Reigniting the 'APP Factory': Is Zhang Yiming Aiming to Be the Edison of the AI Era?

![]() 01/08 2025

01/08 2025

![]() 718

718

More than half of the rising stars of the Internet era have faded in the wave of the mobile Internet. Can the new aristocrats who emerged in the mobile Internet era withstand the baptism of large models?

When a new door is pushed open, it is often the large factories that dominated the previous era that feel the edge, in contrast to the enthusiasm of entrepreneurs. Every wave of innovation reshapes the industry landscape, with emerging forces rising to prominence while original industry giants fall into crisis.

Returning to the present, large factories in a 'defensive' posture react more intensely to new technologies and adopt a more aggressive approach.

Take ByteDance, a frontrunner in large models, as an example.

01 ByteDance Reignites the 'APP Factory'

Over a month ago, a comment by Kunlun Wanwei founder Zhou Yahui on his WeChat Moments made ByteDance's AI strategy the focus of discussion outside the company.

As affirmed by Zhou Yahui, ByteDance's AI strategy boasts two 'full marks':

The first is the AI army formed through the integration of golden talents. Veterans such as Zhu Wenjia, Zhang Nan, and Qi Junyuan have shifted to the AI camp, recruiting heavyweights like Zhou Chang, the former technical leader of Tongyi Qianwen's large model; Jiang Lu, the former project leader of Google's VideoPoet; and Huang Wenhao, the former pre-training leader of Zero One Everything. Together, they form a model and application research and development system of over 10,000 people, encompassing Seed, Flow, and Jianying.

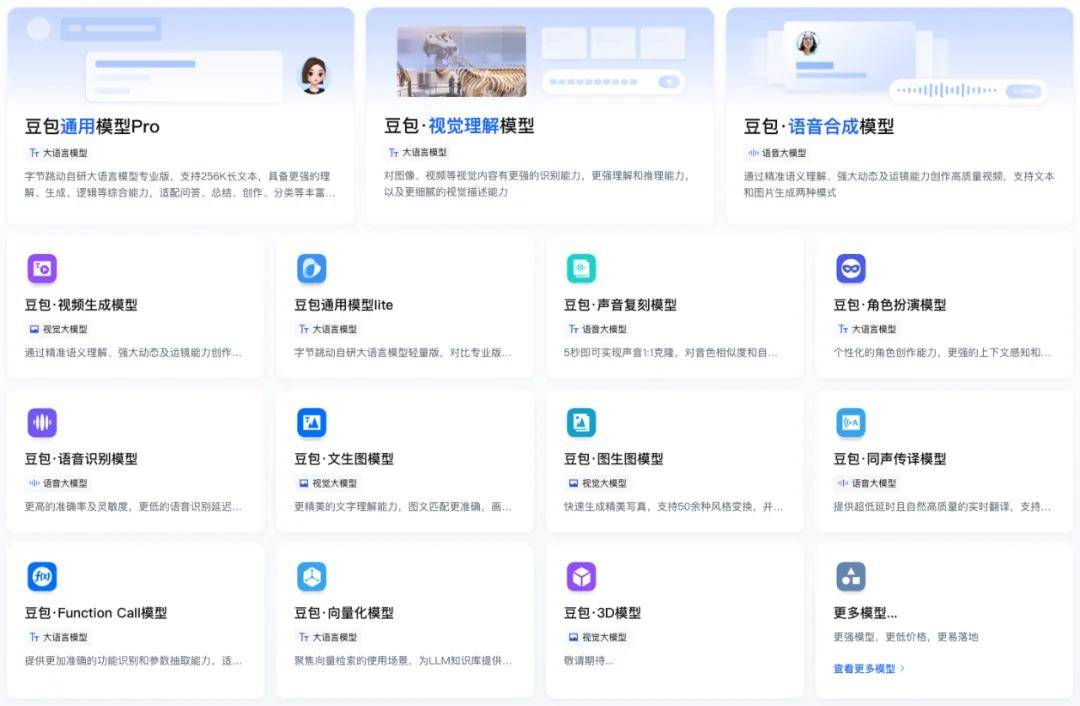

The second is the 'miracle of brute force' at the model training level. After ChatGPT became popular in November 2022, Baidu, iFLYTEK, and others successively launched competing products. ByteDance, however, only tested its AI dialogue product 'Doubao' externally in mid-August 2023. Yet, in May 2024, ByteDance publicly unveiled the Doubao large model family for the first time, launching multiple models including the general model pro, speech synthesis, and speech recognition all at once.

