Cambrian Achieves Profitability in a Single Quarter: Large Models Propel Turnaround

![]() 01/17 2025

01/17 2025

![]() 625

625

By Yang Jianyong

Cambrian, a sought-after AI chip stock, has soared in the capital market, achieving a market value that once surpassed RMB 310 billion. This meteoric rise reflects investors' optimism about the commercial potential of AI amidst the generative AI wave. Cambrian has delivered remarkable performance, not only with substantial revenue growth but also profitability in a single quarter, as it turned a net profit in Q4 2024.

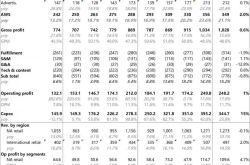

According to the disclosed performance forecast, Cambrian expects revenue for 2024 to range from RMB 1.07 billion to RMB 1.2 billion, marking an increase of 50.83% to 69.16% compared to the same period last year. The projected loss is estimated at RMB 396 million to RMB 484 million, indicating a narrowing of the loss by 42.95% to 53.33% year-on-year.

Notably, Cambrian's loss for the first three quarters of 2024 totaled RMB 724 million, suggesting that the net profit for the fourth quarter is anticipated to be between RMB 240 million and RMB 328 million. This will mark Cambrian's first quarter of profitability, successfully turning losses into profits.

Benefiting from the generative AI era, the AI chip market is experiencing rapid growth. Gartner reports predict that the global AI chip market size will reach USD 67.1 billion in 2024 and USD 119.4 billion by 2027.

Cambrian, a company dedicated to AI chip research and development, offers a comprehensive product line that includes cloud and edge smart chips, accelerator cards, training systems, processor IPs, and software. This diverse portfolio caters to the varying AI computing needs across cloud, edge, and terminal environments.

Regarding large models, Cambrian's new-generation intelligent processor microarchitecture and instruction set are optimized for scenarios such as training and inference in natural language processing, video image generation, and recommendation systems. The company collaborates with leading domestic algorithm companies to assist clients in exploring and implementing large model applications within their respective industries.

Furthermore, Cambrian's training software platform now supports mainstream networks like the Llama3 series and Qwen series, with a focus on enhancing parallel training capabilities. As the potential demand in the AI market unfolds, general-purpose AI chips are poised to become mainstream products, signifying a favorable outlook for AI chip commercialization and unlocking new growth opportunities.

It's worth noting that Cambrian operates in a competitive AI chip sector dominated by giants like Intel, AMD, and NVIDIA. NVIDIA maintains a significant advantage in the global AI chip market, with its high-performance chips integral to the development of AI large models across various sectors. As a relatively nascent player in the integrated circuit industry, Cambrian faces certain competitive challenges.

To address these challenges, Cambrian must invest heavily in R&D to create competitive products, thereby securing a favorable position in the smart chip market. The company is also actively promoting smart chip market development and ecosystem construction, making progress in AIGC business adaptation, open-source ecosystem development, and ease of use. Cambrian's inference software platform supports multiple open-source components built on the PyTorch ecosystem, reducing adaptation costs for new models, shortening performance optimization cycles, improving software stack usability, and supporting the inference demands arising from the industry's adoption of large models.

ChatGPT is driving AI into the era of large models, with enterprises capitalizing on this trend. All sectors are striving to harness the transformative power of generative AI.

Breakthroughs in large model technology are ushering in a new era of growth. The billions of parameters in these models consume immense computing power, leading to a substantial increase in demand. Technology giants are competing to procure NVIDIA's high-performance chips, contributing significantly to NVIDIA's profitability. Cambrian, often compared to China's NVIDIA, follows a similar speculation logic in the capital market. However, the question of whether its high share price contains a bubble remains a subject of debate.

Yang Jianyong, a Forbes China contributor, expresses his opinions solely on his own behalf. The content provided is for reference purposes only and should not be construed as investment advice.