Parallel Policy and Technology: Jointly Accelerating the Commercialization of Robotaxi

![]() 01/20 2025

01/20 2025

![]() 431

431

The advancement of high-level autonomous driving is intrinsically tied to the symbiotic relationship between policy and technology. Governmental support for "vehicle-road-cloud integration" infrastructure has significantly bolstered infrastructural development, while the gradual refinement of regulatory frameworks for autonomous driving has provided a solid policy foundation for its commercialization. From a technological standpoint, integrated perception and lightweight high-precision mapping have emerged as transitional strategies, paving the way for the commercial viability of high-level autonomous driving.

Policy and technology intertwine: the cornerstone of high-level autonomous driving

The evolution of high-level autonomous driving technology and policy support are mutually reinforcing. Policy initiatives create an enabling environment for R&D and implementation, playing a pivotal role in infrastructure development, regulatory enhancements, and pilot projects. Technological breakthroughs, particularly in perception and mapping, have laid the groundwork for autonomous driving's commercial rollout. This "spiral forward" dynamic not only accelerates commercialization but also propels high-level autonomous driving towards greater maturity.

1.1 Policy impetus: accelerating infrastructure and pilot projects

Policy support stands as a primary catalyst for the expedited commercialization of high-level autonomous driving. In July 2024, the Ministry of Industry and Information Technology and four other ministries jointly announced a list of 20 pilot cities, including Beijing, Shanghai, and Chongqing, for the application of "vehicle-road-cloud integration" in intelligent connected vehicles. The establishment of these pilot cities signifies a new era of policy and infrastructural support for autonomous driving in China.

Vehicle-road-cloud integration policies

Under the vehicle-road-cloud integration framework, Chinese governments have significantly increased investments in intelligent connected vehicle infrastructure, with numerous projects being launched. For instance, Beijing plans to invest 9.94 billion yuan in vehicle-road-cloud integration infrastructure, while Wuhan has allocated 17 billion yuan for intelligent connected infrastructure. These initiatives facilitate early testing and practical applications of high-level autonomous driving technology, accumulating rich data and practical experience for future large-scale deployments.

Furthermore, to foster collaboration among enterprises and research institutions in these pilot cities, policies have progressively relaxed licensing standards for high-level autonomous driving tests. Many local governments have issued support policies encouraging the development of new mobility models like Robotaxi, thereby promoting the real-world testing and validation of driverless technology.

