Who is the Fastest-Growing Enterprise in the Doubao Large Model Sector?

![]() 12/16 2024

12/16 2024

![]() 771

771

The Doubao large model has been validated across more than 50 business scenarios within ByteDance, witnessing daily usage of tens of billions of tokens and offering multimodal capabilities.

Growth ability signifies an enterprise's capacity to continually expand its asset scale, profitability, and market share amidst evolving market conditions, thereby reflecting its future development prospects.

This article, part of the 'Enterprise Value' series focusing on 'Growth Ability', examines 27 enterprises leveraging the Doubao large model. Evaluation criteria include revenue compound growth, non-deductible net profit compound growth, and operating net cash flow compound growth. The data presented is based on historical performance and solely intended for static analysis, not constituting investment advice.

Top 10 Enterprises with the Highest Growth Ability in the Doubao Large Model Sector:

10th - Desheng Technology

Industry Segment: IT Services

Growth Ability: Revenue Compound Growth 6.52%, Non-deductible Net Profit Compound Growth -10.06%, Operating Net Cash Flow Compound Growth (Negative)

Performance Forecast: Latest average net profit forecast is 76 million yuan, with an average forecast growth rate of 3.3%

Main Products: IC cards and AIOT applications, contributing 68.98% of profits with a gross margin of 42.63%

Company Highlights: Desheng Technology constructs city-specific one-card service and data product systems. Its self-developed model system aids in summarization and generalization, collaborating with Doubao and others.

9th - BlueFocus

Industry Segment: Marketing Agency

Growth Ability: Revenue Compound Growth 14.58%, Non-deductible Net Profit Compound Growth (Negative), Operating Net Cash Flow Compound Growth -8.13%

Performance Forecast: Latest average net profit forecast is 304 million yuan, with an average forecast growth rate of 160.4%

Main Products: Full-service marketing, accounting for 52.17% of profits with a gross margin of 8.37%

Company Highlights: As a renowned marketing and communication group, BlueFocus innovates marketing solutions and applications leveraging Doubao's AI capabilities.

8th - Visual China

Industry Segment: Image Media

Growth Ability: Revenue Compound Growth 9.03%, Non-deductible Net Profit Compound Growth -6.62%, Operating Net Cash Flow Compound Growth 29.95%

Performance Forecast: Latest average net profit forecast is 143 million yuan, with an average forecast growth rate of -1.49%

Main Products: Visual content and services, contributing 100.00% of profits with a gross margin of 51.20%

Company Highlights: Visual China maintains close ties with platforms like ByteDance, integrating image, video, and music content across diverse applications.

7th - Insight Group

Industry Segment: Marketing Agency

Growth Ability: Revenue Compound Growth -7.32%, Non-deductible Net Profit Compound Growth -55.28%, Operating Net Cash Flow Compound Growth 17.06%

Performance Forecast: Latest average net profit forecast is 47 million yuan, with an average forecast growth rate of 13.89%

Main Products: Brand management, contributing 64.99% of profits with a gross margin of 42.18%

Company Highlights: Insight Group has developed a multimodal AIGC marketing application model, offering services like AI-generated/edited images and videos to clients like Tencent Games, Krafton, and Meizu.

6th - Quectel

Industry Segment: Communication Terminals and Accessories

Growth Ability: Revenue Compound Growth 10.94%, Non-deductible Net Profit Compound Growth -86.96%, Operating Net Cash Flow Compound Growth (Negative)

Performance Forecast: Latest average net profit forecast is 532 million yuan, with an average forecast growth rate of 486.29%

Main Products: Modules and antennas, contributing 98.68% of profits with a gross margin of 18.94%

Company Highlights: Quectel provides one-stop solutions encompassing wireless communication modules, antennas, and software platform services. The company supplies chip modules for Doubao AI toys.

5th - Unilumin Technology

Industry Segment: LED

Growth Ability: Revenue Compound Growth 1.24%, Non-deductible Net Profit Compound Growth 16.88%, Operating Net Cash Flow Compound Growth 638.02%

Performance Forecast: Latest average net profit forecast is 267 million yuan, with an average forecast growth rate of 84.81%

Main Products: Smart displays, contributing 91.88% of profits with a gross margin of 32.11%

Company Highlights: Unilumin's digital humans integrate Volcano Engine's TTS capabilities and Doubao's large model Q&A abilities, suitable for applications like digital human dialogue systems.

4th - Actions Semiconductor

Industry Segment: Digital Chip Design

Growth Ability: Revenue Compound Growth 13.46%, Non-deductible Net Profit Compound Growth -5.54%, Operating Net Cash Flow Compound Growth (Negative)

Performance Forecast: Latest average net profit forecast is 299 million yuan, with an average forecast growth rate of 18.75%

Main Products: Bluetooth headset chips, contributing 51.92% of profits with a gross margin of 19.65%

Company Highlights: Actions Semiconductor's Xunlong III BT895x chip integrates with the Volcano Ark MaaS platform, offering users software and hardware solutions compatible with the Doubao large model.

3rd - Runze Technology

Industry Segment: Value-added Services for Communication Applications

Growth Ability: Revenue Compound Growth 45.79%, Non-deductible Net Profit Compound Growth (Negative), Operating Net Cash Flow Compound Growth -1.07%

Performance Forecast: Latest average net profit forecast is 2.213 billion yuan, with an average forecast growth rate of 25.6%

Main Products: IDC business, contributing 81.22% of profits with a gross margin of 54.46%

Company Highlights: Runze Technology specializes in datacenter business services. Its communication technology and services support the application and promotion of Doubao-related products.

2nd - Yingli Media

Industry Segment: Marketing Agency

Growth Ability: Revenue Compound Growth -7.16%, Non-deductible Net Profit Compound Growth (Negative), Operating Net Cash Flow Compound Growth -1.07%

Performance Forecast: Latest average net profit forecast is 57 million yuan, with an average forecast growth rate of 18.65%

Main Products: Digital marketing, contributing 90.72% of profits with a gross margin of 5.31%

Company Highlights: Yingli Media focuses on major traffic platforms like ByteDance, offering clients precision customer acquisition and efficient growth operation services.

1st - Espressif Systems

Industry Segment: Digital Chip Design

Growth Ability: Revenue Compound Growth 1.68%, Non-deductible Net Profit Compound Growth -20.62%, Operating Net Cash Flow Compound Growth 212.64%

Performance Forecast: Latest average net profit forecast is 345 million yuan, with an average forecast growth rate of 153.38%

Main Products: Modules and development kits, contributing 54.61% of profits with a gross margin of 36.44%

Company Highlights: Espressif's esptool is referenced in ByteDance's AI toy Folotoy documentation.

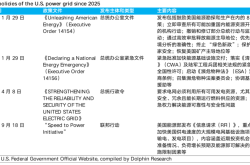

Top 10 Enterprises with the Highest Growth Ability in the Doubao Large Model Sector: Revenue Compound Growth, Non-deductible Net Profit Compound Growth, and Operating Net Cash Flow Compound Growth over the Past Three Years: