agility. Its release significantly boosted Applovin's advertising revenue by improving marketing efficiency. Compared to Axon 1.0, Axon 2.0 behind AppDiscovery has made almost comprehensive improvements. Founder Adam Foroughi once compared the iteration from 1.0 to 2.0 to the progress from ChatGPT-3.5 to ChatGPT-4. It utilizes AI-driven predictive modeling to help advertisers place ads more efficiently.

1. Higher automation: AI automatically allocates budgets and placement methods (including personalized geolocation, device, app, and other dimensions) based on set budgets, ROI indicators, and target demographics, significantly improving marketing personnel efficiency. The AI algorithm is particularly suitable for Applovin's in-app bidding (also known as header bidding), automating the process to achieve optimal ROAS.

2. Creative content generation: After applying large AI models, SparkLabs, a subsidiary product, significantly improved its efficiency in producing high-quality creative content. According to official blog data, SparkLabs' use of generated speech increased ad success rates by 118%. Across video, playable, CTV, and ASO ads, the number of creatives using generative AI technology increased by 220%.

3. Improved accuracy: Axon 2.0 uses predictive modeling to improve audience targeting, enabling ads to reach target users more precisely. While this was supported in Axon 1.0, Axon 2.0 took it a step further, resulting in more accurate delivery rates.

4. Enhanced ad campaign effectiveness: Advertisers can run multiple types of ad campaigns to acquire users with different but complementary user retention and ROAS curves. This helps identify which ad campaigns are best suited for specific goals and discover new potential audience segments.

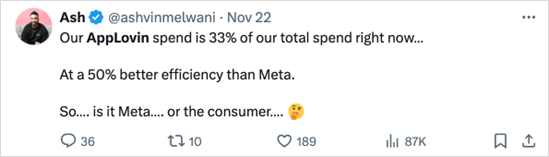

3. How effective is Axon 2.0?

How effective is the highly praised Axon 2.0? The founder of a large model application product on Twitter (haus.io) wanted to verify whether Applovin's delivery performance matched its explosive share price. They conducted a quantitative experiment with their own product, which can be followed on this tweet: https://x.com/oliviaakory/status/1860776402510897445. Although the final effect report will be released in December, Applovin's incremental performance has been prominent based on current results.

4. Is performance improvement solely due to large models?

The reason for Applovin's performance improvement has been a concern for investors in quarterly financial reports since 2023. From management's responses, we found that large models are not the sole contributing factor. An increase in advertisers is another important factor. In addition to advertisers in the company's core gaming sector, the recent explosion of short dramas and short videos in vertical sectors has also been a significant driver of revenue growth. Returning to the topic of large models, even as a single factor, it requires supporting software and hardware facilities. After all, large models are not a secret, and there are countless platforms for developing them. Applovin's outstanding performance is not accidental. The continuous infiltration of application and recommendation AI algorithms into its products is just one aspect. In today's highly competitive tech industry, the flow and emergence of talent make algorithms insufficient to establish deep barriers or moats for companies.

As an Ad-Tech Network, Applovin has many competitors, such as IronSource, Admob, Vungle, InMobi, etc. These platforms undoubtedly also apply large models to enhance their competitiveness within their product ecosystems, but there have been no related reports on model efficiency improvements. Unity, a publicly traded company, also has a mobile app ad network as part of its business. However, to date, Unity is still only generating AI to improve platform ROAS, with no noticeable improvement in financial data. As everyone knows, another hot topic accompanying the large model wave is computing power and the infrastructure required for it. In a Google Cloud blog post, we can see Applovin's efforts in computing power costs. Its core Axon engine algorithm implements AI to achieve higher automation - ad targeting, bidding settings, etc. - which requires powerful cloud infrastructure support from managing training workloads to processing billions of automated recommendations daily.

Quoting directly from the Google blog: "AppLovin has upgraded the infrastructure supporting its AI advertising algorithm by adopting the latest top-tier hardware, including Google Cloud G2 virtual machines. One of AppLovin's goals is to modernize its advertising technology platform by leveraging Google's advanced cloud technology and infrastructure. They have successfully achieved this vision and accelerated the timeline for AI development. In 2022, AppLovin was in the process of a large-scale migration to Google Kubernetes Engine (GKE) to reduce the burden on its traditional infrastructure, reduce latency, and enhance seamless scalability. In early 2023, AppLovin began testing G2, the industry's first cloud virtual machine powered by the NVIDIA L4 Tensor Core GPU. Designed specifically to handle large-scale inference AI workloads like those faced by AppLovin, G2 has become an ideal solution." With powerful software and hardware support, the engine algorithm has room to shine. Secondly, management spared no effort in applying large model algorithms across its product ecosystem.

