Unicorns in the 10-Billion-Yuan Large Model Industry: Navigating Breakthroughs Amidst Controversy

![]() 01/14 2025

01/14 2025

![]() 604

604

Amidst giants dominating the large model industry, where do 10-billion-yuan unicorns find their path?

In 2025, the large model industry embarked on a new year filled with controversy.

On one hand, over the past year, large models have deeply integrated into people's lives and work, leaving everyone in awe of their power. OpenAI's monthly active users have soared to 500-600 million, surpassing TikTok and becoming the fastest-growing product in the history of global technology.

On the other hand, despite acclaim, large models have struggled to gain widespread popularity, with their implementation lagging behind industry expectations. The large model enterprises are rapidly converging, with companies like the "Six Tigers" abandoning pre-training and rumors of layoffs emerging. Early in 2025, ZeroOne once again found itself amidst turmoil and controversy.

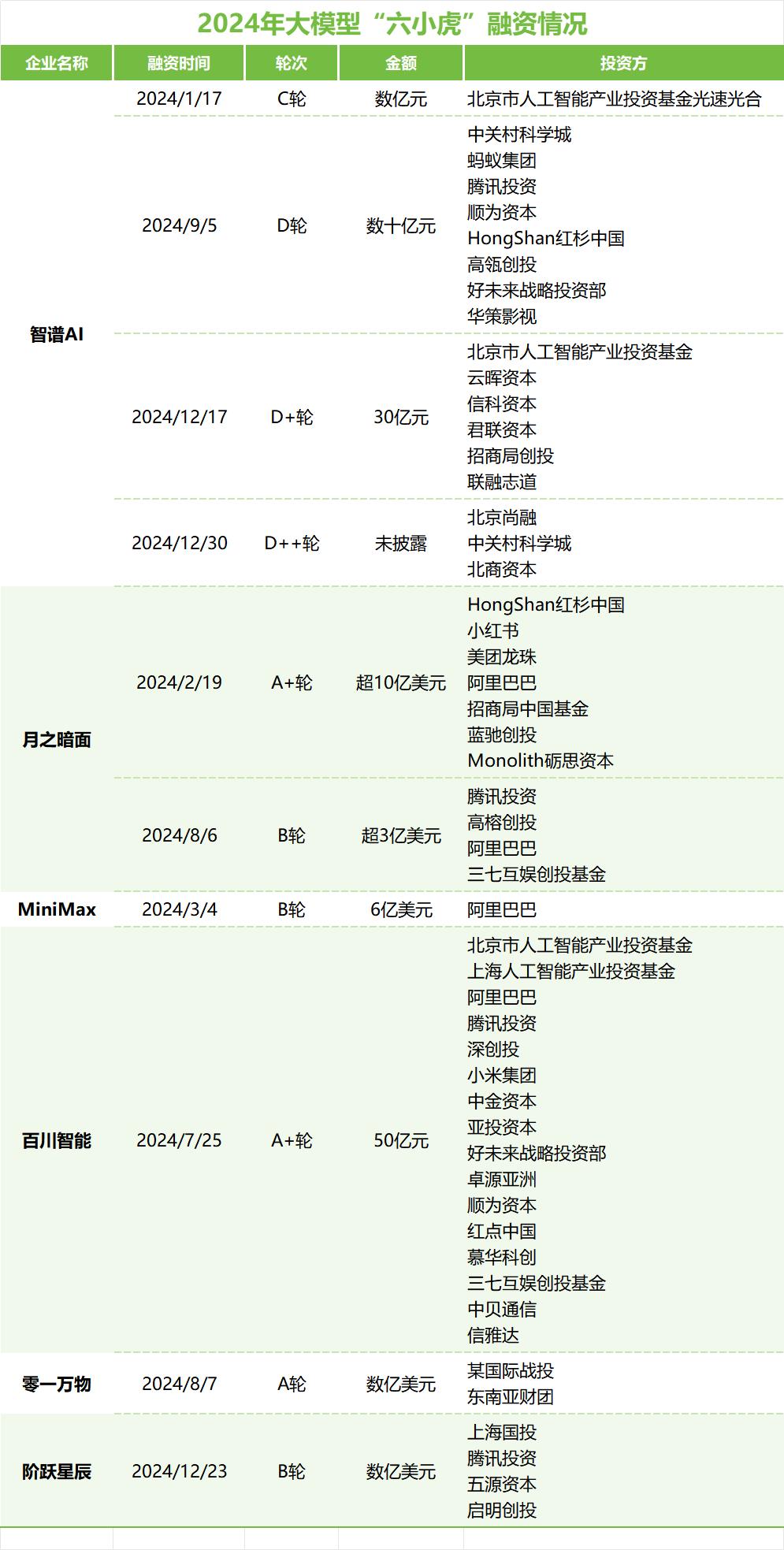

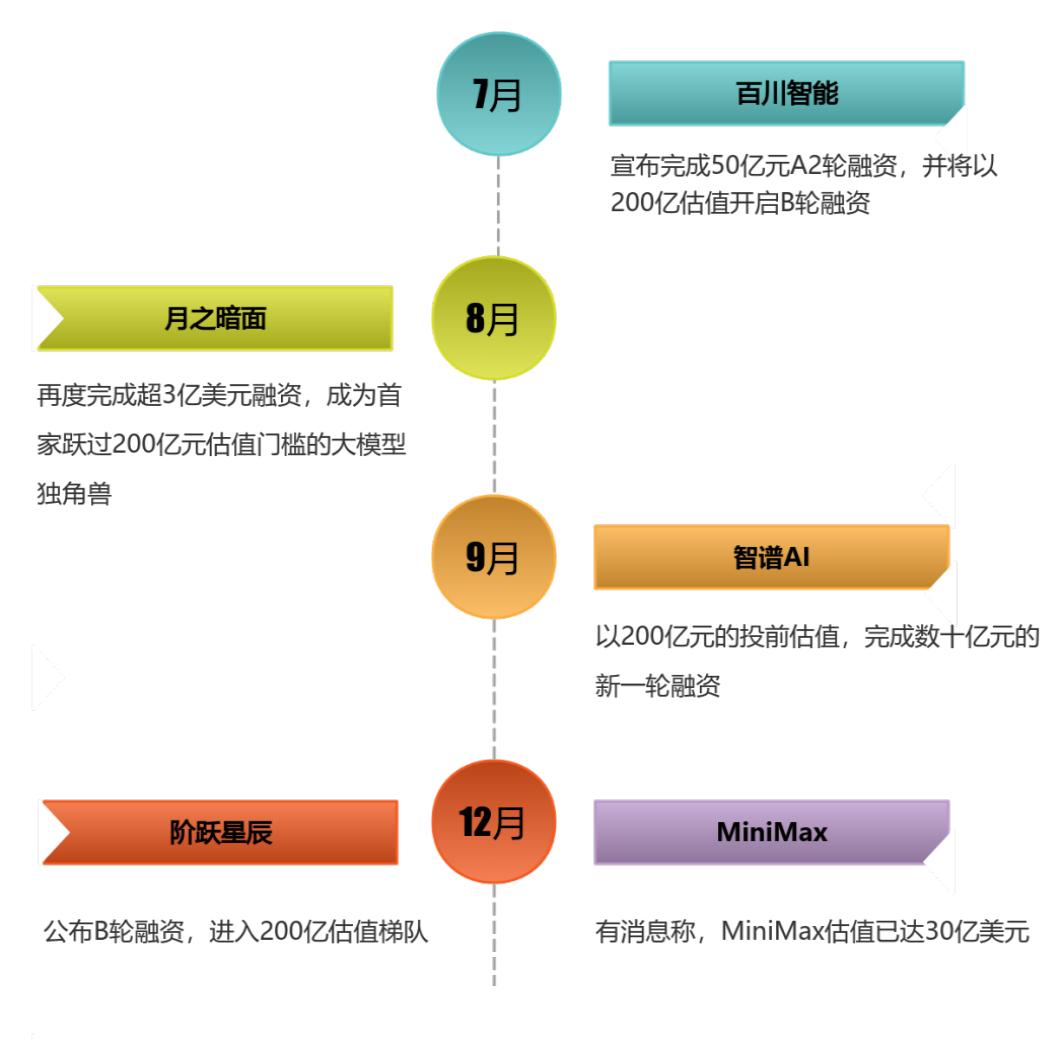

The financing market for large models has also fluctuated significantly. In mid-2024, the "Six Tigers" of large models reached a valuation threshold of 20 billion yuan, but the market fell silent until late 2024, when, after a round of reshuffling, it warmed up again. The financing dynamics were