1.2 Regulatory refinement: addressing the regulatory gap in high-level autonomous driving

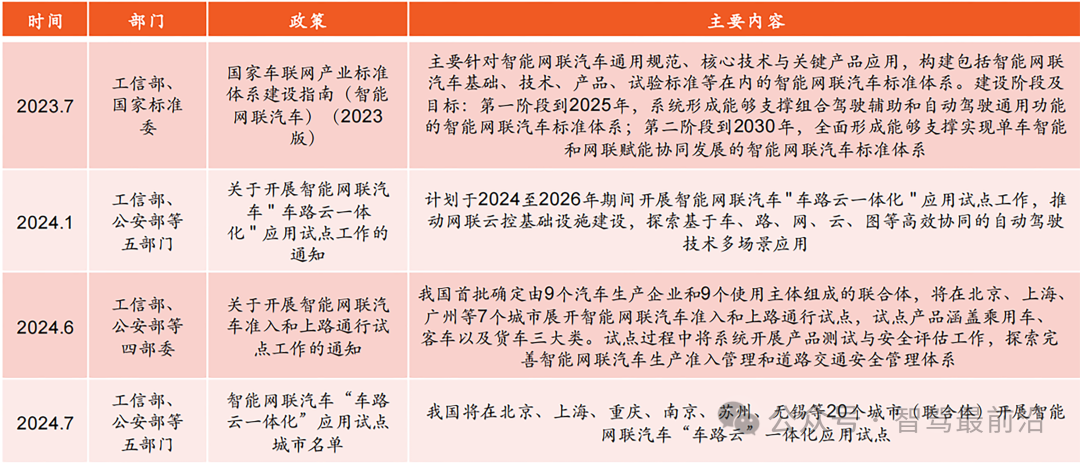

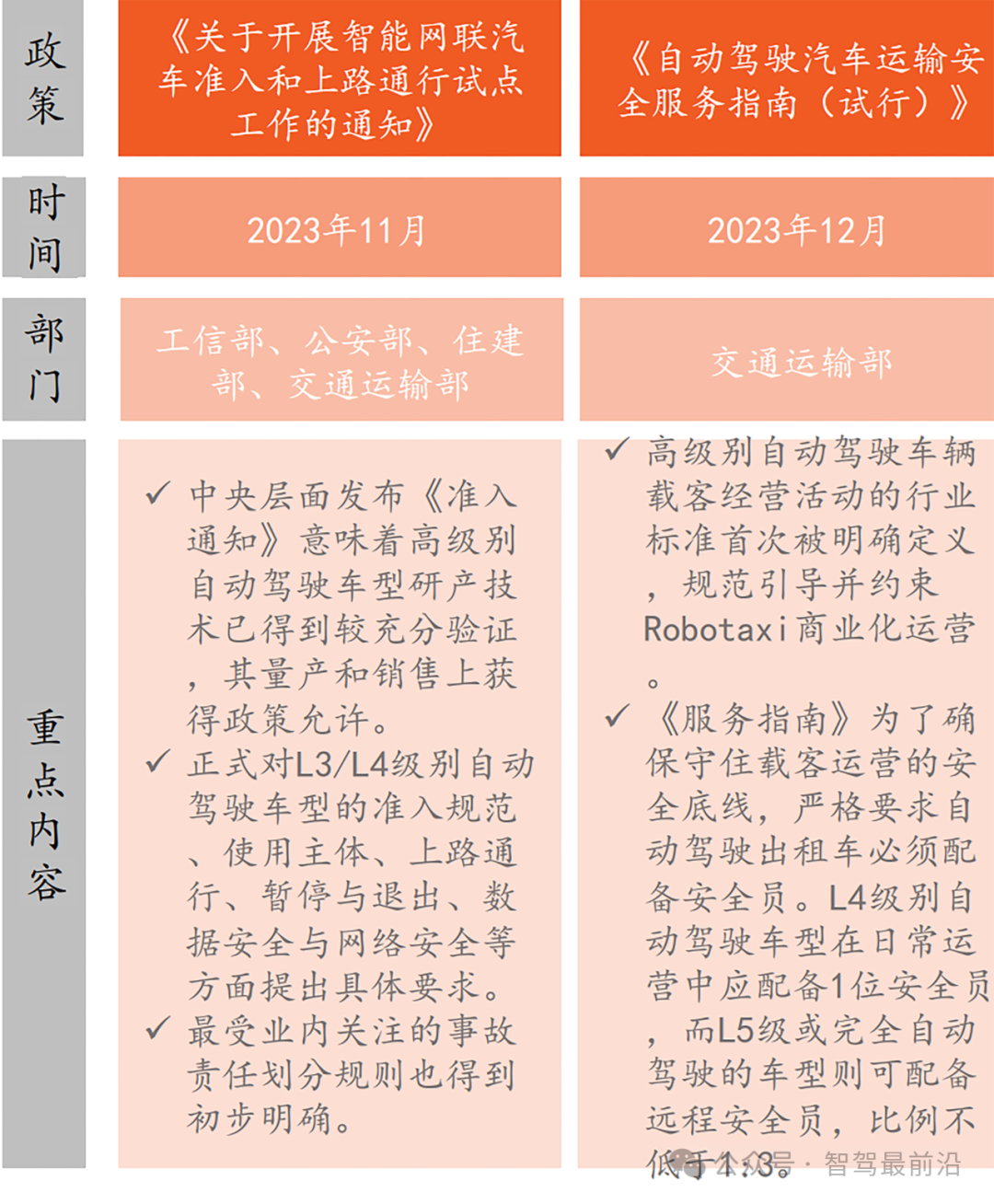

The commercialization of high-level autonomous driving also faces regulatory challenges. It is undeniable that the rapid iteration of autonomous driving technology outpaces existing legal frameworks. To address this, China has intensified the construction of autonomous driving laws and regulations in recent years, ensuring the safe and reliable commercialization of high-level autonomous driving. Since 2023, various ministries have issued several policies, including the "Notice on Carrying Out Pilot Work on the Access and Road Travel of Intelligent Connected Vehicles" and the "Guidelines for Safe Transportation Services of Autonomous Vehicles (Trial)."

