"In 2025, What Kind of Cars Can Survive Without Intelligent Driving?"

![]() 01/20 2025

01/20 2025

![]() 694

694

Introduction

The dawn of technological parity in the first year of widespread adoption has truly arrived.

Data from the China Passenger Car Association revealed that in 2024, retail sales of new energy passenger vehicles soared to 10.899 million units, marking a 40.7% increase year-on-year.

Undoubtedly, an unstoppable trend is unfolding. The structure and order of China's automotive market are undergoing a profound transformation, fueled by the wave of innovation.

Against this backdrop, it is evident that every reader has noticed the proliferation of "green license plates" in their surroundings. In terms of deepening "electrification," all automakers have undeniably reached a unanimous consensus.

As we step into 2025, it is a foregone conclusion that new energy vehicles will continue to experience exponential growth. Conversely, the shrinking market share of traditional fuel vehicles is equally inevitable.

This begs the question: with the first half of China's automotive market battle nearly concluded, what will be the focal point of competition in the second half?

The answer is clear – intelligentization.

Breaking it down further, this primarily revolves around two aspects: smart cabins and intelligent driving. Notably, the latter swiftly emerged as a "must-win battleground" in 2024, witnessing intense competition across technical, experiential, and even marketing domains.

Concepts like "driveable anywhere in China," "easy to navigate across China," "capable on any road," "end-to-end large models," and "from parking space to parking space" have bombarded end-consumers.

Remarkably, the reception has been better than anticipated. From my personal observations, the presence and usability of intelligent driving are increasingly becoming pivotal in many users' purchasing criteria.

More specifically, a new energy vehicle without a relatively mature and user-friendly intelligent driving system is highly likely to be dismissed during the initial selection process.

The situation is indeed brutal and severe. However, in 2025, it is not alarmist. The title of today's article epitomizes the starkest reality in China's automotive market.

"In 2025, what kind of cars can survive without intelligent driving?"

Big Names Hype Up, Giants Go All In

Actually, the judgment at the beginning of this article was reached after a recent conversation with a media expert.

Supporting evidence shows that in 2024, with the collective efforts of emerging automakers such as HarmonyOS Intelligent Drive, Li Auto, XPeng, NIO, Xiaomi, and leading suppliers like Momenta, DJI, and Yuanrong Qixing, the significance of high-level intelligent driving in China's automotive market surged.

Little did we know that as 2025 dawned, several consecutive events further underscored the importance of high-level intelligent driving.

First, another CES concluded in Las Vegas. Most Chinese automotive professionals attending the event had another crucial mission: "to test the value of Tesla's FSD in the United States."

As we all know, this high-level intelligent driving system, which has been delayed in entering China's automotive market, has long been cloaked in an "invincible" aura due to the clustering and rendering of many parties.

It is widely believed that once Tesla's FSD truly enters China, it will inevitably alter the current landscape of the entire sector.

However, after watching multiple freshly released videos and communicating with some participants, it became evident that while this high-level intelligent driving system is indeed smooth in many dimensions and offers much to learn from, Tesla's FSD is not flawless and is gradually losing its allure.

Due to the relatively straightforward overall road conditions in the local area, its performance in complex environments remains a significant unknown.

In contrast, it is not blind self-satisfaction. The Chinese intelligent driving teams, honed and grown in the "regional mode," have the confidence to compete with Tesla's FSD.