robust in both domestic and international markets: xAI secured $6 billion in financing, Perplexity AI completed $500 million, Wisdom AI obtained a new round of 3 billion yuan, and Step Star also secured hundreds of millions of dollars...

Amidst the constant interplay of passion and reality, some large model startups have carved out clear paths through exploration over the past year. In the new year, will large models prove to be a viable business? Do enterprises, especially startups, still have room for development?

01

Amidst the financing boom, at least 10 unicorn large model enterprises with a valuation of 10 billion yuan emerged in 2024.

In 2024, although the financing market presented a mixed picture, the global AI and large model markets consistently maintained strong money-attracting capabilities, with frequent financing activities across various links in the industrial chain.

Statistics from AITO show that over the past year, there were over 168 financing events exceeding 100 million yuan globally around the large model industrial chain, with a total financing amount exceeding 400 billion yuan. As Qingke Group founder Ni Zhengdong said at the China Venture Capital Annual Conference, "The hottest track in the venture capital circle in 2024 is undoubtedly AI."

In the global arena, xAI, OpenAI, and Anthropic led the pack, securing at least $12 billion, $10.6 billion (including a $4 billion bank loan line), and $6.75 billion in financing, respectively. OpenAI's valuation even surpassed $100 billion. Early in 2025, reports emerged that Anthropic was in the midst of $2 billion financing negotiations. Once completed, its valuation was expected to reach $60 billion, more than tripling its valuation of $18 billion a year ago.

In the domestic market, "In the first quarter of 2024, DarkSide of the Moon and MiniMax secured over $1 billion in A+ round financing and $600 million in B round financing, respectively, becoming two landmark events after the new year," said Chen Yu, partner at Qiming Venture Partners. This directly increased the financing amount, which previously generally stayed at the level of 100-200 million dollars, by three to four times, reaching a new level. At the same time, it also put pressure on other enterprises.

At that time, the "Six Tigers," who were still fully pursuing AGI, all achieved the "high touch" of the 20 billion yuan valuation threshold to avoid falling behind in the pre-training track.

Among these enterprises, except for Wisdom AI, which was founded in June 2019, the rest were all founded between March and May 2023. This means they reached the threshold of 20 billion yuan valuation unicorn enterprises in just one year, far faster than previous generation enterprises like SenseTime and Megvii.