For most ordinary people, what we perceive most deeply is precisely the reigniting of the 'APP Factory', rather than Zhou Yahui's perspective.

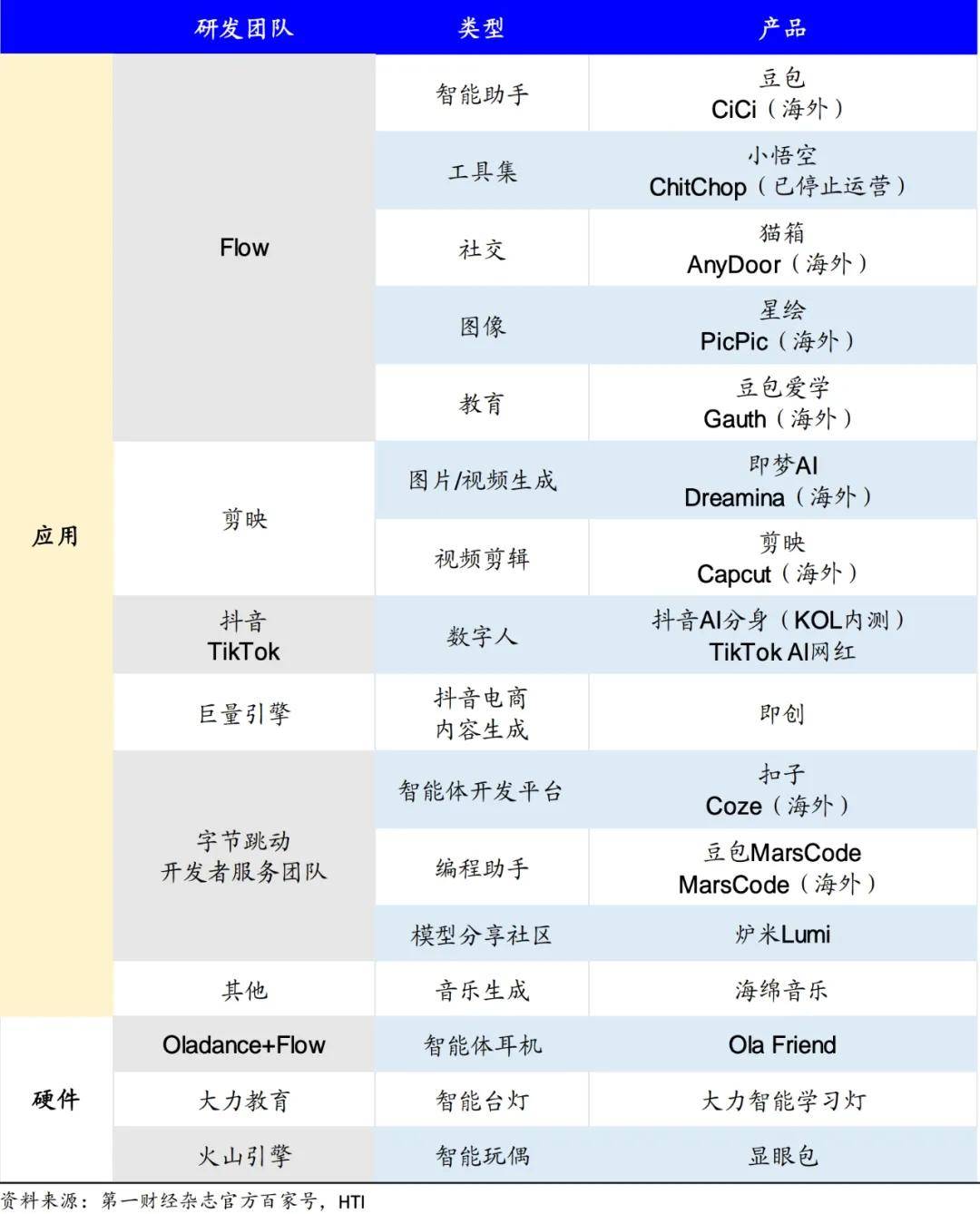

Unlike Li Yanhong, who frequently calls on developers to 'not compete on models, but on applications', ByteDance's strategy is more pragmatic. They are putting full throttle into large models to form a general + vertical large model system, while also personally creating AI applications - Doubao, Kouzi, Jimeng, Maoxiang, Haimian Music, Jichuang, Xinghui, Lumi...

