Seres' HKEX Listing: Valuation Calibration and Value Breakthrough Behind the First-Day Game

![]() 11/06 2025

11/06 2025

![]() 724

724

On November 5th, Seres officially listed on the main board of the Hong Kong Stock Exchange. This event not only marks the birth of China's first luxury new energy vehicle company listed in both 'A+H' markets but also serves as an important window for the capital market to observe the valuation logic and development potential of China's new energy vehicle industry, given its identity as the 'largest IPO of a complete vehicle manufacturer on the Hong Kong stock market since 2022 and the third-largest HKEX IPO in 2025.'

On that day, Seres opened at HK$128.9 per share, slightly lower than the issue price of HK$131.5. The stock price once hit a low of HK$118 during intraday trading, a drop of over 10%. Ultimately, with the stabilization efforts of China International Capital Corporation (CICC) using green shoe funds to support the market, the stock closed at the issue price. This 'nail-biting' first-day performance was not merely a signal of market bearishness but rather a value game shaped by multiple factors—including valuation controversies triggered by high discounts, realistic concerns about short-term performance pressures, the evolving influence of Huawei's cooperation, and differentiated judgments by institutional investors on the long-term competitiveness of new energy vehicle companies.

▍Balancing Discounts, Demand, and Valuation in the First-Day Game

The first controversy surrounding Seres' HKEX listing stemmed from the 'high discount' during the subscription phase. Its final HK stock issue price represented a 22.7% discount from the October 31st A-share closing price, exceeding the typical range seen in similar large-scale A-to-H projects in 2025. Among projects with an issuance size exceeding HK$10 billion this year, only Hengrui Medicine exhibited a higher discount of 25.6% due to historical discounting characteristics in the pharmaceutical industry. In contrast, high-quality targets like CATL saw discounts of just 6.8%, while Haitian Flavoring and Sany Heavy Industry kept theirs below 20%.

Initially, the market believed the high discount might be Seres' strategy to attract Hong Kong investors. However, subsequent market reactions revealed deeper demand divergences—the 15% overallotment option (corresponding to approximately 15.03 million shares) set for this issuance was only exercised at 56%, with an additional offering of less than 8.42 million shares. Even though the announcement disclosed an institutional subscription multiple of 8.6 times, the unused overallotment option still suggested that institutional recognition of the pricing fell short of expectations.

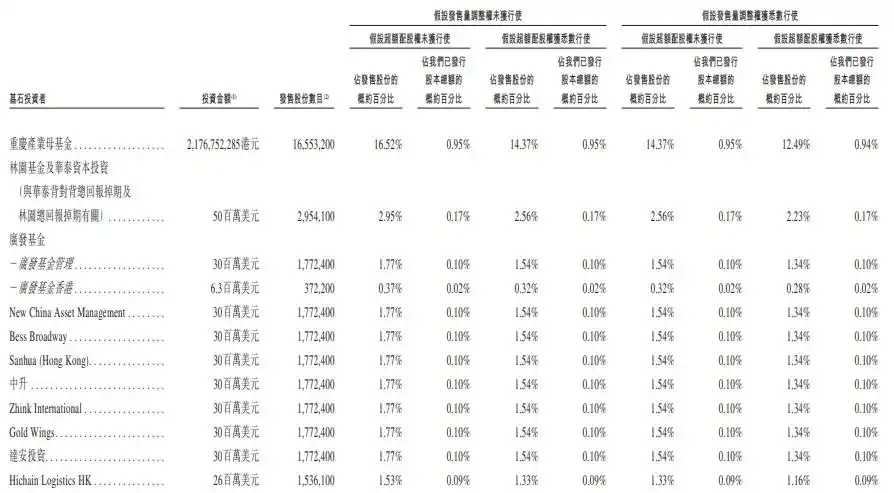

Nevertheless, this weak demand did not tell the whole story. During the subscription phase, the public offering was oversubscribed by 133 times, with financing subscriptions exceeding HK$170 billion. Additionally, 22 cornerstone investors, including Chongqing Industrial Mother Fund, Schroders, and GF Fund Management, participated, indicating positive expectations for the company's long-term value. This contradiction became a microcosm of Seres' valuation controversies.

The intraday stock price fluctuations also amplified divisions among institutional investors. According to data disclosed by the Huashengtong APP, CICC emerged as the sole 'major market stabilizer' on that day, with net purchases reaching 2.2369 million shares, nearly equivalent to the total net sales by the top seven brokers. In contrast, foreign investment banks such as Morgan Stanley, UBS, and Goldman Sachs collectively appeared on the net sales list.

Behind this divergence lay differing judgments on 'valuation-performance alignment' by the two types of investors: Foreign institutions placed greater emphasis on the long-term profitability and independence of the target. Seres' projected price-to-earnings ratio of 26.5 times for 2025 far exceeded the average level of traditional Hong Kong-listed vehicle manufacturers (13.6 times) and was even higher than industry leaders like BYD (21.1 times) and Chery Automobile (10.4 times), which also cooperates with Huawei.