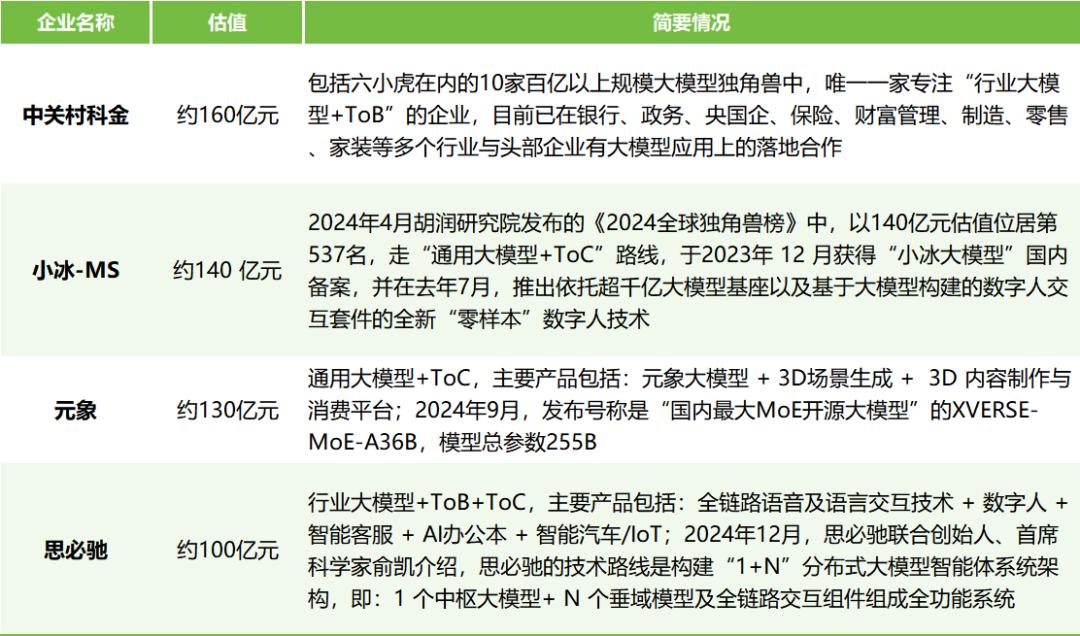

Besides the "Six Tigers," in 2024, at least four other unicorn large model enterprises with a valuation of over 10 billion yuan emerged in the market—Zhongguancun Kejin, Xiaoice-MS, Metaverse Vision, and AISpeech.

In the latest "2024 Hurun China AI Enterprise Top 50," Zhongguancun Kejin and Metaverse Vision were prominently listed. Metaverse Vision, which focuses on 3D and AI, together with DarkSide of the Moon, Baichuan Intelligence, ZeroOne, and Xiyu Extreme Intelligence (MiniMax), became the "youngest listed companies." Zhongguancun Kejin focuses on the application and implementation of large models in the enterprise-level market, centering on scenarios connecting enterprises and customers. It is the only company to be listed based on the advantages of domain-specific large models. To track the implementation trend of large models in the enterprise-level market, this company serves as a weather vane.

It is worth mentioning that, apart from these 10-billion-yuan unicorns, at the end of 2024, another company—DeepSeek—became the focus of industry attention. Although it did not disclose its valuation, it is backed by the private equity giant QuantOpt. "It has no shortage of money and can afford it without financing. Its algorithm is good, and it has unique advantages in Infra, often producing some amazing things," said industry insiders.

02

With the market rapidly converging, is there still space for unicorns?

In 2024, the other side of the coin was that the "Six Tigers" of large models faced continuous controversy.

As early as last October, there were reports that at least two of the "Six Tigers" had gradually abandoned large model pre-training. Soon after, DarkSide of the Moon was mired in a dispute over equity and personnel arbitration. Such setbacks continued into 2025. At the beginning of January, ZeroOne revealed that it would focus on applications and place members of its pre-training and Infra teams. They could join the "Industry Large Model Joint Laboratory" established by ZeroOne and Alibaba Cloud, while considering spinning off AI businesses in gaming, finance, etc., for independent operation and financing.

In fact, with the current level of open-source models leading the way, the vast majority of enterprises no longer need to burn money on pre-training for general large models. In 2024, after sufficient competition in the US market, large models rapidly converged to five players: OpenAI, Anthropic, Google, Meta, and xAI. In China, the battle of hundreds of models ended, and large model enterprises also rapidly converged to a few players.

At the same time, a practical issue that large model players had to face was that the business model for large models had not yet been established. On the C-end, no killer applications had yet emerged. On the B-end, the number of large model projects was rapidly increasing, but there have always been voices questioning whether "the more bids won, the faster the blood loss" and whether "large models are a good business."