China's high-level autonomous driving policies are catching up

These policy documents address regulatory gaps in traffic rules, testing licenses, accident liability, and other aspects of high-level autonomous driving. For example, the "Notice on Carrying Out Pilot Work on the Access and Road Travel of Intelligent Connected Vehicles" clarifies access specifications for L3 and L4 autonomous vehicles and outlines specific requirements for safety, data privacy, and cybersecurity. This has enabled high-level autonomous driving to receive policy support for road testing and licensing, effectively ensuring technology safety and controllability.

The gradual introduction and refinement of these policies provide legal support for high-level autonomous vehicles. Clear legal provisions regarding road use and traffic accident liability have bolstered public trust in driverless vehicles. Concurrently, this regulatory deregulation has created a more permissive environment for autonomous driving technology, enabling broader testing and promotion across various scenarios.

1.3 Technological advancements: widespread adoption of integrated perception and lightweight high-precision mapping

Technological advancements in high-level autonomous driving center around optimizing perception systems and upgrading mapping solutions. The perception system is crucial for achieving high-level autonomous driving, with integrated perception and lightweight high-precision maps emerging as mature and widely applied technological solutions.

Integrated perception technology leverages multiple sensors (e.g., cameras, millimeter-wave radars, LiDAR) to work in unison, providing high-precision environmental perception data. Compared to traditional single-sensor solutions, multi-sensor fusion enhances autonomous vehicles' perception capabilities and robustness in harsh weather and complex road conditions. For instance, Waymo's autonomous driving system fuses LiDAR and camera data, enabling efficient target detection and path planning in adverse environments like nighttime and rainy/foggy weather.

Multi-sensor fusion solution

Additionally, with the rise of pure vision solutions, end-to-end algorithms have garnered increasing attention in high-level autonomous driving. Tesla's pioneering pure vision solution collects environmental data through vehicle-mounted cameras and processes it using deep learning neural networks to directly generate autonomous driving control commands. This solution reduces costs, diminishes reliance on high-precision maps, and simplifies system hardware requirements. However, due to the high demands on algorithms and computing power, pure vision solutions still face challenges in environmental adaptability and safety.

Meanwhile, lightweight high-precision maps have emerged as an effective alternative to traditional high-precision maps. Unlike their traditional counterparts, lightweight high-precision maps lower storage and update costs by simplifying map elements and reducing precision requirements. For example, Baidu's lightweight high-precision map solution reduces map data volume by 80% without compromising positioning accuracy, making it suitable for high-frequency scenarios like urban NOA (Navigation on Autopilot). This technological progress offers a more cost-effective solution for high-level autonomous driving, accelerating its commercialization.

Robotaxi commercialization progress

Robotaxi, as a quintessential application scenario for high-level autonomous driving commercialization, has witnessed rapid development in recent years. With policy liberalization and technological maturity, Robotaxi's commercialization has achieved significant global milestones. China's Baidu "Luobo Kuaipao" project and American companies like Waymo and Cruise have spearheaded large-scale testing and operations. Supported by both policy and technology, China's Robotaxi has gradually established a preliminary commercial closed loop, laying the groundwork for high-level autonomous driving expansion in other scenarios.

2.1 Market background and potential of Robotaxi

Robotaxi, or driverless taxis, represents one of the primary commercial applications for high-level autonomous driving technology. Its development benefits from policy support, capital investments, and technological advancements. As a key autonomous driving market, Robotaxi not only reduces travel costs but also significantly enhances traffic safety and efficiency, thereby alleviating social traffic burdens and generating substantial economic benefits. According to the China Chamber of Commerce Industry Research Institute, China's driverless market size reached 330.1 billion yuan in 2023 and is projected to grow to 383.2 billion yuan by 2024.

China's driverless industry market size and forecast from 2019 to 2024 (in billion yuan)

In China, Robotaxi commercialization enjoys robust policy support. The "Luobo Kuaipao" project, epitomizing Robotaxi operations, has conducted large-scale pilot unmanned driving services in cities like Wuhan, Beijing, and Chongqing. Since 2024, Baidu's "Luobo Kuaipao" has witnessed continuous order volume growth in Wuhan and has gradually expanded to 24-hour all-weather operations, supporting the initial formation of Robotaxi's commercial closed loop, aiming for full profitability in the Wuhan region by 2025. As more cities gradually open up for testing, Robotaxi market demand is expected to surge, providing sustained growth momentum for the entire autonomous driving industry.