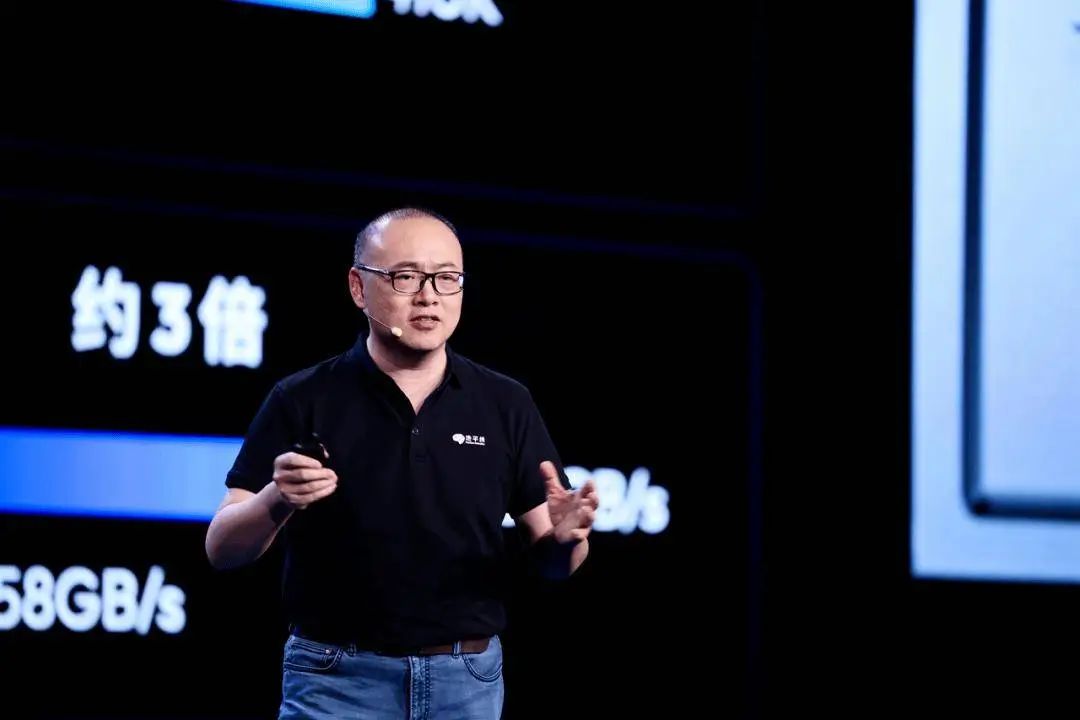

The second event was the Horizon Intelligent Driving Technology Imagination Day, featuring remarks from its CEO Yu Kai.

He believes that 2025 will mark a "true inflection point" for high-level intelligent driving, aiming to propel the entire industry towards hands-off driving in 3 years, eyes-closed driving in 5 years, and carefree driving in 10 years through groundbreaking solutions.

Coincidentally, during the "Li Auto AI Talk" livestream earlier in the year, Li Xiang, who had been silent for some time, also made a similar assessment. For instance, L3 is expected to be achieved within 2025; giving him three years to realize 100% autonomous driving; and L4 will be the key to determining the winner.

The collective hype by big names undoubtedly confirms the underlying currents surging through the market.

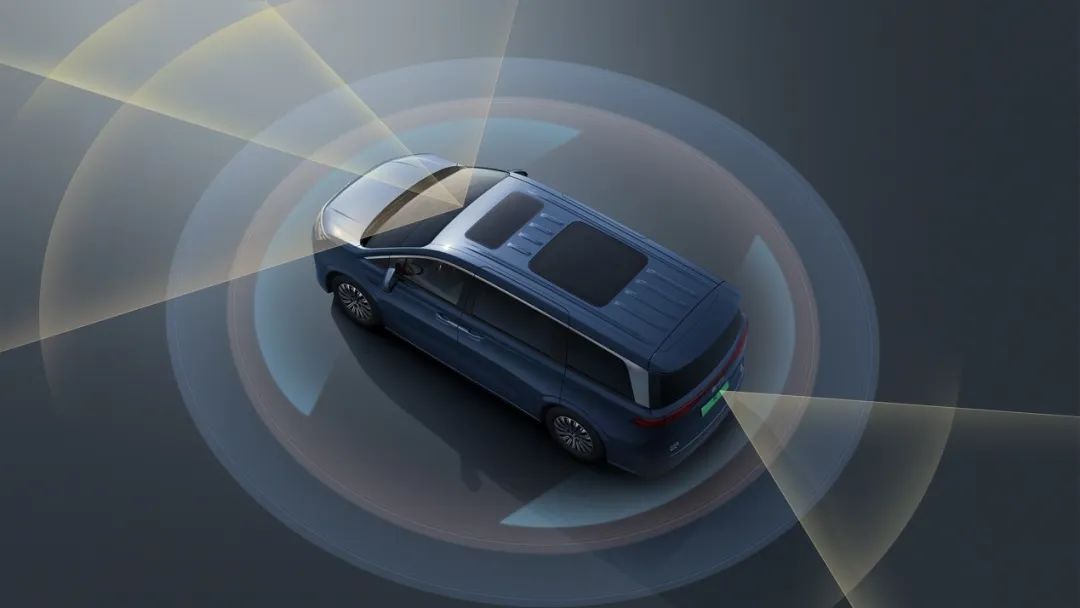

The third event stems from BYD, the "Big Demon" that concluded 2024 with sales of 4.27 million units. Last week, I attended the launch event of its Dynasty Network's new heavyweight model, "Xia".