Large model startups also faced an additional challenge—space compression from large enterprises. The domestic large model unicorns faced a more competitive market and greater pressure. In the second half of 2024, Doubao's rapid overtaking of Kimi already proved the ability of large enterprises to compete for market share. The large model programming market was also extremely competitive, with everyone desperately offering free services.

The difficulties and controversies encountered by the "Six Tigers" of large models and startups also caused concern among many industry insiders: Do unicorn large models have market space?

"There is definitely space," believes Chen Yu, partner at Qiming Venture Partners. However, at the same time, competition will also be fierce. "In the end, I think there may be only about two startups left, and the rest will have a particularly difficult time surviving," he said.

Li Guangmi, CEO of Shixiang Technology, believes that "startups must pay attention to niche markets, as great companies often start from niche markets." Large enterprises are not omnipotent and have their own weaknesses. For example, Google is unlikely to directly turn the gun of AI search on itself; although Microsoft was the first to launch Copilot in its products, facts have proven that Copilot was not very successful; OpenAI's energy is dispersed, exploring various fields, and it has not even done a good job in large model programming, giving other startups a chance to catch their breath and rise.

In the enterprise-level market, the situation is more complex, and there is considerable space. Yu Youping, president of Zhongguancun Kejin, once made an analogy that enterprise intelligence first requires a large model mid-platform, equivalent to a power station that generates electricity; then it also needs appliances like refrigerators and washing machines, because a large model is just a capability, equivalent to "electricity," not an implemented electrical product; with appliances, electricity also needs to be connected. The intelligent implementation process of these medium and large enterprises has created considerable development space for startups. After all, large enterprises have high personnel costs and are unlikely to cast a wide net on the "prairie" of the enterprise-level market.

Furthermore, the enterprise-level market is quite "segmented," and it is impossible to meet customer needs with a general product. Taking intelligent customer service, one of the largest categories currently implemented in the large model market, as an example, over the past decade, it has been an extremely fragmented market with no standards to speak of. Each industry has different requirements for it, and the complexity exceeds imagination. The cost of industry adaptation is very high.

In these scenarios, there may not be large orders of hundreds of millions of dollars, but once the value for customers is solidly created and benchmarks are established, they can be replicated within the industry, enabling sustainable long-term cooperation and survival space.

"I think, whether it's the Six Tigers or the previous Four Dragons, the ultimate soul-searching question is whether they can start with a large model and create a sustainable business model, proving themselves in the commercial arena that they can withstand the tests of investment banks and the secondary market—having revenue, growing, and being profitable," said Kai-Fu Lee.

So how can one traverse the path of revenue scale growth, narrowing losses, and achieving profitability as quickly as possible, without falling behind or being eliminated in the decisive year of commercialization, 2025?

03

Unicorn large models worth 10 billion yuan are seeking breakthroughs everywhere.

Despite increasingly fierce competition and challenges, the large model market still harbors a lot of value and monetization space.

Recently, a Sullivan report showed that the size of China's AI large model market has grown from 10.5 billion yuan in 2023 to 16.5 billion yuan in 2024, a year-on-year increase of 57%. It is expected to reach 62.4 billion yuan by 2028, with a compound annual growth rate of 40%.

To find the "value breakthrough," both domestic and foreign enterprises are actively trying.

Overseas, Anthropic has dominated the coding field. In June 2024, Anthropic released the Claude-3.5-Sonnet model, bringing significant improvements in coding abilities and attracting the use of a large number of relatively professional and segmented groups like programmers. Some believe that its capabilities and reputation have surpassed GPT-4.

Coincidentally, emerging from the AI coding track are also AI code tool companies like Cursor, which achieved $4 million in ARR within 4 weeks, and Bolt.new, which surpassed $20 million in ARR within 2 months.

Perplexity won the hearts of users by redefining the interactive form of AI search and secured $500 million in new financing in December 2024. Devin quickly gained popularity at the end of 2024 due to breakthroughs in agent technology...