According to 'China Business News', ByteDance currently has about 20 AI applications in normal operation, most of which were released after 2024.

Further subdividing by time, ByteDance has new products launching almost every month, with the product system already covering the model layer, the intermediate layer for developing agents, and the application layer. Among them, the application layer presents a trend of 'hundred flowers blooming', including but not limited to chatbots, virtual characters, social networking, image generation, AI development platforms, smart hardware, etc., making it the enterprise with the most AI applications currently.

Especially Doubao Smart Assistant, as a chatbot, launched large-scale traffic investment in June 2024, and there are even rumors that 'ByteDance has restricted the advertising placement of Doubao's competing products on the Douyin platform'.

According to data from the 'AI Product Rankings', as of December 2024, Doubao's monthly active users have exceeded 71 million, second only to ChatGPT globally, and leaving a considerable gap with Kimi, Wenxiaoyan, and others.

Unlike Doubao's aggressive expansion, Li Yanhong directly stated at Baidu's 2024 third-quarter director meeting that AGI is a long-term exploration, and there is no need to promote 'Wenxiaoyan' as aggressively as Doubao and Kimi.

Baidu's 'conservatism' and 'trade-offs' are not without reason. After a brief honeymoon period, more and more enterprises began to consider the commercialization of AI applications. In the case of models such as paid subscriptions and tipping not meeting expectations, different enterprises have different answers to whether it is necessary to continue burning money for growth.

As for ByteDance, while there may be anxiety about missing the new round of technological waves, there is no lack of confidence in the 'APP Factory'.

Time goes back to the beginning of 2019, when an article titled 'Zhang Yiming's APP Factory' unexpectedly went viral, revealing the terrifying strength of a newly emerged unicorn.

The so-called 'APP Factory' is actually a packaged term. Large factories such as Tencent and Alibaba all have a mechanism of 'internal horse racing', where after identifying a certain direction, two or three project teams operate simultaneously. The product that ultimately performs best will receive the full support of the company's resources.

Relying on Toutiao to verify the 'magic' of algorithmic recommendation, ByteDance further optimized the horse-racing mechanism and built an 'APP factory' for assembly line production: in terms of organizational structure, it formed three core functional departments of technology, User growth, and commercialization, responsible for retention, acquisition, and monetization respectively. They participate in each APP and then decide the final focus of investment based on quantitative data such as AB testing.

The most classic example is short video.

In 2016, ByteDance simultaneously launched Douyin, Huoshan, and Xigua Video. Huoshan was the first to launch an independent APP, but it was later proven that Douyin had the best retention, so resources were constantly concentrated on Douyin, forcibly snatching the short video pie from Kuaishou, which already had 300 million users.

Entering 2020, ByteDance's 'APP Factory' seemed to no longer work, with products such as Kesong, Paidao Island, and Feiliao successively failing, and hardware products such as Dali and Pico also falling short of expectations. ByteDance gradually reduced the frequency of new product releases.

In the era of large models, can ByteDance's 'AI Factory' create the next Douyin?

In the APP era, products such as Toutiao, Douyin, and Dongchedi were supported by the same relatively mature recommendation algorithm, and the cost of trial and error for new products was relatively controllable.

However, in the era of large models, the scope of 'horse racing' has risen to the model layer. For the scenario of text-to-video alone, ByteDance's Seed team has successively launched multiple models such as MagicVideo-V2, AnimateDiff-Lightning, PixelDance, and SeaWeed, requiring a large amount of resource investment and team configuration.

The competitive logic of the large model track is by no means a game of comparing quantities. Wanting to continue the horse-racing mechanism at the model layer while firmly occupying a place at the application layer means that ByteDance must invest far more than its competitors at the research and development level.

Facts also confirm this. According to a report by Zheshang Securities, ByteDance's expenditure on AI in 2024 reached 80 billion yuan, close to the combined total of Baidu, Alibaba, and Tencent (about 100 billion yuan).

A closer look at ByteDance's capital expenditure mainly reflects in two aspects:

One is recruiting talent. It is rumored that ByteDance has no upper limit on recruitment quotas for talents related to basic model research and development, and it is often possible to see salary increases based on double the original salary. The approach may seem brutal, but it can enhance their own 'talent density' while quietly weakening the strength of competitors.

