China's four leading embodied intelligent humanoid robots: Unitree, Starbot, Zhuji, Zhejiang Humanoid

![]() 12/05 2024

12/05 2024

![]() 637

637

Having been in the automotive robot industry for nearly a decade and having seen nearly a hundred embodied intelligent humanoid robot enterprises in the past two years, after investing in nearly 10 of them, I would like to share some of my thoughts with you~

1. Regarding investment and financing timing: The investment boom in embodied intelligent humanoid robots may be coming to an end. Most institutions that intend to invest have already done so. The rest either do not believe in it or are waiting for commercialization. There is not much time left for PPT financing.

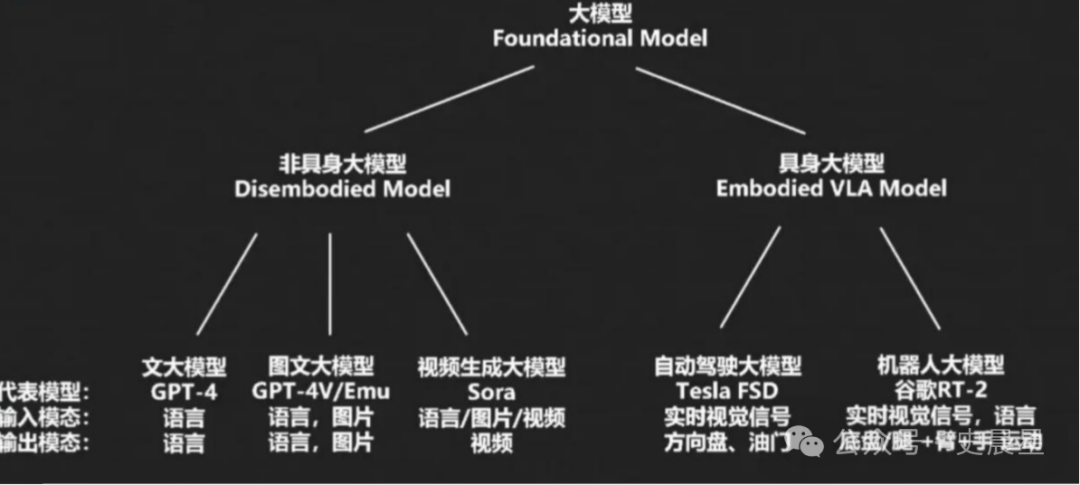

2. Regarding technical routes: There are still a large number of media investors keen on labeling companies. This is an AI Native team, and that is a traditional control team. In fact, the technical routes have rapidly converged this year, and everyone is quickly turning to embodied large models for end-to-end perception and control. Borrowing a picture from Teacher Wang He of Yinhe, as shown below, the specific actions at the bottom level may be more effective with traditional control, but to achieve generalization and embodied intelligence, everyone is currently using the same technical route of embodied large models.

3. Regarding embodied large models: Embodied large models consist of three parts: data, algorithms, and computing power. Regarding computing power, that's NVIDIA's business. The core lies in data and algorithms.

4. Regarding data: There are many data modalities, including vision, force perception, touch, hearing, etc. There are also many data sources, such as simulation, teleoperation, video, etc. To achieve generalization, it is necessary to integrate multi-modal and multi-source data. Therefore, there is actually no so-called simulation faction or teleoperation faction now. Everyone uses multi-modal and multi-source data. The controversy is which type of data will dominate in the final outcome. Autonomous driving mainly relies on real data because there are too many cars, but too few robots.

5. Regarding algorithms: The main algorithms are imitation learning and reinforcement learning. New algorithms are being sought, but have not yet been found. Everyone is using these two algorithms, with the focus on improvements at a lower level, such as the evolution of PPO and BC.

6. Regarding end-to-end: End-to-end has been proven effective in autonomous driving, but which end to which end in robots? Perception to execution is end-to-end, but should the task planning part be connected to a large language model? If it is connected, is it still considered end-to-end? The controversy lies in whether it is the end-to-end of the cerebellum or the end-to-end of both the cerebrum and cerebellum.

7. Regarding the cerebrum: Recently, Professor Qiongche Lu Cewu, Zhipingfang, Ruoyu, etc., have all expressed interest in developing the cerebrum. I understand that the true cerebrum is Open AI, as only large language models can perform task planning. Unless they intend to create China's Open AI, which doesn't seem to be the case, those claiming to be developing the cerebrum on the market currently cannot perform task decomposition and planning. That means they are developing the cerebellum. Without standardized hardware for humanoid robots, the cerebellum and body are tightly coupled. It is hard to imagine controlling such a variety of humanoid robots on the market with one brain. Developing a general embodied large model separately from the hardware is currently not feasible. Each type of hardware requires individual fine-tuning, which is a significant workload.

8. Regarding form: Wheeled humanoids are sufficient for indoor scenarios. For both indoor and outdoor scenarios, bipedal humanoids are necessary. If the lower body progresses sufficiently quickly, wheeled humanoids will only be a transitional form. Referring to Starbot's latest video, the current progress of the lower body is quite impressive, capable of running at 3.6m/s in outdoor real-world scenarios, equivalent to a human running pace of 4:38 per kilometer.

