Meitu Sheds Its 'Retro Coat' and Transforms Amidst the AI Wave

![]() 01/17 2025

01/17 2025

![]() 596

596

Andrew Ng, a professor at Stanford University and former chief scientist at Google, once said, "AI is akin to electricity. If your competitors are leveraging it, you must do so too, or risk losing your competitive edge."

Recently, the Consumer Electronics Show (CES) 2025, a bellwether for consumer electronics, echoed this sentiment. Smartphones, laptops, TVs, and smart glasses are actively integrating artificial intelligence (AI) technology.

With AI's support, numerous industries are embarking on a new upgrade cycle. Among them, Meitu, a well-established internet giant, has been keeping pace, stepping out of the cryptocurrency realm, and striving to fully embrace AI to revitalize its core business. In this burgeoning wave of AI, Meitu's strategy is becoming increasingly clear.

"Meitu, with its 'leapfrog thinking,' is finally serious about its transformation."

Looking back, in 2021, Meitu purchased Ethereum and Bitcoin three times, amassing approximately 31,000 Ethereum and 940.89 Bitcoin, at a total cost of $100 million. By December 2024, Bitcoin had reached new all-time highs, trading at $93,574.2. On December 5, when Bitcoin surpassed the $100,000 mark, Meitu chose to sell all its cryptocurrencies, realizing a profit of approximately $79.63 million (about RMB 571 million).

Image source: pixabay

Regarding Meitu's cryptocurrency investments, Cai Wensheng, then chairman of Meitu, believed that someone had to be the pioneer. This was the first step in Meitu's blockchain strategy, with the purchase of ETH and BTC seen as a value reserve for long-term blockchain development. Simultaneously, Meitu hoped to bolster its financial performance with the rising cryptocurrency prices.

Now, with its 'cryptocurrency journey' concluded, Meitu's transformation seems to have reached a turning point.

It's noteworthy that Meitu's decision to 'cut ties' at this juncture is partly due to the explosive growth of cryptocurrencies but primarily driven by the robust momentum of its image and design products.

Financial reports indicate that in the first half of 2024, Meitu achieved total revenue of RMB 1.62 billion, a 28.6% year-on-year increase. The adjusted net profit attributable to equity holders of the parent company was RMB 270 million, an 80.3% year-on-year rise.

Among these, revenue from image and design products, mainly from paid subscriptions, amounted to RMB 930 million, accounting for 57.4% of total revenue. In the first half of the year, Meitu's paid subscription user base surpassed 10.81 million, setting a new record with a paid penetration rate of approximately 4.2%. Meitu's image and design product business is thriving.

The robust growth of its core business has charted a clear path forward, and Meitu has emerged from its transitional confusion. Amidst the general trend, Meitu no longer needs to rely on 'external factors' to drive performance growth.

Behind this success lies the support of generative AI technology, which enables Meitu to provide users with enhanced image and video processing, as well as visual design creation functions, further increasing the appeal of its products. This has led to a rapid increase in the penetration rate of paid subscription users and a concurrent growth in paid subscription revenue.

Furthermore, in October 2024, Morgan Stanley, a renowned international investment institution, gave Meitu an 'overweight' rating for the first time, focusing on the key indicator of paid penetration rate and the potential of Meitu's paid subscription business model.

In 2025, as AI accelerates its penetration, Meitu has decisively abandoned transitional businesses to refocus on its core offerings. While capitalizing on the vitality brought by 'AI+', it must remain vigilant against the sudden rise of similar competitors.

Competitors are emerging, and giants are forming alliances. Where will Meitu go from here?

With the rapid development of generative AI technology, the visual content industry is undergoing an unprecedented transformation. The ability to generate images and videos from text, fueled by large model technology, has become a crucial tool for content creation and continues to reshape the visual content industry.

Recently, global visual content platforms Getty Images and Shutterstock announced a merger agreement, aiming to create a leading global visual content company. Post-merger, they will expand their presence in areas such as innovative content creation, search technology, 3D imaging, and generative AI technology.

This powerful alliance is seen as one of the strategies for the visual content industry to navigate market changes and challenges in the era of generative AI.

In this surging wave of AI, some are seeking warmth through collaboration, while others are charting their own course.

Xingtu APP, which 'debuted' in 2020, soared to the 7th position on the App Store's photography and video list within a year of its launch, ranking second in downloads among similar photo editing software, trailing only Meitu Xiuxiu. In contrast, Meitu Xiuxiu, launched in 2008, took over a decade to achieve what Xingtu accomplished in just one year.

