Navigating Baidu's Growth Path Post-Geely Jiyue Collapse

![]() 12/31 2024

12/31 2024

![]() 627

627

Although Geely Jiyue has not been officially declared defunct, a brand that has lost the trust of both employees and users may be irretrievably doomed.

Behind Geely Jiyue stand two titans, Baidu and Geely. For Geely, the collapse of Geely Jiyue is merely the loss of a customer – both Baidu and Geely are suppliers to Geely Jiyue. In a sense, as a major automaker, Geely loses a competitor with the fall of Geely Jiyue, albeit one that posed no real threat.

However, for Baidu, Geely Jiyue holds a different significance entirely – it represents a critical component of Baidu's intelligent driving efforts.

As early as 2013, Baidu embarked on its self-driving car project, becoming one of the pioneering tech companies in China to enter the intelligent driving arena. By 2017, Baidu had established an Intelligent Driving Group and launched the "Apollo Program," opening up its autonomous driving platform, Apollo.

In November 2017, the Ministry of Science and Technology held a conference to unveil the development plan for the new generation of artificial intelligence and the launch of major science and technology projects. The event revealed the list of the first batch of national open innovation platforms for the new generation of artificial intelligence, prominently including Baidu's autonomous driving program. As such, Baidu's intelligent driving team was once hailed as the "national team."

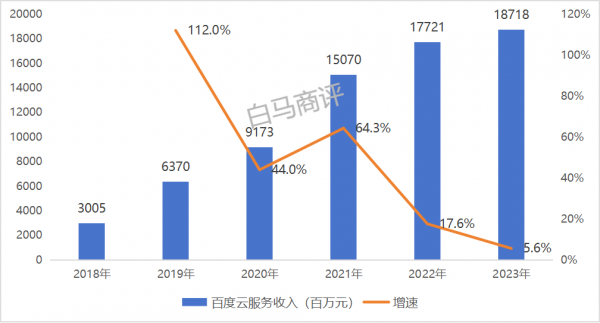

It must be acknowledged that among the frontline internet companies, Baidu has significantly "lagged behind" in recent years. Its core advertising business growth has essentially stagnated, cloud service revenue growth has continued to decline, achieving only single-digit growth in 2023, and iQIYI, after finally achieving profitability for the first time in 2023, has seen both revenue and profit decline this year.

The external world primarily holds two expectations for Baidu: one is the large model represented by ERNIE Bot, and the other is intelligent driving.

Now, the prospects for Baidu's intelligent driving business are overshadowed. So, where will Baidu's growth stem from after the collapse of Geely Jiyue?

Baidu's Decline and Quest for Breakthrough

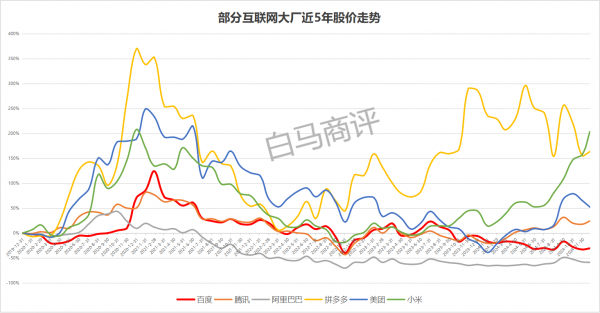

Amid peak internet traffic and slowing industry growth, internet giants have experienced a general "correction" in the capital market over the past few years. However, after a soft landing, the performances of different companies have diverged significantly.

Xiaomi, which has successfully ventured into car manufacturing, and Pinduoduo, with its consistently impressive performance, have rebounded strongly. Meituan, which has turned a profit, and Tencent, with its solid moat and renewed growth, have emerged from their lows. However, Baidu and Alibaba are still "searching for the bottom."

If we consider a five-year cycle, only Alibaba and Baidu's share prices have yet to "recover." In other words, if you bought Baidu or Alibaba shares five years ago, you would still be underwater today.

The fundamental issue facing Baidu today is that, within the mobile internet ecosystem, vertical apps have created information silos, with search, recommendations, product services, and transactions all taking place within these app ecosystems.

This leads to two consequences: Firstly, since Baidu missed the golden age of mobile internet development and never launched a flagship product, search engines are no longer the sole traffic entrance amid the fragmentation of information and the app-ification of content on the internet. Content platforms have further diverted traditional search users by leveraging AI to enter vertical search, diverting Baidu's traffic.

Secondly, Baidu's search engine primarily functions as a "transit station" where users search and are redirected to merchant pages through ads placed by merchants on the platform. However, Baidu cannot capture user behaviors such as lead generation, ordering, and conversion on merchant pages, resulting in lower monetization value of traffic.