As Yuan Jinhui, CEO of Silicon-based Flow, said in a podcast, for startups to break through and develop, they need to focus, find their unique applications and scenarios with competitive advantages, and concentrate their efforts to penetrate and deepen them.

For example, Anthropic is relatively focused compared to OpenAI, with its core scenarios placed in writing and programming. "But domestic large model companies need to be even more focused than Anthropic," said Wang Hua, managing partner at Sinovation Ventures.

In China, "By the second half of 2024, it was already very clear what each company was good at, what they could do, and what they couldn't do," said Chen Yu, partner at Qiming Venture Partners.

MiniMax has been aggressively attacking the overseas ToC market but has not completely abandoned the domestic ToB market. In December 2024, Yan Junjie, founder of MiniMax, revealed that MiniMax's three products, Talkie, Hailuo AI, and Xingye AI, had an annualized revenue of $70 million. The main business model was advertising and user subscriptions. Among them, Hailuo AI, a productivity tool, had been online for 8 months and had a global average monthly active user base (MoU) of nearly 10 million.

Baichuan Intelligence placed many resources on medical models and products. Although ZeroOne initially chose to focus on ToC, it adjusted its strategy in the second half of 2024 and began to focus on ToB.

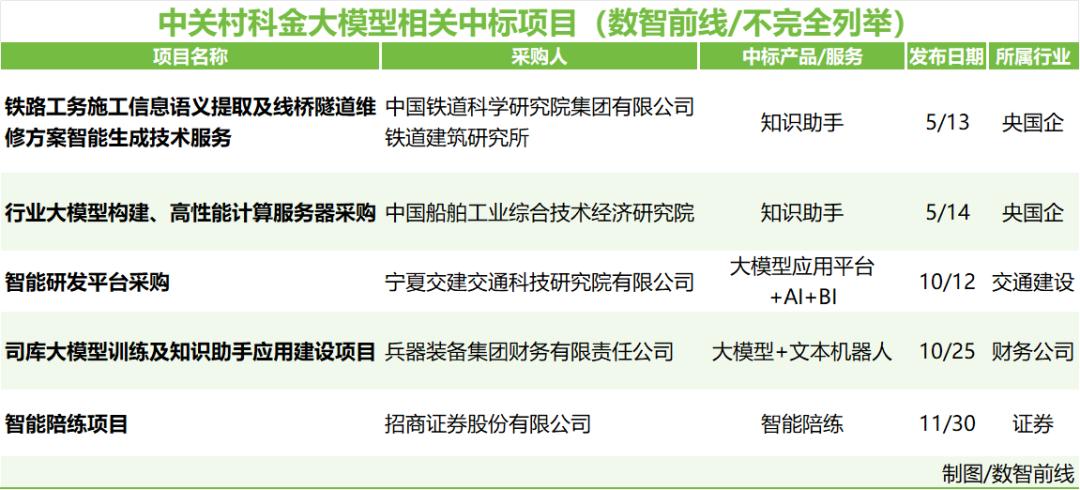

Wisdom AI and Zhongguancun Kejin, focusing on the B-end market, became the two companies with the most projects among the top ten unicorn large model enterprises with a valuation of over 10 billion yuan in 2024.

According to incomplete statistics from Datawise, in 2024, Wisdom AI won at least 28 large model-related projects, involving multiple fields such as energy, finance, education, automobiles, government affairs, operators, scientific research, and transportation and logistics. These included not only the procurement of basic large models and application projects but also talent training projects.

Wisdom AI has not abandoned the C-end market, but internally, it was assessed that the C-end had not yet hit its critical mass, prompting the adoption of a follow-up strategy, akin to a "marathon." Nonetheless, an insider from Wisdom AI admitted to Datawise that the C-end serves as a vital showcase for technical prowess to B-end users, necessitating the initial rollout of many new features from the Wisdom AI lab to the consumer segment.