9. Regarding the upper and lower bodies: Both are important. If one had to choose, the upper body is slightly more important. However, the key is that the differences between companies can be seen more clearly in the lower body. The differences in the upper body are not yet apparent. For companies developing wheeled humanoids, the gap in the lower body has already widened.

10. Regarding generalization: Generalization is strongly related to the amount of data. After the data volume reaches the billion level, generalization ability will gradually emerge. The current focus is on accumulating data volume.

Now, let's look at global and Chinese companies.

Three global giants and six unicorns

Three giants: Tesla, Google, NVIDIA

Seven unicorns: Figure, π, Skild, Agility, Boston Dynamics, Covariant, Spatial AI

There is a lot of information available on these, so I won't go into detail. You can look them up yourself.

Four domestic giants and six startups

Four giants: Huawei, Xiaomi, XPeng, UBTECH

Startups: The main ones with a valuation exceeding 1 billion are Zhiyuan, Unitree, Fourier, Leju, Yinhe, Zhejiang Humanoid, Zhuji, Starbot, and Xinghaitu. The rest have a valuation below 1 billion. Today, we will mainly analyze these nine companies with a valuation exceeding 1 billion. The remaining companies will be analyzed in the next article for their future potential.

Unitree Technology: First in hardware

There should be no doubt about this. The price of 99,000 yuan and the backflip video have already proven everything. Additionally, it is worth mentioning that Unitree's hardware is renowned both domestically and internationally. Major universities and research institutes in the United States are purchasing Unitree's hardware, essentially dominating the research market.

Zhejiang Humanoid: First in funding amount

From last year to this year, the embodied intelligent humanoid robot sector has seen fierce financing competition. However, after reviewing the situation, although Zhiyuan and Yinhe have also received significant funding, Zhejiang Humanoid has received the largest amount, with over 1.2 billion yuan in angel round funding. The team, led by Professor Xiong Rong from Zhejiang University and backed by Supcon Technology's industrial expertise, is highly promising. Here are a few advantages:

First, Professor Xiong Rong specializes in AI. With a formal computer science education and expertise in AI, she is one of the earliest teams in China to develop humanoid robots, boasting nearly 20 years of experience in humanoid robot research and development, from traditional control to the latest AI control, covering both the cerebrum and cerebellum. The team has deep accumulations.

Second, Zhejiang Humanoid operates as a fully corporatized entity, not a pure research and development institution. The name is mainly for applying for government subsidies. The major shareholder, Supcon Technology, is a leading listed company in the industrial control field with strong market and industrial resources, aiming for an IPO in the future.

Starbot Era: First in end-to-end

This year, everyone has started shifting towards embodied large models, and Starbot has made relatively rapid progress. Currently, there is no significant difference in upper body manipulation, but Starbot clearly leads in the lower body. Here are a few key advantages:

First, Professor Chen Jianyu specializes in AI. Starbot has gone the furthest in AI direction among this wave of companies. While many enterprises are still using MPC at the bottom level, Starbot is already fully driven by end-to-end AI. At the top robotics conference RSS 2024, Professor Chen's DWL end-to-end reinforcement learning framework received a full score, one of only three full-score papers from Tsinghua University. In the second half of the year, another full-score top journal paper is expected in the field of imitation learning, demonstrating Starbot's significant contributions to AI.

Second, Starbot has a complete industrialization team, with executives from major automakers and robotics listed companies joining to oversee commercialization.

Third, Starbot is progressing the fastest in full-body development. Upper body development in the industry is generally slow, but Starbot's fully self-developed dexterous hands for the upper body and imitation learning manipulation keep it at the forefront of the industry. Its full-body mobility allows it to run at 3.6m/s in outdoor real-world scenarios, equivalent to a human running pace of 4:38 per kilometer, making it the fastest in the world. In the future, a single model will drive both the upper and lower bodies end-to-end, maintaining Starbot's leadership.

Zhuji: First in progressive implementation

Zhuji is a standard company that progressively implements embodied intelligent humanoid robots, gradually industrializing from four-wheeled bipeds, bipedal lower bodies, to full-body applications. Here are a few advantages:

First, Zhuji has a complete industrialization team. After completing the angel round of funding, it introduced Zhang Li, the former Cisco executive and COO of WeRide, to oversee commercialization.

Second, Professor Zhang Wei specializes in AI. With a computer science background, he has made significant contributions to AI, proposing the CTS (Concurrent Teacher-Student) parallel teacher-student reinforcement learning framework, which significantly enhances the motion capability and robustness of legged robots in complex terrains.

Third, Zhuji is the first to achieve industrialization. Currently, the upper bodies of humanoid robots are not yet ready for application. Zhuji is the first to launch products for the lower body that are ready for market sales. The upper body is progressing similarly to others, resulting in an overall lead with a comparable lower body advantage. In 2024, Zhuji has already achieved batch sales revenue.