U.S. companies like Waymo and Cruise are also actively advancing Robotaxi commercialization. In 2023, Waymo and Cruise obtained commercial operating licenses for driverless taxis in San Francisco, enabling 24-hour all-weather services, marking a significant step towards full Robotaxi industry commercialization in the U.S. The development of the Robotaxi market in China and the U.S. has consistently led the way, becoming the primary driving force in the autonomous driving industry. Through their respective policy and technological advantages, these two countries' Robotaxi market developments have amassed valuable practical experience for global autonomous driving technology.

Global major Robotaxi enterprise scale

2.2 Technical solutions for Robotaxi: multi-sensor fusion and end-to-end vision in practice

Robotaxi's realization hinges on multiple technical solutions, primarily multi-sensor fusion and end-to-end vision. The multi-sensor fusion solution typically employs multiple sensors such as LiDAR, millimeter-wave radars, and cameras to ensure the autonomous driving system can perceive real-time environmental changes and avoid accidents. This solution excels in system robustness and high precision but is disadvantaged by high hardware costs. Waymo's Robotaxi employs a multi-sensor fusion solution in complex urban environments, effectively addressing perception accuracy and redundancy through sensor coordination, enabling operation in all weather conditions.

Another solution is the pure vision + end-to-end algorithm, which collects environmental information through cameras and directly generates vehicle control commands after processing via neural networks. This approach is widely used in Tesla's FSD system. Tesla has significantly enhanced its vision system's perception and generalization capabilities by introducing the BEV (Bird's Eye View) + Transformer algorithm architecture. Inspired by Tesla, an increasing number of enterprises are developing end-to-end vision-based solutions. While the end-to-end vision solution still has limitations in harsh weather and complex traffic environments, it shows great potential in reducing hardware costs and improving computational efficiency.

In the future, with the declining price of LiDAR and the further refinement of end-to-end vision algorithms, Robotaxi technical solutions are expected to evolve towards parallel development of multi-sensor fusion and end-to-end algorithms. Multi-sensor fusion will be suitable for high-precision positioning in complex environments, while end-to-end vision will be ideal for low-cost scenarios. The combination of both will further bolster Robotaxi's commercialization potential.

2.3 Robotaxi commercialization path: from technical validation to large-scale application

The commercialization path of Robotaxi has progressively evolved into a cohesive "technology + vehicle + mobility platform" cooperation model. This model involves a tight collaboration between autonomous driving technology firms, vehicle manufacturers, and mobility service platforms, forming a robust "golden triangle." For instance, Waymo in the United States has partnered with Uber and Jaguar to jointly develop a Robotaxi operation platform, accelerating technology deployment and market penetration through specialized labor division. Similarly, in China, Baidu's "Luobo Kuaipao" project has achieved unmanned driving applications in various locations by collaborating with local governments and leveraging Baidu Apollo's autonomous driving technology.

Ecological Cooperation in the American Robotaxi "Golden Triangle"

The strength of this business model lies in its resource integration and labor division. Autonomous driving technology companies focus on technological innovation, vehicle manufacturers handle the development and optimization of vehicle platforms, while mobility platforms take on market promotion and user service responsibilities. This model not only expedites the technological maturity of Robotaxi but also reduces costs for all parties involved, enhancing commercialization efficiency. Currently, the Robotaxi sector primarily comprises three types of participants: internet companies (such as Baidu, Google), automakers (such as Tesla, XPeng), and mobility platforms (such as Didi, Caocao Mobility). This cooperative model has firmly established a foundation for the swift implementation and operation of Robotaxi.

According to McKinsey's predictions, by 2025 to 2027, the unit operating cost of Robotaxi will fall below that of traditional ride-hailing vehicles of the same tier, thereby achieving a genuine cost advantage. Currently, the Robotaxi commercialization process is accelerating, fueled by policy incentives and market demand. As a pioneer in autonomous driving commercialization, Robotaxi's market potential is gradually unfolding and is anticipated to further expand in the coming years.

