Which Doubao Large Model Company is the Most Profitable?

![]() 12/13 2024

12/13 2024

![]() 585

585

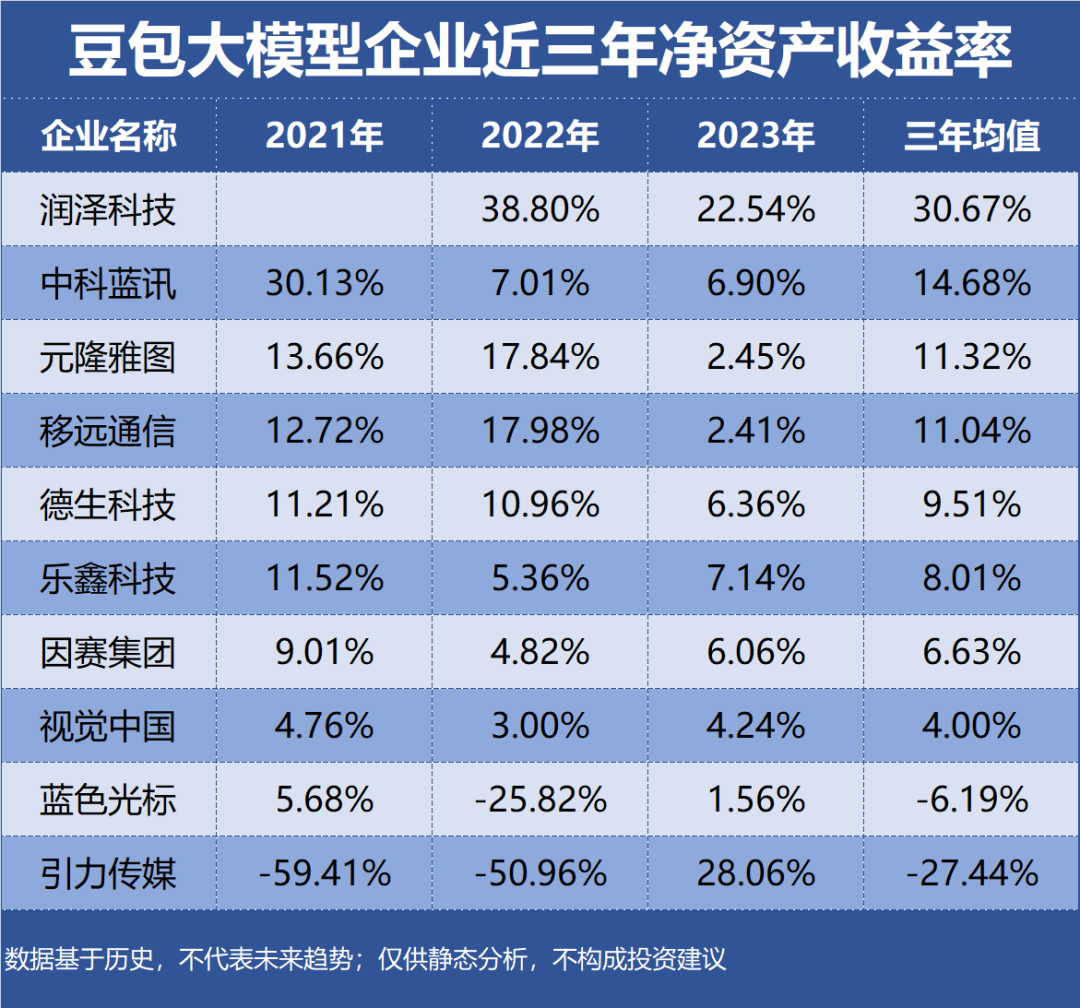

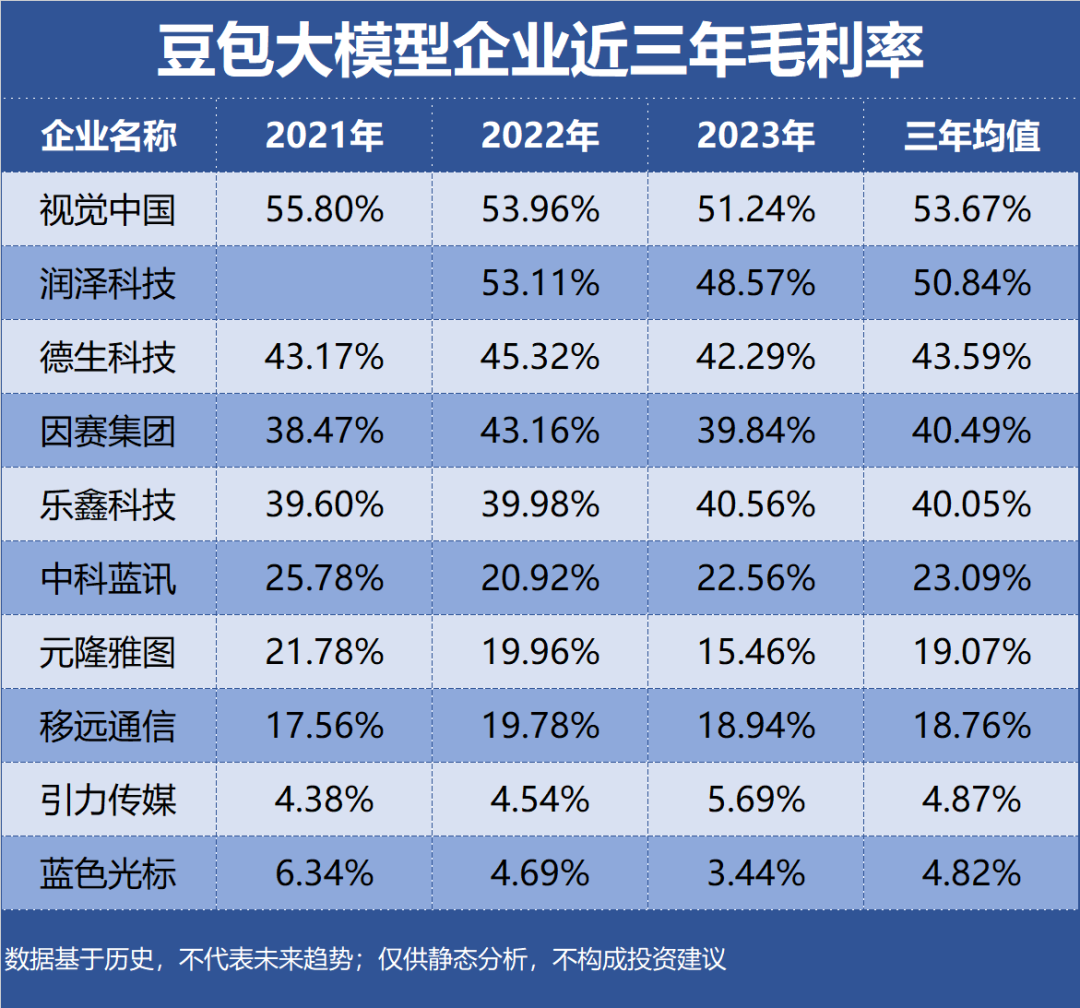

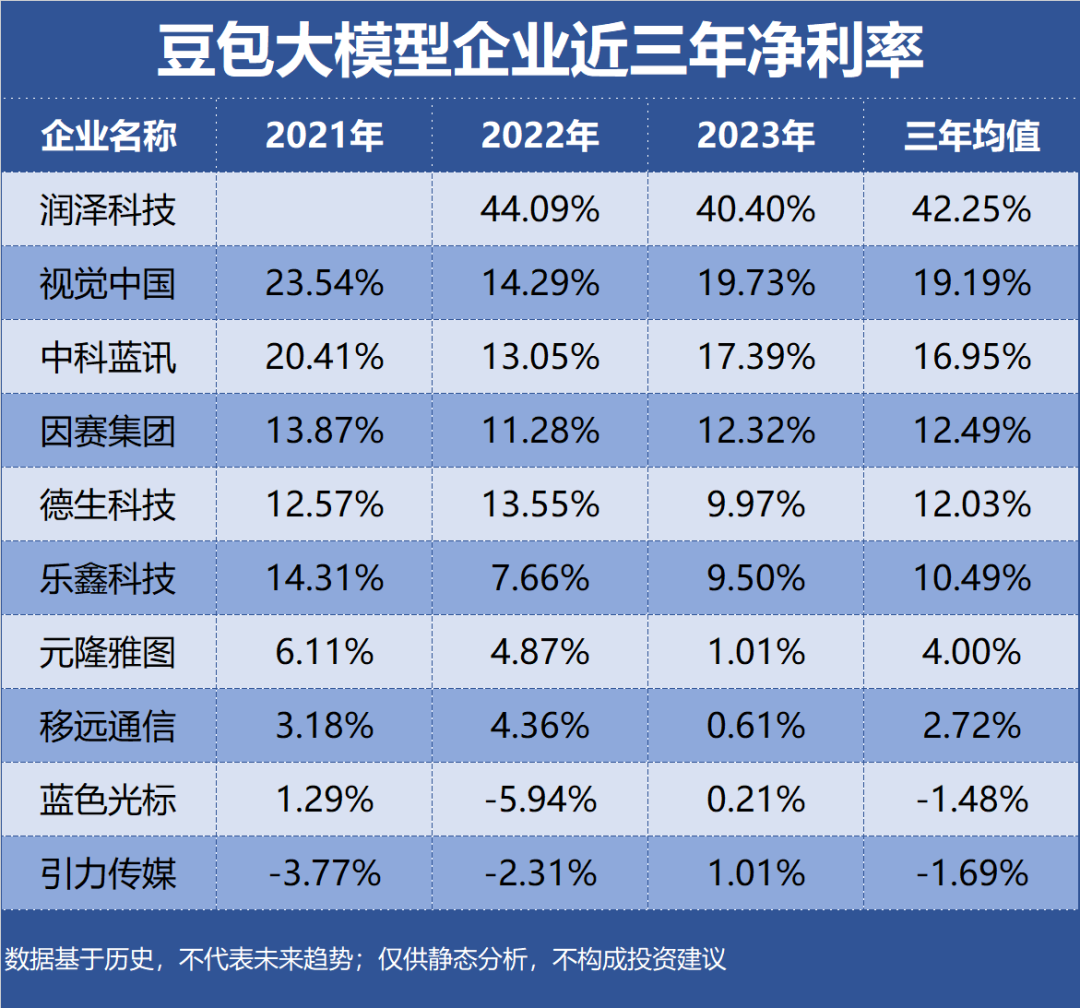

Douyin Doubao, an AI smart assistant application developed by ByteDance leveraging the Lark large model, integrates advanced AI technology to address user queries ranging from common sense to scientific principles and technical challenges, providing precise answers. Profitability, typically gauged by the volume and level of corporate earnings over a specific period, necessitates a thorough examination of profit margins. This article, part of the