Alibaba's Tongyi Jumps on the "Final Train"

![]() 12/31 2024

12/31 2024

![]() 668

668

Written by | Hao Xin

Edited by | Wu Xianzhi

After nearly a year of silence, Tongyi has finally ceased its hesitation and rejoined the fierce competition in AI applications.

Recently, multiple media reports have confirmed that Alibaba's AI application Tongyi has officially been spun off from Alibaba Cloud and integrated into Alibaba's Intelligent Information Business Group. This adjustment includes product managers for Tongyi's To C products, as well as related engineering teams. Following this reorganization, Tongyi's PC and App teams are now on par with the intelligent search product "Quark," while the original Tongyi Lab remains within the Alibaba Cloud system.

This move represents both Alibaba's strategic realignment in its large-model business direction and a repositioning of Tongyi's applications.

Developed by Alibaba DAMO Academy, the Tongyi suite is currently Alibaba's "flagship product" in the AI domain, belonging to the Alibaba Cloud system and primarily providing services externally through MaaS.

According to insiders at Alibaba, Tongyi applications were initially bundled with large models into To B services, serving as a "showcase" to attract B-end users' attention by displaying various model functions and demonstrating scenario implementation potential. Consequently, despite an early launch, the Tongyi App has remained low-key with minimal promotion.

Following this spin-off, Tongyi applications have officially shifted from B-end to C-end applications. Having just exited the cloud competition, it has now entered the fiercely competitive AI assistant market. However, Tongyi has completely lost its first-mover advantage, as Kimi, Doubao, and Wenxiaoyan have already secured top-tier positions.

Photon Planet has learned that Tongyi applications have begun prioritizing metrics such as DAU and MAU, making user acquisition a pressing concern.

There is a common perception within the industry about Alibaba and ByteDance: Alibaba focuses on B-end customer service, while ByteDance emphasizes C-end productization capabilities.

Now, however, each is trying to emulate the other. Alibaba is reorganizing its Intelligent Information Business Group, betting on Tongyi and Quark, hoping to break into the AI To C market. Meanwhile, ByteDance hopes that the buzz generated by Doubao on the C-end will one day lead to large-scale conversions on the B-end.

Tongyi's "Wavering"

In its early days, Tongyi was the AI application with the most C-end potential and the likelihood of becoming a hit.

Unknown to many, Tongyi was the first domestic AI assistant application to be launched, approximately four months earlier than Doubao and nearly six months ahead of Kimi.

When most people were unaware of what AI Q&A entailed, Tongyi received a surge of traffic from overseas networks late last year, going viral with its "Dancing King" feature, with "Terracotta Warriors Dancing Driving Test" even trending on Weibo.

However, as the hype faded, Tongyi also became more laid-back, evidenced by its lack of enthusiasm for promoting new features. In the trendy marketing buzzwords like "AI Search," "Multimodal," "Multi-step Reasoning," and "Agent," Tongyi was virtually absent. As a result, Kimi and Doubao surpassed Tongyi, rising to prominence through internet advertising and user acquisition, while Tongyi remained lukewarm and lost its presence.

The reason lies in Tongyi's wavering self-positioning. The Tongyi app served more as a showcase for Alibaba's AI capabilities, providing a centralized entry point for scattered functions. These functions were all developed based on the Tongyi Qianwen large model and had both C-end and B-end service attributes.

Unlike other competitors, the different AI functions within Tongyi come from different business teams. For example, "Tongyi Tingwu" in the efficiency assistant section is an independent product in its own right, originally launched in 2021, evolving from an internal corporate efficiency tool to an AI assistant for office and learning.

According to AI Product Rankings data from September, Tongyi Tingwu alone generated nearly 430,000 visits. This also led to a diversion of traffic away from the aggregated Tongyi App and webpage, with significant traffic flowing to individual AI products instead.

The commercialization strategy for Tongyi Tingwu was similar to Tongyi's pre-spin-off approach: free for C-end users and paid for B-end customers. As its product leader Yang Fan put it, "The mission of conducting business on the C-end is to demonstrate Alibaba's technical research direction and the evolution of the Tongyi large model to customers."

This set the tone for Tongyi's early days, with each function operating independently and unevenly in terms of upgrades. The C-end served as a hook, while the B-end was the true target audience.

The spin-off of Tongyi applications signifies another shift towards the C-end, returning to its origins. Tongyi remains the same, but the landscape has changed.

Old Players Re-enter the Field

Currently, AI assistants on the market can be divided into two categories: those that rely on advertising for growth, such as Doubao and Kimi; and those that prioritize light investment and natural retention growth, represented by Wenxin Yiyan (now Wenxiaoyan) and Tongyi.

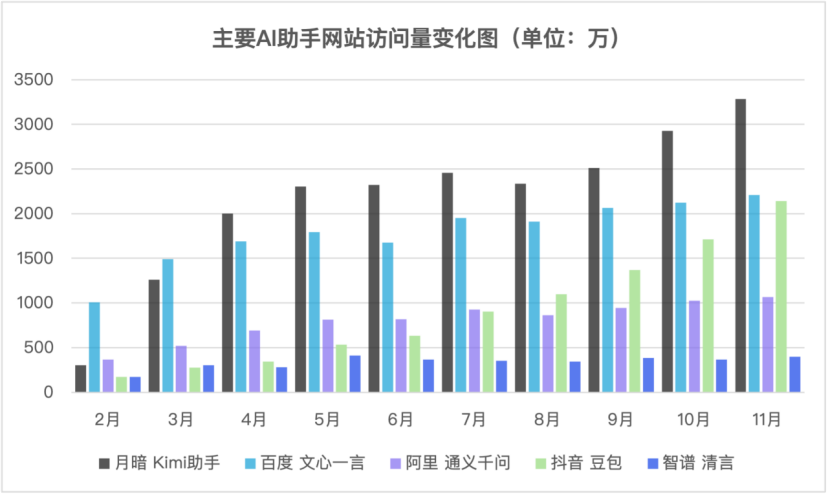

Advertising-driven growth is a classic example of "spending big to achieve miracles." According to AI Product Rankings data, from February to November this year, Kimi's website visits soared from 3.05 million to 32.82 million, while Doubao grew from 1.73 million to 21.43 million.