Baidu is also attempting to make changes. For instance, it has added mini-programs and hosted pages to its Baidu APP search pages, extending towards a closed-loop transaction to enhance traffic monetization efficiency. Simultaneously, it is reconstructing over ten AI-native applications, including Baidu Search, Rulai, Maps, Pan, and Wenku, based on ERNIE Bot to improve the user search experience.

While these adjustments are tactical, what truly determines Baidu's growth are its strategic choices. Robin Li announced the slogan "all in AI" early on and made breakthroughs in large models and intelligent driving through AI capability building.

However, in reality, whether it's large models or intelligent driving, Baidu faces severe competition.

Large Models: "Distant Water Cannot Quench a Near Thirst"

Regarding large models, Robin Li stated at Baidu World 2024 that as of early November, the daily invocation volume of ERNIE Bot reached 1.5 billion, with a six-month growth rate of 7.5 times and an approximately 30-fold increase from the 50 million invocations first disclosed a year ago.

Baidu faces a typical dilemma as a "defender" in large models – if it doesn't participate, it will fall behind, but participating means revolutionizing itself.

Currently, many participants are involved in domestic large models, with no internet giant absent and numerous startups competing on the same stage.

The latest ranking released by Xsignal shows that in October 2024, ERNIE Bot had 19.1066 million daily active users, ranking third, behind Doubao and Kimi apps.

Most current large model products targeting C-end users are free, and how to achieve commercial monetization is a universal challenge in the industry.

Overall, large models' value lies in their integration with specific scenarios. For example, Liu Qingfeng, the chairman of iFLYTEK, mentioned last year that thanks to large models, the company's sales of smart devices and learning machines surged. Therefore, the commercial exploration of large models ultimately needs to return to scenarios.

Returning to Baidu, Robin Li has publicly stated that Baidu does not aim to launch a "super app" but rather continuously help more people and enterprises create millions of "super useful" apps.

Currently, large models primarily generate revenue for Baidu in two ways: by optimizing the search user experience and ad targeting accuracy through large models to increase advertising revenue, and by providing basic large models to enterprises to help them develop products and optimize management.

In fact, the emergence of large models has intensified competition in the search field for Baidu. 360 released a new AI search product, "Nano AI Search," at the end of November, and companies like iFLYTEK and Kunlun Wanwei have also entered the "generalized search industry" through generative AI. According to Baima, the introduction of AI has reignited competition in the search industry, which is not good news for Baidu.

Additionally, Zhou Hongyi, the founder of 360 Group, recently stated publicly that search vendors, including 360, Baidu, and Google, still have an unresolved concern: "Where should ads be placed after switching to AI search? We haven't found a place yet."

Therefore, direct monetization of large model search scenarios will take time, while increased search competition may further squeeze Baidu's market share.

Another scenario for Baidu's large models – enterprise applications – has also yet to show results. Baidu Cloud's revenue growth has gradually hit a bottleneck in recent years, with the growth rate continuously declining, achieving only single-digit growth in 2023.

Luobo Kuaipao: "Run Fast"

Unlike large models, the commercialization of intelligent driving business is much simpler and clearer, with real-world success stories.

In May 2021, Robin Li proposed three business models for Apollo: Firstly, providing automakers with Apollo autonomous driving technology solutions; secondly, manufacturing cars end-to-end, integrating Baidu's autonomous driving innovations; Thirdly, shared driverless vehicles, i.e., Luobo Kuaipao, which is still being pilot-tested nationwide.

With Geely Jiyue's collapse, Baidu's self-manufacturing ambitions seem out of reach.

In providing solutions to automakers, Baidu faces a row of formidable competitors. Huawei needs no introduction, and new forces like NIO, XPeng, and Li Auto are reluctant to outsource core functions.

In fact, Baidu has never successfully provided complete intelligent driving solutions to automakers as a supplier. The only real implementations of Baidu's complete intelligent driving solutions are Geely Jiyue and Lantu FREE – Geely Jiyue has collapsed, and Lantu signed a strategic cooperation agreement with Huawei in January this year. In August, the new Lantu M8 was launched, featuring Huawei's HiCar ADS 3.0 advanced intelligent driving system and HarmonyOS cabin for the first time.

In other words, besides partial solution applications, no automaker customers systematically use Baidu's intelligent driving solutions anymore. Without scenarios, Baidu's intelligent driving solutions will only drift further away from automakers and users.

As such, Luobo Kuaipao remains the only commercialization path for Baidu's intelligent driving. Baidu is indeed the company that has gone the farthest and fastest in the domestic Robotaxi (driverless taxi) sector.

In May this year, Baidu Apollo launched the sixth-generation Luobo Kuaipao driverless vehicle equipped with the sixth-generation intelligent system solution and stated that with the completion of the autonomous operation network for Luobo Kuaipao vehicles, operating costs would be reduced by 30%, and service costs would decrease by 80% through continuous optimization of autonomous driving technology and human-vehicle cabin efficiency. "The goal is to achieve a break-even point for Luobo Kuaipao in Wuhan by the end of 2024 and enter a period of full profitability in 2025."

Subsequently, Luobo Kuaipao began providing 100% fully autonomous ride-hailing services across most areas of Wuhan city, sparking a wave of public interest and marking another step forward in Luobo Kuaipao's full commercial operation.

The latest data shows that as of October 28, 2024, Luobo Kuaipao had accumulated over 8 million ride-hailing orders. In October, fully autonomous rides accounted for 80% of the total national orders for Luobo Kuaipao.

The industry generally believes that the trend toward driverless taxi operations is inevitable, with progress primarily influenced by policy. Even if Robotaxi becomes commercialized, Baidu will face fierce competition.

Domestic Robotaxi players include Pony.ai, WeRide, and other companies. It is rumored that Tesla is actively seeking to introduce its Full Self-Driving (FSD) technology into China and launch a Robotaxi business.

Another player that cannot be ignored is Didi. Currently holding a 70% market share in the online car-hailing industry, Didi is also actively testing autonomous taxis.

In terms of test data volume, operational scope, and commercialization achievements, Luobo Kuaipao undoubtedly surpasses other competitors by a wide margin. Given Geely Jiyue's collapse and the delay in the standalone commercialization of autonomous driving solutions, Luobo Kuaipao has become the "sole survivor" of Baidu's intelligent driving business, with the possibility of more resources being poured into it in the future.

Conclusion

As one of the original internet giants, Baidu has witnessed and participated in numerous internet trends but has only managed to create a handful of businesses with sustained "hematopoietic capacity."

From an external perspective, Baidu excels at strategy, and each strategic choice, while not infallible, is quite forward-looking. However, it often encounters problems at the tactical level, giving the impression of indecisive strategic execution.

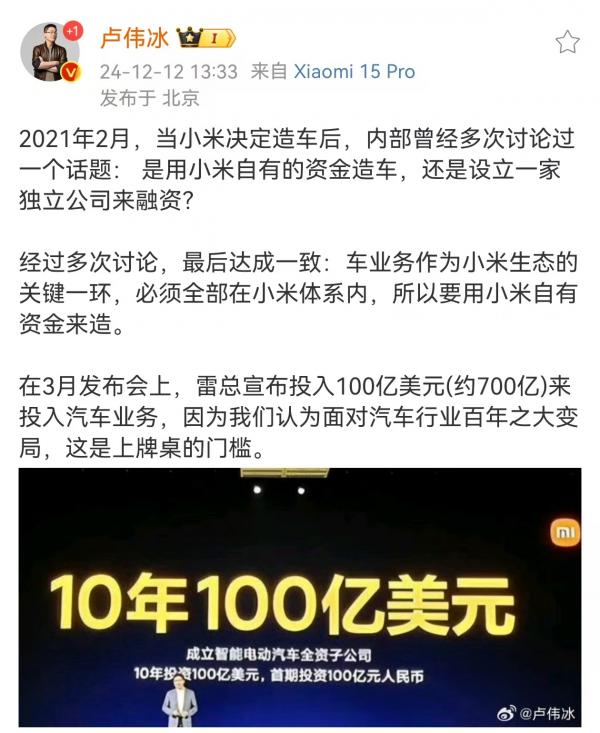

Compared to Baidu's approach of collaborating and investing in car manufacturing, Xiaomi has firmly chosen to manufacture cars on its own and has achieved initial success.

Baidu has been involved in the intelligent driving field for over a decade, with cumulative investments exceeding RMB 100 billion. Objectively speaking, Baidu has made significant contributions to promoting the development of China's intelligent driving industry, and a large number of talents from Baidu are now active in the field.

Peng Jun, co-founder and CEO of Pony.ai, and Lou Tiancheng, co-founder and CTO of Pony.ai, both held senior architect positions in Baidu's autonomous driving department. Yu Kai, founder and CEO of Horizon Robotics, was once the dean of Baidu Research Institute and director of Baidu's Deep Learning Lab. Han Xu, founder and CEO of WeRide, was originally the chief scientist of Baidu's Autonomous Driving Business Unit...

The question is, when will Baidu's intelligent driving business generate its own "hematopoietic capacity"?

It is worth mentioning that Baidu is currently a rare net asset value-breaking stock in China's internet industry, with a price-to-book ratio of less than 0.9, reflecting the market's pessimistic expectations.

It seems that Baidu will continue to experience pain until it finds a new growth path. So, will the business that leads Baidu back to growth be Luobo Kuaipao?

The content and opinions in this article are for reference only and do not constitute investment advice. Investment involves risks, and decisions should be made cautiously.