Double Defeat of Japanese Automakers: Losing Ground in Southeast Asia and Pressured by U.S. Tariffs

![]() 11/03 2025

11/03 2025

![]() 441

441

From Southeast Asia to the United States, Japanese automakers are experiencing a 'double defeat.'

When the streets of Southeast Asian markets are no longer dominated solely by Toyota and Honda, and when the U.S. tariff baton precisely strikes at the lifeblood of Japanese automotive manufacturing, the balance of power in the global automotive industry is quietly shifting. Japanese automakers, once self-proclaimed as the 'Asian Fortress,' are now forced to confront a global game of survival amidst dual pressures.

The Collapse of the Monopoly Myth

In the congested traffic of Jakarta, Indonesia, billboards for Chinese electric vehicle brands are replacing the logos of Japanese hybrid models; in 4S stores in Bangkok, Thailand, orders for the BYD Atto 3 have surpassed those for the Toyota Corolla.

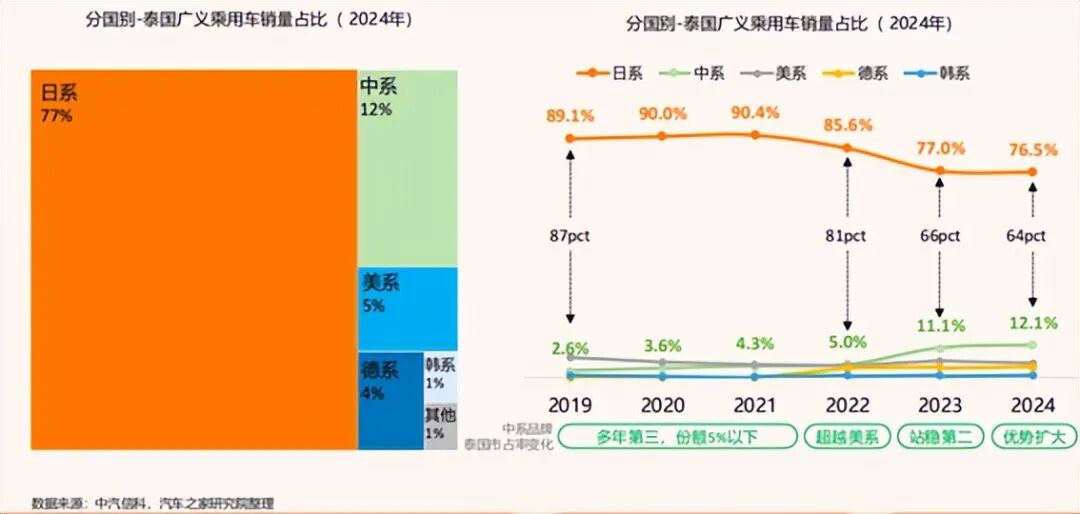

According to PwC data, in the first half of this year, the market share of Japanese automakers represented by Toyota, Honda, and Nissan in the six major Southeast Asian markets has dropped to 62%, compared to an average of around 77% in the 2010s.

This 'backyard' of Japanese automakers is being breached by Chinese automakers wielding electrification and intelligence as weapons.

Data shows that the penetration rate of new energy vehicles in Southeast Asia will exceed 15% by 2025, with Japanese automakers accounting for less than 30% of this share. Meanwhile, the market share of Chinese brands in the Southeast Asian new car market is on the rise.

Comparing the market share of Chinese brands in six major Southeast Asian countries in 2024 to that in 2019, five countries show an increase, led by BYD, which is also expanding its product matrix with an offensive based on pure electric vehicles.

Faced with the strong offensive from Chinese brands, Japanese automakers, which have been deeply rooted in Southeast Asia for decades, are retrenching.

Nissan Motor, which operates two assembly plants on the outskirts of Bangkok, plans to partially close one of the factories and consolidate production into the second plant by September 2025.

Similarly, Honda has announced that it will halt production at its Ayutthaya factory in Thailand by 2025 and consolidate its capacity to its factory in Prachinburi, Thailand. Honda's production volume in Thailand has already decreased from 228,000 units in 2019 to less than 150,000 units in 2023, still significantly higher than its annual sales of less than 100,000 units.

Other Japanese brands are facing similar dilemmas, with Suzuki and Subaru directly announcing their withdrawal from local production in Thailand.

Japanese automaker executives are anxious, with Mitsubishi Motors' Executive Vice President Tatsuo Nakamura even calling for Japanese automakers to unite in the ASEAN market to counter the competitive pressure from Chinese automakers.

According to data, the Southeast Asian new car market reaches an annual size of 3.5 million units, which, although only about a quarter of the U.S. market, has been a 'cash cow' where Japanese automakers dominate market share and pricing. Currently, the market share of Japanese automakers continues to decline, and if profitability decreases, it will affect the funds available for developing next-generation vehicles such as pure electric vehicles.

According to Bloomberg data analysis, from 2019 to 2024, Japanese automakers have lost the most market share in China, Singapore, Thailand, Malaysia, and Indonesia compared to all other automakers (by country) globally. Especially in Thailand and Singapore, Japanese automakers have lost 12 and 18 percentage points, respectively, over these five years.

It is no exaggeration to say that Chinese new energy vehicles are launching a strategic offensive against Japanese automakers in the Southeast Asian market.

Ramesh Narasimhan, former president of Nissan Thailand, directly stated that Chinese automakers are rapidly expanding sales and market share with flexible pricing strategies, a trend visible across Southeast Asian markets.

The market barriers built by Japanese automakers over half a century are being eroded by the wave of new energy.

The defeat of Japanese automakers in the Southeast Asian market is also due to their hesitation in electrification strategies, with their lag becoming a fact. Data released by global research firm Counterpoint Research shows that Chinese electric vehicle sales now account for 75% of the Southeast Asian electric vehicle market.

Even Toyota, a dominant player, finds it difficult to break through the defensive line of Chinese automakers in the Southeast Asian electric vehicle market.

What adds even more pressure to Japanese automakers is that Chinese brands are accelerating their local strategies in Southeast Asia, using their products to open a gap and then establishing a presence through industrial chain expansion.

Today, the landscape of the Southeast Asian automotive market is undergoing profound changes, and Japanese automakers are facing unprecedented challenges. How to regain market competitiveness in the wave of electrification has become an urgent issue for Japanese automakers.

Survival Battle Under the Shadow of Tariffs

'The reduction of U.S. tariffs has provided temporary 'relief' for Japanese automakers and automotive finance.'

The executive order signed by U.S. President Trump in September finally lowered the import tariff on Japanese automobiles from 27.5% to 15%, temporarily alleviating the anxiety in the Japanese automotive industry.

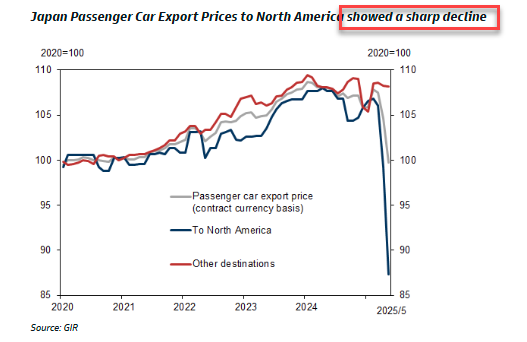

However, even at 15%, this tariff level is still six times the pre-Trump U.S. tariff on Japanese automobiles, and Japanese automakers will still suffer significant losses. A recent survey by Nikkei Asian Review showed that over 80% of major Japanese automotive parts manufacturers have begun or are considering passing on the additional tariff costs to consumers.

'Without significant price increases, it is unsustainable in the long run.'

Mark Templin, Chief Operating Officer of Toyota North America, stated in an interview that affordability has become an issue with the new automotive tariff policy, and import tariffs 'will make new cars unaffordable for many Americans.' On June 21, Toyota announced that it would raise prices for some models sold in the United States starting in July, with an average increase of $270. Meanwhile, prices for its luxury brand, Lexus, will also increase, with an average rise of $208.

Before Toyota's price hike, Subaru and Mitsubishi Motors had already announced price increases for their models in the United States. However, due to their smaller scale, the impact was not as strong as Toyota's. Mitsubishi stated that its U.S. car prices would increase by an average of 2.1%, with regular adjustments based on inflation.

Although Honda, Nissan, Mazda, and other Japanese brands have not yet made statements, U.S. media now generally believe that with Toyota joining the price hike trend, it will have a stronger demonstration effect (demonstration effect), and more brands are expected to raise prices in the future.