Vehicle-Road-Cloud Integration: The Cornerstone of High-Level Autonomous Driving

Vehicle-Road-Cloud Integration, an indispensable aspect of intelligent and connected vehicle development, serves as a pivotal foundation for the implementation of high-level autonomous driving. By orchestrating intelligent roadside equipment such as smart roads and vehicles, it provides autonomous vehicles with "beyond-visual-range" perception capabilities, significantly enhancing vehicle safety and adaptability. The evolution of Vehicle-Road-Cloud Integration not only hinges on advancements in road and communication infrastructure but also on the support of emerging technologies like cloud computing and edge computing. The progression of this technology has become a critical factor in facilitating the large-scale deployment of high-level autonomous driving.

Vehicle-Road-Cloud Integrated System Architecture

3.1 Concept and Development Background of Vehicle-Road-Cloud Integration

Vehicle-Road-Cloud Integration facilitates real-time information sharing and processing through the synchronized operation of in-vehicle sensors, roadside perception equipment, and cloud computing systems. Specifically, the Vehicle-Road-Cloud Integration system encompasses three components: intelligent vehicles, intelligent roadside equipment, and a cloud control platform. Intelligent vehicles are tasked with perceiving the surrounding environment, intelligent roadside equipment provides real-time data on road conditions and traffic signals, and the cloud control platform handles global scheduling and data processing. This architecture substantially augments the perception range and information acquisition capabilities of the autonomous driving system, enabling vehicles to respond to emergencies in complex environments and enhancing autonomous driving safety and adaptability.

The development of Vehicle-Road-Cloud Integration traces back to the early research stages of intelligent and connected vehicles. As autonomous driving technology progresses to higher levels, the limitations of standalone vehicle intelligence become apparent: for instance, the sensing range of cameras and radars is finite, and recognition accuracy diminishes significantly in adverse weather conditions like nighttime and fog. Through Vehicle-Road-Cloud coordination, the perception equipment of intelligent roads can furnish real-time information over extended distances to vehicles, enabling them to obtain traffic data in blind spots and complex road conditions, thereby boosting system safety and reliability.

3.2 Promotion and Policy Support for Vehicle-Road-Cloud Integration in China

The growth of Vehicle-Road-Cloud Integration in China benefits from government policy support and substantial infrastructure investment. In 2024, five departments, including the Ministry of Industry and Information Technology, launched the pilot project for the "Vehicle-Road-Cloud Integration" application of intelligent and connected vehicles, selecting 20 cities like Beijing, Shanghai, and Chongqing as pilot areas to foster efficient coordination among "vehicles, roads, and clouds." According to Ministry of Industry and Information Technology data, as of July 2024, China had established 17 national-level intelligent and connected vehicle test zones, 7 Internet of Vehicles pilot zones, 16 "dual intelligence" pilot cities, and opened over 32,000 kilometers of test roads. Government backing and infrastructure construction have laid a solid foundation for the advancement of Vehicle-Road-Cloud Integration.

These pilot cities have emerged as vital venues for exploring and validating Vehicle-Road-Cloud Integration. Beijing has invested nearly 10 billion yuan in constructing Vehicle-Road-Cloud Integration infrastructure, including the installation of intelligent roadside perception equipment and the development of a vehicle networking system. These projects not only propel local autonomous driving testing but also provide technical and experiential support for the future large-scale promotion of Vehicle-Road-Cloud Integration. The intelligent and connected vehicle project in Wuhan is also progressing rapidly. Through the deployment of numerous intelligent perception devices and data collection, the project will effectively bolster the operational safety of high-level autonomous driving, such as Robotaxi, and propel the widespread adoption of autonomous driving in urban traffic scenarios.

3.3 Technical Architecture and Advantages of Vehicle-Road-Cloud Integration

The core advantage of Vehicle-Road-Cloud Integration lies in its facilitation of data sharing and multi-level coordination. Intelligent vehicles gather real-time data about their surroundings through in-vehicle sensors, including vehicle speed, pedestrian, and obstacle information, to aid the system in perception and decision-making. Secondly, intelligent roadside equipment supplements vehicle perception blind spots, monitors information like traffic signals and emergencies, and uploads this data to the cloud. Lastly, the cloud control platform offers higher-level decision support through large-scale data computing, such as traffic signal optimization and route planning. The distributed architecture of Vehicle-Road-Cloud Integration achieves a high degree of coordination among vehicles, roadside equipment, and the cloud, enabling autonomous vehicles to navigate safely and efficiently in complex traffic scenarios.

This multi-level data sharing and collaborative computing effectively addresses the limitations of standalone vehicle intelligence and enhances the vehicle's environmental perception and decision-making efficiency. Through the beyond-visual-range information provided by roadside equipment, autonomous vehicles can receive early warning signals before entering blind spots, enabling them to adjust their paths in advance. Additionally, the cloud system can monitor traffic flow throughout the road network in real-time, coordinate vehicle travel routes, reduce road congestion, and improve overall traffic efficiency. Vehicle-Road-Cloud Integration bolsters the adaptability and risk resilience of the autonomous driving system through information sharing and optimized allocation of computing resources, emerging as a significant development trajectory for future high-level autonomous driving.

Formation of Robotaxi Business Closed Loop and Future Development Trends

With the maturation of high-level autonomous driving technology and Vehicle-Road-Cloud Integration, Robotaxi has gradually transitioned into the commercial operation stage, forming a "golden triangle" closed-loop model centered around self-driving technology, vehicle platforms, and travel service platforms. Driven by technology, policy, and market forces, Robotaxi has shifted from the testing and validation phase to practical application, demonstrating considerable market potential.

4.1 Construction of Robotaxi Business Closed Loop and Market Structure

The Robotaxi business closed loop primarily relies on the close collaboration between technology companies, vehicle manufacturers, and travel platforms. Autonomous driving technology companies provide perception, decision-making, and control technologies for Robotaxi, vehicle manufacturers develop vehicle platforms, and travel platforms offer operational support for Robotaxi. For example, Waymo in the United States has collaborated with Uber and Jaguar to devise a driverless taxi operation model, achieving paid operations in San Francisco and other locations. Baidu's "Luobo Kuaipao" project, leveraging Baidu Apollo's technical support, has gradually achieved large-scale Robotaxi applications through partnerships with local governments. The formation of the Robotaxi business closed loop integrates and optimizes resources and functions at all levels, enhancing operational efficiency and cost-effectiveness. Through centralized technology development and market promotion,

The cost of Robotaxi is expected to gradually decrease with large-scale operations. According to McKinsey's predictions, between 2025 and 2027, the unit service cost of Robotaxi is anticipated to be lower than that of traditional ride-hailing vehicles, signifying that the Robotaxi business model will gradually attain sustainable profitability.

The Robotaxi market structure is gradually shaping into a competitive landscape encompassing internet technology companies, traditional automakers, and emerging travel platforms. For instance, internet enterprises such as Baidu, Google, and WeRide hold a dominant position in technology development due to their strengths in algorithms and data. Traditional automakers like Tesla and General Motors are progressively entering the Robotaxi market based on their extensive manufacturing experience and financial might. Travel platforms such as Didi and Ruqi Chuxing have operational and user service competitive advantages. This diversified market landscape accelerates the rapid development of Robotaxi and lays the groundwork for future market expansion.

4.2 Cost Control and Profit Model Exploration of Robotaxi

Although the Robotaxi business model is taking shape, it still faces profitability challenges. Currently, the unit service cost of Robotaxi is higher than that of traditional taxis, along with maintenance costs incurred during testing and operation. However, with technological advancements and the promotion of mass production, the cost of Robotaxi is expected to significantly decline, gradually achieving profitability. To attain sustainable profitability, Robotaxi has undertaken numerous explorations in cost control, business model innovation, and operational efficiency enhancement.

Cost control is crucial for the commercialization of Robotaxi. Presently, the prices of sensors such as LiDAR and high-definition cameras are still high, but as these technologies continue to mature and market demand increases, their costs have begun to gradually decrease. According to forecasts, by 2030, the price of primary LiDAR may drop to 1,800 yuan, and blind-spot LiDAR may fall to 600 yuan, substantially reducing the per-vehicle cost for Robotaxi. Many Robotaxi companies have commenced researching and adopting lightweight perception solutions to reduce reliance on expensive high-precision maps. Tesla's pure vision end-to-end solution, with its cost advantage, has become a significant choice for autonomous vehicles on urban roads.

