The Booming Era of Large 6-Seater SUVs: Is the MPV 'Golden Age' Still Thriving?

![]() 02/10 2026

02/10 2026

![]() 437

437

Lead

Introduction

As competition in the MPV market intensifies and products become increasingly differentiated, even the remarkable surge of large 6-seater SUVs cannot prevent this segment from entering a new era.

The mainstream MPV market, once dominated solely by the Buick GL8, reached an unprecedented zenith in 2025. Amidst this flourishing scene, Chinese domestic brands have made significant strides, achieving high-end breakthroughs through new energy and intelligent technologies.

The MPV market concluded the year with unprecedented enthusiasm, marked by Yu Chengdong's announcement during a December livestream of the impending launch of Huawei's first MPV, the Luxeed V9, and Leapmotor's unveiling of the D99 as a 'tech-luxury flagship' at its 10th-anniversary event.

For years, we have hoped to see the MPV market transition from niche to mainstream, from business-oriented to family-oriented use, and break free from its limited survival mode.

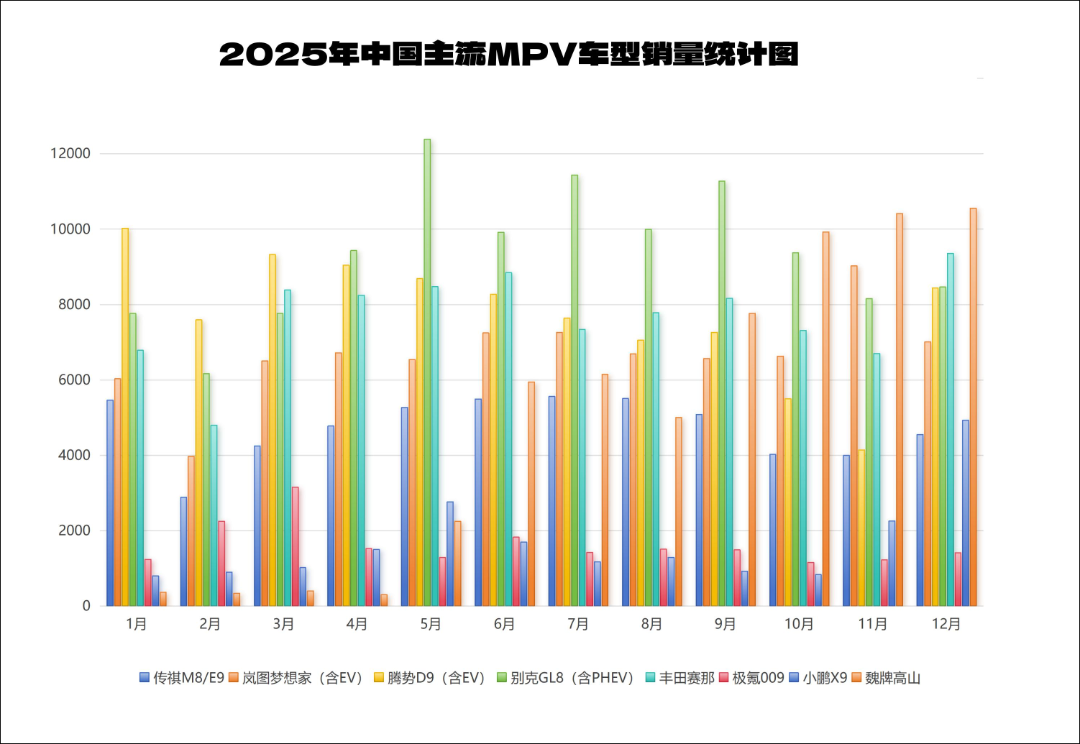

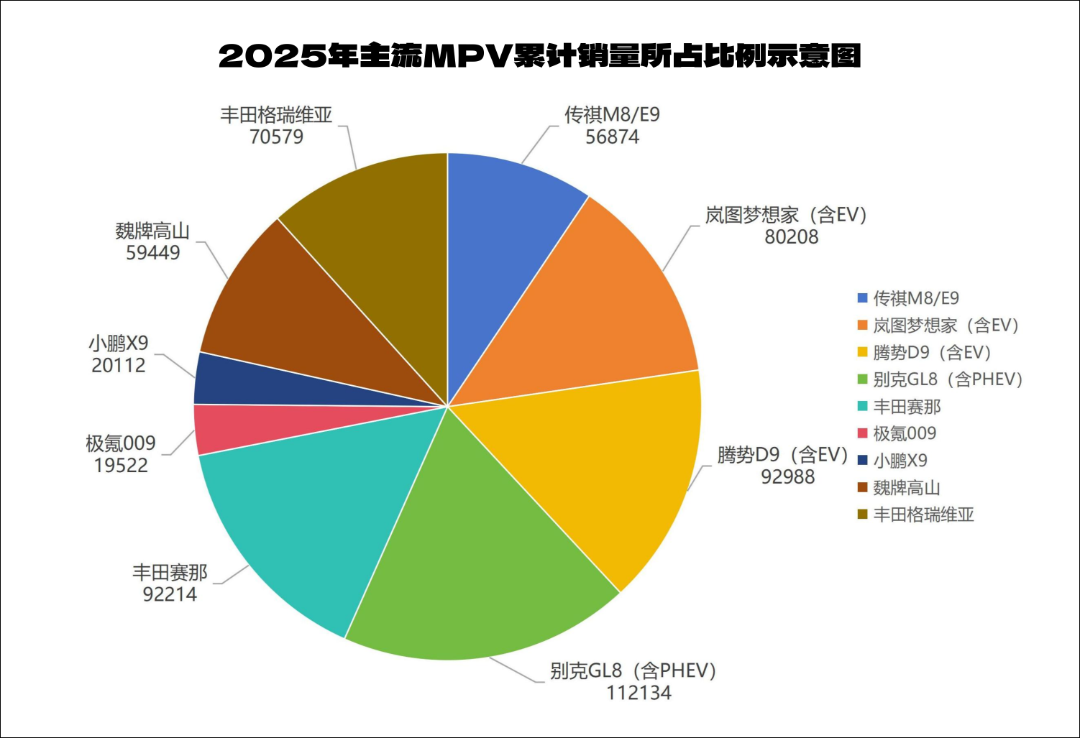

In 2025, according to data from the China Passenger Car Association, MPV sales in China exceeded 1.03 million units, showing a slight year-on-year increase. Meanwhile, sales of new energy MPVs soared by 36%, capturing nearly half of the market share. Although the Buick GL8 remained at the forefront of sales, it managed to maintain its position only through a diverse lineup of models. Perhaps the anticipated transformation is finally taking shape.

MPVs have never been the most consumer-centric vehicle segment. Discussions about market changes rarely dominate public opinion or sales floors. Over the past year, at most, some have amused themselves by repeatedly highlighting the unconventional appearance of the Li Mega to garner attention. However, as the 'big vehicle culture' becomes increasingly entrenched in the Chinese auto market, it would be a mistake to claim that MPVs lack potential.

Even as large 6-seater ASUVs pose a growing threat, attempting to carve out space with their philosophy of comfort and homeliness, the MPV market remains highly attractive to automakers due to its unique product attributes.

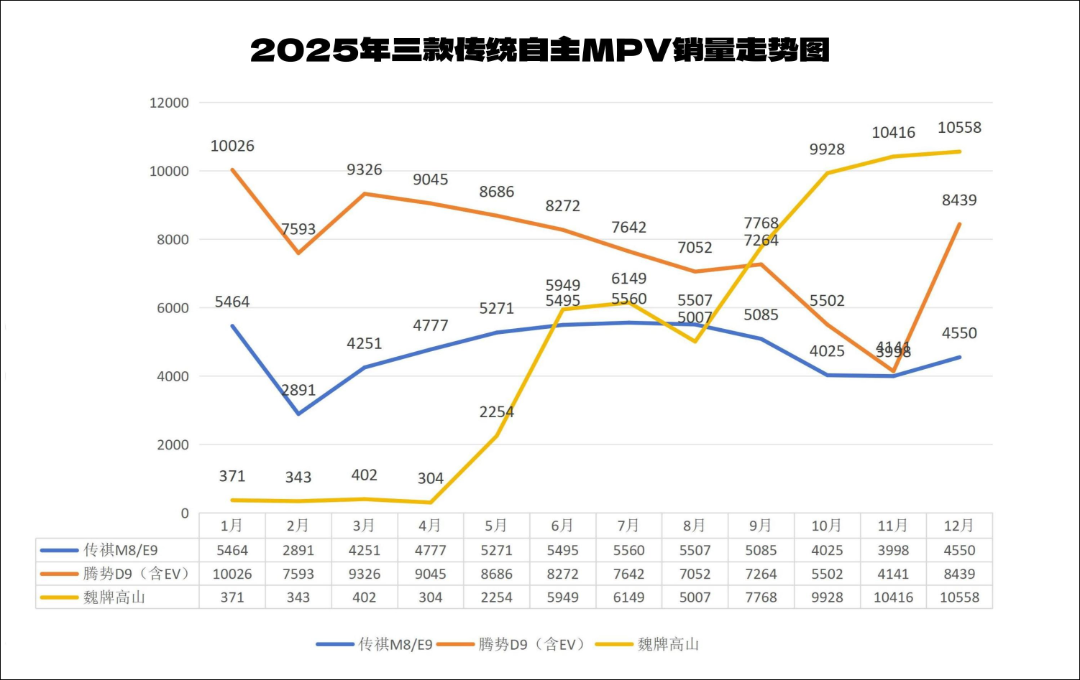

In this new era, MPVs are no longer just 'tools.' Encased in a technological veneer and influenced by shifting consumer consciousness, everyone is eyeing this market. Last year, the sudden rise of the WEY Highland may have seemed fortuitous, but with emerging brands like Voyah and Xpeng entering the fray, no amount of external skepticism can hold back the arrival of the MPV renaissance.

01 The Rise of Chinese Domestic Brands: No Longer Under the Radar

In the past, few newcomers could penetrate the MPV market. The Buick GL8 reigned supreme with its image as the 'on-road business class,' while the Toyota Alphard occupied the luxury segment priced at a million yuan. The remaining Chinese domestic brands, such as Dongfeng Fengxing and Wuling, only managed to capture the mid-to-low-end market, focusing on production materials.

Around 2020, with the strong rise of the Trumpchi M8, hopes emerged for disrupting the market landscape. However, given the market's limited capacity, most automakers found the return on investment in the MPV segment far less attractive than entering the booming SUV market.

Products like the Roewe iMAX8 and Maxus G10, which defied the odds, became market casualties, warning others: Rather than rashly launching MPVs, it was better to experiment with low-cost SUV products repeatedly. Successfully promoting just one model would be considered a triumph.

Everything changed when the industry underwent deep transformation and intelligence fully infiltrated the Chinese auto market. Li Auto's innovative approach, which realized the concept of a 'mobile home' with the Li ONE, ignited Chinese consumers' aspirations and brought this trend into the MPV market. Simultaneously, the idea of integrating home and vehicle gradually inspired automakers to reimagine car forms.

Constrained by market stereotypes, many believed that MPVs bound to family use could be adequately covered by products like the Toyota Sienna and Granvia. However, as the desire for 'color TVs, refrigerators, and large sofas' permeated every market segment and smart ecosystems took shape, MPVs, with their inherent space advantages, naturally attracted some users seeking large family vehicles.

In terms of sales, it is clear that Buick and Toyota MPVs still hold significant value. Their family lineups consistently sell over 10,000 units, forcing newcomers to carefully assess their capabilities. However, the emergence of these new trends has made it difficult for automakers to ignore the MPV market as they once did. The success of the Denza D9 further stirs the restless hearts of enterprises.

From the Voyah Dreamer to the WEY Highland, and from the Li Mega to the Xpeng X9, the entry of these new models did not immediately alter the market landscape. Even when the Buick GL8 employed a 'flood-the-market' strategy and the Toyota Sienna/Granvia engaged in price wars to block competitors, there were hints of repeating the mistakes of past models like the Mazda 8.

But the magic of the Chinese auto market lies in its unpredictability.

What qualities define a good MPV? Space? Features? Or price?

In the past, these were the key indicators for consumers deciding whether to buy. Today, while these basics remain, the gradual dominance of intelligent experiences has given new MPV players a chance to leapfrog. The Voyah Dreamer, backed by Huawei, and the revamped WEY Highland, both owe their popularity to such product advantages.

In an era dominated by large 6-seater SUVs, concerns arise that MPVs might become victims of new industry trends. After all, total MPV sales last year, at 1.03 million units, still saw a 2.3% year-on-year decline. Given the chaotic competition in the auto market, such worries are not unfounded. With an annual MPV market capacity of just around 1 million units, any effort by similarly priced products could easily disrupt this market.

However, we must not forget the diversity among Chinese consumers. Historically, as long as MPVs do not voluntarily expand into other segments, their irreplaceable role in business reception and group travel ensures their survival based on inherent model advantages. The continued success of latecomers like the WEY Highland in 2025 suggests that this trend will persist.

Compared to SUVs, even similarly priced MPVs may have limited combat effectiveness. Yet, when Chinese automakers, driven by fierce competition, refuse to overlook even seemingly unpromising segments like station wagons—with nearly 10 similar models launched in just a year—who can say that MPVs will not experience another concentrated surge this year?

02 The Old Order Crumbles, a New World Emerges

The current trajectory of the MPV market is clear. Backed by industrial transformation, the MPV market has transcended simple competitions over space and price, evolving into a holistic experience battle centered on scenarios and intelligence, regardless of expert analyses.

Even traditional players like Buick and Toyota must continually evolve to arm themselves. The GL8's adoption of a plug-in hybrid system aims to shed its overly commercial image, while the Sienna's integration of Huawei-powered infotainment serves the same purpose.

For newcomers, as annual data shows, the Denza D9 led Chinese domestic MPV models with 93,000 units sold, while the Voyah Dreamer secured its footing in the high-end market above 300,000 yuan with over 80,000 units sold. The GWM Highland series achieved a market comeback with astonishing growth rates several times higher than before. Behind these figures lies the dual drive of technological breakthroughs and shifting consumer attitudes.

This offers the market a new revelation: After finding a path forward with hybrid technology and intelligence, staying competitive requires avoiding homogenization. Beyond adhering to the basic principle of product upgrades, transitioning from 'stacking features' to 'building systems,' and shifting from pure pragmatism to embracing luxury or high-end business segments, becomes even more critical.

Recently, when the Luxeed V9 debuted, Zhao Jianghe, the brand's newly appointed executive vice president, jokingly claimed about the new car's capabilities, 'Conservatively, it will have no rivals for three years.' Some say Zhao is overly confident after his experience propelling the Denza D9 to the top of MPV sales. In the MPV market, where strong players dominate, gaining market share through direct competition is no easy feat.

But reality forces us to acknowledge that the Huawei-equipped Luxeed V9 possesses disruptive market potential. One need only look at the sales trends of the traditional fuel-powered GL8 over the past two years to see the stark contrast between old and new eras.

After two years of re-education, across the Chinese auto market, vehicles empowered by Huawei are almost synonymous with strong sales. This 'tradition' may well extend to the MPV segment.

Now that the competitive landscape of the 2025 MPV market has undergone a qualitative transformation—where size once defined MPVs—the focus must shift to intelligent cockpits, advanced driving assistance, and other areas as these features become standard across the board. Will high-end MPV competition not then center on these domains?

In other words, as intelligence becomes the core competitive edge, the competition between Huawei's HarmonyOS cockpit + Qiankun Intelligent Driving and automakers' proprietary solutions will determine the next generation of MPV intelligent experience standards. Meanwhile, scenario refinement will deepen further. Demand differences among family-oriented, business-oriented, and high-end custom segments will become more pronounced, making MPVs an emerging hotspot and automakers' rush to enter this market a logical step.

What can powerful players like the Aito M series and Li L series do about it? MPVs have never relied on imposing size or seemingly decent off-road capability. At the high end, models like the Alpharda aim for an elegant riding experience and a strong sense of identity. At the lower end, deepening family attributes, exemplified by functional configurations like sliding doors, has become increasingly irreplaceable.

Against this backdrop, even as new players further crowd the already competitive MPV segment—with over 10 emerging MPV models currently on sale, spanning price ranges from 150,000 to 800,000 yuan—brands like Luxeed, Denza, and Li will continue to vie for the high-end MPV market above 500,000 yuan, while Leapmotor, Geely Galaxy, Xpeng, and Voyah will focus on competing in the high-value MPV segment around 300,000 yuan.

However, as long as industry transformation remains incomplete in China, we can believe that MPVs still hold immense potential for consumers.

After more than a decade, China's auto industry has evolved from the confusion of 'market-for-technology' exchanges to the confidence of 'technology-for-market' dominance. The transformation of the MPV market mirrors this journey: from Buick GL8's dominance to the collective rise of Chinese domestic brands, from fuel-powered dominance to electric drive proliferation, and from single business use to diverse scenario coverage. This year, with brands like Denza, Luxeed, and Leapmotor, which have broad popular support, stirring the pot, the market is poised for an even more significant reshaping.

Editor-in-Chief: Cao Jiadong Editor: Chen Xinnan

THE END