In fact, Japanese automakers, already at a disadvantage in the global automotive industry transformation, are facing a huge impact from Trump's tariff policies, with the dual pressures causing significant operational stress for Japanese automakers. Compared to automakers in other countries globally, Japanese automakers are more significantly affected by changes in trade policies due to their over-reliance on the North American market and single technological path.

Changes in automotive tariff policies may end the good days for Japanese automakers in the U.S. market.

Toyota stated in early May that its performance is being severely impacted by automotive tariffs, which will reduce the company's operating profit for the fiscal year (April 2025 to March 2026) by 180 billion yen ($1.8 billion, 1 yen ≈ 0.05 yuan) in just April and May, with an expected 35% decrease in net profit for the fiscal year.

Nissan Motor announced its financial results on May 13, reporting a net loss of over 670 billion yen for the previous fiscal year ended in March. To revive its operations, Nissan decided to expand its global layoff plan from the previous 9,000 to 20,000 and reduce its global vehicle assembly plants from 17 to 10. Considering the uncertainty of U.S. tariff policies, Nissan has not yet released its performance forecast for the fiscal year.

In addition, Honda Motor recently announced its financial results, showing a 12.2% decrease in operating profit for the 2024 fiscal year. CEO Toshihiro Mibe stated that the U.S. tariff policy has a significant impact on the company, and with Trump frequently adjusting policies recently, it is difficult for the company to accurately predict its performance. Based on the current situation, the company's main business profit is expected to shrink significantly in the 2025 fiscal year, with an estimated 70% decrease in net profit.

According to Japanese media, the seven major Japanese automakers are expected to lose a total of approximately 2.7 trillion yen in profit due to Trump's automotive tariffs in the current fiscal year.

However, the U.S. market must be defended—the last stronghold for Japanese automakers globally.

Currently, Japanese automakers' sales are facing a comprehensive decline in the global automotive market. Besides the Southeast Asian market mentioned earlier, in China, the world's largest automotive market, facing the comprehensive offensive of Chinese brands' intelligent electric vehicles, Japanese cars' market share in China dropped to 11% in 2024, a 13 percentage point decrease from their peak four years ago, according to data from the China Passenger Car Association.

In the European market, Japanese automakers faced tariff pressures as early as the 1960s and 1970s and were forced to establish local production in the 1980s or enter the market through alliances with European automakers (such as the Renault-Nissan-Mitsubishi Alliance). Even so, in the face of strong local automakers, Japanese automakers still have a relatively low market share in Europe.

For a long time, the United States has regarded Japanese automobiles as a major cause of the U.S.-Japan trade imbalance. In the United States, many people are hostile to Japanese cars, believing that they are the culprits driving the U.S. automotive industry into a desperate situation.

To defend their stronghold, Japanese automakers are making adjustments in multiple directions.

Firstly, they are increasing investment and production in the United States.

Currently, major automakers are actively taking countermeasures by adjusting some models exported to the United States to local production. Honda and Nissan expect that this capacity allocation may reduce tariff losses by about 30%. Toyota announced an additional investment of $88 million in its factory in West Virginia, United States, to build a new production line to strengthen the local production of hybrid vehicle components.

Secondly, they are adjusting their new energy development strategies and strengthening supply chain restructuring and cooperation. In addition, Japanese automakers are also stepping up efforts to explore markets outside the United States; promoting more thorough localization in local markets to enhance competitiveness; strengthening industry collaboration and even engaging in cross-border cooperation to try to keep pace with the electrification and intelligence trends in the automotive industry.

Several experts pointed out that for a certain period, the Japanese automaker industry may find it difficult to avoid the automotive tariff policies implemented by the Trump administration. Japanese automakers are slow in their efforts in the electrification and intelligence tracks, with many companies entering a difficult period of operation. The prospects for surviving the severe winter imposed by the Trump administration's automotive tariff policies are not optimistic.

From Southeast Asia to the United States, Japanese automakers are experiencing a 'double defeat.'

Meanwhile, Chinese automakers have already broken into multiple markets with electrification and intelligence. Faced with profit margin squeezes from U.S. tariff policies and still hesitant in their transformation, Japanese automakers are caught in a dilemma between 'maintaining the status quo' and 'breaking out.' Whether Japanese automakers can jump out of traditional frameworks, reconstruct global supply chains, and integrate into new ecosystems will determine their survival in the next round of industry reshuffling.

Note: The image sources are from the internet. If there is any infringement, please contact for deletion.