The second is chips. According to data released by Omdia, ByteDance ordered about 230,000 chips from NVIDIA in 2024, second only to Microsoft. There are even reports that ByteDance has formed its own AI chip team and plans to independently research and design AI chips based on Tensor.

So far, ByteDance's tactic of burning money to buy time is not infeasible, even if the efficiency of spending money may not be that high. Some startup teams are unlikely to withstand ByteDance's fierce firepower. If subsequent returns can be obtained in commercialization, it will undoubtedly be a classic case recorded in history.

Many compare AI to electricity. Following this metaphor, Zhang Yiming and Thomas Edison essentially belong to the same category of people.

When I was young, I learned in history books about Edison's invention of the electric light bulb, experimenting with thousands of materials before finally finding 'carbonized cotton thread'.

In fact, Edison's laboratory in Menlo Park had hundreds of engineers, scientists, and technicians, divided into countless groups and experimenting with different filament materials every day.

Like Thomas Edison, Zhang Yiming plays the role of a 'helmsman' in the team, with a large group of technical personnel innovating and verifying in the direction they specify. Their cognitive heights also profoundly influence the rise and fall of enterprises.

Just as Edison's talent was not originality, but his keen ability to perceive needs that could be changed by innovation. Therefore, most of the inventions of the Edison team were improvements on existing technologies, giving new technologies practical value, such as electric lights, microphones, phonographs, and so on.

To some extent, Zhang Yiming's ByteDance is also an application-oriented company, skilled at converting technology into products rather than being driven by technological ideals.

According to reports from some media, ByteDance established an AI Lab in 2016, setting up multiple teams for computer vision, natural language processing, speech and audio processing, machine learning, etc., even earlier than Alibaba.

However, when products such as Douyin and TikTok occupied more than half of the market share, and ByteDance's business focus shifted increasingly towards commercialization, the 'APP Factory' strategy no longer worked, and the AI Lab was forced to be downgraded to the technical team of Douyin, with less than 50 people remaining at one point.

ByteDance's 'slowness' in the field of large models is clearly due to Zhang Yiming's 'misstep'.

As early as May 2020, GPT3 with 175 billion parameters sparked a wave of enthusiasm in the technology circle, initially possessing the ability to write novels and tell stories. By 2021, many domestic teams had already begun researching large models, but ByteDance, which was originally at the forefront of AI technology, did not shift its research and development center from content distribution to content production, nor did it realize the disruptive impact of large models on content production.

Time came to 2023, with ChatGPT's monthly active users exceeding 100 million within two months. The belated ByteDance finally began to 'catch up', leading to the scenes mentioned earlier: snatching talent, snatching computing power, and reigniting the 'APP Factory'.

Of course, a misjudgment of technological trends should not be a reason to underestimate ByteDance, and its competitiveness in the era of large models still cannot be underestimated. After all, what determines the success or failure of an enterprise is not only the timing of entry but also strategic decision-making and execution.

The success of Edison, with the electric light bulb being the icing on the cake, was rooted in the 'modern invention system', gathering a large number of technical talents and then accumulating over 2,000 'utility model patents' through the dimensionality reduction strike of 'using scientists as engineers and engineers as technicians'.

Zhang Yiming's ByteDance seems to be replicating a similar approach, building a complete AI ecosystem in just one year and releasing models and applications like dumplings into boiling water.

What is regrettable is that Edison, who was sensitive to application directions, had an unavoidable cognitive ceiling. In the 'war of currents' between AC and DC, he chose the simpler business model of the DC system, ultimately losing the 'invention factory' he had run for many years.

Historical laws have repeatedly proven that new technologies will bring about a major reshuffle of the industry landscape, consistently producing winners and losers.

ByteDance, which is in its prime, once broke through the ceiling of BAT and is now playing the role of the 'ceiling' itself, with a defensive intensity far exceeding that of BAT. The good news for entrepreneurs is that even large factories like ByteDance are still in an exploratory stage.

All players at the large model table are 'betting' on a better tomorrow, competing on whether their wallets are thick enough, their resolve is strong enough, their luck is good enough, and their vision is high enough. Even Edison made wrong bets, and the window of opportunity for entrepreneurs has never been closed.