As a leading large model technology and application company specializing in industry-specific large models and the ToB market, Zhongguancun Kejin focuses on scenarios bridging enterprises and customers. It has secured over 10 large model projects, spanning securities, central and state-owned enterprises, transportation and construction, banking, government affairs, logistics, and other industries.

04

While the direction of the B-end market is becoming increasingly clear, the trajectory of the C-end remains uncertain.

After a year of continuous exploration and trial-and-error, some unicorn large model enterprises are accelerating their methodology consolidation.

For instance, in the B-end market, Wisdom AI's success in winning numerous projects is partly attributed to its high-caliber model. An individual who once participated in a bidding process with Wisdom AI stated that the company "emphasizes technology" and boasts a relatively comprehensive model product lineup. Wisdom AI was also among the earliest teams to open-source large models, with global downloads of its open-source model series surpassing 30 million, significantly boosting its commercialization efforts.

Industry observers have noted that Wisdom AI "made an early decision on the B-end and assembled a robust commercialization team." Currently, its B-end commercialization team is focused on covering four key sectors: technology and the Internet, top vertical industries, large state-owned and central enterprises, as well as the automotive and mobile phone industries. In 2024, Wisdom AI also increased its investment in MaaS, which, unlike the cloud giants' software-oriented definition, encompasses IaaS and PaaS and can be simply regarded as intelligent cloud. Media reports indicated that "Wisdom AI's MaaS platform witnessed a commercialization revenue surge of over 100% in the first 11 months of 2024, with API annual revenue increasing by over 30 times."

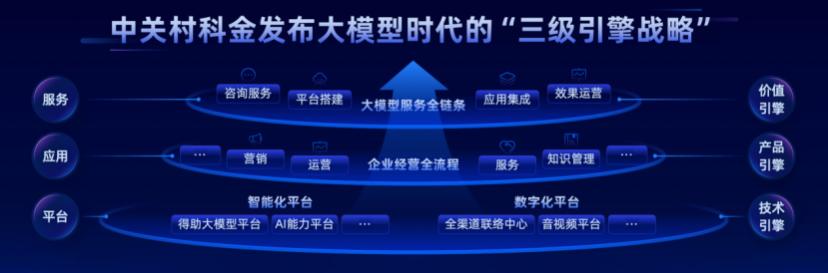

Meanwhile, Z-Park Tech Finance, which also secured numerous projects last year, took a different approach. Instead of pursuing scale or investing in foundational large models, it established partnerships with all large model enterprises to address the diverse needs of different industries and scenarios for models with specific characteristics. It focused on building an enterprise-level large model mid-platform and launched the Deshu Large Model Platform, which already boasts over 200 intelligent components of various types to cater to enterprises' personalized needs.

This approach is increasingly becoming the choice of more large model startups. Recently, when discussing ZeroOne's latest strategic transformation, Kai-Fu Lee emphasized that ZeroOne would accelerate the sharing and joint construction of technology, platforms, and applications, ushering in a new era of cooperation between "big factories and small tigers" in China. The "Joint Lab for Industrial Large Models" established with Alibaba Cloud serves as a prime example.

Faced with the paramount challenge in ToB implementation – customization leading to a scenario where "the more bids won, the greater the losses" – industry observers point out that Z-Park Tech Finance is meticulous in selecting industries and clients, preferring high-knowledge-density industries and profitable enterprises, and concentrating on developing scenario applications within the industry.

It prioritizes scenarios where enterprises engage with customers, such as intelligent customer service and intelligent marketing in finance, manufacturing, retail, logistics, and other fields, where the value of large model implementation is more readily measurable and demonstrable. It has gradually refined general products for intelligent marketing, intelligent customer service, intelligent operations, and knowledge management within these scenarios.

Apart from customer and market selection, a more professional commercialization team, along with end-to-end solutions and full-chain services, are also common strategies adopted by many large model service providers.