It is undeniable that in terms of comprehensive products, this mid-to-large-sized new energy MPV, with a starting price of 249,800 yuan, is fully equipped and is poised to challenge the dominance of Buick GL8, Toyota Sienna, and Granvia.

More notably, BYD Xia officially announced that the entire line will be equipped with the DiPilot 100 "Sky Eye" high-level intelligent driving system. This bold move fully reflects its impending ambitions.

Expanding the perspective, although it has not been officially announced, rumors suggest that this "Big Demon" aims to fully promote the mass production of high-level intelligent driving in 2025. Based on an annual sales target of 5 million vehicles, it plans to equip 3 million vehicles with "High-Speed NOA Starting Intelligent Driving Systems," accounting for 60% of its total new vehicle sales.

Yes, you heard it right – it's that terrifying.

As another piece of evidence, from the application catalog recently released by the Ministry of Industry and Information Technology, even many products, including the 100,000-yuan Qin L and the newer, lower-positioned Qin PLUS, will be equipped with a "three-eye vision hardware solution."

BYD's all-in approach has undoubtedly reinforced the initial judgment of this article. In the next 365 days, the term "Sky Eye" will engage in a mental battle with everyone repeatedly.

The First Year of High-Level Intelligent Driving Popularization Has Truly Arrived

Perhaps, by now, most readers still don't comprehend what the impending arrival of Tesla's FSD in China, the collective hype by big names, and the giants' all-in strategies are pointing to.

The answer is straightforward: "The first year of high-level intelligent driving popularization has come."

If before 2025, the sparks of change had already ignited, then in 2025, as the "dry wood" piled up by all parties accumulates, it will soon turn into a raging fire.

Otherwise, why would those stubborn joint venture automakers have "bowed their heads" and begun to collectively embrace Chinese intelligent driving suppliers? The fundamental purpose is to stay competitive. Faced with the increasingly alluring "cake" of new energy vehicles, they don't want to miss out on the initial selection list of end-consumers.

Since it is the so-called "first year of high-level intelligent driving popularization," one can't help but make a bold prediction.

Taking 100,000 yuan and 200,000 yuan as benchmarks: products below 100,000 yuan will at least attempt to include the most basic L2 function like "lane keeping"; for products between 100,000 yuan and 200,000 yuan, high-speed and high-speed pilot assistance will gradually become standard; for products above 200,000 yuan, all-domain high-level intelligent driving will be a prerequisite.

Furthermore, in 2025, I believe we will also witness many players "overstepping and equipping" their vehicles. After all, the old adage still holds true: "In China's automotive market, there is only more competition."

Taking advantage of this, let's delve into a deeper question: Why is the importance of high-level intelligent driving continuously increasing and expanding in the layouts of major automakers?

Regarding this, I want to say: "In previous articles, I have been convinced that the ultimate outcome of new energy vehicles dominating the market will certainly lead to the increasing homogenization of the overall product experience. In such an environment, to strive for more sales, shaping corresponding brand power will be crucial."

Take Model Y as an example. Despite intense competition, it is still thriving in China's automotive market. Tesla's own aura has undoubtedly contributed significantly to its success. And so far, the strategic fulcrum that cannot be compromised to enhance brand power is – high-level intelligent driving.

Its quality, maturity, or lack thereof, not only determines the degree of differentiation among new energy vehicles but has also become a new criterion for potential customers to decide whether to spend their hard-earned money.

Let's take another example from the smartphone industry. A large part of the reason why Apple's iPhone is popular is due to the exceptional experience of the iOS operating system.

Similarly, in today's era dominated by electrification and intelligentization, an automaker labeled as a member of the "top tier of intelligent driving" will also save a lot of trouble in expanding its territory. Conversely, if it cannot even present a good high-level intelligent driving system at this juncture, it will only face the grim reality of elimination in China's automotive market.

After all, the title of today's article is blatant, and the "first year of popularization" is not just a slogan. Technological parity – how delightful indeed...