(Data Source: AI Product Rankings | Chart by Photon Planet)

Similarly focused on natural growth, Wenxin Yiyan represents another facet of Tongyi. Launched four months after Tongyi, Wenxin Yiyan had a total of 22.07 million website visits as of November.

Overall, if AI assistants are divided into tiers based on user volume, Kimi, Doubao, and Wenxin Yiyan belong to the first tier, Tongyi to the second tier, and other AI products to the third tier. The gap is evident from the data: Tongyi had only 10.65 million website visits in November, about a third of Kimi's and half of Doubao's.

From the moment Tongyi announced its official spin-off, it truly arrived on the battlefield. The challenge before it is simple: how to narrow the gap.

Doubao is the biggest obstacle facing Tongyi. Although ByteDance has recently been reported to be prioritizing its Jimeng product, it has not abandoned Doubao. In the future, Doubao will continue to serve as a channel for user input and output data, a gateway to activate hardware, and an entry point for multimodal functionality. The brute force approach of "spending big to achieve miracles" continues, with ByteDance reportedly setting an aggressive goal of achieving 100 million monthly active users by the end of the year, boasting the title of "the largest native AI application in China with the most users."

While ByteDance has chosen to go all-in, it remains a mystery how much Alibaba will bet on Tongyi. It is understood that Tongyi is already showing signs of restlessness in terms of marketing and user acquisition, aiming to quickly achieve its DAU goals.

From an organizational structure perspective, Doubao receives significantly more internal attention than Tongyi, which to some extent determines the allocation of resources. Doubao is the flagship product of ByteDance's Flow department's AI product team, with its web and App leaders reporting directly to the general leader Zhu Jun, underscoring its importance. In contrast, Tongyi has been integrated into Alibaba's Intelligent Information Business Group, a department jokingly referred to as "marginal" and "the least Alibaba-like" within the company.

"We only found out later that we were even included in the 'Four Dragons,'" an Alibaba insider revealed, noting that the Intelligent Information Business Group has limited access to the group's budget resources. It remains to be seen whether this situation will change with the return of Wu Jia.

When resources are limited, where to direct them becomes particularly crucial. For now, advertising is a losing proposition.

According to the latest data from Zhipu, on the C-end, the Zhipu Qingyan App has over 25 million users and an annualized revenue (ARR) exceeding ten million yuan. Assuming an annualized revenue of ten million yuan, each user contributes only 0.4 yuan, while current customer acquisition costs range from 20 to 30 yuan.

Industry insiders believe that Tongyi's entry may not bring about significant changes. "Alibaba's focus is still on the B-end, and Tongyi can only be considered a C-end test product. However, ByteDance must make Doubao a success to gain a foothold in the B-end market."

The two logics of leveraging the B-end to drive the C-end and vice versa are gradually converging.

In a recent interview with Tan Dai, President of Volcano Engine, he mentioned that Doubao has brought Volcano many attentions and new cooperation opportunities. Tan Dai stated, "In the past, technology for To B and To C was separated because the value of C-end platforms like Douyin and B-end platforms like Volcano Engine were seen differently. However, the C-end and B-end of large models are essentially the same thing behind the scenes."

Tongyi and Quark

Spinning off C-end-oriented businesses from the B-end portfolio is just the first step. Many challenges remain for Alibaba.

Foremost among these is the unification of Tongyi's various AI functions, which come from different product development teams that need to be integrated into the Tongyi app. Compared to other AI assistants, Tongyi appears somewhat fragmented. For example, Kimi closely follows OpenAI's footsteps, emphasizing AI search and reasoning, while Minimax stands out in video generation and multimodal functionality. AI assistants are highly replaceable, and so far, Tongyi has failed to give users a compelling reason to choose it over others.

The relationship between Tongyi and Quark has become delicate due to the reorganization.

Previously, Quark stated that it had "no direct competition" with Tongyi, primarily because Tongyi served the B-end while Quark served the C-end. This balance has now been disrupted.

While Quark far surpasses current AI application products in downloads and user base, Tongyi has the advantage of being more adaptable to AI-native environments and having greater potential for future growth. The potential competition between Quark and Tongyi manifests in several ways, such as competition for resources within the same business unit, positioning as "efficiency assistants" or "productivity tools," differentiating promotional strategies, and allocating advertising resources. Quark, which extends various functions from learning and work scenarios, overlaps with Tongyi in some functionalities, necessitating decisions on whether to duplicate efforts.

On the bright side, Tongyi's addition will strengthen Alibaba's position on the desktop. As companies compete fiercely in the mobile space, the desktop market gap becomes apparent. The high entry barrier for the desktop market excludes many AI startups, with only a few players, including Quark, Doubao, and Kimi, currently having some competitiveness.

The importance of the desktop may gradually become apparent later on. It serves as a more scalable entry point than mobile devices, implying the need to break down barriers between PC applications to enable seamless integration of various functions and facilitate collaboration between AI and humans in productivity.

In areas of rigid demand, users are more critical when using various AI functions, and only a handful of applications are likely to remain in the end. This to some extent influences the development trajectory of applications aiming to become entry-level in the AI era. For Tongyi, entering the market later could present an opportunity for overtaking.

Perhaps in the near future, we will witness a scenario on the PC end where Quark and Tongyi join forces to "encircle" Doubao.