Behind Xingtu's rapid rise, both domestically and internationally, the 'AI' label has played a pivotal role. For instance, when Xingtu's overseas version, Hypic, was first launched in 2023, its AI image function was prominently featured on the promotional banner. After generating AI images, users could share them directly to TikTok, further fueling viral growth.

Digital art painting 'The Space Opera House'

Meanwhile, Midjourney, which won the championship in the digital art category with 'The Space Opera House,' gained overnight fame. Public data shows that Midjourney swiftly achieved profitability within less than half a year after launching its beta version in March 2022. In comparison, Meitu, with over 240 million monthly active users during the same period, was less efficient in generating revenue.

Driven by generative AI, new concepts, functions, and products are emerging continuously. This was a particularly pressuring time for Meitu, as its lack of AI capabilities initially left it behind. Just like the line from the movie 'Coco,' 'Death is not the end; it's being forgotten that truly matters.'

Previously, the keywords frequently mentioned by Meitu in its financial reports were subscription fees, SaaS service fees, and AIGC. To break it down, VIP subscription fees are the lifeblood of Meitu, SaaS is the long-term goal, and AIGC is the primary driver for the continuous growth and rebound of monthly active users.

Thus, there is only one path for Meitu: to 'evolve' at a rapid pace, with a weekly or even daily focus, and the top priority now is to diligently work on AI technology.

By fully embracing AI, Meitu has seized the 'moment of transformation.'

After learning from past mistakes, Meitu Xiuxiu, which added generative AI capabilities in 2023, topped the app store charts in many countries worldwide, with a significant increase in paid overseas users. By the end of 2023, Meitu's overseas monthly active user base had rebounded to 77.68 million. In early 2024, Meitu ranked third on the list of China's non-game vendors' overseas revenue.

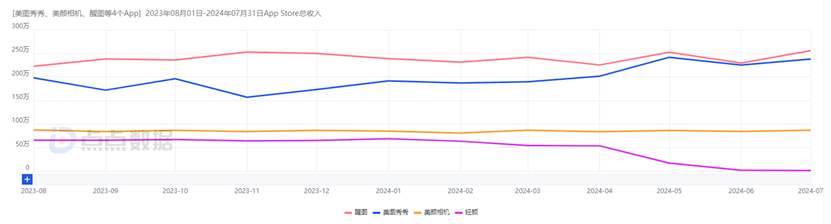

Revenue of Meitu Xiuxiu, Meiyan Camera, Qingyan Camera, and Xingtu on the iOS platform in the domestic market; Image source: Diandian Data

Moreover, after integrating AI technology, domestic market data from Diandian shows that Meitu Xiuxiu's revenue is on an upward trend, gradually narrowing the gap with Xingtu.

As Meitu's AI focus intensifies, we find that the proportion of users utilizing AI functions across its entire product line has reached 82.8%. According to statistics, in 2023 alone, Meitu's AI functions generated over 3 billion images and videos. Evidently, Meitu has forged a strong connection with its users.

This time, AIGC has truly become a pivotal factor in Meitu's turnaround.

In 2024, Meitu delved deeper into AI, updating and iterating the Meitu MiracleVision large model, embedding AI functions into existing product groups, and focusing on AI productivity tools.

Particularly in AI productivity tools, taking the AI model function launched by Meitu Design Studio as an example, e-commerce professionals have exclaimed, 'Finally, we've made it!' It supports the generation of models in both real-person and mannequin modes, with effects so realistic they are indistinguishable from the real thing. Moreover, the built-in model library is rich in content, and models can be finely adjusted according to needs, solving scenarios for cross-border e-commerce as well.

Another illustration is the AI product image function of Meitu Design Studio, which can not only generate product images in batches but also support the simultaneous generation of product images for multiple subjects, with details like lighting and shadows handled meticulously, significantly enhancing production efficiency. It's no longer a dream for one person to handle the workload of an entire team.

Meitu, with its unique insights into 'making products,' has worked tirelessly to uncover user needs. While adhering to the principle of 'simplicity and ease of use,' it has continuously streamlined interactions, significantly boosting image and video editing capabilities. In 2024, by prioritizing productization, Meitu has gained more core competitiveness.

From its former flagship products Meitu Xiuxiu and Meiyan Camera to the 'new darlings' such as the AI video editing tool Wink, AI voiceover creation tool Kaipai, AI design tool Meitu Design Studio, and AI creation tool WHEE for e-commerce scenarios, Meitu is evolving at an increasingly rapid pace.

Today, the topic of 'turnaround' is a thing of the past. In choosing between To B and To C, Meitu has successfully balanced user needs and technological evolution while focusing on vertical application scenarios.

After a tumultuous journey, Meitu has found its own path.

Source: Hong Kong Stock Research Society