Based on the above analysis, the four leading embodied intelligent humanoid robots in China should be: Unitree, Starbot, Zhuji, and Zhejiang Humanoid.

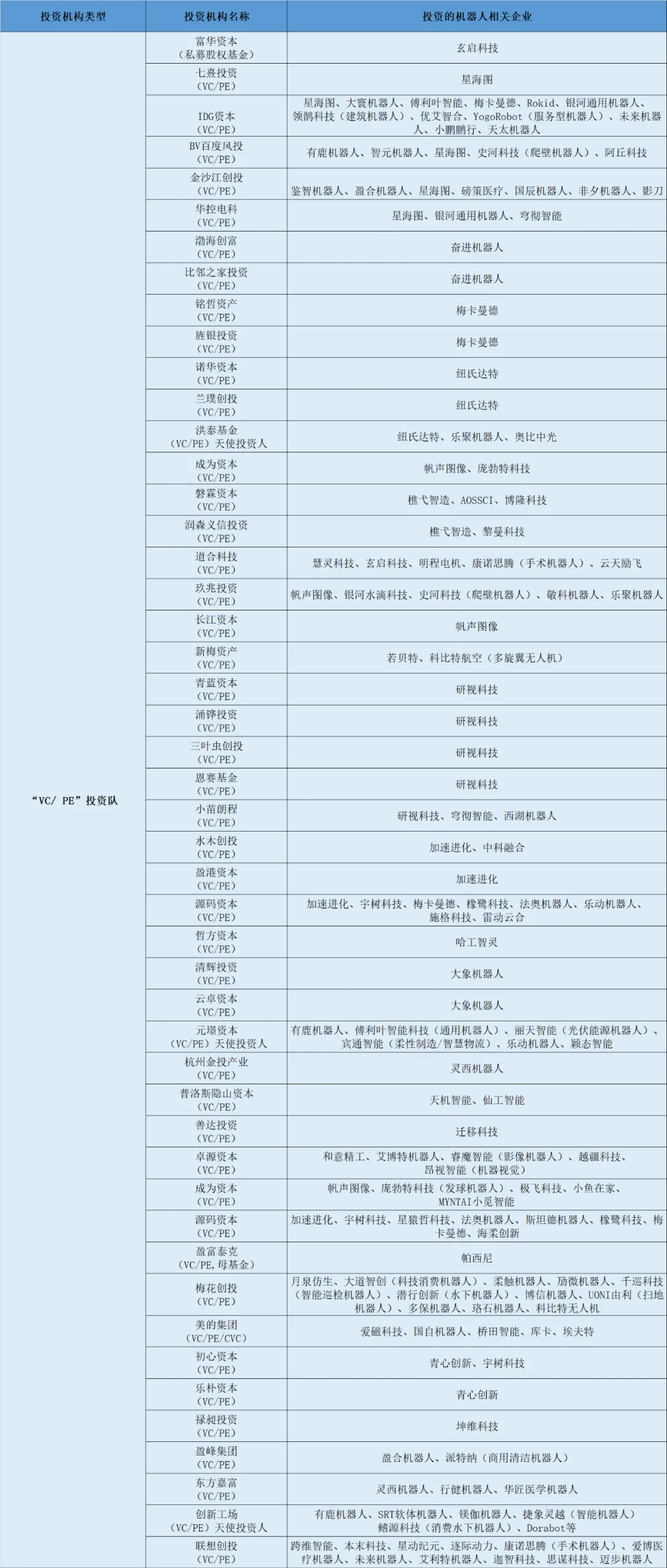

Finally, let's summarize the investment institutions with a significant presence in the embodied intelligence/robotics field.

30 institutions: Legend Capital (Supcon, Gowon, Starbot, Zhuji, Zhejiang Humanoid, Demeng, Benmo, Kuawei, Yunxin, Zhongkehuiling, Laifu, Jiazhi, Weilai, Yunji, Atom, Elite, Megvii, Agv, Changmugu, Concentus, Aibo, Noah, Bangce, Maibu, Feima, Zero-G, Songzhi, Zhucheng, Zhongfei Aivi, etc.)

13 institutions: Source Code Capital (Naruwa, Unitree, Meka, Yinhe, Jiasu Jinhua, Qinglang, Standard, Keyi, XYZ, Xianglu, Fa'ao, Xingmai, Aiou)

11 institutions: Plum Ventures (Yuequan, Dadao, Rouchu, Maiwei, Qianxun, Qianxing, Boxin, Youli, Luoshi, Kobit, Duobao)

11 institutions: Meituan Strategic Investment (Yinhe, Unitree, Pudu, Gaoxian, Feixi, Meka, Weilai, Shihe, Yinghe, Concentus, Fa'ao)

10 institutions: IDG (Yinhe, Xinghaitu, Fourier, Dahuan, Meka, Weilai, Lingque, Youai, XPeng, Tiantai)

Conflict of interest: I have led investments in Starbot, Zhuji, and Zhejiang Humanoid.