The profit model of Robotaxi is also constantly being refined. Baidu's "Luobo Kuaipao" project has launched round-the-clock driverless service operations in Wuhan and other locations, aiming to achieve breakeven by 2025. By reducing the production and operating costs of driverless vehicles while enhancing the efficiency of autonomous driving technology, Baidu has gradually established a closed-loop model integrating "technology development + operational support + user experience." Additionally, by constructing rich user data and travel habits, Robotaxi can expand profit sources in areas like travel data analysis, advertising, and additional services. For instance, providing customized services and entertainment content based on passenger needs and travel preferences represent potential avenues for Robotaxi to explore diversified profit streams in the future.

4.3 Future Development Trends and Challenges of Robotaxi

With the continuous enhancement of policies and technologies, the future development prospects of Robotaxi are promising. However, there are also challenges in advancing its commercialization. The future development trends and challenges are primarily reflected in the following aspects:

1. Market Expansion and Regulatory Adaptability

Currently, the deployment of Robotaxi remains concentrated in select cities and pilot regions across the globe. The expansion of this market hinges on the support of local policies and regulations. Governments, particularly in China where policies differ significantly from region to region, have imposed stringent requirements on road safety, data privacy, and accident liability to ensure operational safety. For instance, Beijing and Chongqing have distinct access requirements for Robotaxi, complicating cross-regional operations. Achieving rapid market expansion while adhering to these regulations presents a major challenge for the commercialization of Robotaxi.

2. Technological Advancement and Safety Assurance

For Robotaxi to become widespread, it must ensure safety and stability in complex urban environments. Despite advancements in technologies like fusion perception and multi-sensor integration, which provide high environmental awareness, the stability of sensors and robustness of algorithms still need enhancement, particularly in extreme weather conditions, emergencies, and harsh road conditions. Moreover, cybersecurity in autonomous driving systems is a concern. Ensuring the protection against hacking attacks and safeguarding passenger privacy data during data uploads to the cloud will be a persistent challenge for the Robotaxi industry.

3. Enhancing User Acceptance and Service Experience

Promoting Robotaxi also involves gradually increasing user acceptance and trust. Public awareness and acceptance of autonomous driving technology are still nascent, with many passengers expressing safety concerns about driverless vehicles. Consequently, Robotaxi often includes safety officers during services to ensure passenger safety. By providing exceptional service experiences, such as reducing waiting times, enhancing ride comfort, and offering personalized services, Robotaxi can gradually strengthen user loyalty and improve passenger satisfaction. As technology further advances, Robotaxi may eventually phase out safety officers and achieve true driverless travel.

Summary and Outlook

The evolution of high-level autonomous driving has followed a spiral path, propelled by policies and technologies. Vehicle-Road-Cloud Integration has laid a solid foundation, with Robotaxi emerging as a pioneer in the commercialization of this technology. Policy support, optimization of high-precision maps, cost control, and other factors have collectively contributed to the maturation of autonomous driving technology. On the technological front, continuous improvements in perception systems, multi-sensor fusion technology, and end-to-end algorithms enable autonomous vehicles to navigate more complex traffic environments. Furthermore, the proliferation of lightweight high-precision maps and cost reductions in sensors like LiDAR enhance the commercial viability of autonomous driving.

Looking ahead, as autonomous driving technology matures, the commercialization of Robotaxi will accelerate, gradually expanding to more cities and regions. Through ongoing technological advancements and business model innovations, the market potential of Robotaxi will continue to be unleashed. As a crucial application of autonomous driving, Robotaxi not only provides valuable insights for implementing high-level autonomous driving but also spurs the development of the entire intelligent transportation ecosystem. In the future, Robotaxi may integrate more closely with smart city construction, becoming a pivotal component in enhancing urban traffic efficiency and improving travel experiences.

The full-scale popularization of Robotaxi still faces dual challenges from technology and regulation. Ensuring the safety of autonomous driving technology, adapting to complex road environments, and formulating reasonable policies and regulations are issues that must be continuously addressed. Driven by policies and technologies, high-level autonomous driving will usher in a broader development horizon in the coming years. Through Vehicle-Road-Cloud Integration and technological upgrades, Robotaxi and other high-level autonomous driving applications will become cornerstone components of modern intelligent transportation systems, steering the global transportation system towards greater intelligence, efficiency, and safety.