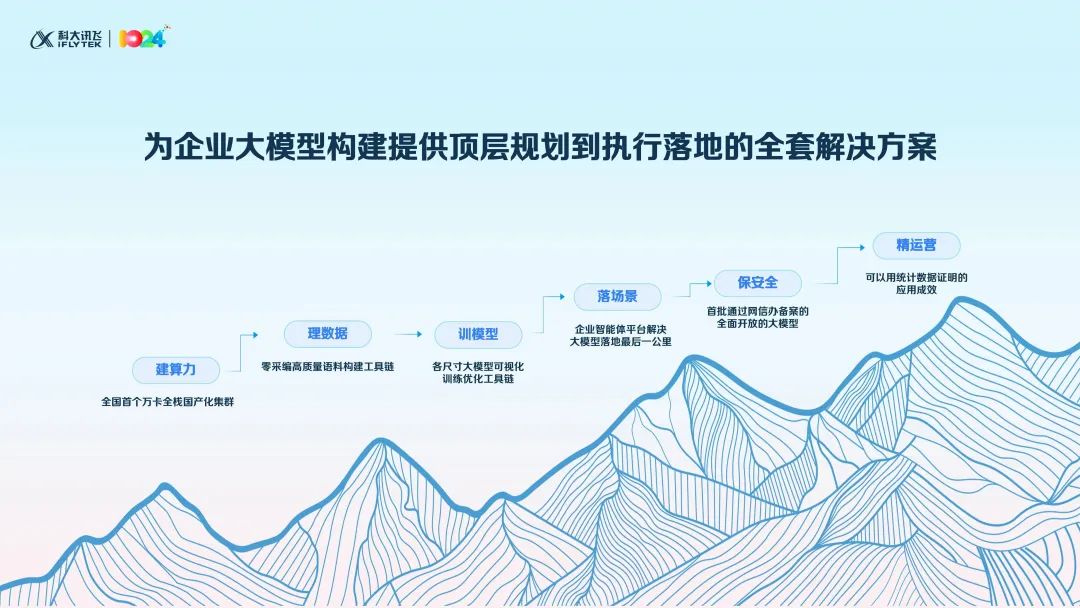

As another large model enterprise that secured a plethora of projects in 2024, iFLYTEK Chairman Liu Qingfeng emphasized at a pivotal conference in 2024 that full-chain investment was the cornerstone of iFLYTEK's success in securing numerous projects.

Similarly, at a conference in December 2024, Z-Park Tech Finance officially unveiled its "Three-Level Engine Strategy" for the large model era, believing that "platform + application + service" constitutes the optimal path for enterprise large model implementation. This entails providing end-to-end solutions to realize customer value while simultaneously offering full-chain services.

While certain directions and methodologies have emerged for the B-end market, industry insiders observe that the path to C-end commercialization remains hazy, and its ultimate destination remains to be seen.

As 2024 draws to a close and 2025 begins, large models continue to evolve rapidly, with several new trends already surfacing.

Following the full-scale launch and commercialization of Devin, the world's first AI Agent programmer, on December 11, 2024, early in 2025, tech company Artisan erected a billboard in San Francisco, USA, advocating to "stop hiring humans" and promoting its AI sales agents. Agents have emerged as a key direction recognized by many in the industry for 2025.

Concurrently, the implementation of large models is continuously expanding. According to IDC research, 42% of Chinese enterprises have commenced preliminary testing and key concept validation of large models, while 17% have introduced the technology into the production stage and applied it to actual business operations. As more enterprises advance in intelligence, their investments in large models are on the rise.

Industry predictions suggest that in the consumer market, as individuals adopt more large model applications, products with greater subscription rates and user stickiness will emerge. In the enterprise market, the ecosystem established by startups and large factories is accelerating its maturity, and all stakeholders will collectively welcome the inflection point in the implementation of industry large models. In this process, the competition for large model implementation will intensify, and companies that have already clarified their methodologies and directions may find it easier to breakthrough.