03 Pinterest: Representative of a closed-loop large model ecosystem, with hidden concerns behind growth

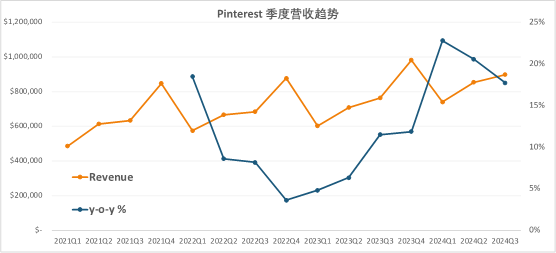

Pinterest is also a company that has achieved revenue growth through large model technology. Since 2023, revenue has accelerated again year-over-year, with Q3 2024 revenue increasing by 17.7% year-over-year. Revenue for the three quarters of 2024 approached $2.5 billion, with an expected increase of approximately $500 million for the full year 2024 compared to 2023.

Similar to Applovin, Pinterest's advertising business also benefits from large model technology. In the Q3 2024 financial report, management revealed that AI has gradually become a core part of the transformation for both users and advertisers over the past few quarters. Since late 2022, when large models entered the mainstream, Pinterest has also increased investment, developing its large models based on first-party data. 1. Large models boost the advertising platform

As a content-based social platform, Pinterest has broader application scenarios for large models compared to Applovin. On the C-end user experience, large models may have the highest invocation volume. Management revealed that the large model currently generates over 400 million predictions per second, enabling highly personalized content recommendations based on individual browsing behavior. Pinterest possesses vast amounts of user behavior data, such as content posting, searching, and interacting. On the commercial side, AI-driven page optimization technology makes ad inventory adjustments more flexible and placements more precise. On October 1, 2024, Performance+ was officially launched to the public.

Performance+ is an advertising platform similar in architecture to Meta's Advantage+ and Google's Pmax, enabling AI-driven budget allocation, bidding, and targeting functions while reducing the workload for advertisers. According to multiple levels of alpha and beta testing within Pinterest, the effectiveness of the Performance+ suite was quantitatively assessed. For example, from relevant information in the Q3 financial report, management revealed that Performance+ ROAS bidding can automatically optimize bids based on user needs to maximize ad revenue. Most advertisers using Performance+ ROAS bidding have seen at least a 15% increase in ad spend return. The automated settings of Performance+ can reduce the time required to set up traditional marketing campaigns by 50% through process automation. In addition to the initial suite of automation tools, Performance+ Creatives helps advertisers generate and optimize ad materials. Internal beta testing showed that advertisers using Performance+ Creatives experienced an average conversion rate increase of 14% and a 9% reduction in cost per campaign. While Performance+ does not revolutionize the architecture, large model technology has infiltrated every aspect of marketing, driving up the automation rate and ROAS throughout the process.

To some extent, Performance+ represents a general model for social platforms to create their own marketing ecosystem using large model technology. Even for giants like Meta, their Advantage+ follows a similar architecture. This model involves social platforms training their own large models based on accumulated user content and data. This model not only enhances the C-end user experience but also aids in marketing products, such as content generation, automating ad placement processes, and improving efficiency. Currently, from recent quarterly financial reports, we have seen multiple companies investing in this endeavor. We anticipate significant results from large models in the coming quarters.

2. Pinterest's Concerns

Despite the resurgence in ad revenue growth driven by large models, Pinterest still operates at a loss. The primary issue lies in high R&D costs. For social platforms, marketing expenses are crucial for maintaining user growth, with Pinterest allocating around 30% of its quarterly revenue to marketing. Post-investment in large models, R&D costs have consistently exceeded 30% of revenue, consuming over 60% of total revenue alongside marketing expenses. It will take several quarters to amortize R&D costs, and converting user growth into ad inventory is also a central challenge.

04 How to Benefit from the Large Model Wave?

Does adopting large models guarantee positive returns for companies? Not all companies entering the large model arena benefit. Many have integrated large models into their products without direct revenue generation. This is partly due to insufficient large model infrastructure and the failure to convert improved C-end experiences into commercial revenue, despite substantial investments in computing power, storage, and personnel. An example is Unity, a game engine company unable to juggle the software, hardware, and human resources required for large models, leading to limited growth in its advertising business. In July 2022, Unity merged with ironSource to compete with Applovin. Post-merger, Unity actively invested in AI large models, launching the 'AI Hub' on the Unity App Store, featuring AI-powered music, image, and text creation tools.

In 2023, Unity released two 3D resource creation AI tools, Muse and Sentis. However, Unity's focus remains on gaming, and ironSource, once a competitor to Applovin, has failed to keep pace in the large model trend. Another example is Snapchat, which has integrated generative AI into its filters for several quarters, introducing the GenAI Suite with animation blending, body morphing, and icon generation features to enhance user content creation. While providing richer experiences, this incurs significant model costs for Snapchat.

Besides filters, Snapchat collaborates with Google Cloud to enhance its AI chatbots with generative AI features and memory capabilities. While Snapchat's large model efforts are commendable, they currently do not directly generate more ad impressions or significantly boost subscription fees. These applications fail to directly translate into commercial benefits despite the high computational and storage costs. To leverage large models for business growth, pure C-end applications incur substantial costs. In contrast, online advertising can indirectly transfer large model costs to advertisers, yielding a higher return on investment and forming an ideal business loop.