Meanwhile, the 1.7% year-on-year decline in net profit attributable to the parent company for Q3 in the 2025 third-quarter report raised doubts among some foreign investors about the company's ability to deliver results. In contrast, cornerstone investors and market stabilizers placed greater weight on Seres' layout in the new energy sector—the scale of RMB 110.5 billion in revenue and RMB 5.3 billion in net profit attributable to the parent company for the first three quarters, coupled with a 56.8% quarter-on-quarter increase in sales of the high-margin M8 model, which drove the gross profit margin up to 29.9%, led them to believe that short-term valuation controversies could not obscure long-term growth potential.

In fact, the valuation controversy surrounding Seres essentially reflects the clash between the 'dividends of new energy transformation' and the 'inertia of traditional automakers.' As a company transitioning from a traditional vehicle manufacturer to the new energy sector, Seres achieved a leap in market value from the billion-yuan level to the 250-billion-yuan level through its cooperation with Huawei. The AITO series has delivered over 800,000 units cumulatively, with the M9 maintaining its position as the sales champion in the RMB 500,000 price segment for an extended period—a transformation speed rarely seen in the industry.

However, the Hong Kong stock market tends to be more cautious in valuing 'transforming enterprises,' considering both their delivered results and sustained growth momentum. The 2025 annual targets of RMB 178.2 billion in revenue and RMB 10 billion in net profit have only been 60% and 53% achieved, respectively, while cumulative vehicle sales for the first ten months declined by 4.3% year-on-year. These short-term pressures make it difficult for the valuation to fully align with that of pure new energy vehicle companies. This 'unfinished transformation' status lies at the core of the first-day market game.

▍Dual Breakthroughs: Huawei Cooperation and Independent Capabilities

The long-term value of Seres after its HKEX listing remains inextricably linked to the keyword 'Huawei cooperation.' From a historical perspective, deep integration with Huawei has been the core driver of Seres' leapfrog development: Before the cooperation, its main business focused on traditional commercial vehicles, with limited market attention. After the cooperation, relying on Huawei's technical support in intelligent cockpits and autonomous driving, the AITO series quickly became a popular model in the high-end new energy market, significantly boosting brand premium.

This 'Huawei halo' brought Seres significant differentiated valuation in the A-share market but requires rebuilding confidence in the Hong Kong stock market: On the one hand, Huawei's automotive cooperation landscape continues to expand, with original equipment manufacturers like Chery, BAIC Group, and JAC Motors successively joining, diluting Seres' 'exclusivity' within the Huawei ecosystem. On the other hand, the Hong Kong stock market boasts new energy targets like Li Auto and XPeng Motors, which possess independent core technologies. Li Auto achieved full-year profitability as early as 2023, demonstrating greater profit stability than Seres, which only turned profitable in 2024. This has gradually transformed 'Huawei dependence' from an advantage into a risk point for investors.

Faced with these cognitive differences, Seres is building new competitiveness through 'strengthening independent capabilities' and 'business diversification.' On the research and development front, approximately 70% of the net proceeds of HK$14.016 billion from this HKEX IPO will be invested in R&D, focusing on core areas such as intelligent electric technology, battery safety, and autonomous driving algorithms, aiming to reduce single reliance on Huawei's technology. Meanwhile, Seres' subsidiary, Chongqing Fenghuang Technology, signed the 'Embodied Intelligence Business Cooperation Framework Agreement' with ByteDance's Volcano Engine, exploring the integration of intelligent technology and automotive scenarios to open up new growth tracks for the business.

On the product front, despite a quarter-on-quarter decline in M9 sales in Q3, M8 model sales increased by 56.8% quarter-on-quarter. The facelifted M7, which began deliveries on September 26th, surpassed 20,000 units delivered within 36 days, demonstrating the resilience of the product matrix. In the future, with the continuous launch of new models and the iterative optimization of existing models, the product structure is expected to further tilt toward high-margin segments, providing support for profit growth. In terms of internationalization, Seres' market already covers multiple countries and regions in Europe, the Middle East, Americas, and Africa. This HKEX listing will accelerate its global layout, especially investments in overseas charging network construction and localized marketing channel expansion (approximately 20% of the proceeds will be used for this purpose), which is expected to unlock long-term growth potential.

The 'nail-biting market stabilization' on the first day of Seres' HKEX listing does not mark the end of its value but rather an important calibration by the capital market of the valuation logic for 'transforming enterprises' among Chinese new energy vehicle companies. In the short term, the company faces performance sprint pressures (needing to achieve 40% of its annual revenue target in the fourth quarter), valuation gaps with peers, and challenges from the dilution of Huawei's cooperation halo, with potential stock price volatility remaining. However, in the long run, its actions in product matrix, R&D investment, and international layout have demonstrated efforts to break free from 'single cooperation dependence' and build independent competitiveness.

For Seres, the more mature investor structure and fundamental-focused valuation logic in the Hong Kong stock market will compel the company to continuously improve in performance delivery, technological independence, and risk control. Meanwhile, the international platform of the Hong Kong stock market provides convenience for introducing global capital and expanding overseas markets. From an industry perspective, Seres' HKEX listing also reflects the valuation differentiation within China's new energy vehicle industry—as the market transitions from 'wild growth' to 'meticulous cultivation,' valuation logic based solely on concepts or single cooperation is losing effectiveness. Companies with core technologies, stable profitability, and sustainable development capabilities will receive more capital favor.

Layout 丨 Yang Shuo

Image source: Seres Group