Enterprise Value Series focusing on [Profitability], analyzes 24 Doubao large model enterprises using metrics such as return on equity (ROE), gross margin, and net profit margin. Note that the data is based on historical figures, offering static analysis and not constituting investment advice.

Top 10 Most Profitable Doubao Large Model Enterprises:

10. Visual China Industry Segment: Image Media

Profitability: ROE 4.00%, Gross Margin 53.67%, Net Profit Margin 19.19%

Performance Forecast: ROE has fluctuated between 3%-5% over the last three years, with the latest forecast averaging 4.10%

Main Products: Visual content and services, accounting for 99.83% of revenue with a gross margin of 46.81%

Company Highlights: Deep cooperation with ByteDance, officially part of the ByteDance ecosystem; Douyin's CapCut software integrates Visual China's material section.

9. Yuanlong Yatu Industry Segment: Marketing Agency

Profitability: ROE 11.32%, Gross Margin 19.07%, Net Profit Margin 4.00%

Performance Forecast: ROE has fluctuated between 2%-18% over the last three years, with the latest forecast averaging 4.35%

Main Products: Marketing business revenue, accounting for 95.48% of revenue with a gross margin of 14.89%

Company Highlights: Broad layout across various IPs including sports, animation, games, cultural tourism, national trends, and original art.

8. BlueFocus Industry Segment: Marketing Agency

Profitability: ROE -6.19%, Gross Margin 4.82%, Net Profit Margin -1.48%

Performance Forecast: Highest ROE over the last three years was 5.68%, with the latest forecast averaging 3.99%

Main Products: Overseas advertising placement, accounting for 71.01% of revenue with a gross margin of 1.66%

Company Highlights: Developed a global business AI marketing tool matrix, including advertising placement analysis assistants, in collaboration with ByteDance and other mainstream Maas and cloud vendors.

7. Desheng Technology Industry Segment: IT Services

Profitability: ROE 9.51%, Gross Margin 43.59%, Net Profit Margin 12.03%

Performance Forecast: ROE has continuously declined to 6.36% over the last three years, with the latest forecast averaging 6.15%

Main Products: Smart card and AIOT applications, accounting for 64.71% of revenue with a gross margin of 44.28%

Company Highlights: Self-developed model system applied to intent recognition in the government sector, collaborating with Doubao in summarization and other areas.

6. Insigma Group Industry Segment: Marketing Agency

Profitability: ROE 6.63%, Gross Margin 40.49%, Net Profit Margin 12.49%

Performance Forecast: ROE has fluctuated between 4%-10% over the last three years, with the latest forecast averaging 7.20%

Main Products: Performance marketing, accounting for 52.63% of revenue with a gross margin of 5.80%

Company Highlights: Self-developed multimodal marketing AIGC large model collaborates with well-known large models like Doubao through API interface calls.

5. Actions Semiconductor Industry Segment: Digital Chip Design

Profitability: ROE 14.68%, Gross Margin 23.09%, Net Profit Margin 16.95%

Performance Forecast: ROE has continuously declined to 6.90% over the last three years, with the latest forecast averaging 7.59%

Main Products: Bluetooth headset chips, accounting for 59.61% of revenue with a gross margin of 19.65%

Company Highlights: Xunlong III BT895x chip integrated into the FIIL GS Links AI high-fidelity open-ear headset, becoming the second headset product to support the Doubao large model AI.

4. Quectel Industry Segment: Communication Terminals and Accessories

Profitability: ROE 11.04%, Gross Margin 18.76%, Net Profit Margin 2.72%

Performance Forecast: ROE has fluctuated between 2%-18% over the last three years, with the latest forecast averaging 12.82%

Main Products: Modules + antennas, accounting for 98.67% of revenue with a gross margin of 18.94%

Company Highlights: Specializes in wireless communication modules and IoT solutions, with chip modules supplying Doubao AI toys.

3. Espressif Systems Industry Segment: Digital Chip Design

Profitability: ROE 8.01%, Gross Margin 40.05%, Net Profit Margin 10.49%

Performance Forecast: ROE has fluctuated between 5%-12% over the last three years, with the latest forecast averaging 15.66%

Main Products: Modules and development kits, accounting for 57.80% of revenue with a gross margin of 38.91%

Company Highlights: ByteDance's AI companion toy FoloToy integrates multiple AI technologies from Volcano Engine, including the Doubao large model, utilizing Espressif Systems' esptool.

2. Runze Technology Industry Segment: Communication Application Value-Added Services

Profitability: ROE 30.67%, Gross Margin 50.84%, Net Profit Margin 42.25%

Performance Forecast: Highest ROE over the last three years was 38.80%, with the latest forecast averaging 21.76%

Main Products: AIDC business, accounting for 57.46% of revenue with a gross margin of 22.14%

Company Highlights: Primarily provides IDC and AIDC services, with communication technology and services supporting the application and promotion of Doubao-related products.

1. Yinli Media Industry Segment: Marketing Agency

Profitability: ROE -27.44%, Gross Margin 4.87%, Net Profit Margin -1.69%

Performance Forecast: Highest ROE over the last three years was 28.06%, with the latest forecast averaging 22.40%

Main Products: Digital marketing, accounting for 97.07% of revenue with a gross margin of 5.31%

Company Highlights: Core agent of ByteDance, holding both TikTok TSP and TAP licenses.

ROE, Gross Margin, and Net Profit Margin of the Top 10 Most Profitable Doubao Large Model Enterprises Over the Past Three Years: